Great Tips About Off Balance Sheet Liabilities

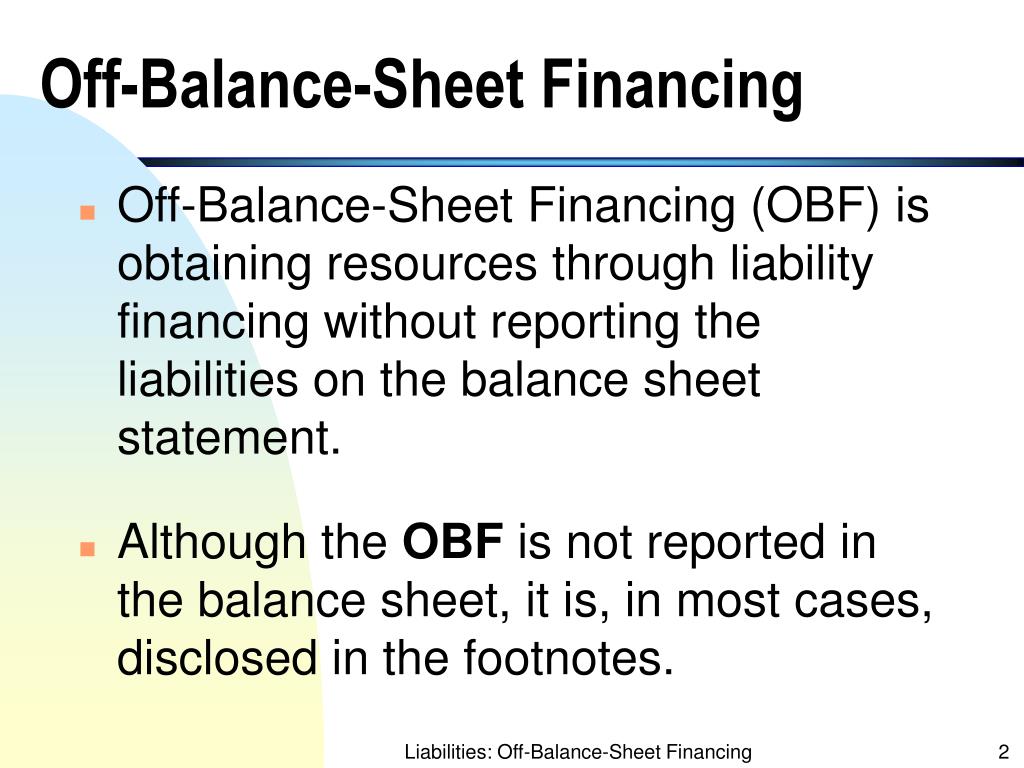

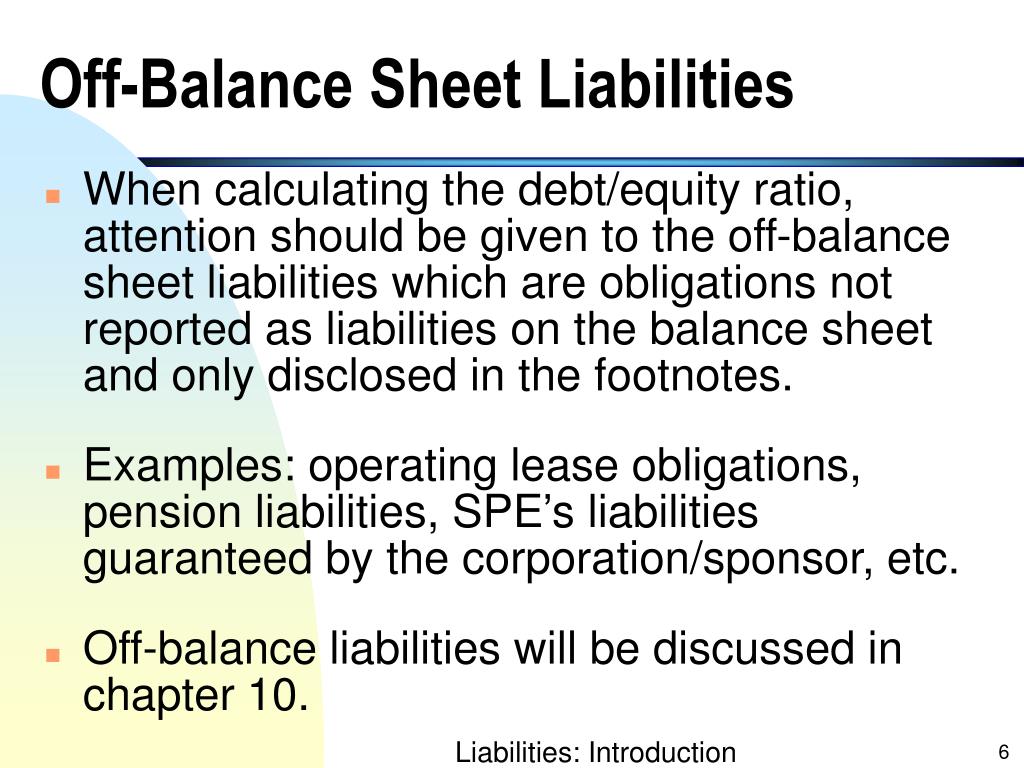

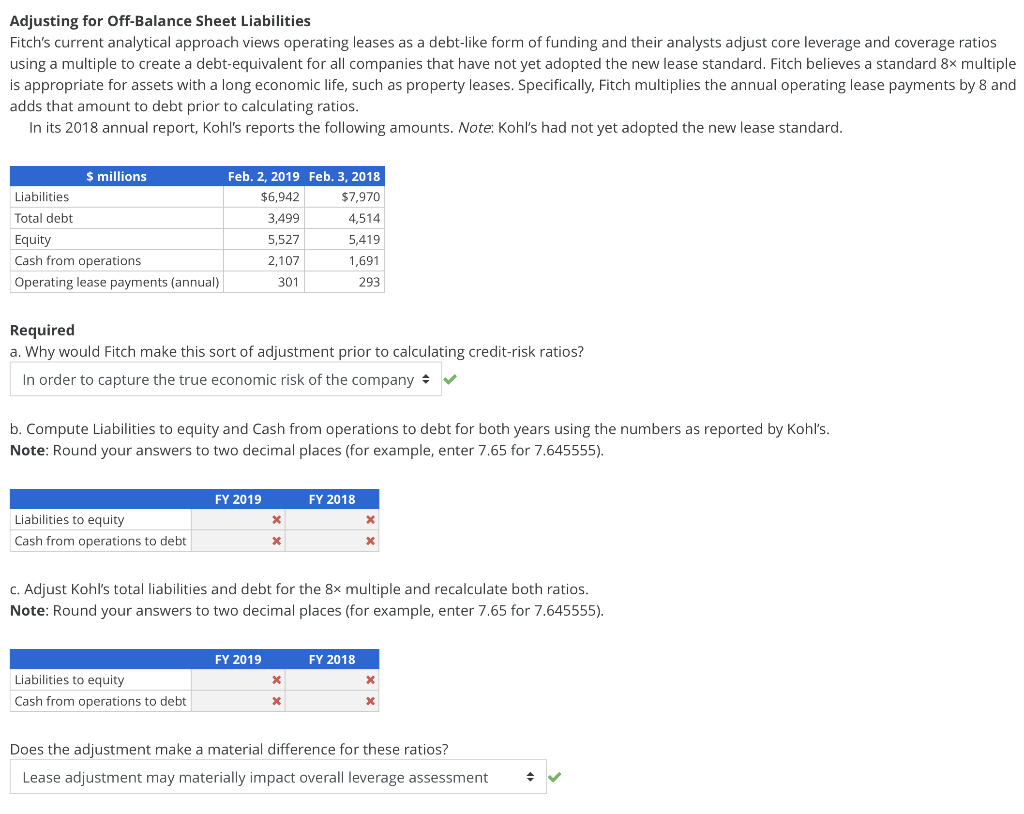

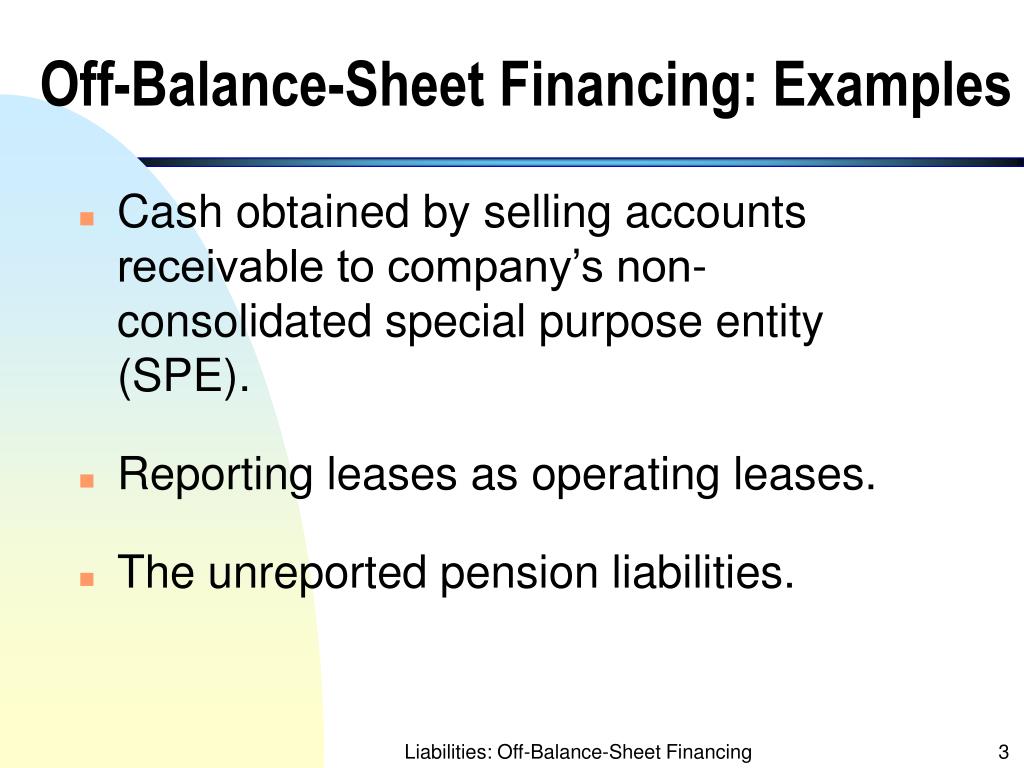

An off balance sheet liability is an obligation of a business for which there is no accounting requirement to report it within the body of the financial statements.

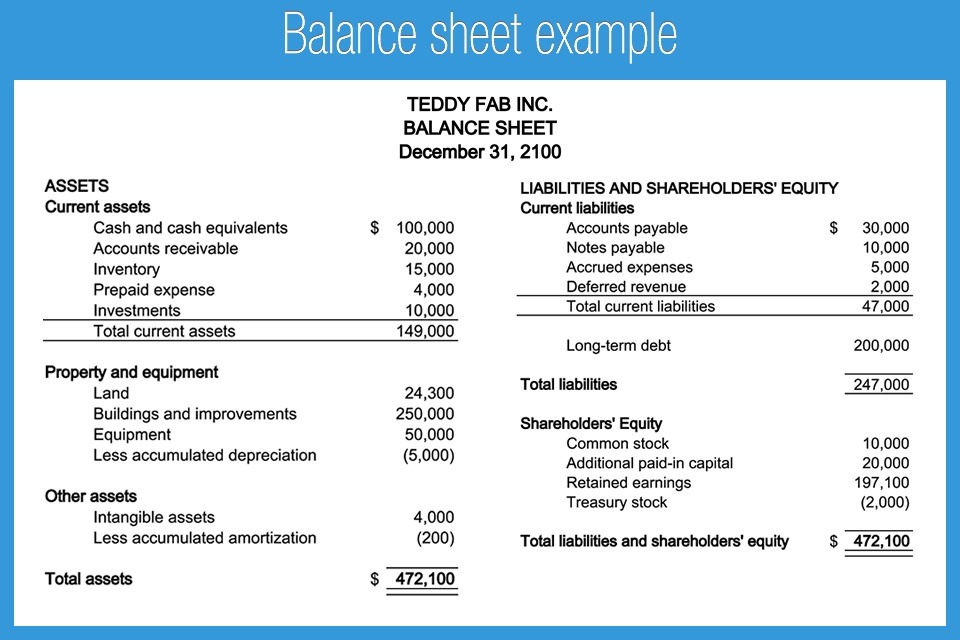

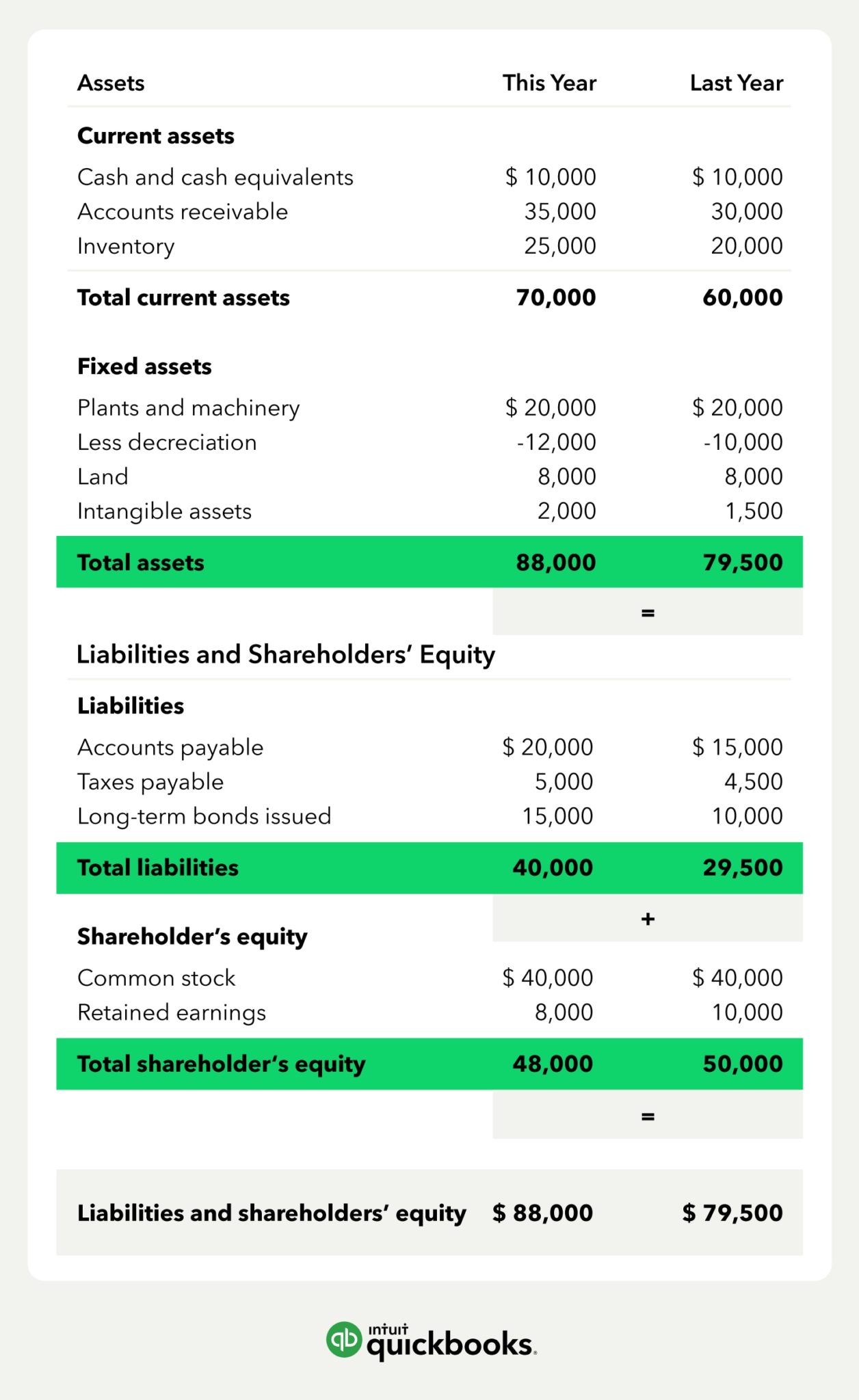

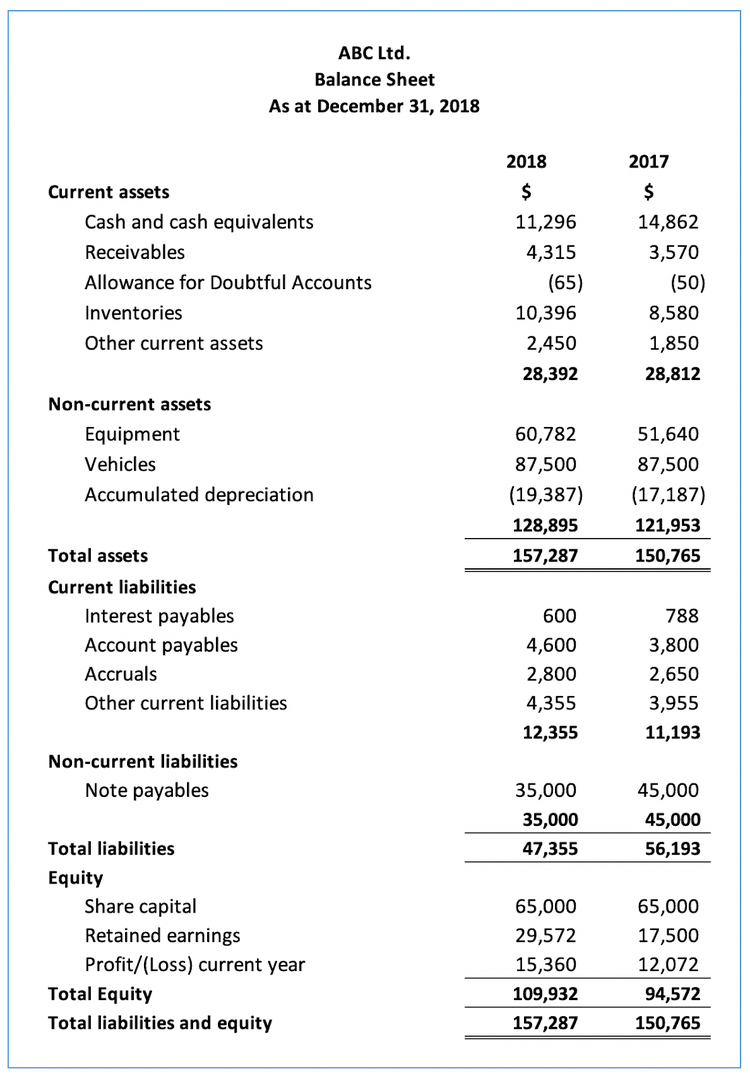

Off balance sheet liabilities. Assets = liabilities + owners’ equity the formula can also be rearranged like so: But what do they actually mean and include? Liability is an obligation between one party and another not yet completed or paid for in full.

Remember the balance sheet formula: They are either a liability or an asset which are not shown on a company’s balance sheet as the business is not a legal owner of the respective item. When you think about investing in a business, whether it is a public stock you can buy via schwab, or a mature business you are acquiring with debt financing in a leveraged purchase transaction, or a growth company you.

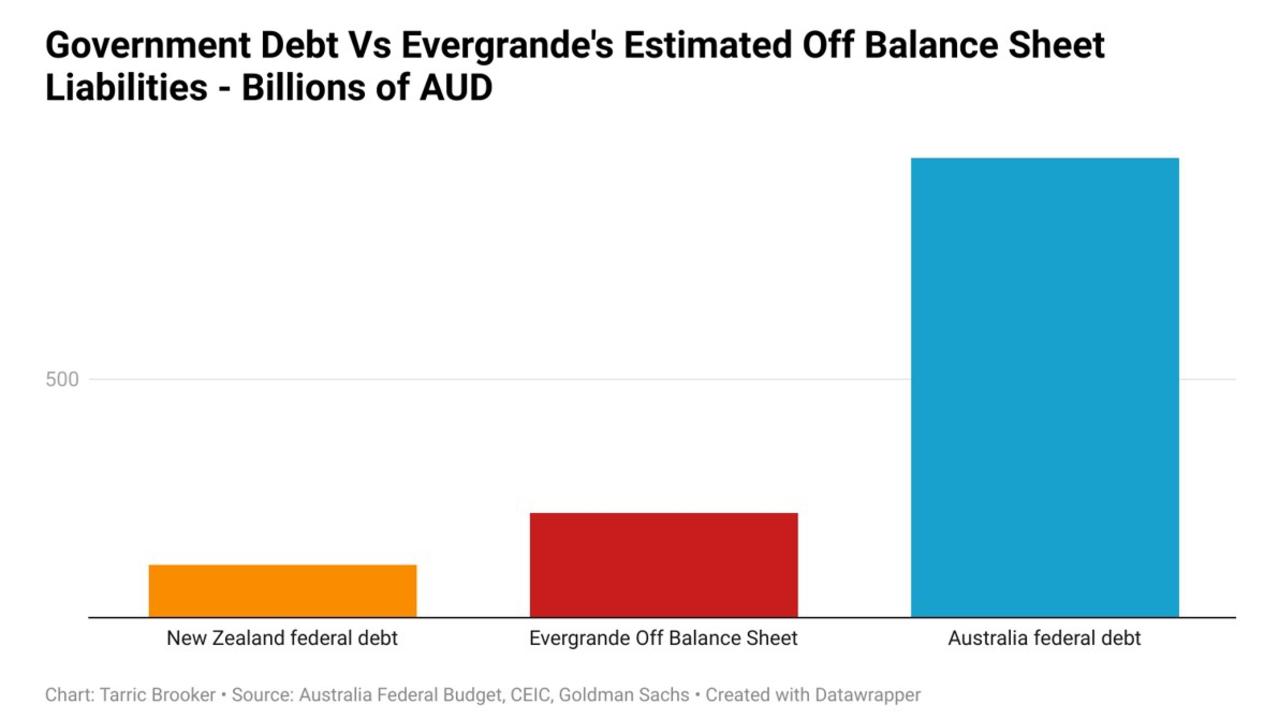

It is used to impact a company’s level of debt and. Off balance sheet refers to those assets and liabilities not appearing on an entity's balance sheet , but which nonetheless effectively belong to the enterprise. What is net worth or owners’ equity?

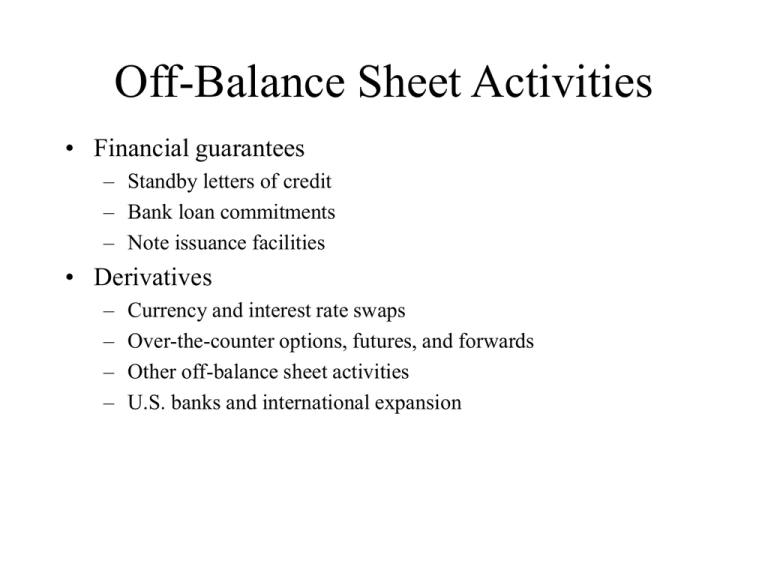

Although they may not be present on the. You’ve probably heard at least some of these terms before. Although the obs accounting method can be used in a number of scenarios, this.

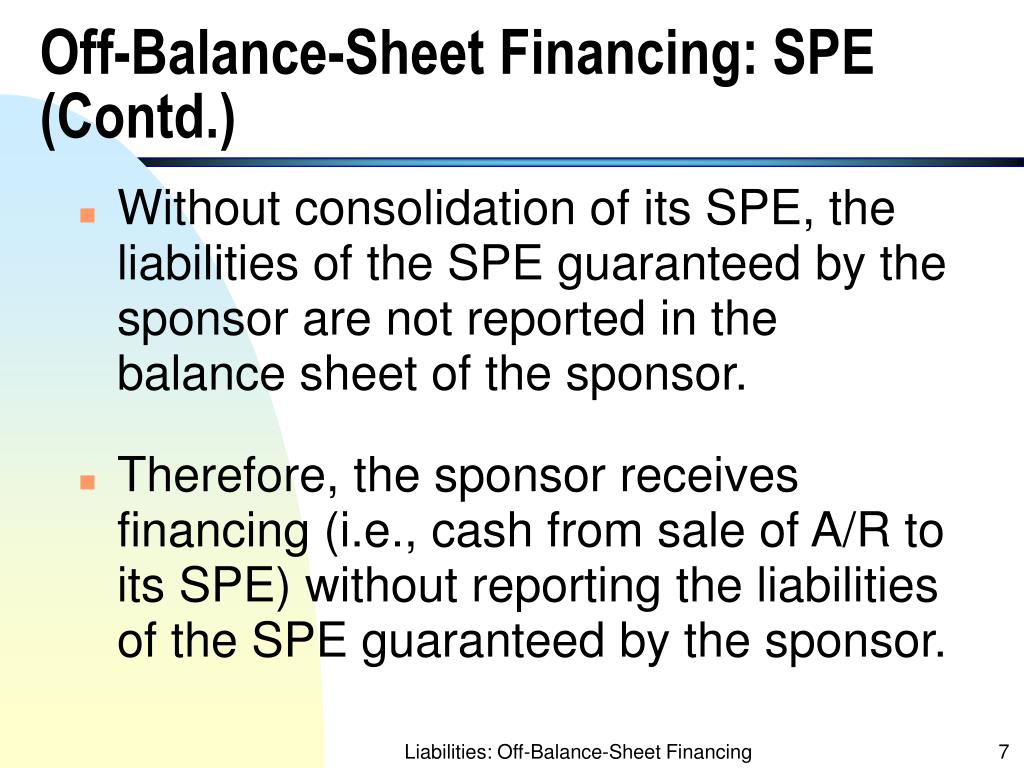

Although not recorded on the balance sheet, they are still assets and. For example, let's assume that company xyz has a $4,000,000 line of credit with bank abc. Firms, lenders, and investors care about obs for different reasons.

These items are usually associated with the sharing of risk or they are financing transactions. Those bonds are thus listed as liabilities on the company’s balance sheet. Obs activities can improve earnings ratios but may deceive stakeholders.

These liabilities are usually not firm obligations, but might require settlement by the reporting entity at a future date. On a company’s balance sheet, owners’ equity shows what the owners of the business (or shareholders) would have if the company paid off all its debt with its assets. While there’s no official categories for.

How does an off balance sheet work? What is off balance sheet? Total return swaps are generally bonds and loans in which all of the risk is transferred to the receiver, so that the receiver has access to the asset immediately, in exchange for the risk.

The technical term for them is “off balance sheet liabilities” and they are something to be very wary of as an investor. They still remain important components of the business but are just not directly fall under company obligations of ownership. Balance sheets provide the basis for.

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. However, these assets and liabilities still belong to the company though they may not be directly associated with the company. These items may expose institutions to credit risk, liquidity risk, or counterparty risk, which is not reflected on.

:max_bytes(150000):strip_icc()/GettyImages-172940273-28a7232c2a9149a9a191440b7b8a397c.jpg)