Simple Tips About 4 Main Financial Statements Ledger Balance Sheet Format

A balance sheet has three primary components:

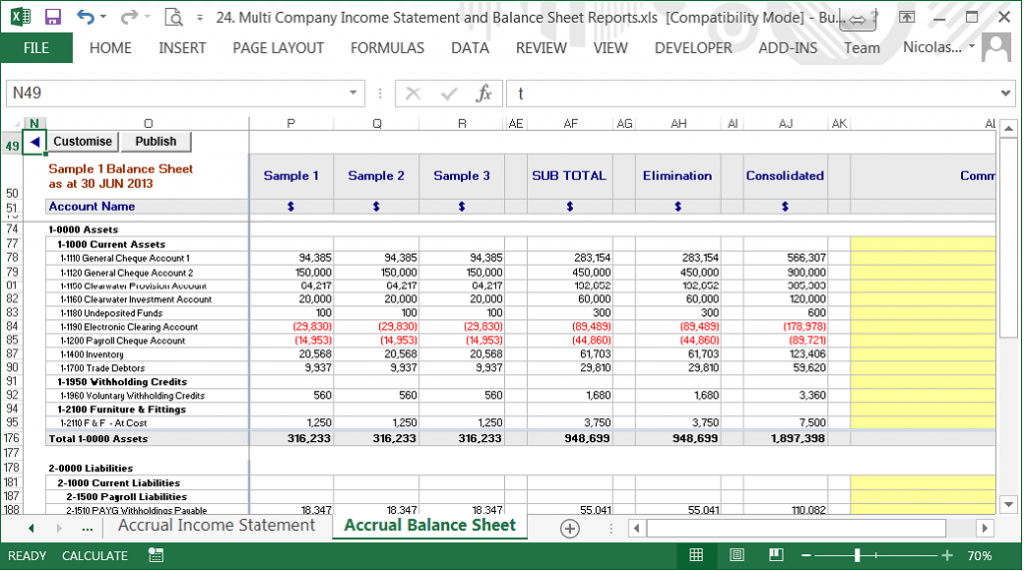

4 main financial statements ledger balance sheet format. Prepare an accounts receivable schedule and an accounts payable schedule. Get the best ledger balance sheet formats created by vyapar. Assets = liabilities + equity.

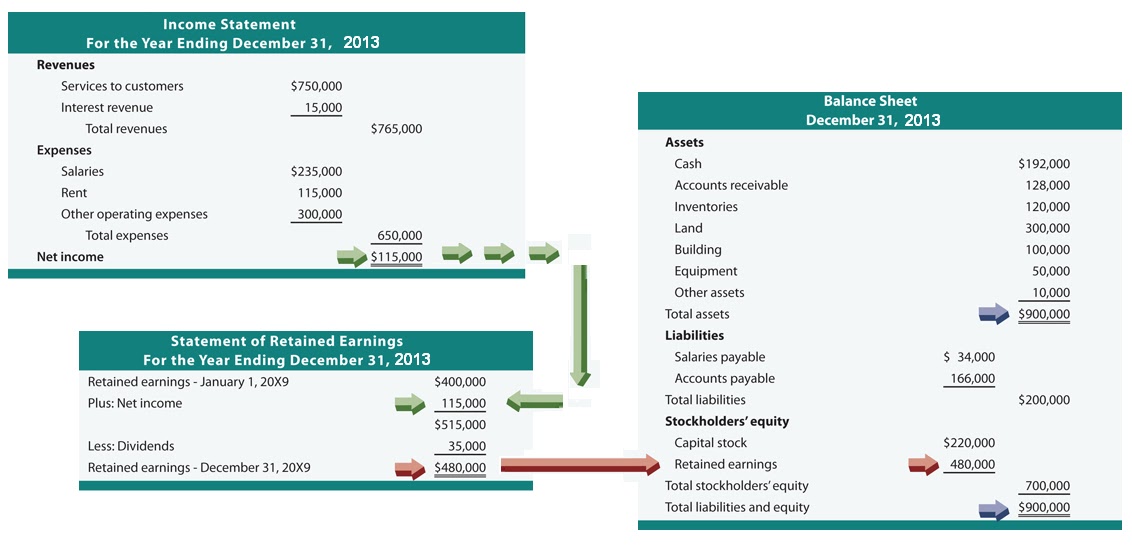

It is based on a fundamental accounting equation which is; Balance sheet shows the business’s financial position at a glance at a particular time. Format of the balance sheet.

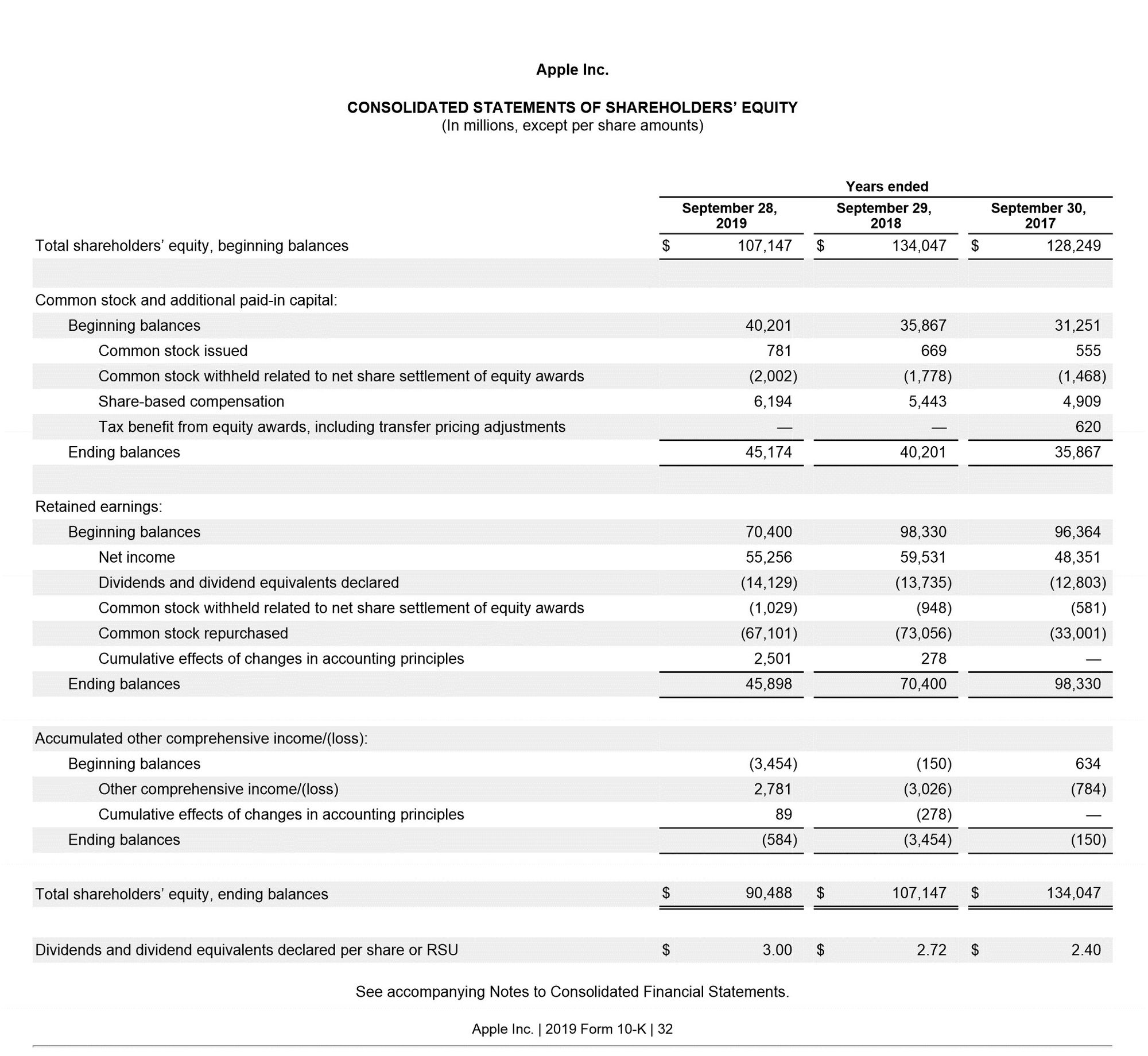

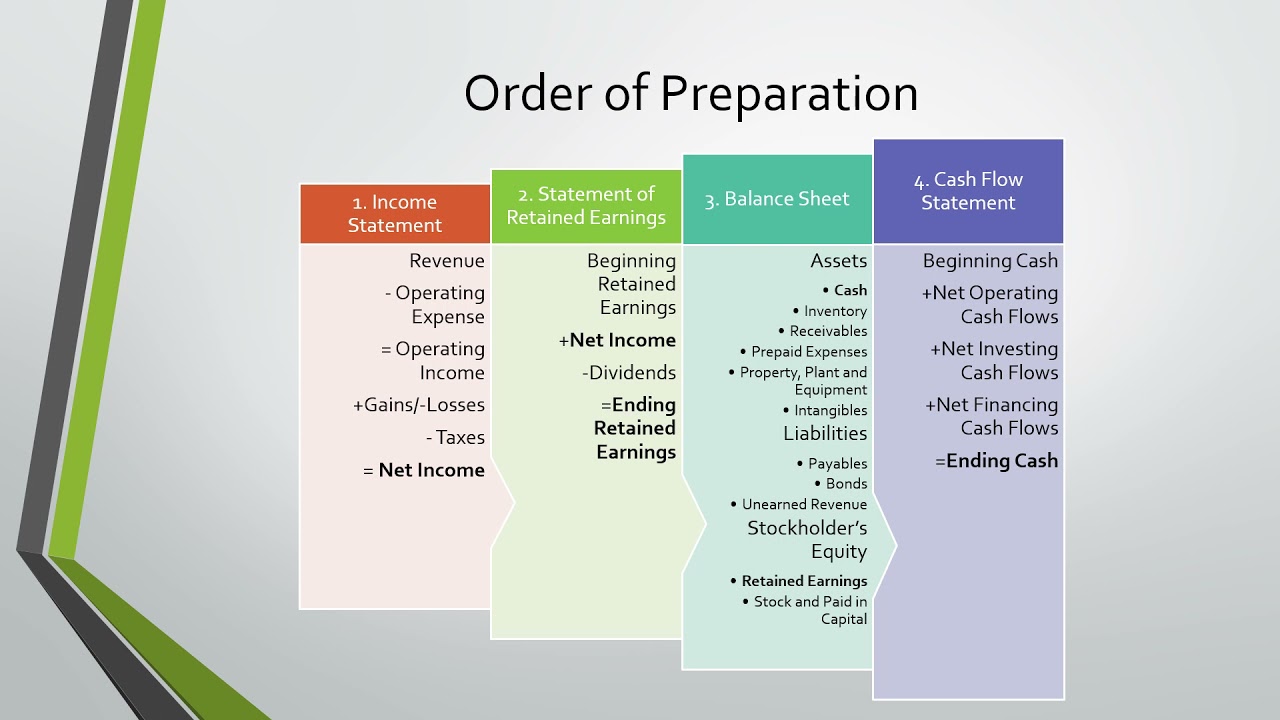

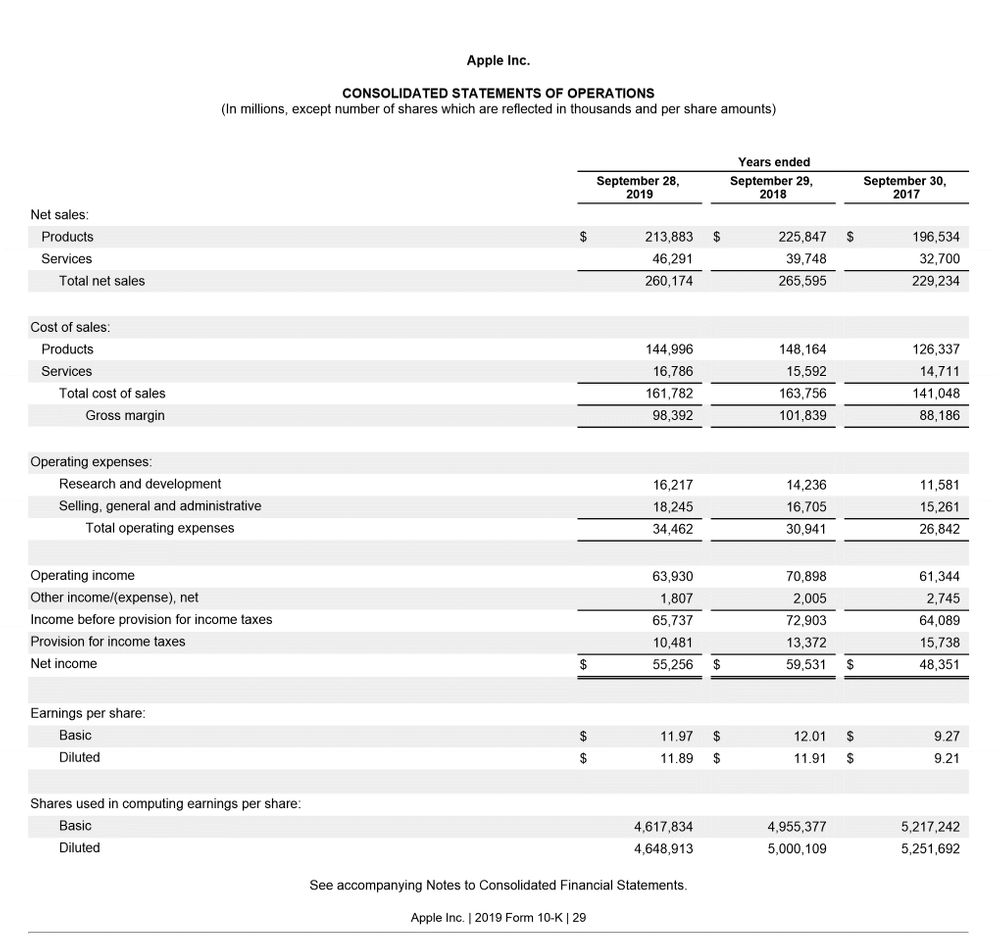

A general ledger template must always be in balance between the debit and credit amounts. What are the four basic financial statements? The four basic financial statements are the income statement, balance sheet, statement of cash flows, and statement of retained earnings.

The four main financial statements are: Using the vyapar best accounting software is effortless and eliminates the need for multiple apps. Many small business owners rely on our app for their ledger maintenance and accounting requirements.

Following is an example of a receivable ledger account: In account format, the balance sheet is divided into left and right sides like a t account. Assets, liabilities, and shareholders’ equity.

The two middle columns, (2) and (3), are the heart of the ledger account.particulars of the transaction (1)monetary sumdebit(2)credit(3)balance(4)explanation of the columnsthe usa furniture company will register this transaction in two ledger accounts: The balance sheet formula is: The balance sheet is a snapshot used to provide a companys financial position on a specific date.

There are four types of financial statements: The balance sheet is one of the four main financial statements of a business. The ledger also holds the recorded information of all your business account information over the course of its life you need for preparing financial statements.

The four basic financial statements. Company’s general ledger account is organized under the general ledger with the balance sheet classified in multiple accounts like assets, accounts receivable, account payable, stockholders, liabilities, equities, revenues, taxes, expenses, profit, loss, funds, loans, bonds, stocks, salaries, wages, etc. Usually, the balance sheet is prepared from a trial balance.

A balance sheet is a financial statement that contains details of a company’s assets or liabilities at a specific point in time. Nonprofit entities use a similar but. Assets assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash.

That way, you know which statements to have handy. The four basic financial statements that businesses and organizations use to track profits, expenses and other financial information work together to form a complete picture of a company's financial health. The balance sheet, income statement, and cash flow statement:

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)