Best Tips About Investment In Trial Balance Debit Or Credit

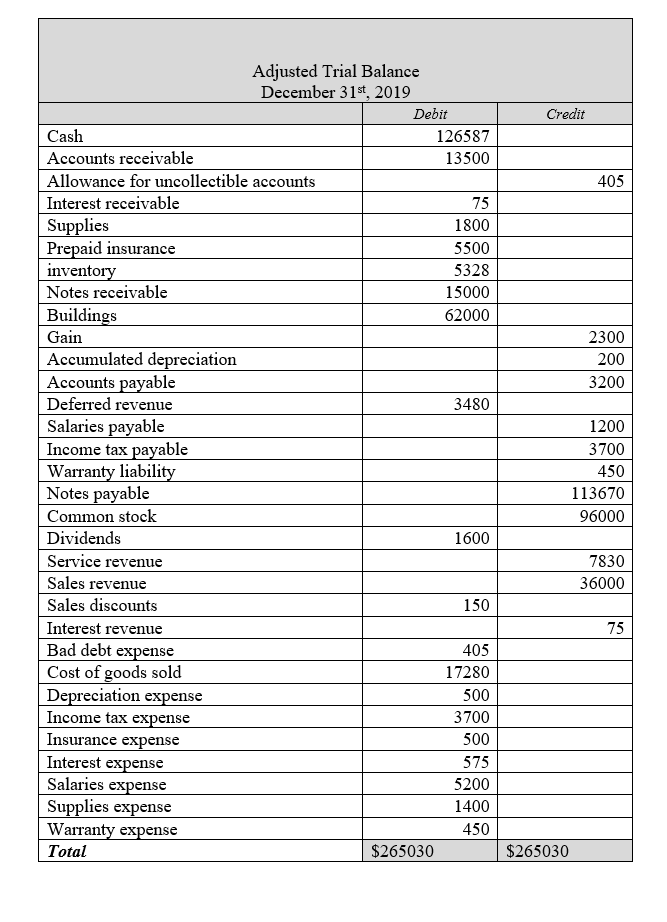

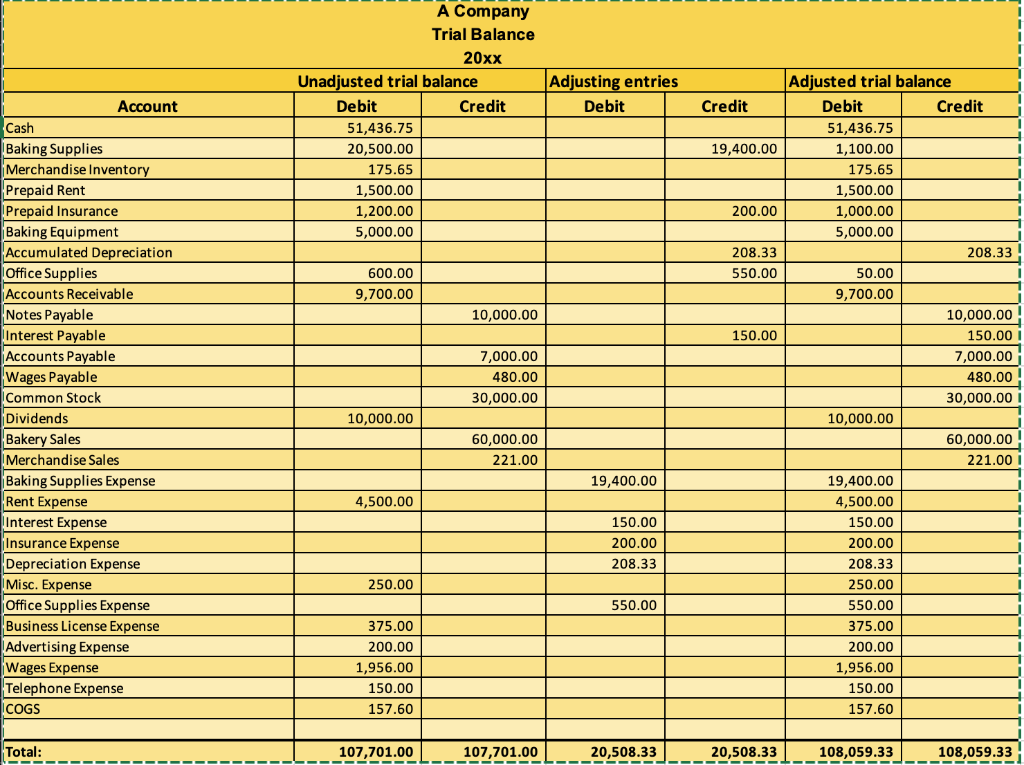

A trial balance is a financial report that lists a company's general ledger accounts closing balances at a certain period.

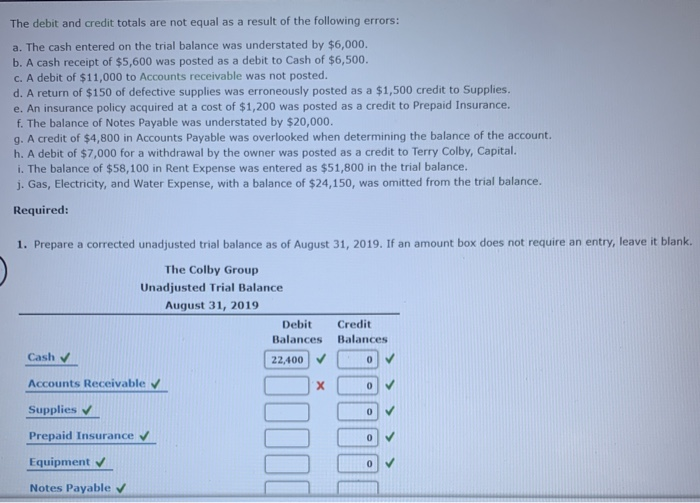

Investment in trial balance debit or credit. A trial balance contains accounts that. Trial balance is a statement that assembles the balances of all ledger accounts in a definite format. Is investment credit or debit in trial balance?

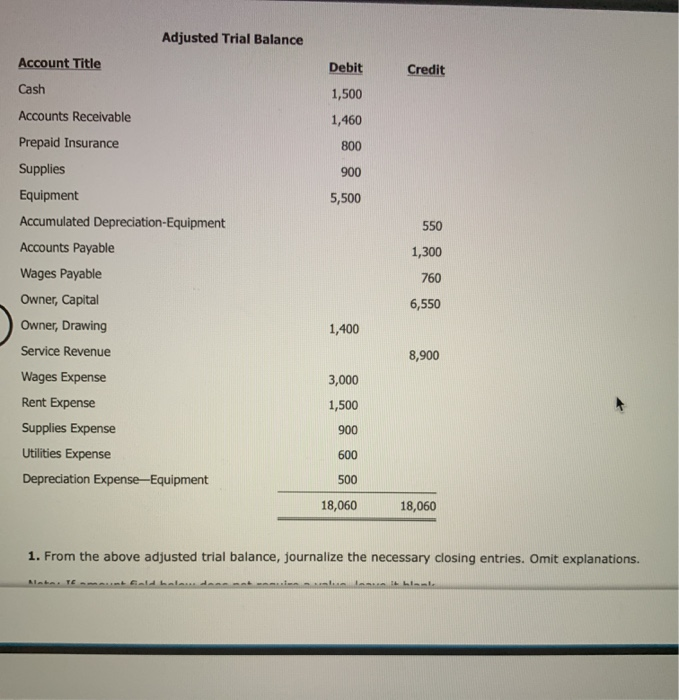

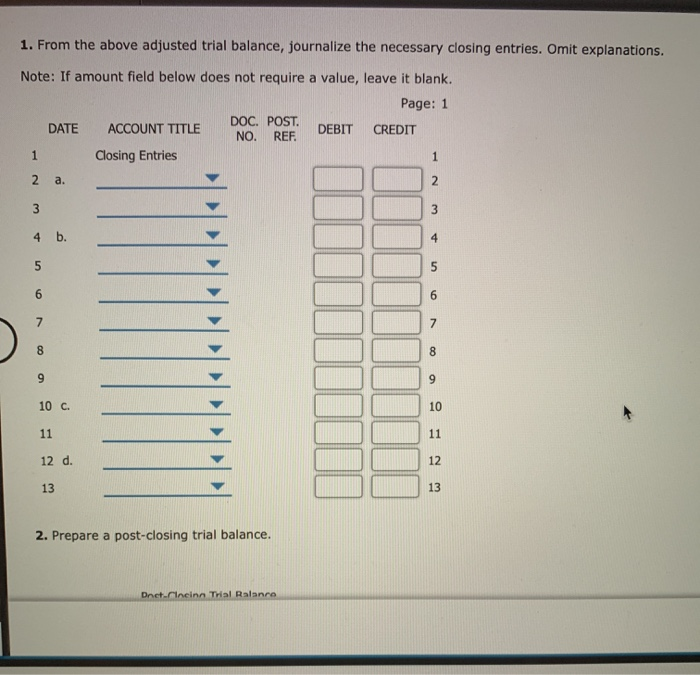

3 why are investment accounts debited? The total of debit balances must be equal to the total of credit. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into equal debit and credit account column totals.

Investment is an asset to business. Accounts receivable carries a debit status on the trial balance sheet. 4 is investment an asset?

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each. The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances. It records both debit balance as well as credit balances from the.

In contrast, individual transactions are recorded as. Generally capital, revenue and liabilities have credit balanceso they are placed on the credit side of the trial balance. The debit to the dividends account is not an expense, it is not included in the income statement, and does not affect the net income of the business.

In essence, the list contains the balances of all accounts open at the start of the reporting period (assets, liabilities and equity) and then a summary of all the debits and credits. The capital, revenue and liability increase when it is credited and vice versa. Exclusive list of items 1.

Is investment debit or credit in trial balance? 1 is investment debit or credit in trial balance? Debit and credit amounts must be equal:

Since interest on investment is an income, it is shown on the credit side of the trial balance. It serves as the first sign of accuracy (or inaccuracy) when the time comes to close the. Generally, investment is a debit and not a credit entry.

This method is also known as balancing the. As assets, expenses, drawings, provisions are shown in the debit. This is because investment is an asset to the investor who can either be an individual or a business.

This is based on the accounting rule that all increase in incomes are credited. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. If the final balance in the ledger account.