Exemplary Info About Difference Between Cash Flow Statement And Fund

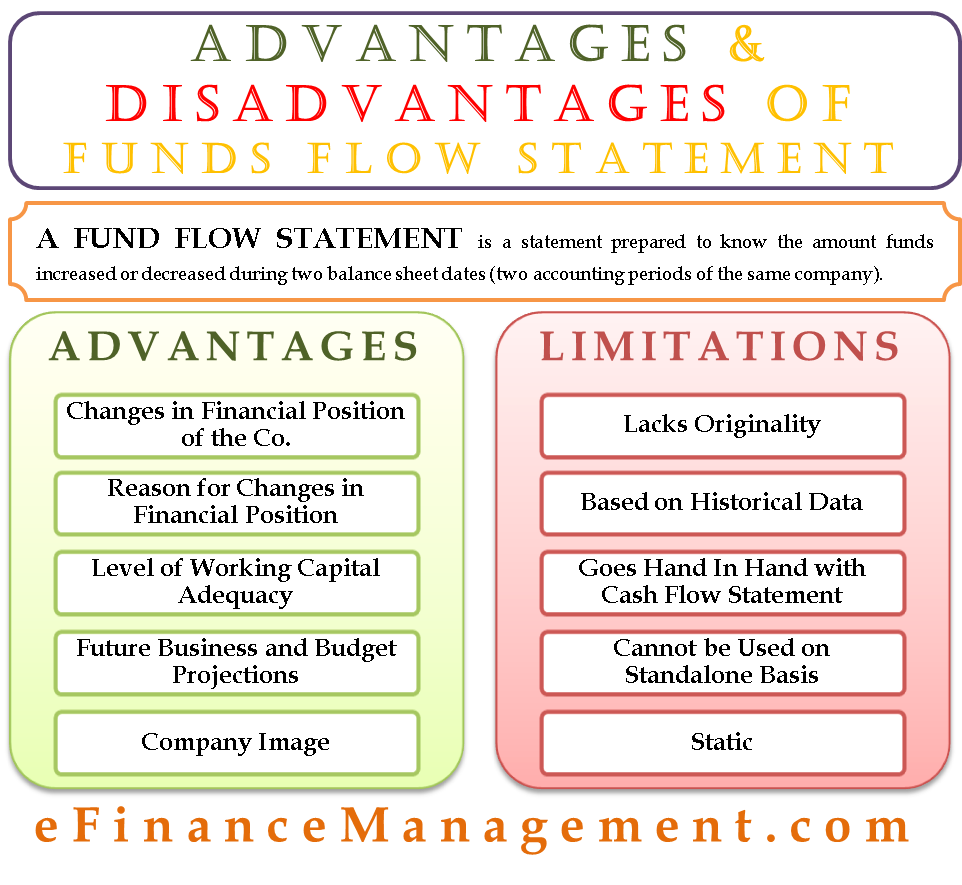

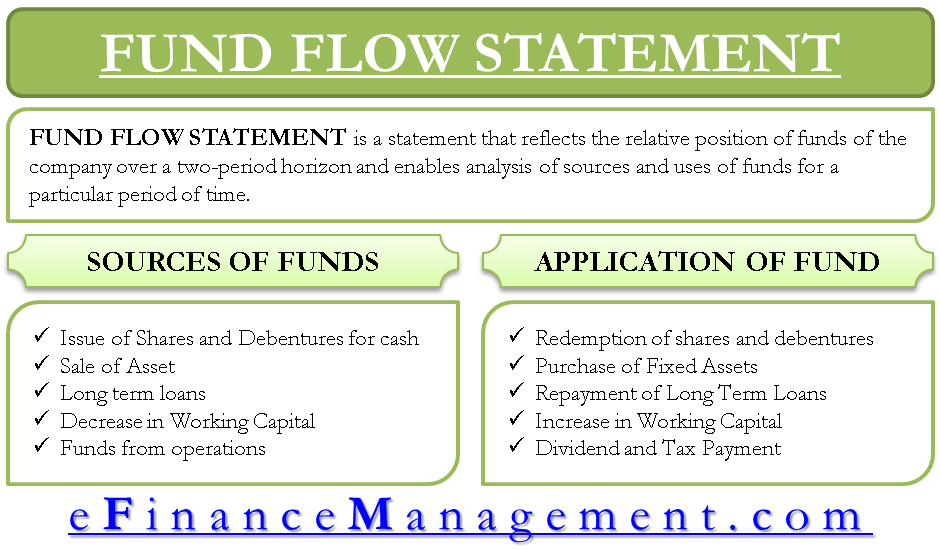

Thus, a fund flow statement tracks and records the net movement of funds in and out of the enterprise.

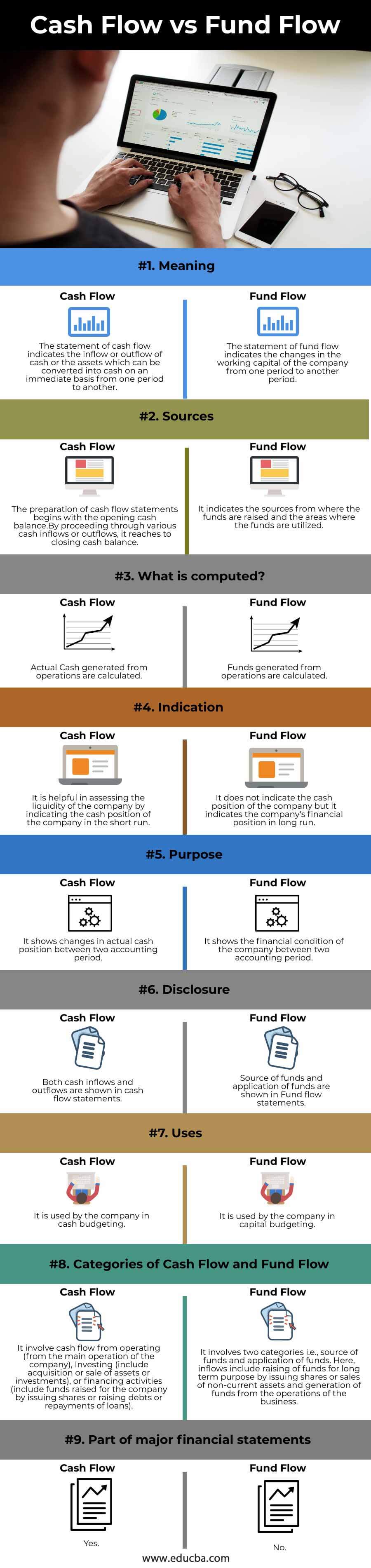

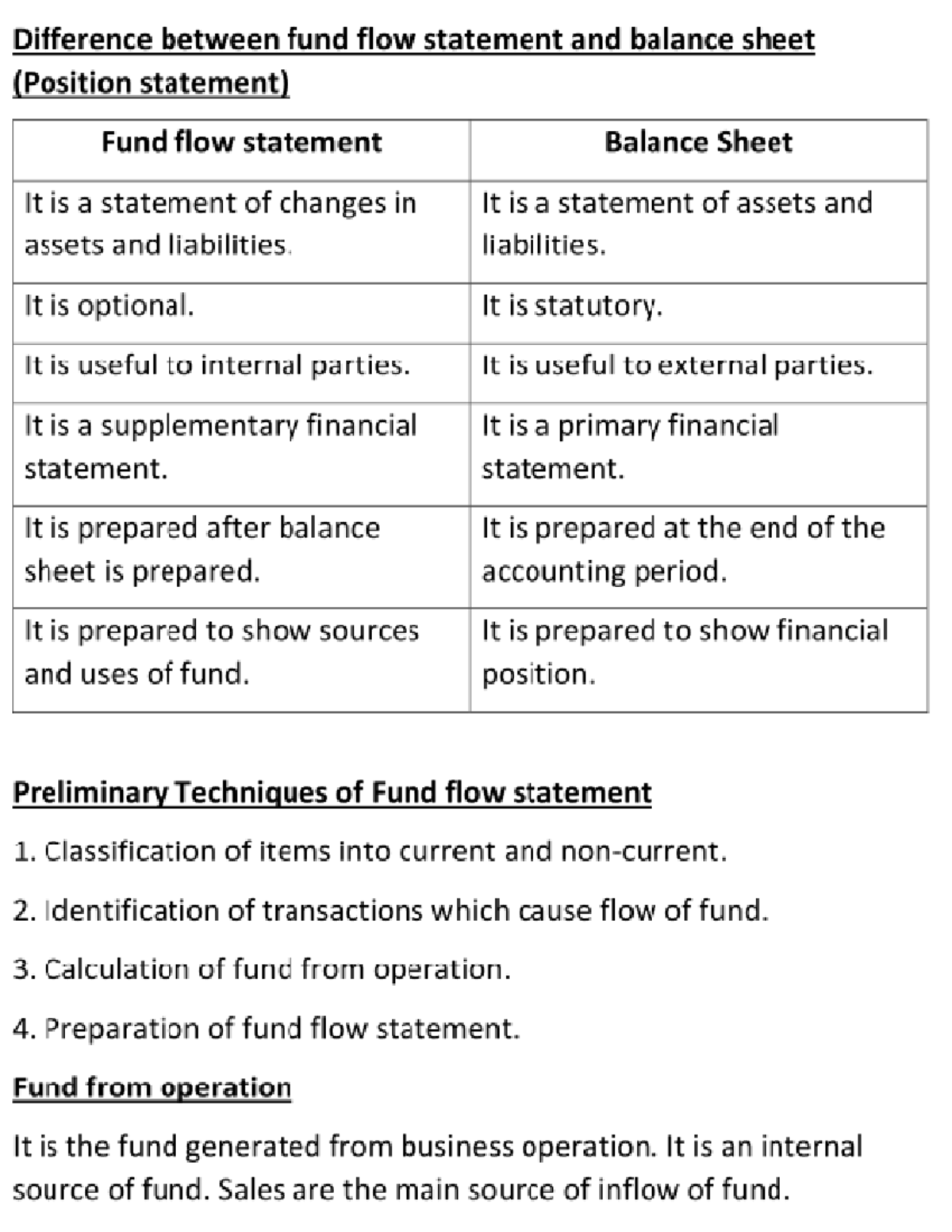

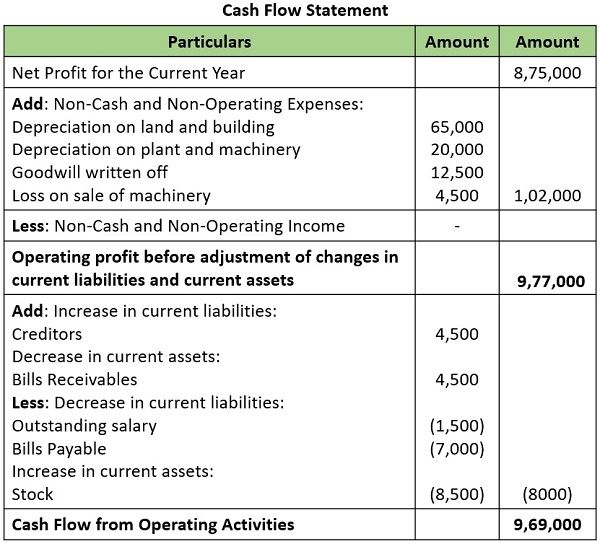

Difference between cash flow statement and fund flow statement. The cash flow statement is used to budget for cash. The difference between cash flow and fund flow statements emerges from the conceptual difference between cash and funds and both statements are analyzed in different lights to measure financial metrics and formulate future strategies. It helps in assessing company balance sheets and profit and loss statements.

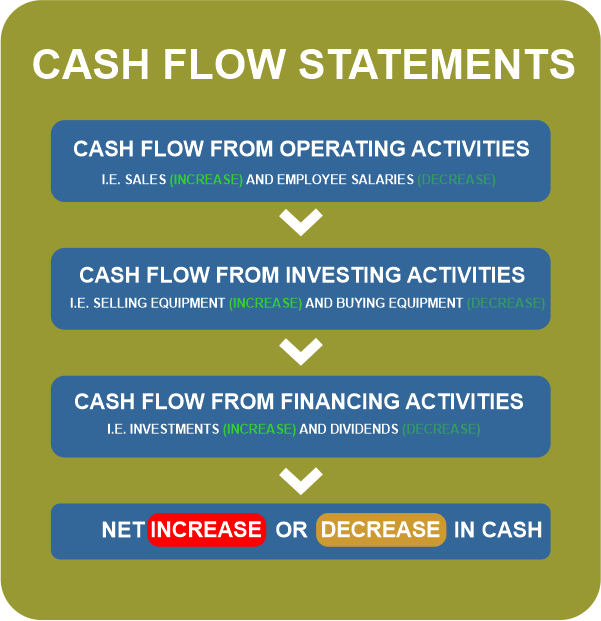

Cash flow refers to the concept of inflow and outflow of cash and cash equivalents during a particular period. While a cash flow statement is concerned with the flow of actual or notional cash, a fund. The fund flow statement, in contrast, makes it easier to identify the reasons for changes in the assets and liabilities listed on the balance sheet between two fiscal years.

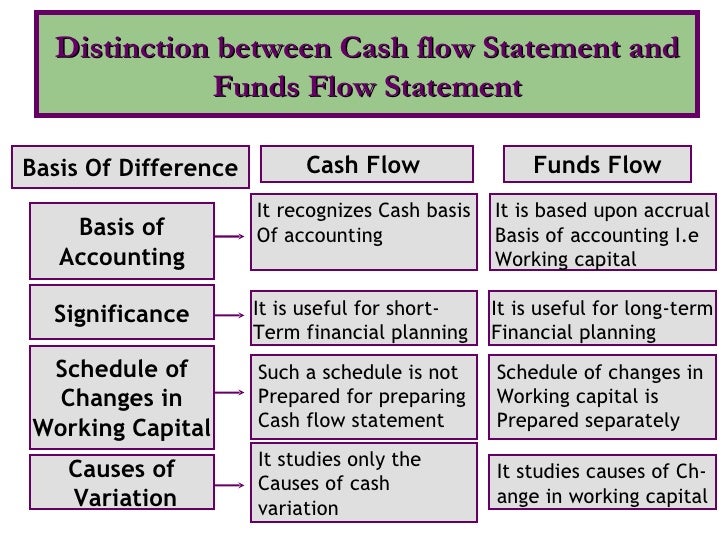

The cash flow statement vs fund flow statement are as follows: The fund flow statement, on the other hand, is generated using the accrual accounting method. The cash flow statement indicates the actual cash position of the business which is not shown by the fund flow statement.

Cash flow vs fund flow statements? They provide valuable information to investors, managers, and other stakeholders. Cash flow is used to identify the net cash flow of a business for a given period.

The key differences between the cash flow and fund flow are as follows: Cash flow is derived from the statement of cash flows. The income statement and balance sheet.

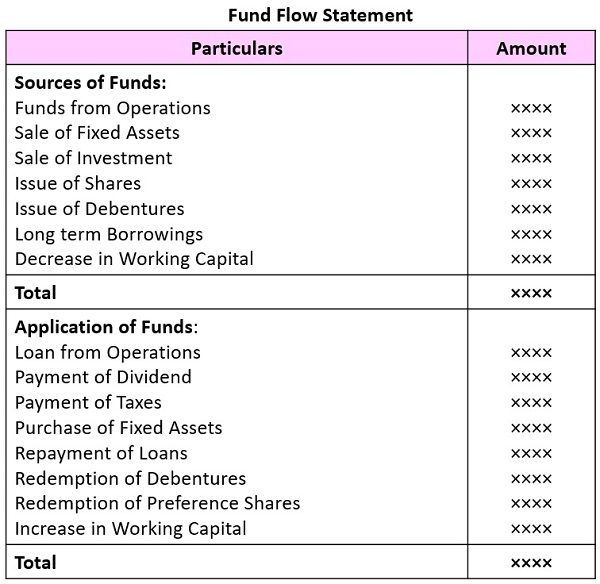

Fund flow signifies the working capital of an enterprise. There are many sources of cash flow in an organisation which may be categorized as: Differences between cash flow and funds flow statement cash flow and funds flow statements are both essential financial reports serving as a barometer of a company’s performance and efficiency in cash and funds management.

Advantages of cash flow statements the following are the advantages of a cash flow statement: It analyses the changes in the source of funds and the application of. | 3 min read contents [ show] the cash flow vs fund flow statements of a corporation are two separate indicators that measure funds over time.

To know about the liquidity of the company, one should refer cash flow statement instead of a fund flow statement. Is created by following a cash basis of accounting. Cash flow refers to the outflow and inflow of cash or cash equivalents in an organization in a specific period.

Cash flow statement a statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. It starts with opening and closing balance of cash and deals only with cash and it shows causes for changes in cash. Fund flow statement, which is distinct from the financial statement.

Following are the key differences between cash flow statement and fund flow statement: Accounting for cash flow is done only when liquid cash is involved in the form of currency or bank transfer. It is useful for short term financing.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)