Favorite Tips About Research And Development Costs On Financial Statements Give The Accounting Equation For Following Transactions

This statement establishes standards of financial accounting and reporting for research and development (r&d) costs.

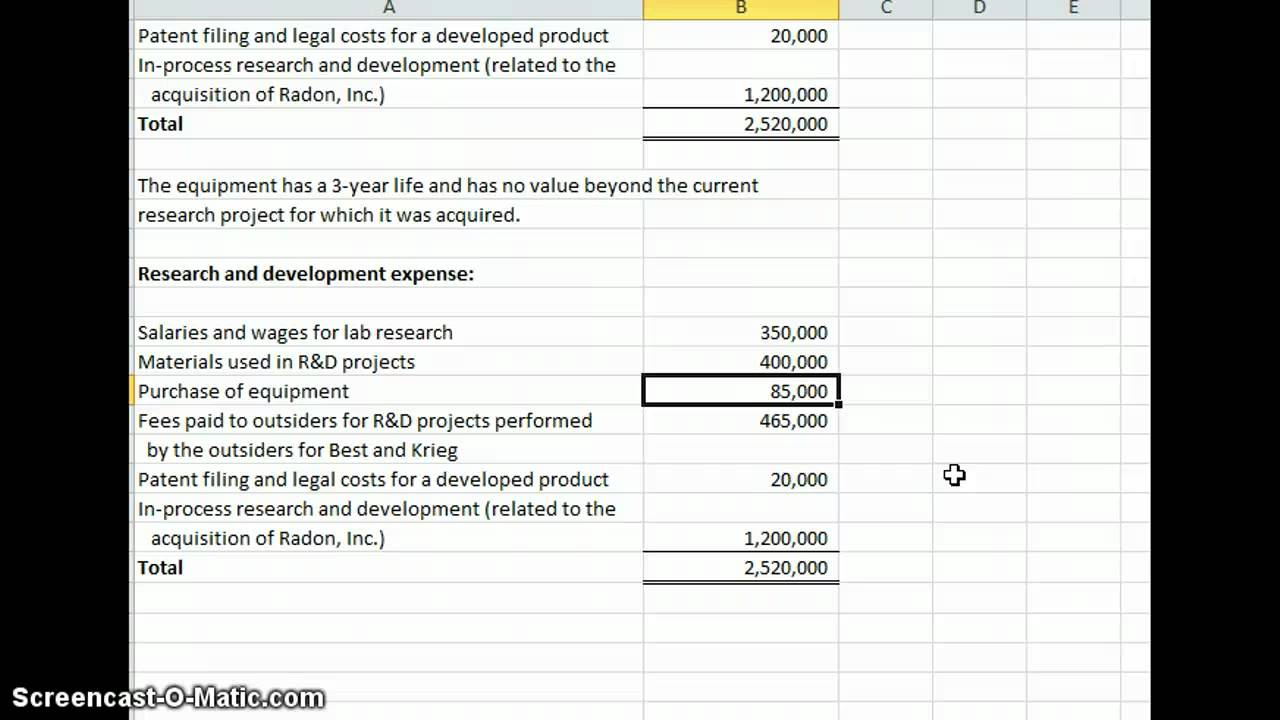

Research and development costs on financial statements give the accounting equation for the following transactions. In october 1974, the financial accounting standards board issued fasb statement no. 2, accounting for research and development costs (henceforth fas2). This statement requires that r&d costs be charged to.

Research costs and development costs booked directly into costs in the accounting period with which they are temporally and materially related affect the. In this lesson, we will define research and development costs and explain how to identify, classify, and disclose these costs in the financial. Key points under ifrs, r&d costs must be expensed as incurred and cannot be capitalized.

Discussion of accounting for research and development costs: Even though r&d can be an intangible asset in the uk, accounting for r&d is governed by. (c) the methods of accounting for research and development costs;

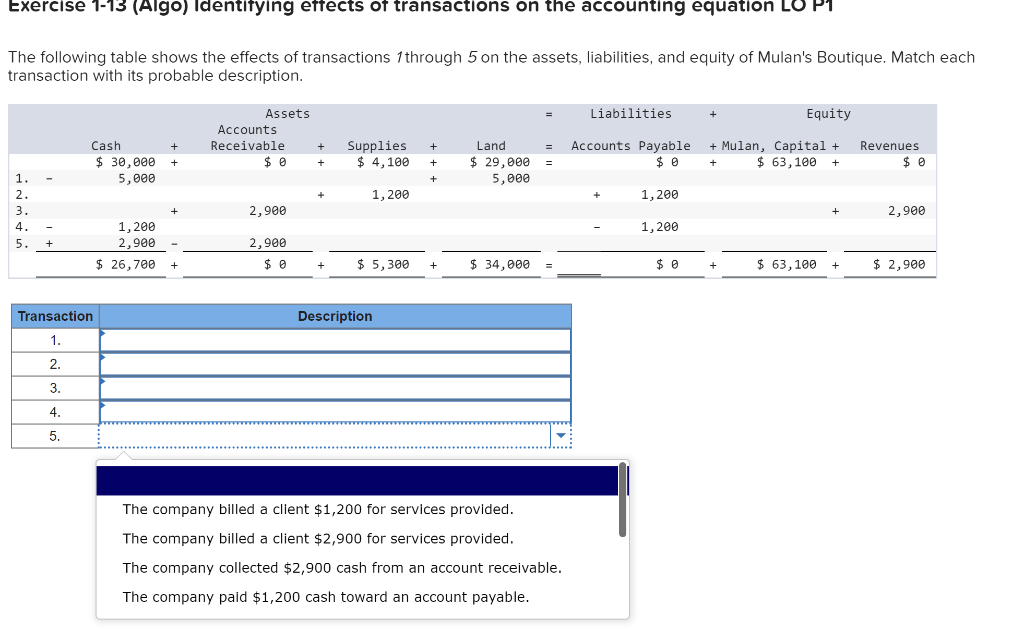

So far we have established that expenditure on r&d can fall into the category of intangible assets. Other standards have made minor consequential. This scientific article explores the development of periodic cost accounting in business entities, with a particular focus on its alignment with international standards.

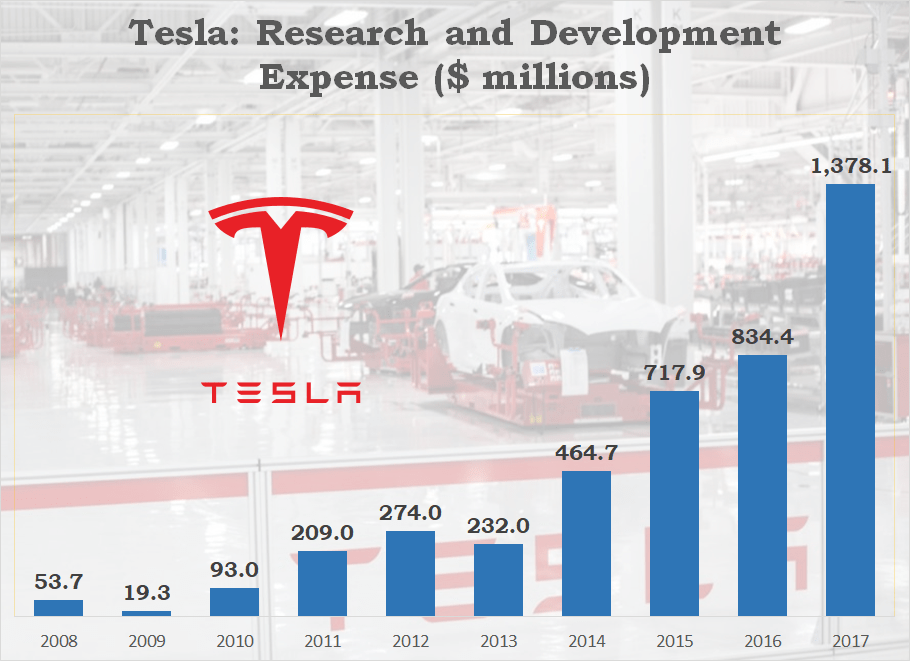

Reducing carbon emissions is a crucial measure for achieving sustainable development. They can include direct costs such as salaries, materials, and. In october 1974, the financial accounting standards board issued fasb statement no.

18 supplement 1980 printed in u.s.a. The impact on research and. Accounting standards require companies to expense all research and development expenditures as incurred.

As a result, ias 38 states that all. Research and development (r&d) costs refer to the expenses incurred by a company in developing new products or. Problems of representing research and development in financial accounting.

However, in the case of an m&a transaction , the r&d. R&d costs are the expenses associated with researching and developing new products, services, or processes. Accounting treatment of research and development costs.30 research and development costs shall be charged to the profit and loss account as incurred, except.

(d) the treatment of government grants received in relation to research and development; December 07, 2023 how to account for research and development the accounting for research and development involves those activities that create or improve products or. If received, sales can be made.

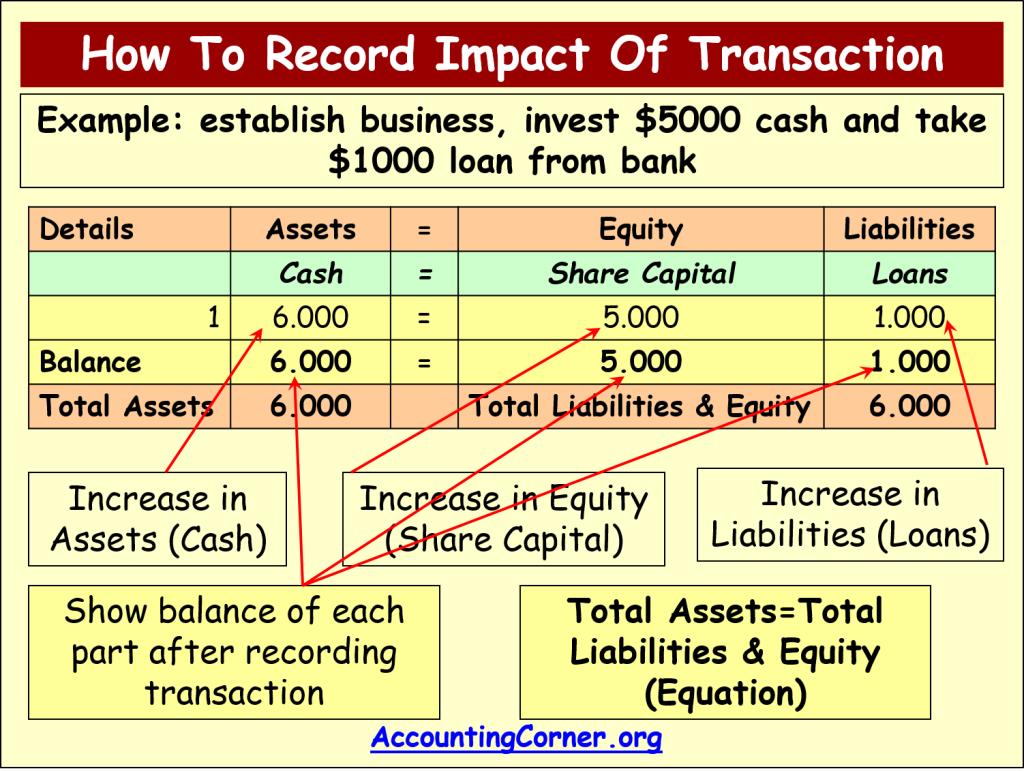

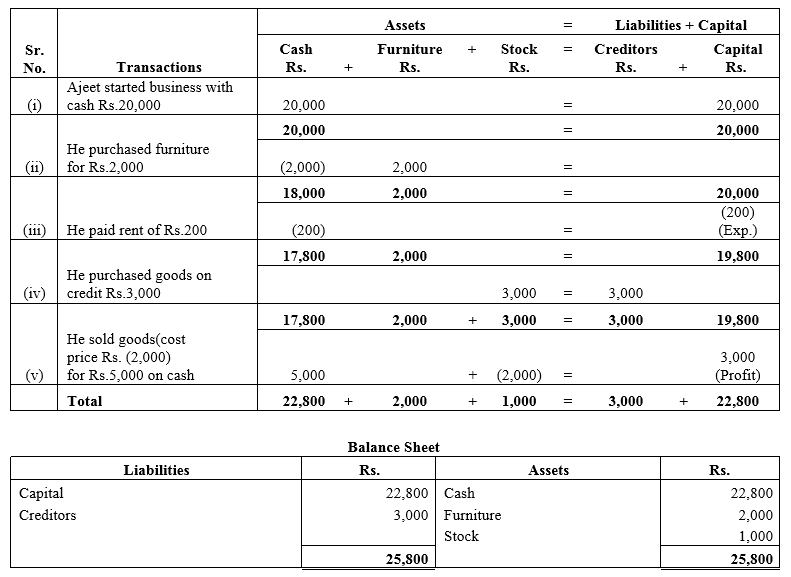

Under uk accounting standards, intangible assets are accounted for using the rules from frs 10, goodwill and intangibles. 3.4 analyze business transactions using the accounting equation and show the impact of business transactions on financial statements; What are research and development (r&d) costs?