Spectacular Info About My Balance Sheet

It summarizes a company’s financial position at a point in time.

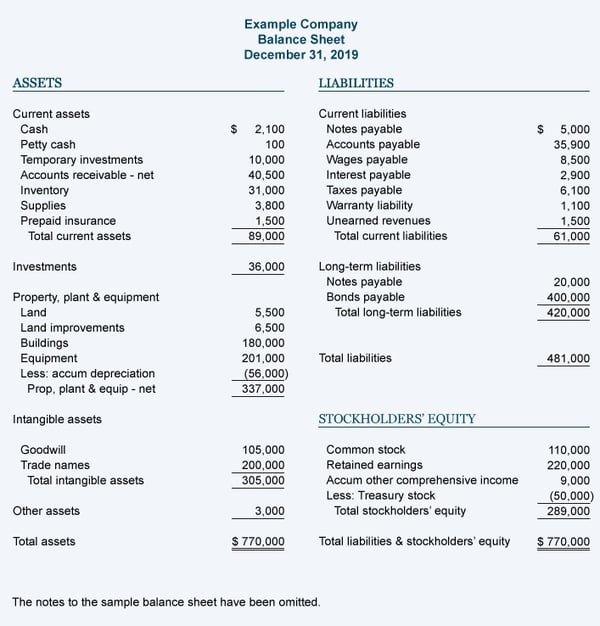

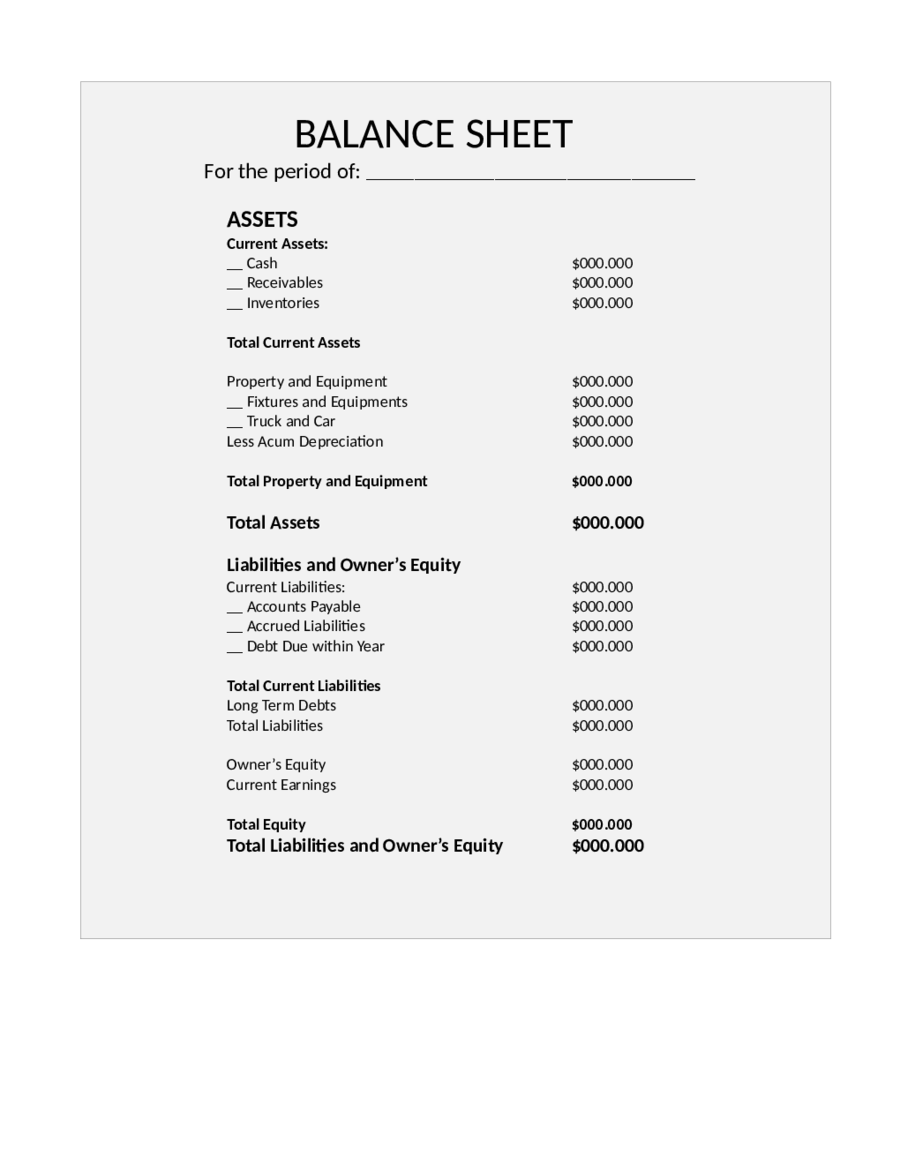

My balance sheet. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year. 4 ways to strengthen your balance sheet. Assets = liabilities + shareholders’ equity

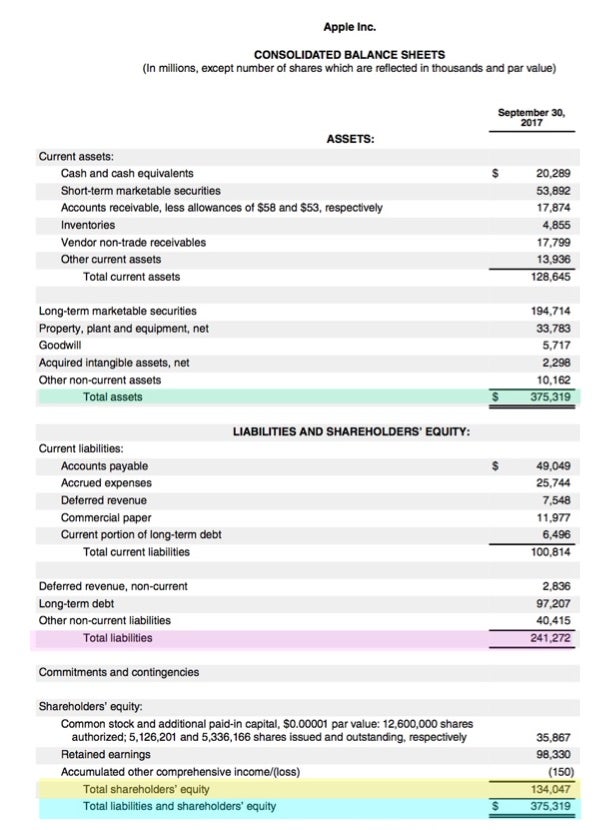

The balance sheet is one of the three financial statements businesses use to measure their financial performance. The balance sheet, together with the income. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health.

Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity). Assets = liabilities + equity. It’s important to note that assets can be divided into several categories, which we’ll cover in.

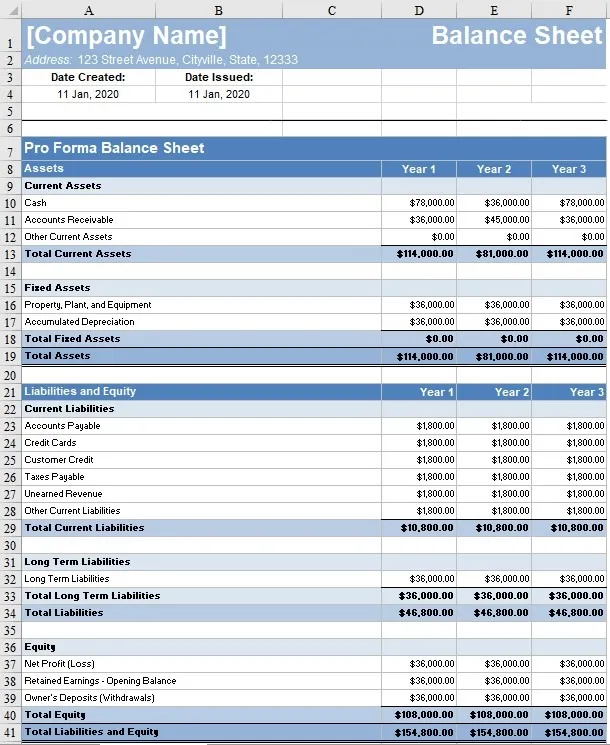

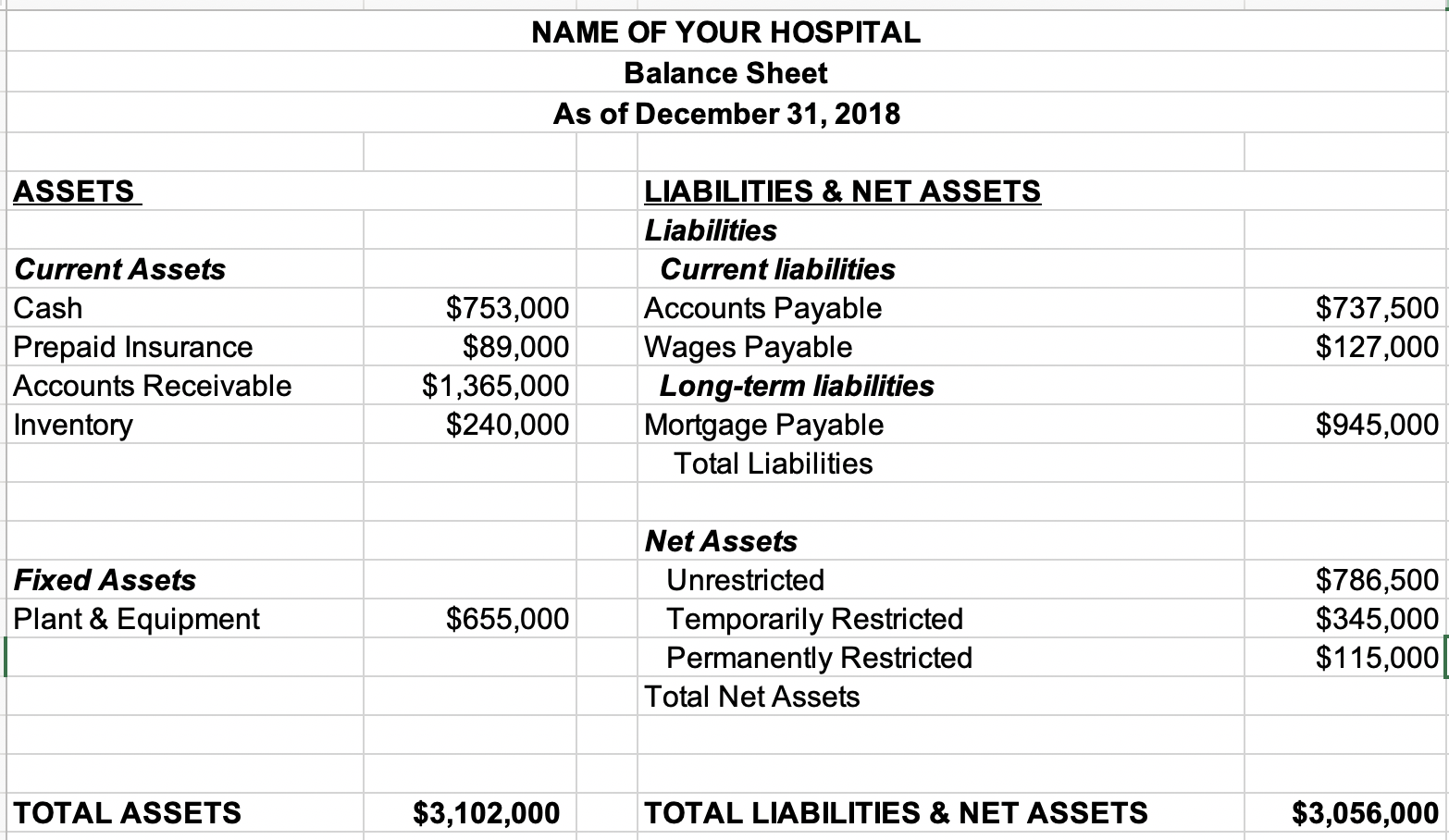

On a balance sheet, assets (what you own) are presented on the left side, and liabilities (what you owe) plus equity are on the right side. The balance sheet, also known as the statement of financial position, is one of the three key financial statements. Wire the balance sheet so that it always balances by making retained earnings equal to total assets less total liabilities less all other equity accounts.

A balance sheet summarizes your firm’s current financial worth by showing the value of what it owns (assets) minus what it owes (liabilities). There are three main components of a balance sheet: Your balance sheet (sometimes called a statement of financial position) provides a snapshot of your practice's financial status at a particular point in time.

However, if you want to position your business for growth or increase cash flow, building a fortress balance sheet should be a serious goal. By subtracting your assets from your liabilities to calculate your net worth, it creates a picture of your financial position. Assets are resources owned by the business that can be used to produce economic value.

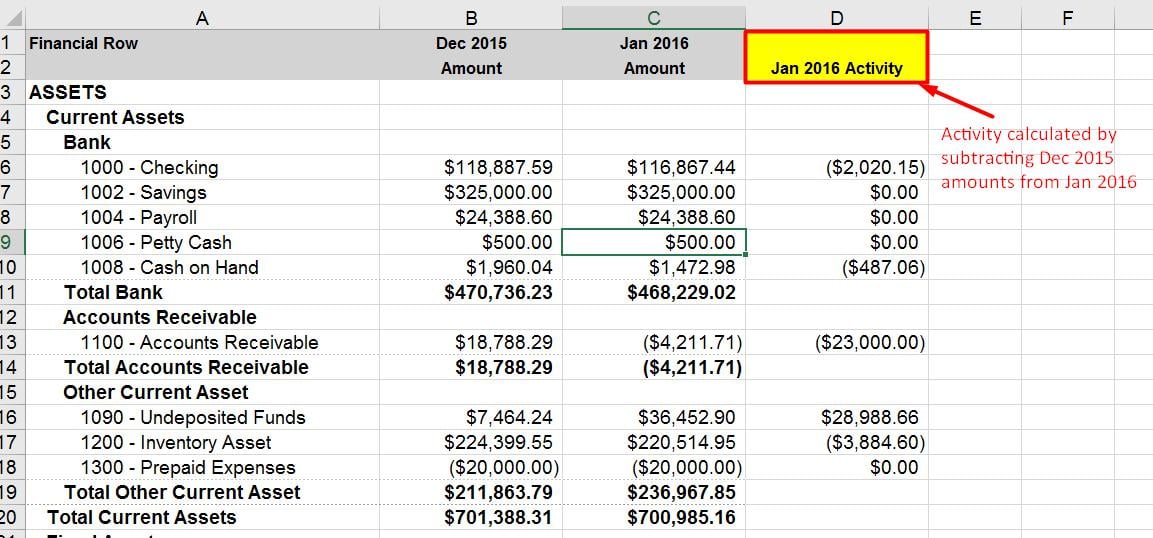

This financial statement details your assets, liabilities and equity, as of a particular date. Enter hardcodes across one row of the balance sheet for each year that doesn’t balance). The european central bank’s (ecb’s) audited financial statements for 2023 show a loss of €1,266 million (2022:

It can also be referred to as a statement of net worth or a statement of financial position. Current assets, unlike land, are items that can be converted into cash within one year like cash itself, inventory, and accounts receivable. It can be understood with a simple accounting equation:

The balance sheet is one of the three core financial statements that are used to. What a balance sheet is all about. A balance sheet provides a summary of a business at a given point in time.

Typically, a balance sheet is prepared at the end of set periods (e.g., every quarter; A balance sheet is comprised of two columns. This loss takes into account the full release of the provision for financial risks, amounting to €6,620 million, which.