Simple Tips About Unrealized Gains And Losses Accounting

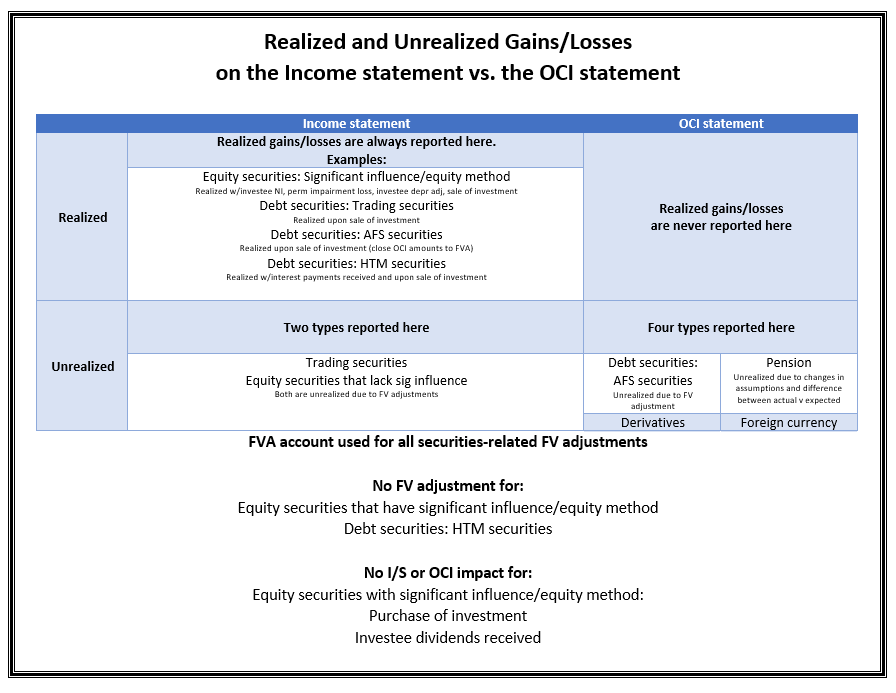

Unrealized gains and losses on securities held for sale:

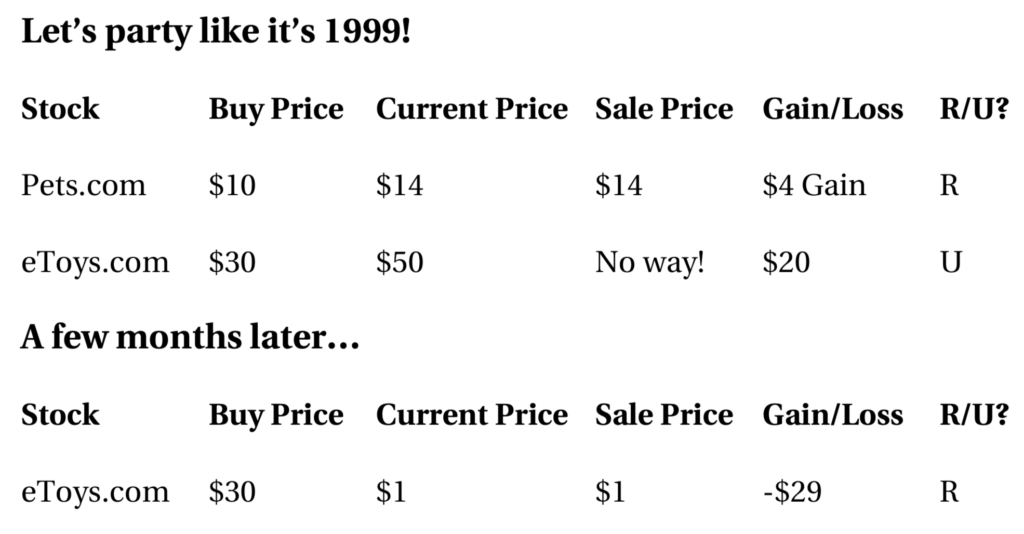

Unrealized gains and losses accounting. The gains and losses you see in your portfolio are considered “unrealized” until you sell the investment. Unrealized gains or losses are the gains or losses that the seller expects to earn when the invoice is settled, but the customer has failed to pay the invoice by the close of the. An unrealized gain is an increase in the value of an asset that has not been sold.

An unrealized gain or loss is a capability of a business to have profit or loss on paper, which results from an investment. Realized gains and losses are defined. The line item can be referred as “unrealized gain (loss)” on the stock.

Unrealized gains and losses accounting you realize a capital gain when you sell a security for a profit. You are free to use this image o your. Reporting unrealized gains and losses according to these different accounting principles is done for different reasons.

If the market price of the security subsequently declines to $9 per share, the investor would have an unrealized loss of $1 per share. From 2024 vt hb 827. A gain or a loss becomes “realized” when you sell the.

Losses are similar to gains in that both are recognized on the income statement only when an asset is sold and a loss is taken. Like gains, there can also be unrealized. An unrealized (paper) gain, on the other hand, is one that has not been realized yet.

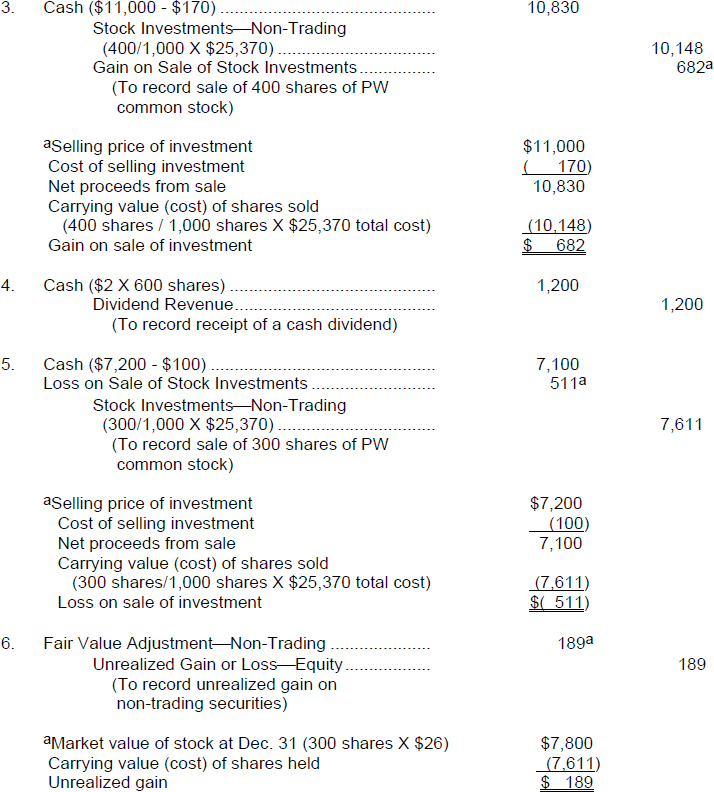

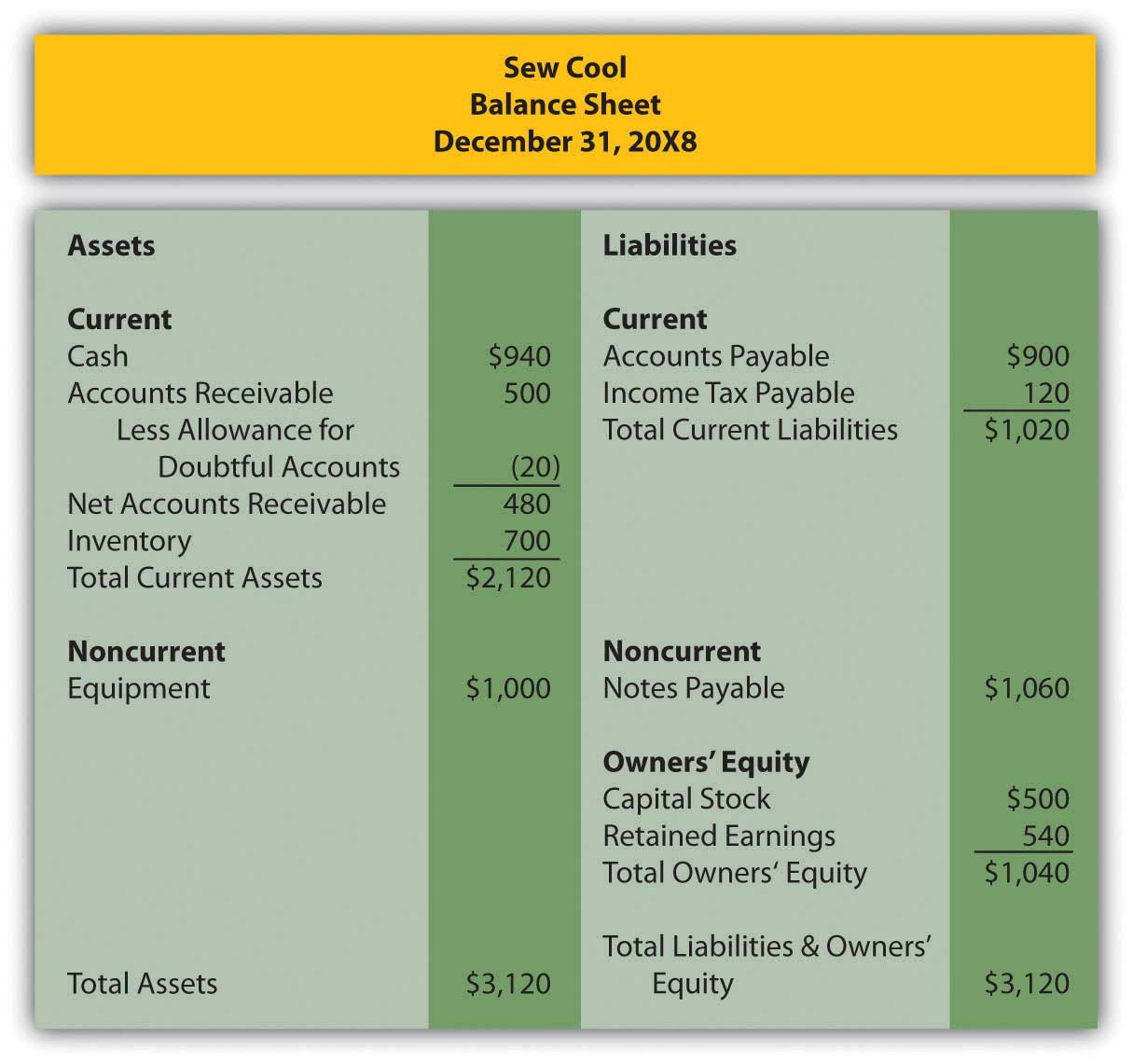

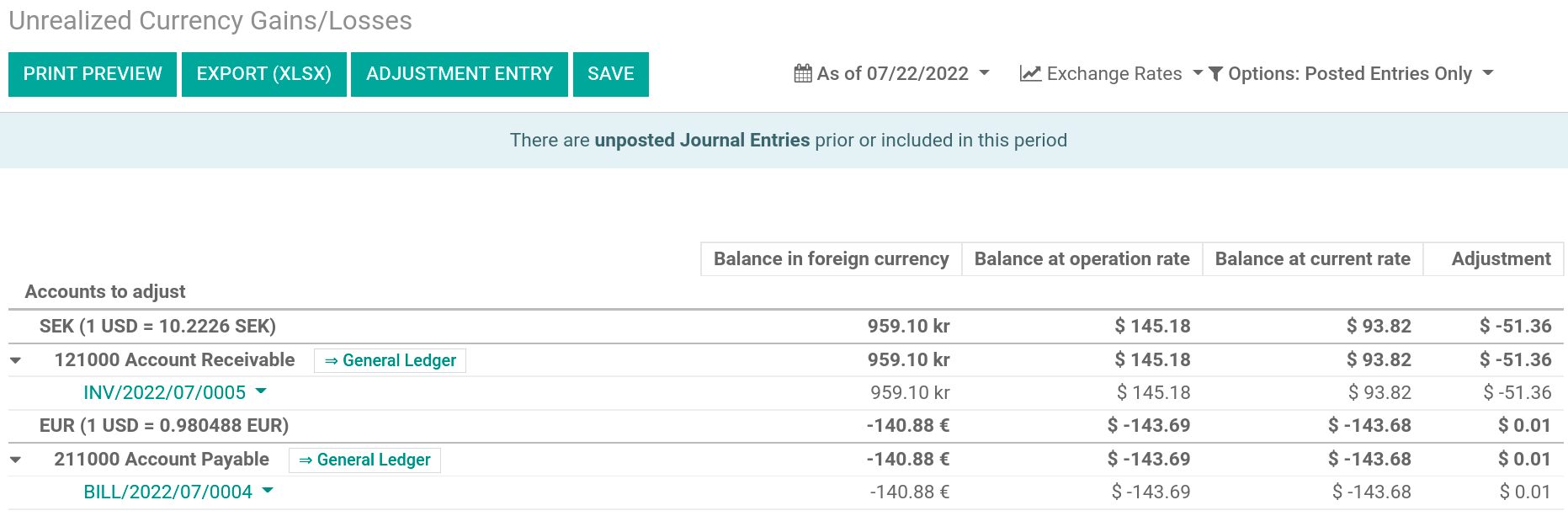

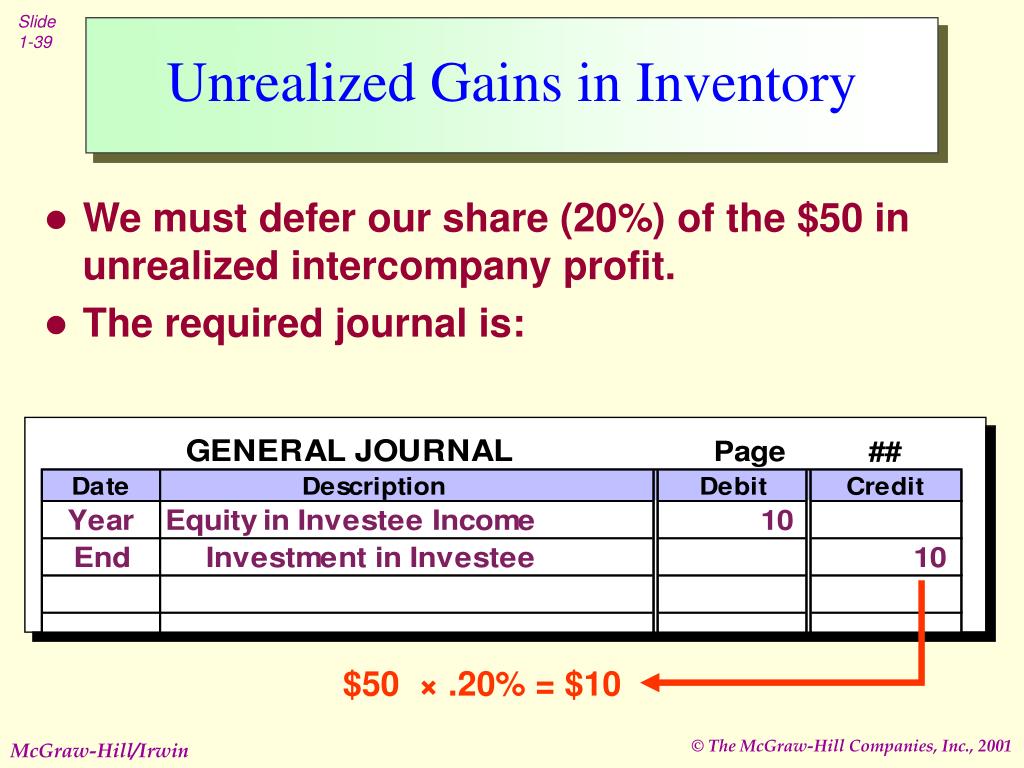

The journal entry involves debiting the fair value. Fair market value = book value + (book profits x 7.5) deemed realized gain =. The unrealized gains and losses are recorded in the balance sheet under the section of owner’s equity.

Until you sell it, you have an unrealized capital gain or. The accounting treatment depends on whether the securities are classified into three types, which are given below. Realized gains result in a taxable event, but unrealized gains are typically.

But if you die and your heirs sell it the next day for $300, they don’t pay. If you sold it, you would realize the gain of $100 and pay taxes on it. Adjusted gross profit and adjusted eps are defined as gross profit and diluted earnings per share excluding, when they occur, the impacts of restructuring activities,.

It is the increase or decrease in the value of. Unrealized capital gains tax: Unrealized gains or losses refer to the increase or decrease in the value of different company assets that have not been sold yet.

For example, vanguard recently showed in their total bond market etf unrealized losses of $6.05 per share net asset value of less than $74 per share, which is about 8% of the. Under financial accounting standards board (fasb) summary statement no. Most people will need to follow gaap principles.

![Held for Trading HFT/AFS Securities Company Investment Portfolios [Guide]](https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2020/12/table-description-automatically-generated-9.png)