Have A Tips About Financial Statement That Summarizes Revenues And Expenses

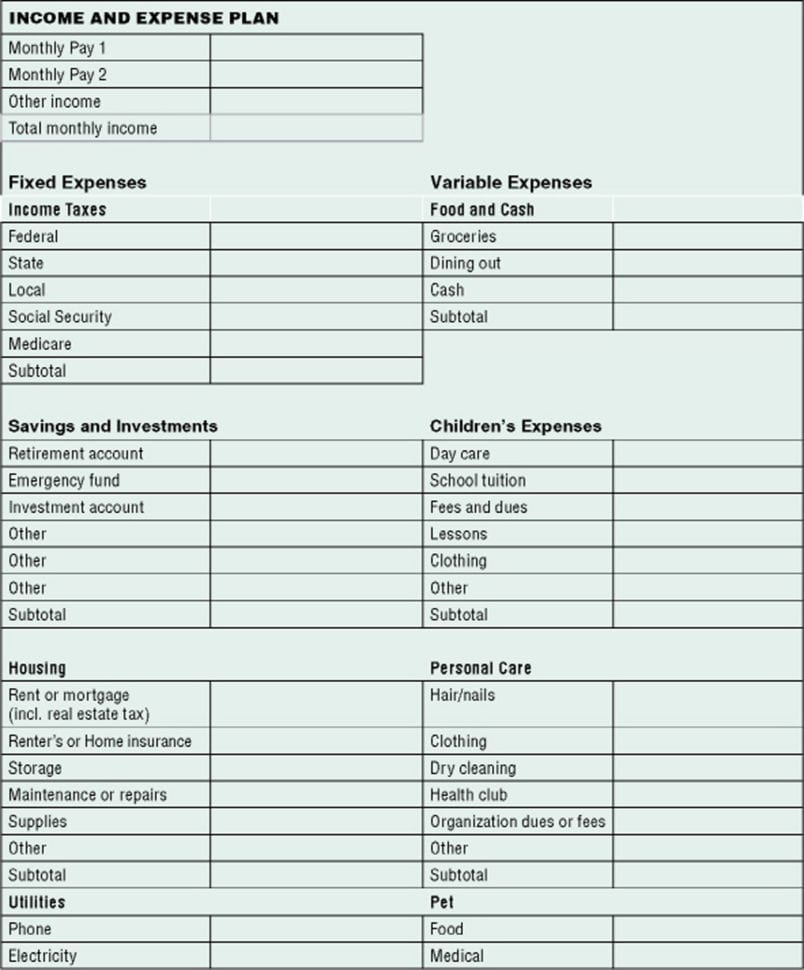

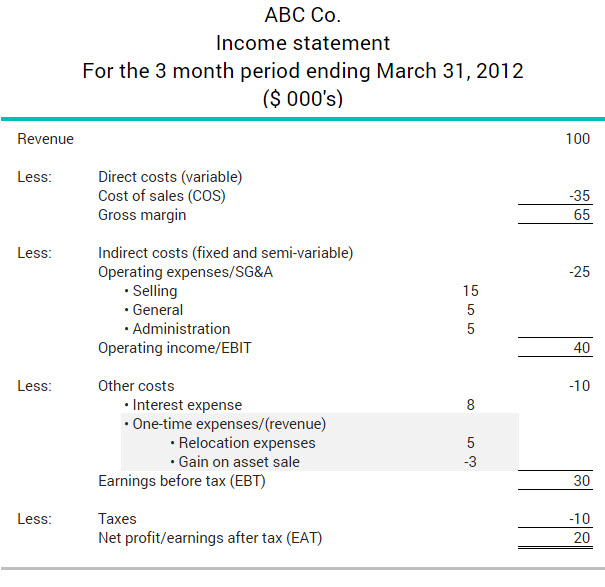

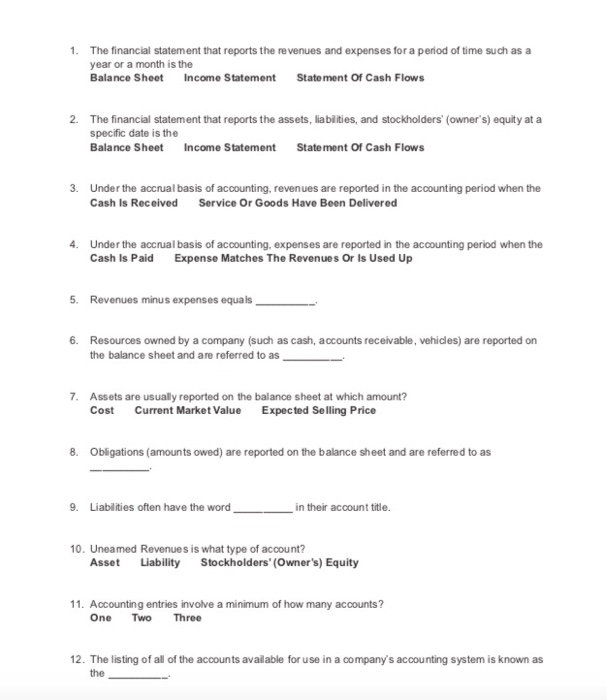

This information included revenues, expenses, and profit or loss for the period.

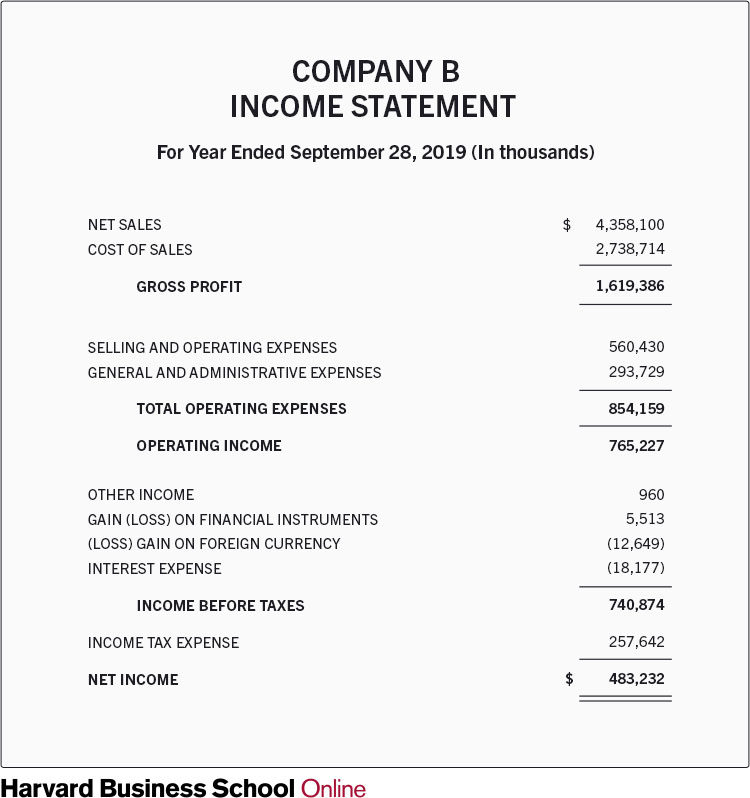

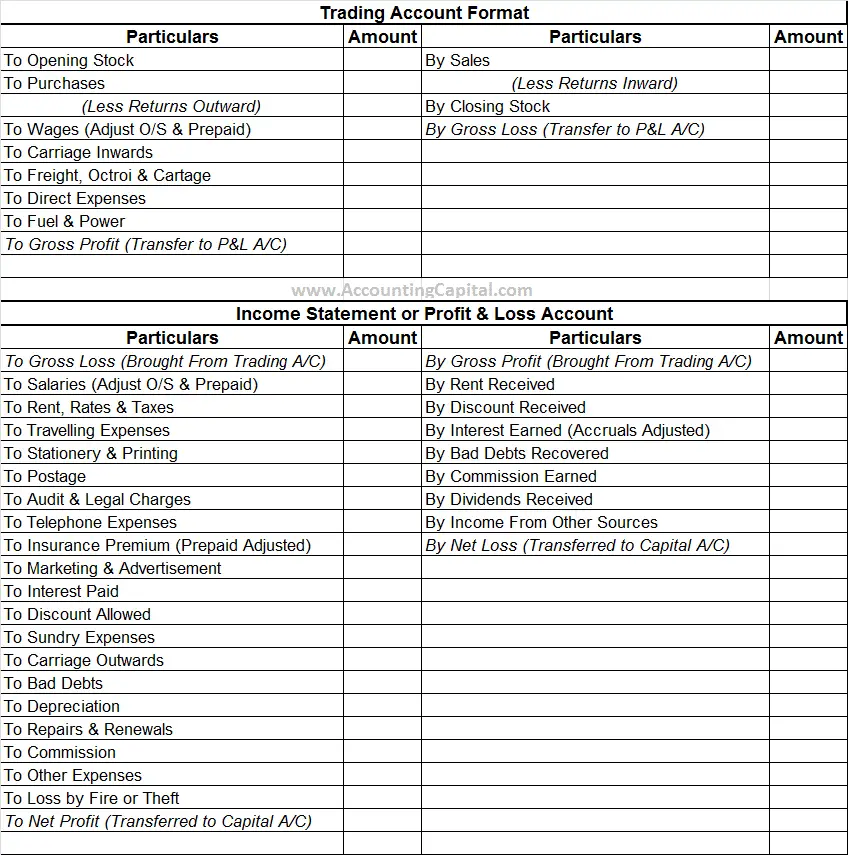

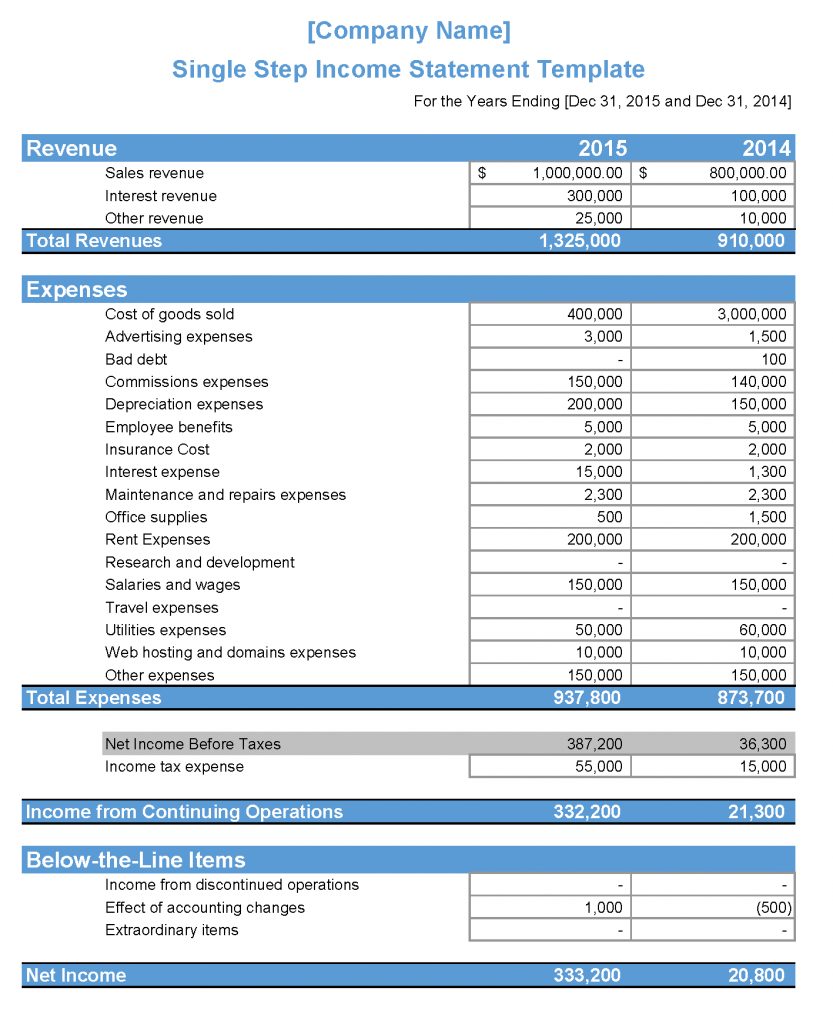

Financial statement that summarizes revenues and expenses. An income statement, also known as a profit and loss (p&l) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. It is based on the following equation: The income statement the income statement the income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity over time based on user requirements.

For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. Q4 2023 total nr of $293m increased 22% (q4 2022: A profit and loss (p&l) statement is a type of financial report that summarizes your company’s revenue, expenses and net income or losses over a particular period of time.

The income statement is a report that lists and summarizes revenue, expense, and net income information for a period of time, usually a month or a year. We measure revenues by the prices agreed on in the exchanges in which a business delivers goods or renders services. Net cash € 10.7 billion.

Click the card to flip 👆 Most companies prepare monthly income statements for management and quarterly and annual statements for use by investors, creditors, and other outsiders. Free cash flow before m&a and customer financing € 4.4 billion;

The income statement summarizes the firm’s revenues and expenses and shows its total profit or loss over a period of time. Santa clara, calif., feb. The three financial statements are:

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a fiscal quarter or year. Income statement a financial statement that presents the revenues and expenses and resulting net income or net loss of a company for a specific period of time. The income statement is a report that lists and summarizes revenue, expense, and net income information for a period of time, usually a month or a year.

It reveals the ability of a company to. A p&l statement provides information about whether a company can. The income statement primarily focuses on a company's revenues and expenses during a particular period.

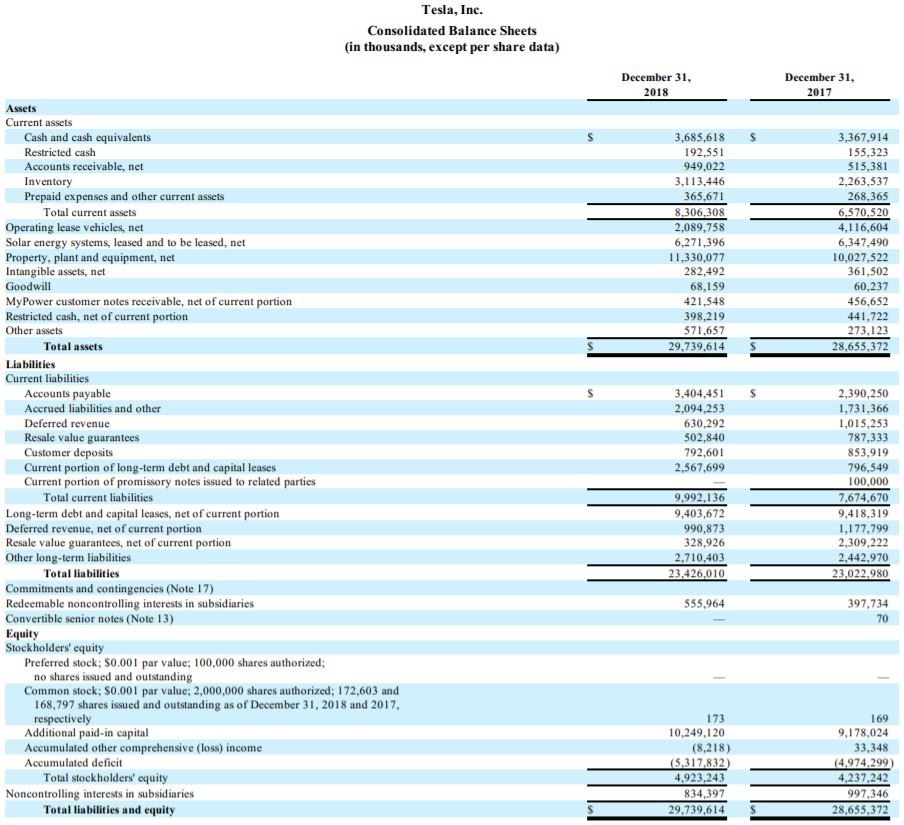

When expenses exceed revenues, the business has a net loss. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. The income statement focuses on four key items:

This document gauges the financial performance of a business in terms of profits or losses for the accounting period. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

The income statement is one of the financial statements of an entity that reports three main financial information of an entity for a specific period. Profit and loss statement, also referred to as income statement, is a statement that summarizes y. bloovera on instagram: The cfs measures how well a company.

:max_bytes(150000):strip_icc()/plstatement-5f8980ff2b264ff4a874daa9a3c06ec5.png)