Looking Good Tips About Importance Of Fund Flow Statement

The fund flow statement provides the information regarding changes in working capital of an organization for a particular period.

Importance of fund flow statement. Sources of funds and applications of funds for a. It portrays the inflow and outflow of funds i.e. It analyses changes in a company’s financial position between two balance sheet dates.

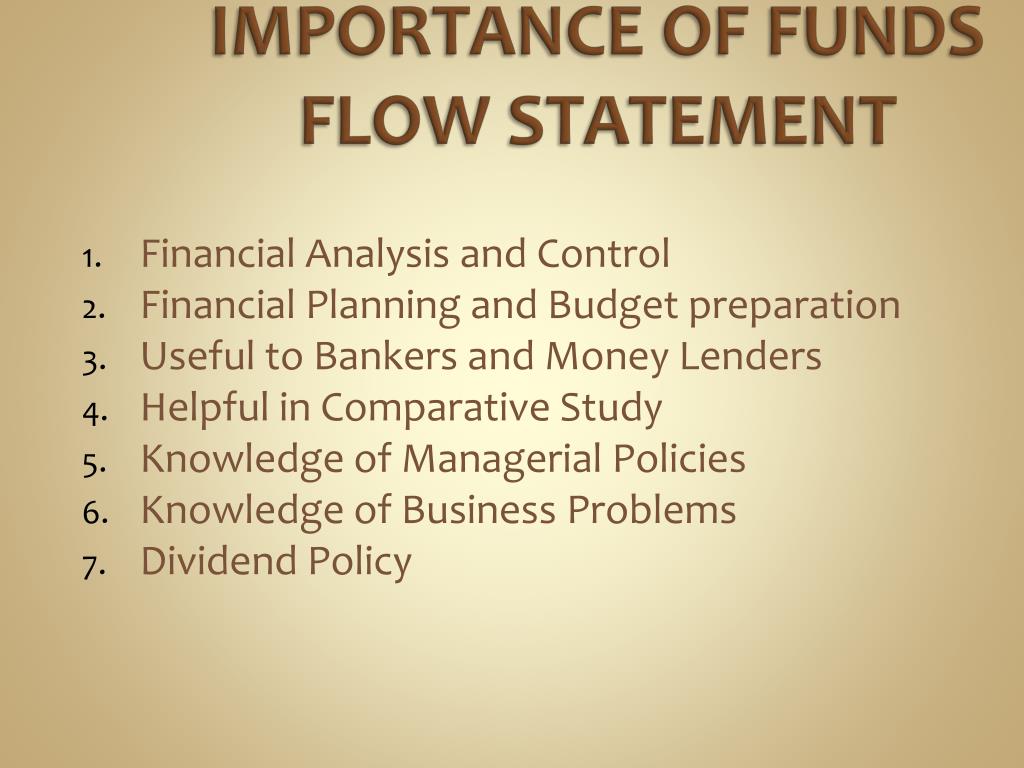

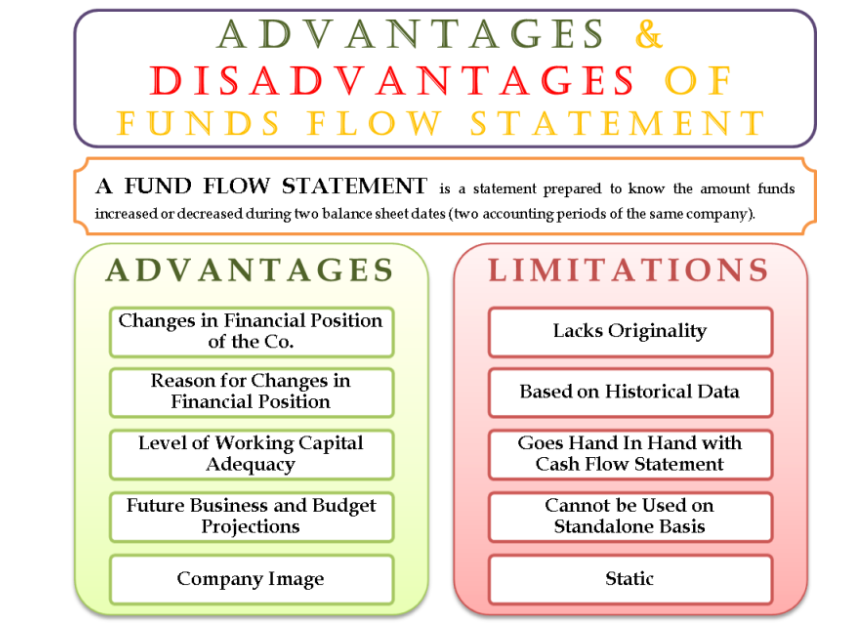

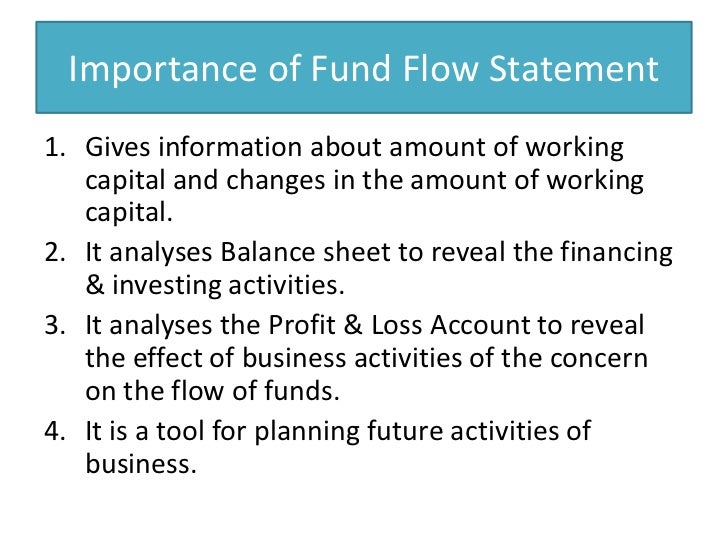

Therefore, we say that the importance of fund flow statement is as follows: A fund flow statement is a financial document that systematically presents the inflow and outflow of funds within an organization over a specified period. A funds flow statement is a financial document that analyses a company’s balance sheet of two years to validate the movement of funds from the previous financial year to the current year.

Therefore, we say that the importance of fund flow statement are as follows: It is a statement which shows the sources an application of funds or it shows how the activities of a business is financed in a particulate period. The fund flow statement can highlight changes in share capital.

Looks at cash in hand, bank balances, and cash equivalents, and accounts payable balances. The funds flow statement helps analyze the reasons for changes in the company’s financial position. It helps the analyst to understand if the increase in funds is due to the sale of assets or an improvement in company performance.

Importance of fund flow statement. Suppose we have issued share capital. A funds flow statement is an essential tool for the financial analysis and is of primary importance to the financial management.

A fund flow statement is a statement prepared to analyse the reasons for changes in the financial position of a company between two balance sheets. Significance / importance of fund flow statement 1. Looks at increases or decreases of current assets and current liabilities to determine level of cash use.

In order to understand the funds flow statement the meaning of ‘fund’ must be known although the ‘fund’ has got different meaning and interpretation different accountants/ authors have used the term in different sense, e.g. A funds flow statement analyzes the factors contributing to changes in a company's financial standing between two account balances. Financial manager can take corrective actions.

This section sets the stage for. Fund flow statements assist in determining the shift in amount of current assets investment and current liabilities financing. Shows addition or reduction in share premium.

The management can formulate its financial policies— dividend, reserve etc. Importance of fund flow statement. The financial resources of the company are analyzed in detail and disclose the changes made between the two balance sheet dates.

Fund flow statement determines the financial consequences of business operations. Uses, benefits, significance & importance of fund flow statement. Fund flow statement helps in providing information regarding the allocating of the resources more efficiently and effectively.