Divine Info About Difference Income Statement And Cash Flow

Income statement vs cash flow statement.

Difference income statement and cash flow. The income statement operates on the accrual system of accounting whereas statement of cash flows records actual receipt and payment of cash and cash equivalents in a given financial year. Income from operations of $652 million; Trump claimed under oath last year that he was sitting on more than $400 million in cash, but between justice engoron’s $355 million punishment, the interest mr.

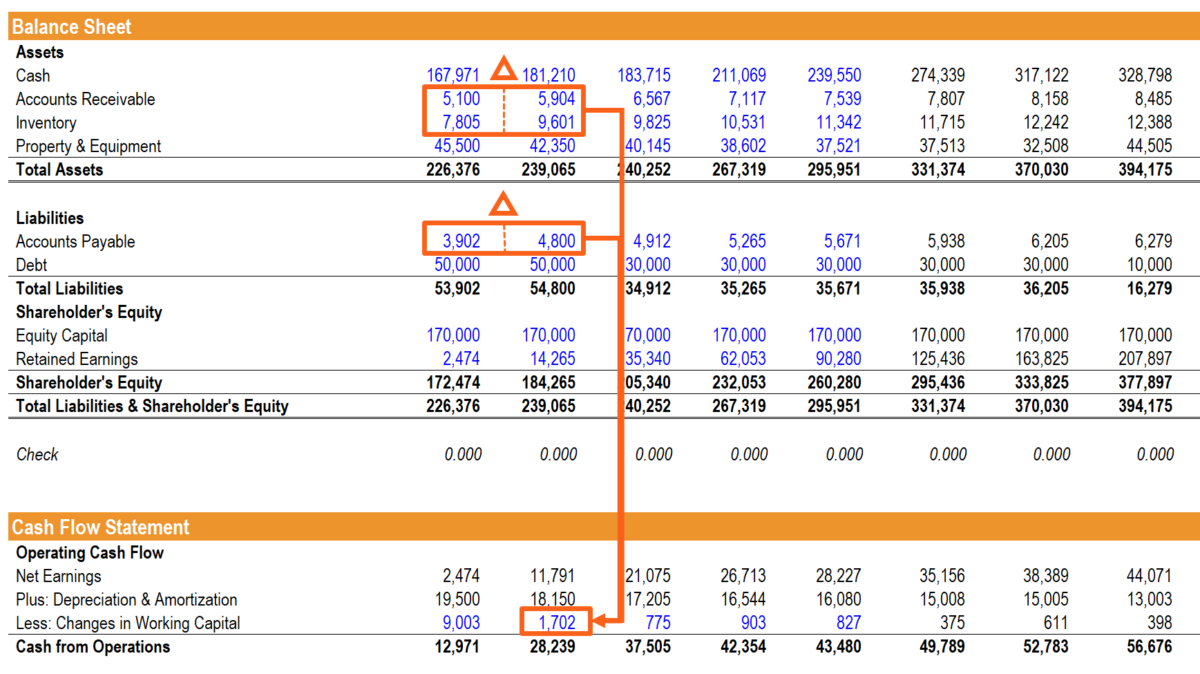

Remember, most firms use accrual accounting. Tools how do net income and operating cash flow differ? An overview the balance sheet and cash flow statement are two of the three financial statements that companies issue to report their.

This can create timing differences between profits and cash flows. The cash flow statement helps to know the solvency and liquidity of a business, which will. For many expenses for which a business pays cash, the expense shows up immediately on the income statement.

Murphy updated april 17, 2023 reviewed by michael j boyle fact checked by jared ecker net income is the profit a company. Income statements and balance sheets provide information for the cash flow statement. To fully understand the firm’s flow of cash, the statement of cash flows is needed.

The balance sheet can tell you where a company stands financially, and is separated. As the name implies, this is where you can find details about a company's income. The statement starts with net income and makes several adjustments related to cash generated as well as changes in operating assets and liabilities.

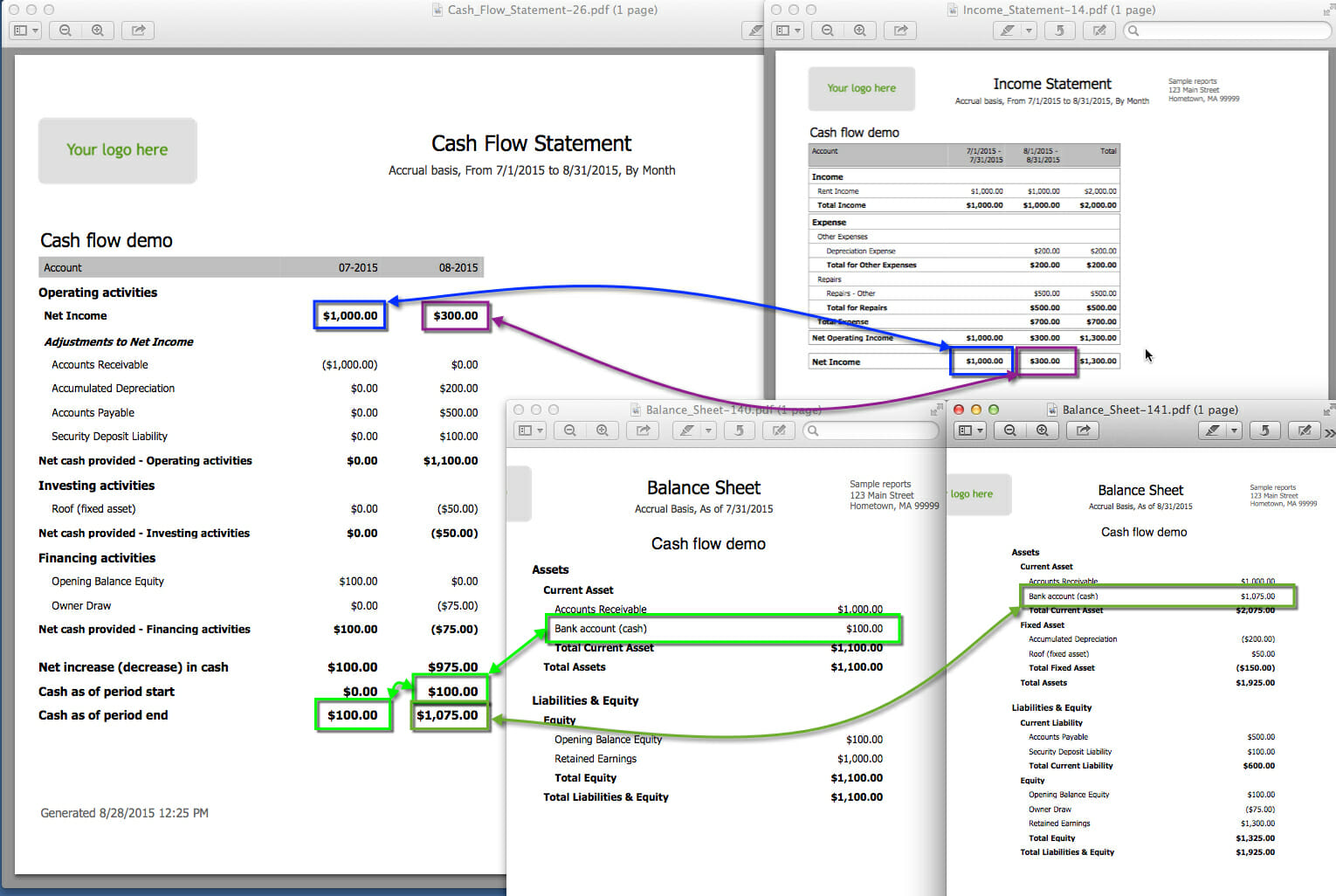

The cash flow statement shows cash movements from operating, investing, and financing activities. The most important number is the increase or decrease in cash and cash equivalents. The income statement monitors the financial performance of your firm and shows if your company made profits.

Which one should i use? Cash flow statement vs. Importance of the statement of cash flows.

The cash flow statement tracks the cash sources of your company and how you use them over time. The cash flow statement reports cash received or paid. Key differences between income statement and cash flow statement.

An income statement shows whether a company made a profit, and a cash flow statement shows whether a company generated cash. A balance sheet shows a company's financial position in terms of how many assets it has, as opposed to liabilities. What is the difference between income statement, balance sheet, and cash flow?

The cfs highlights a company's cash management, including how well it generates. The balance sheet shows a company’s assets, liabilities, and shareholders’ equity at a particular point in time. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)