Wonderful Info About Loans From Officers On Balance Sheet

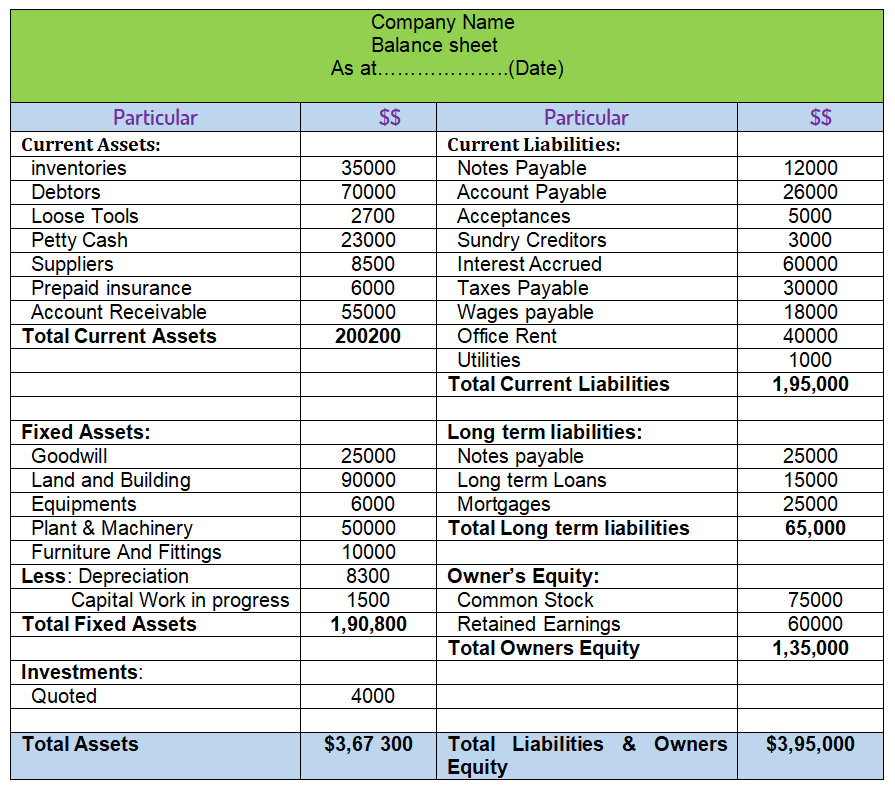

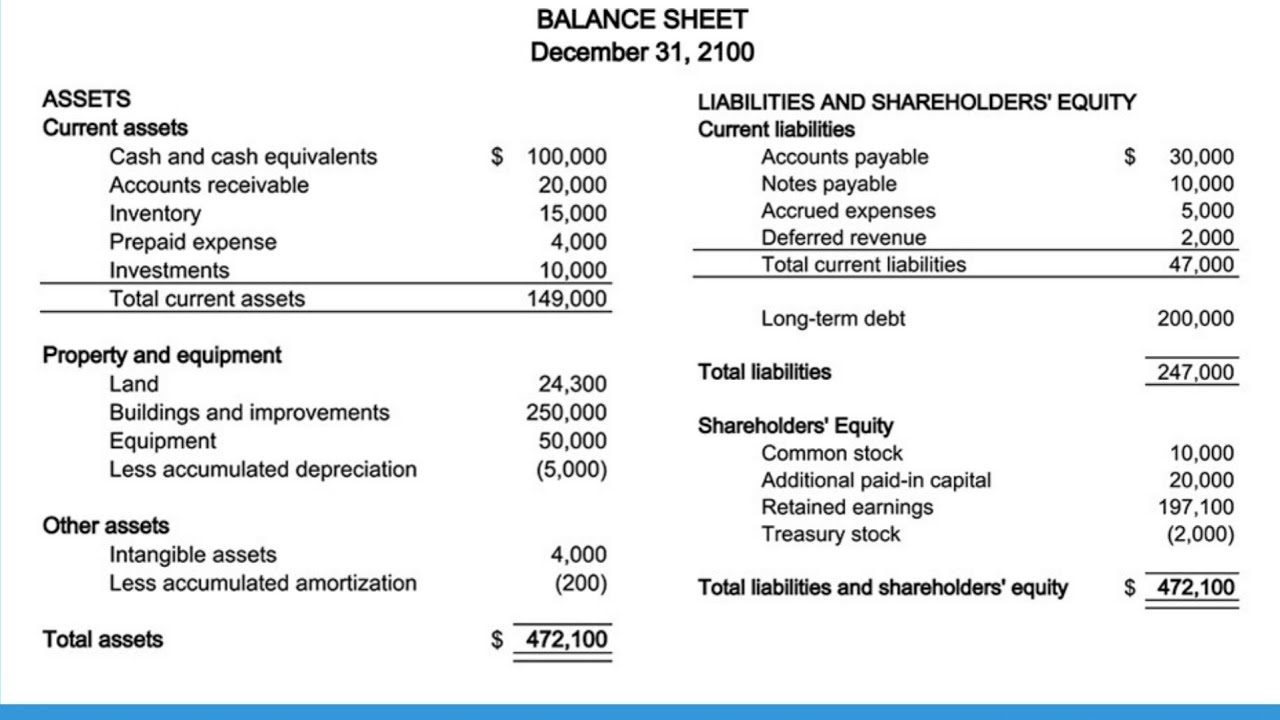

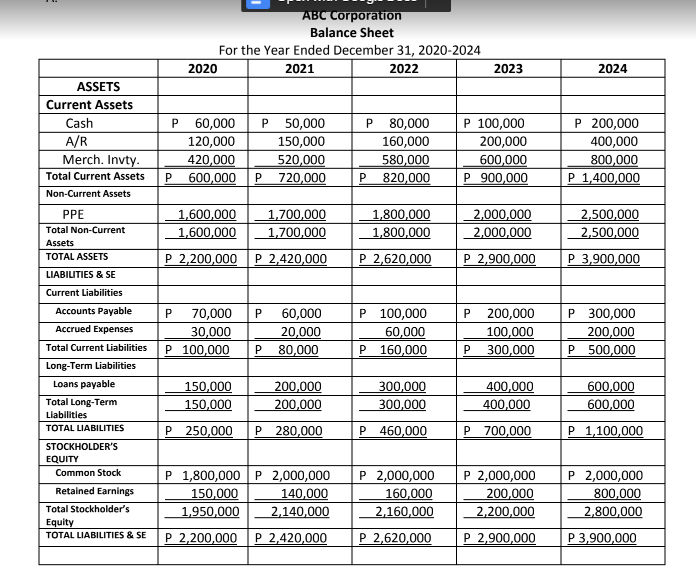

Non current portion of long term debt is the principal portion of a term loan not payable in the coming year.

Loans from officers on balance sheet. An equity financing method is a capital contribution. The loan itself is not a deduction. A loan to an employee is money advanced by the company to assist the employee.

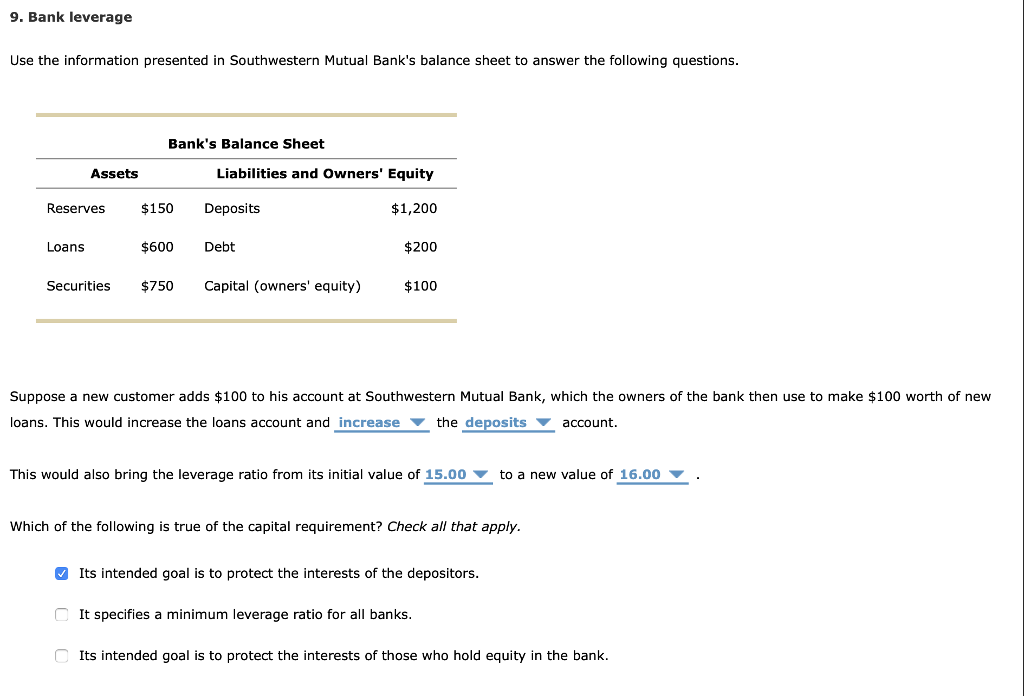

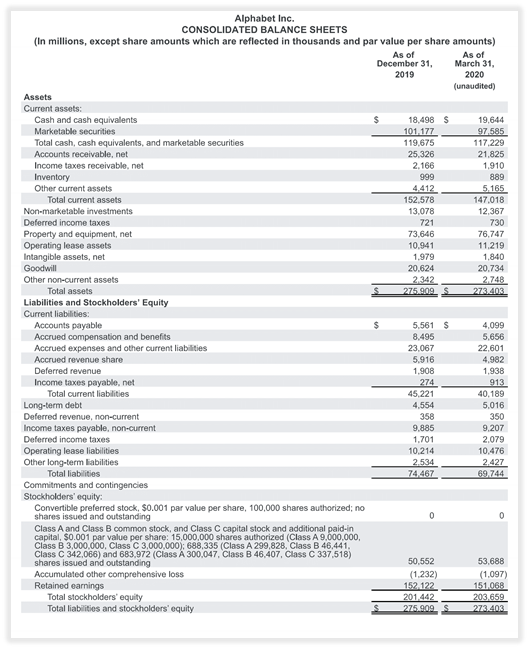

You’ll see it as an asset (receivable) of the business when the shareholder owes the company. The latter step is to record cash did on the loan. We now have around 14 to 15% share of loans on the stock of our balance sheet as against to 10 to 11% of deposits,” jagdishan said.

When a shareholder avails themselves of a loan from the company’s funds, it’s recorded as a debit balance in the shareholder loan account. Is a shareholder loan debt or equity? From the account dropdown list, select the liability statement you produced for this loan.

A loan on a balance sheet is a liability. Your shareholder loan balance will appear on your balance sheet as either an asset or a liability. What is the entry for a loan to an employee?

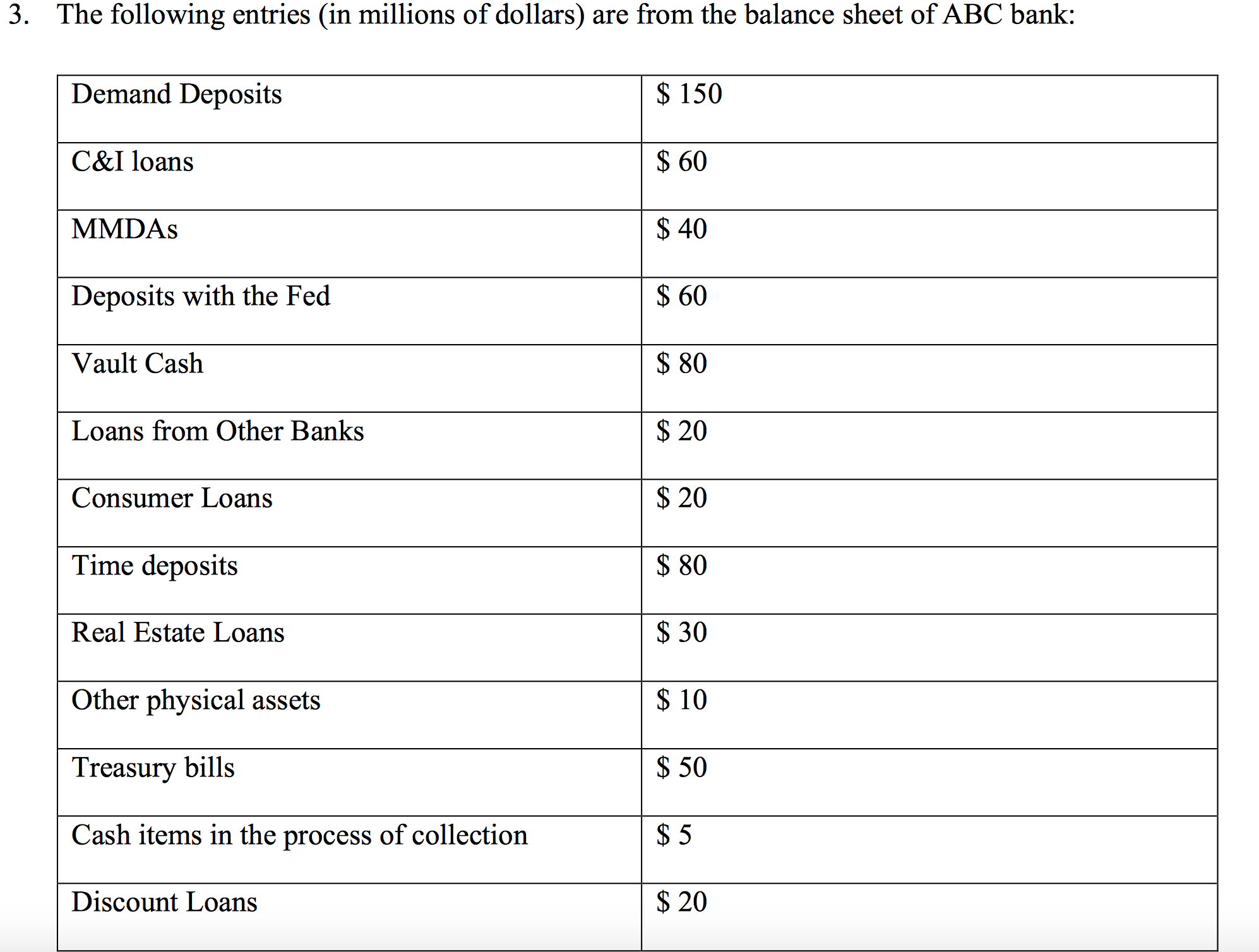

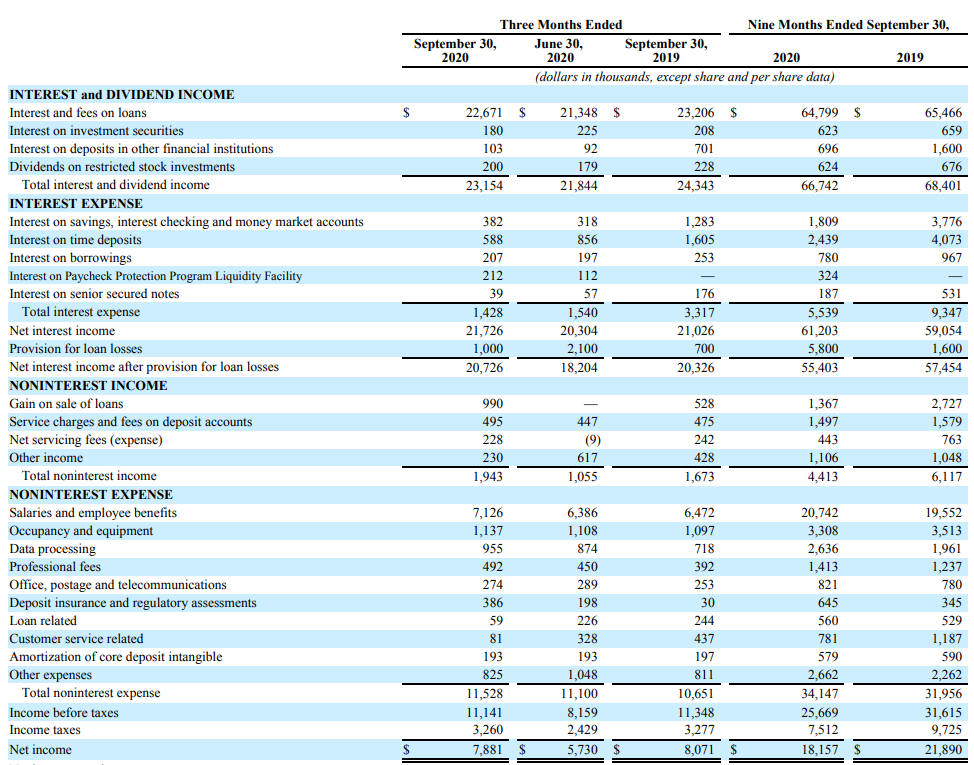

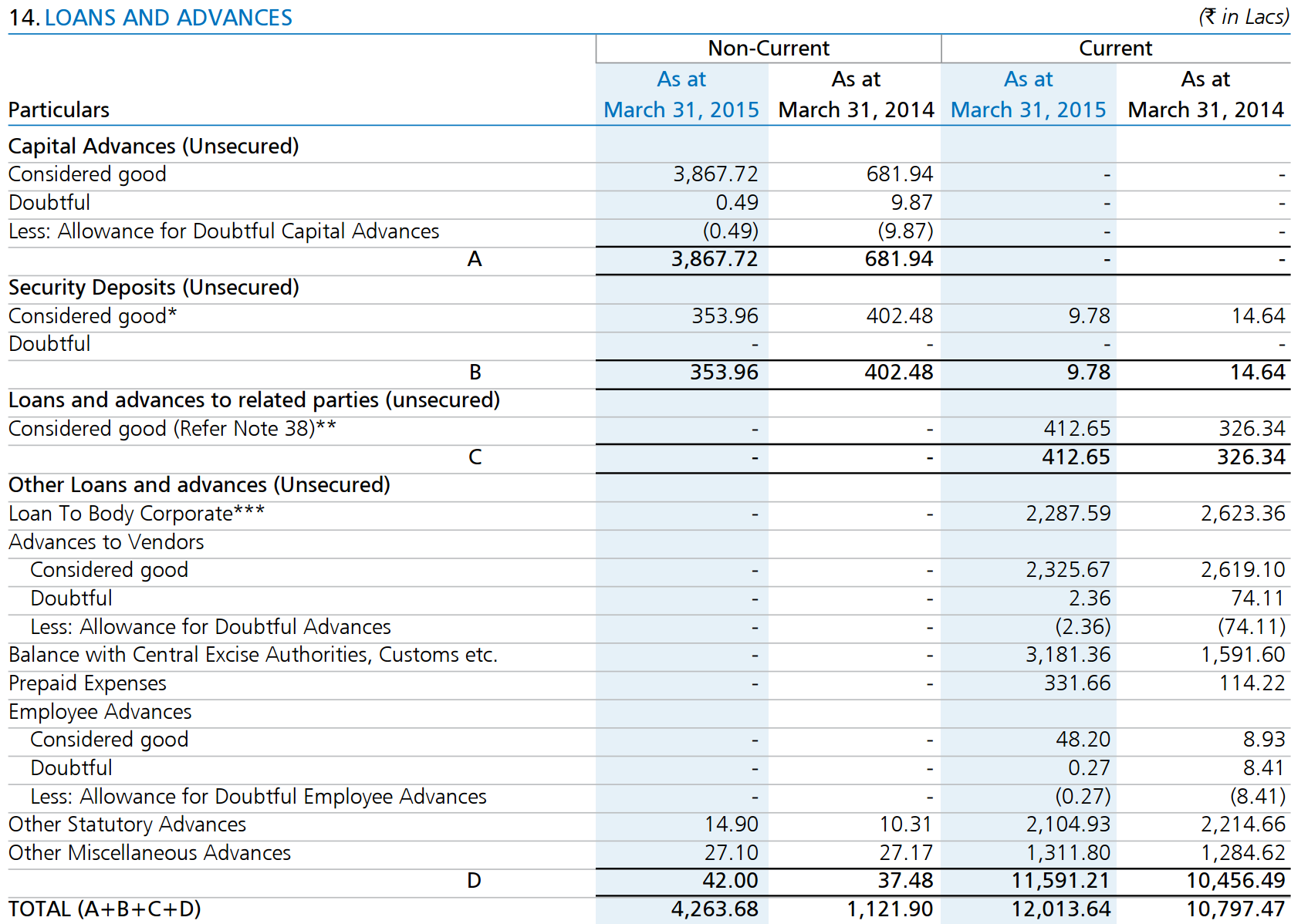

Examples of financing receivables include trade accounts receivable, notes receivable, credit card receivables, loans, and certain receivables relating to a lessor’s. Some specialized loan officers, called loan underwriters. Loans and receivables that are held for sale should be presented separately on the face of the balance sheet.

As fixed assets age, they begin to lose their value. Advance to employee or officer (employee advance) represents a cash payment (loan) made by the employer for the business expenses that are anticipated to be incurred by the employee or officer on behalf of the employer; See fsp 8.3 for additional information on the presentation of loans and receivables, including the presentation of loans from officers, employees, or.

Which means, the company paid more than the amount needed. Definition of loan to employee. The steps in the following sections provide guidance for this process.

If a reporting entity intends to sell a loan, the loan should be classified as held for sale (see li 4.3.2 ). But when you use the proceeds to pay for company expenses, those expenses are deductible in your p&l. The shareholder loan will appear on the balance sheet as a liability for the amount you draw out.

It is considered to be a liability (payable) of the business when the company owes the shareholder. Your shareholder loan will appear as an asset or liability on the balance sheet. What is a shareholder loan?

In the subsidiary's accounts i have dr bank and cr long term liabilities as it is likely the loan will take a few years to repay. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. However, in the holding company's.