Smart Info About Balance Sheet Cheat

Our balance sheet cheat sheet highlights six key measures that are useful for all types of nonprofits.

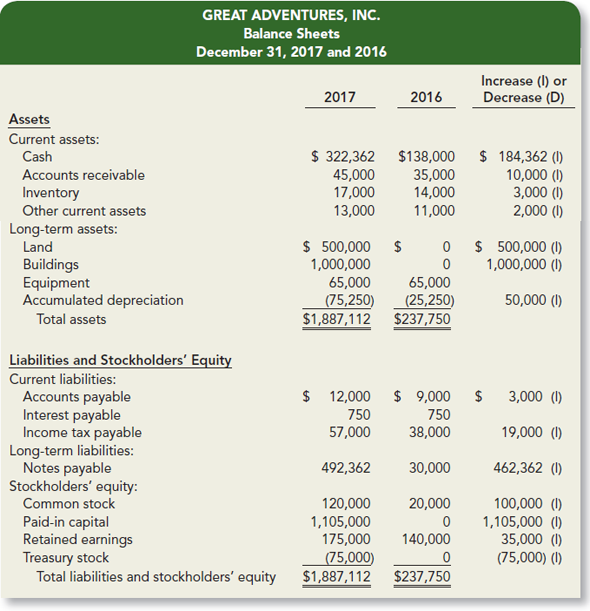

Balance sheet cheat sheet. The balance sheet is based on the fundamental equation: Check out our video on the balance sheet below, and subscribe to our youtube channel for more explainer content! The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

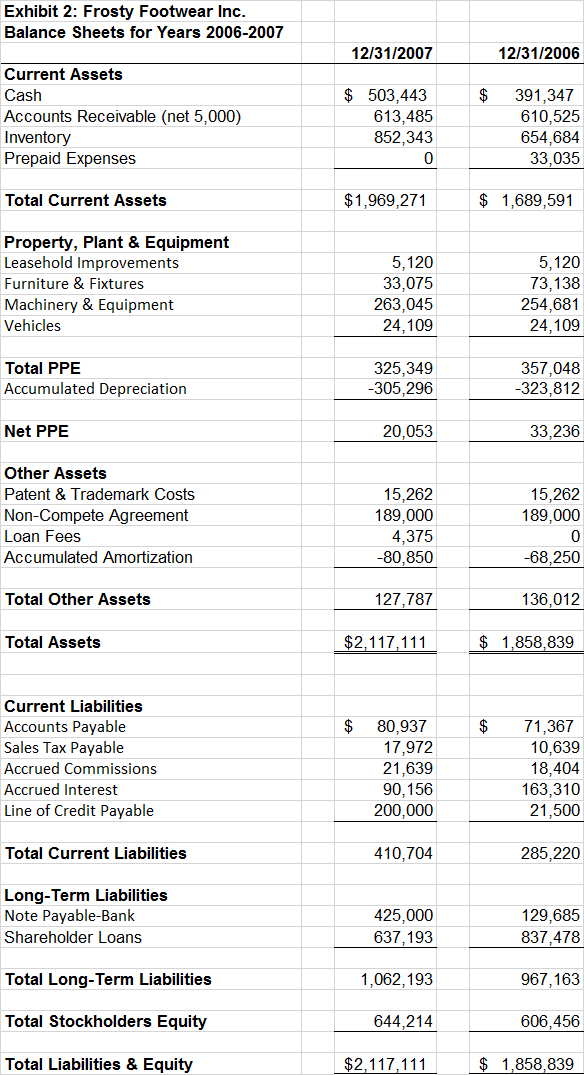

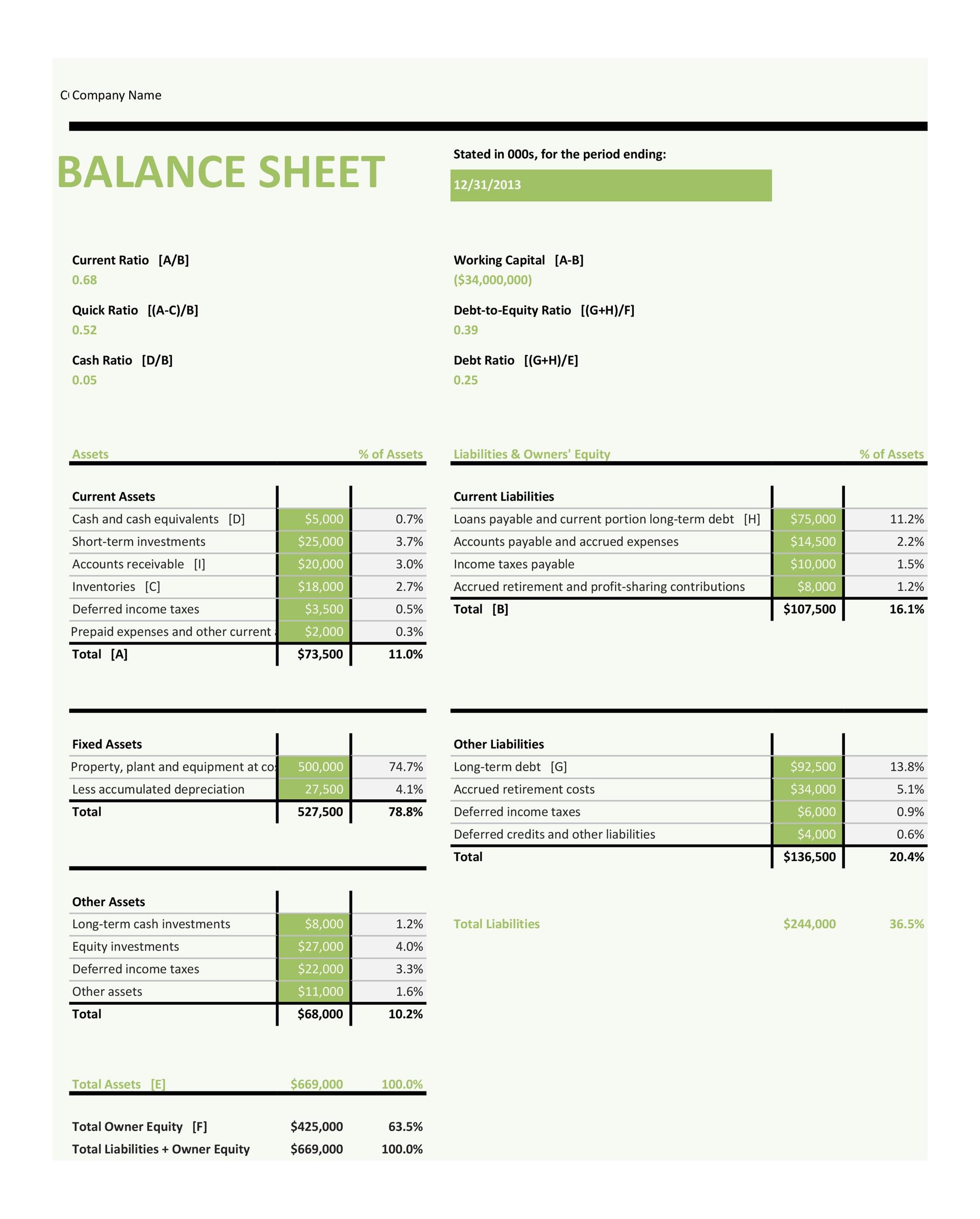

The net assets (also called equity, capital, retained earnings, or fund balance) represent the sum of all the annual surpluses or deficits that an organization has accumulated over its entire history. A balance sheet summarizes your firm’s current financial worth by showing the value of what it owns (assets) minus what it owes (liabilities). And there’s also equity, which is the owners’ share of the business after it pays out liabilities.

Comment fiber to get my fiber cheat sheet!. Our balance sheet cheat sheet provides the highlights of this very important financial statement. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

You will learn about asset classifications, liabilities, and owner's (and stockholders') equity. A balance sheet is a financial statement that lists a company’s assets, liabilities, and equity. It can also be referred to as a statement of net worth or a statement of financial position.

The bottom line. The balance sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’ equity at a specific point in time. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date.

Assets = liabilities + shareholders’ equity Take our quick test #1 The balance sheet is one of the three core financial statements that are used to.

So_this_is_50 on february 19, 2024: Days cash on hand measures liquidity and estimates how many days of organizational expenses could be covered with current cash balances. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year.

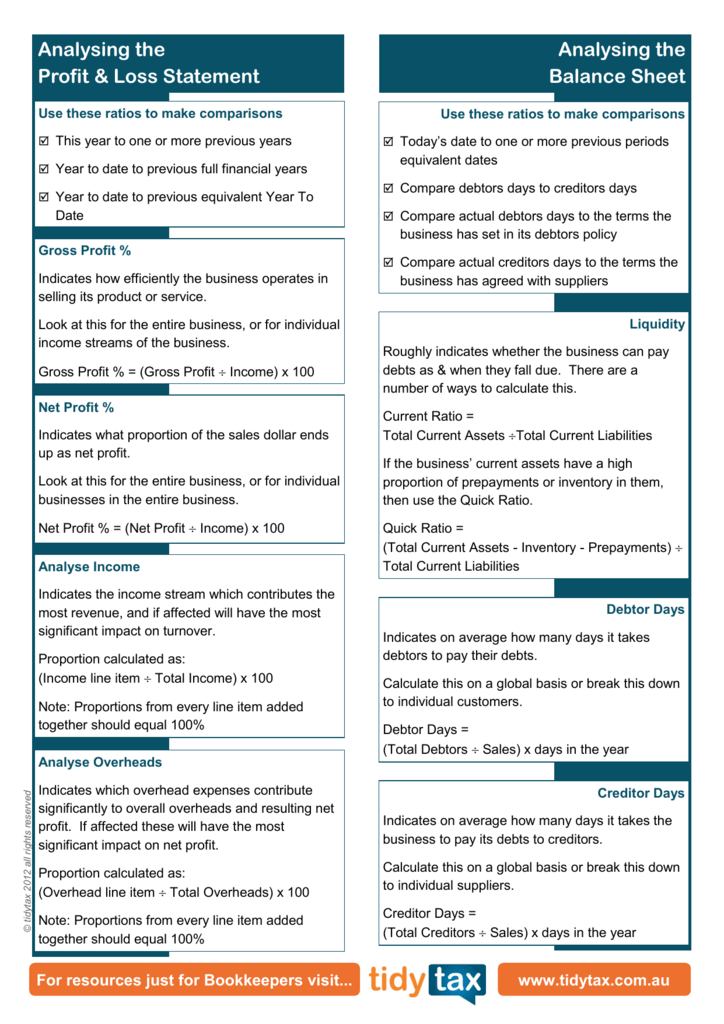

This statement allows us to gain an idea about leverage, sustainability, and liquidity. Days cash on hand measures liquidity and estimates how many days of organizational expenses could be covered with current cash balances. Assets = liabilities + equity.

To better understand a business's financial situation and level of solvency, you can do a few quick and easy calculations that use data found within the balance sheet. What is a balance sheet? Included on this page, you'll find many helpful balance sheet templates, such as a basic balance sheet template, a pro forma balance sheet template, a monthly balance sheet template, an investment property balance sheet template, and a daily balance sheet template, among others.

It's like a 101 guide to understanding the what, why, and how of these statements, making them as easy to comprehend as a leisurely sunday. Determine the reporting date and period. Typically, a balance sheet will be prepared and distributed on a quarterly or monthly basis, depending on the frequency of reporting as determined by law or company policy.