Beautiful Info About Income Statement Under Ifrs

However, there are differences between.

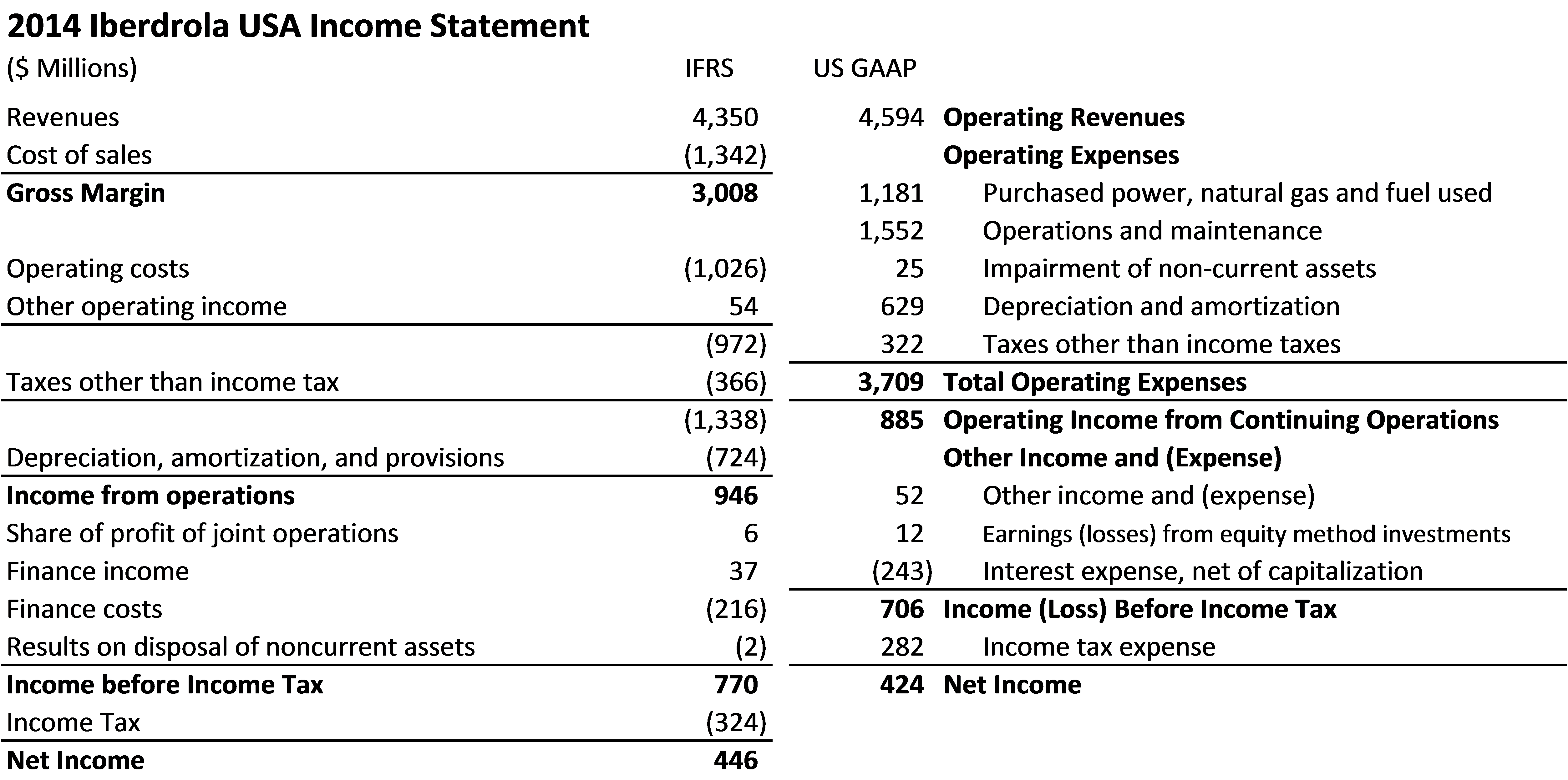

Income statement under ifrs. Format of the income statement. Supplier finance arrangements, which amended ias 7 statement of cash flows and ifrs 7 financial instruments: There are significant differences in the way the u.s.

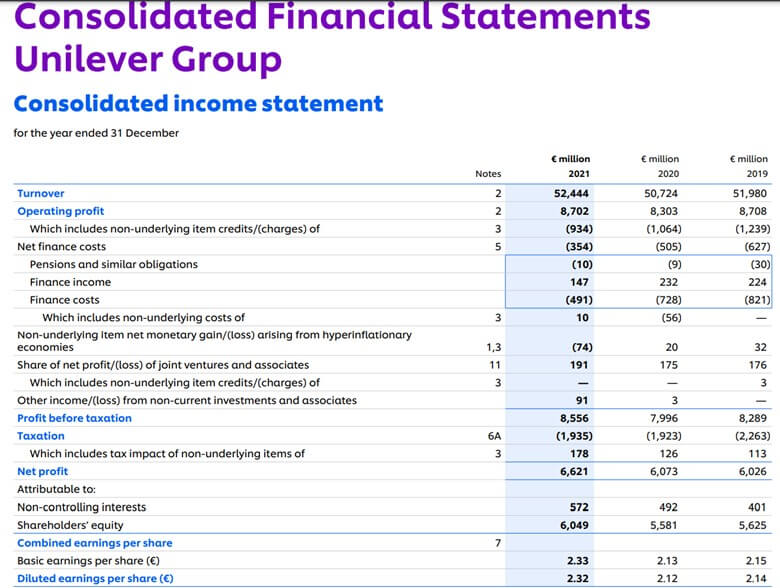

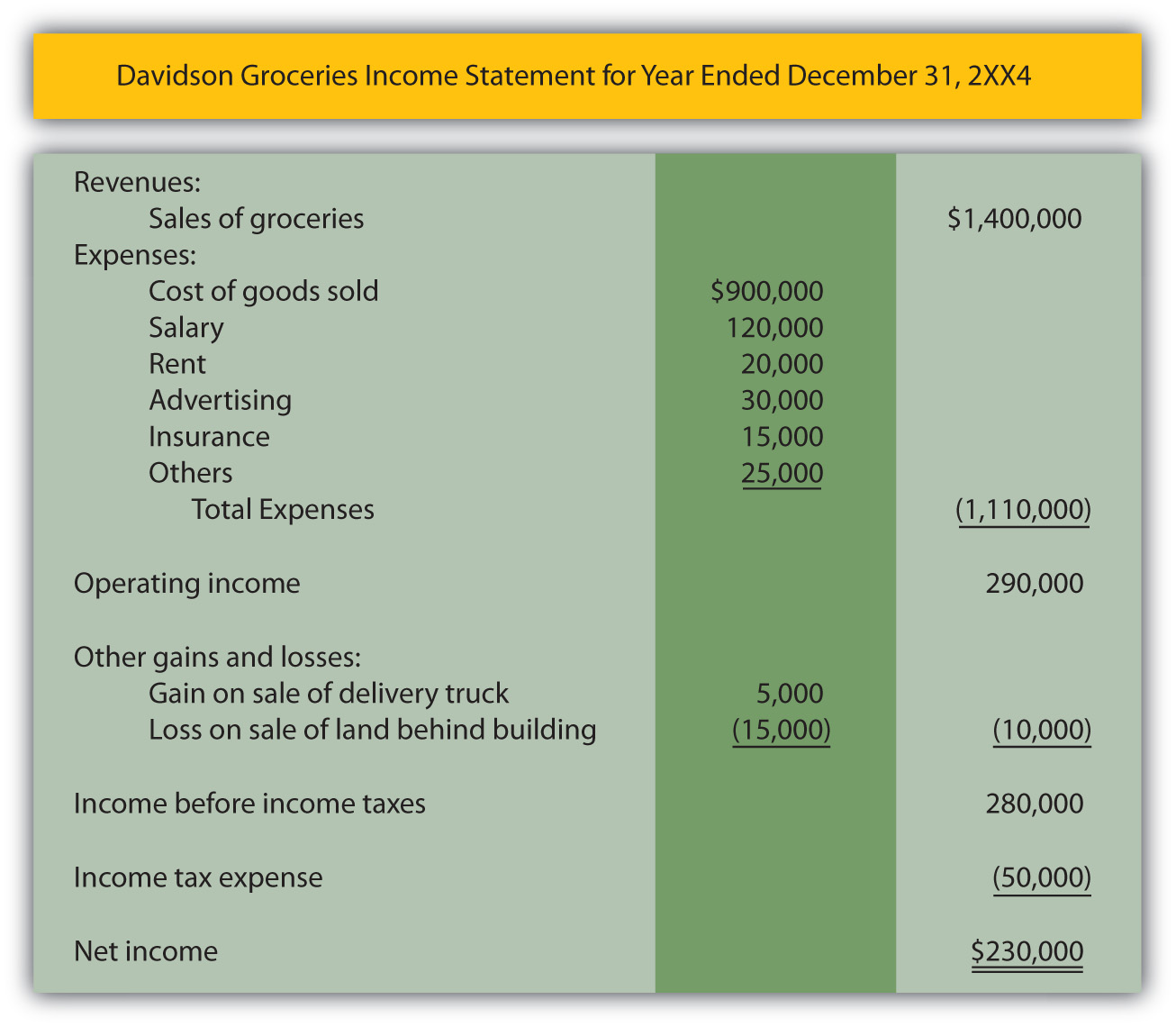

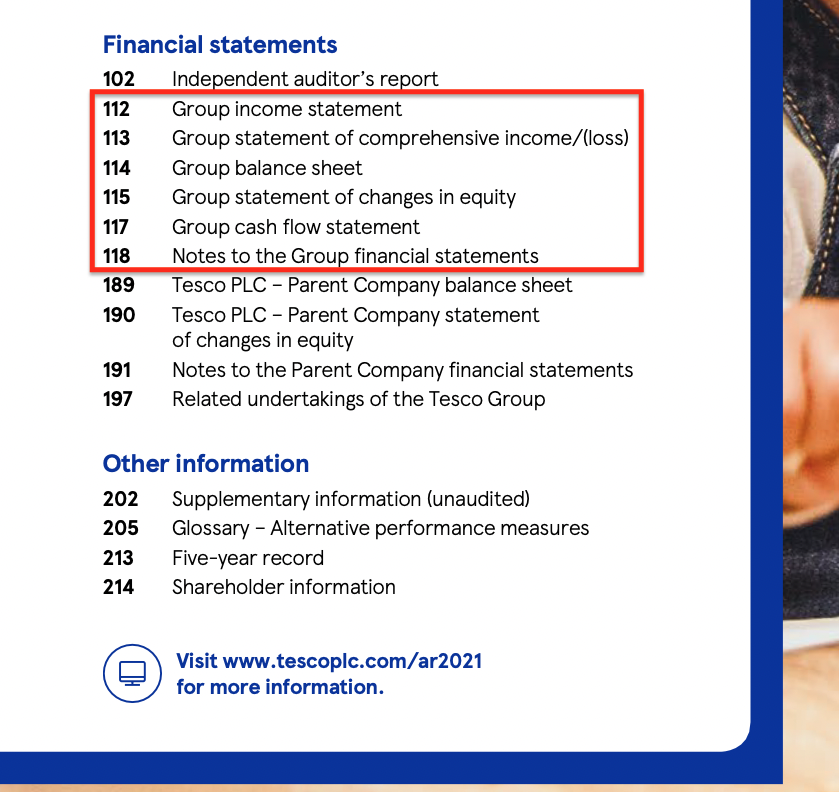

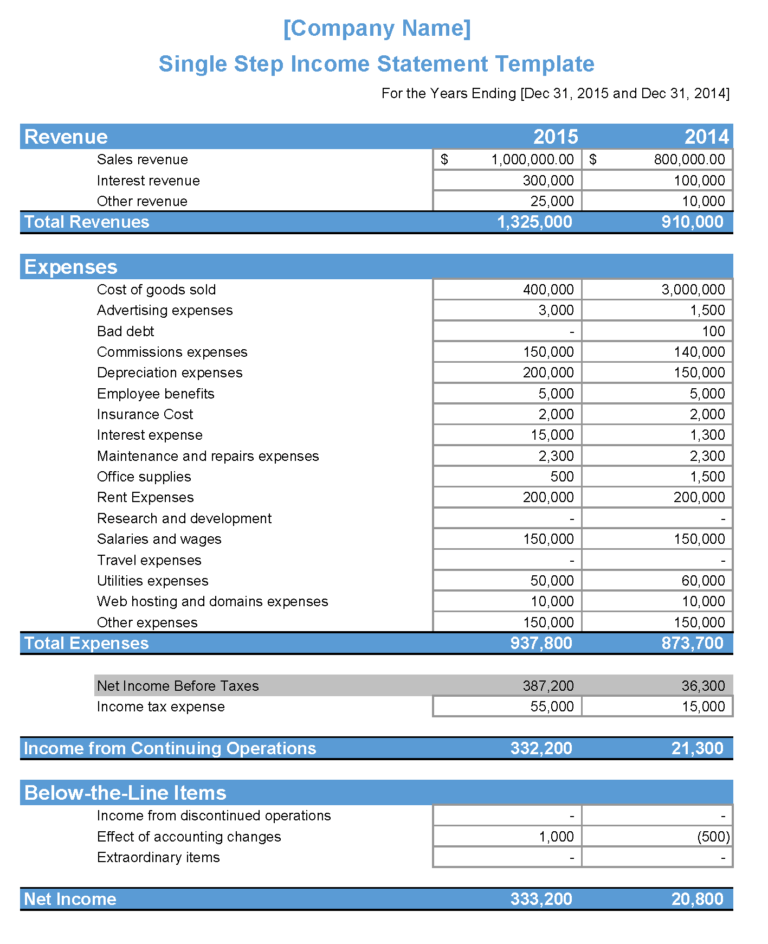

Profit or loss, profit or loss from continuing. A statement of profit and loss and other comprehensive income for the period. Ifrs example consolidated financial statements 1

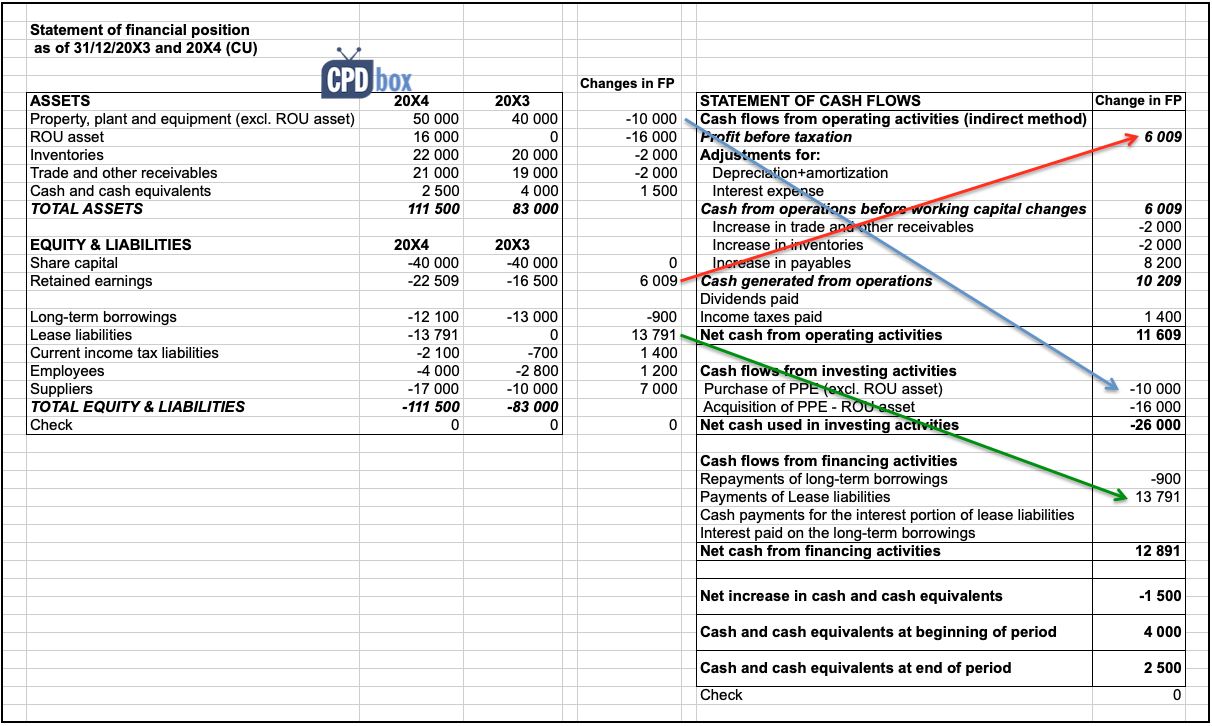

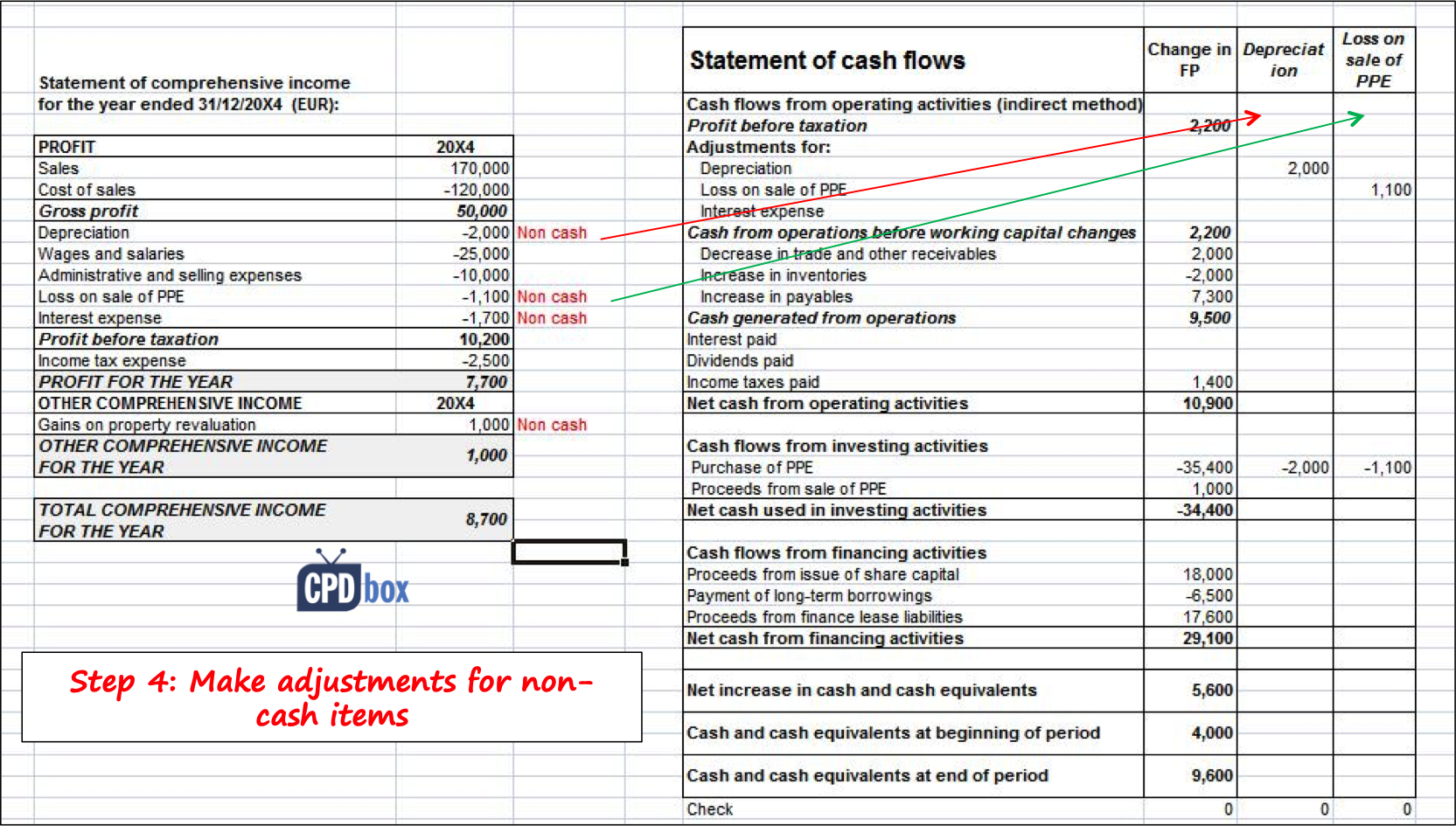

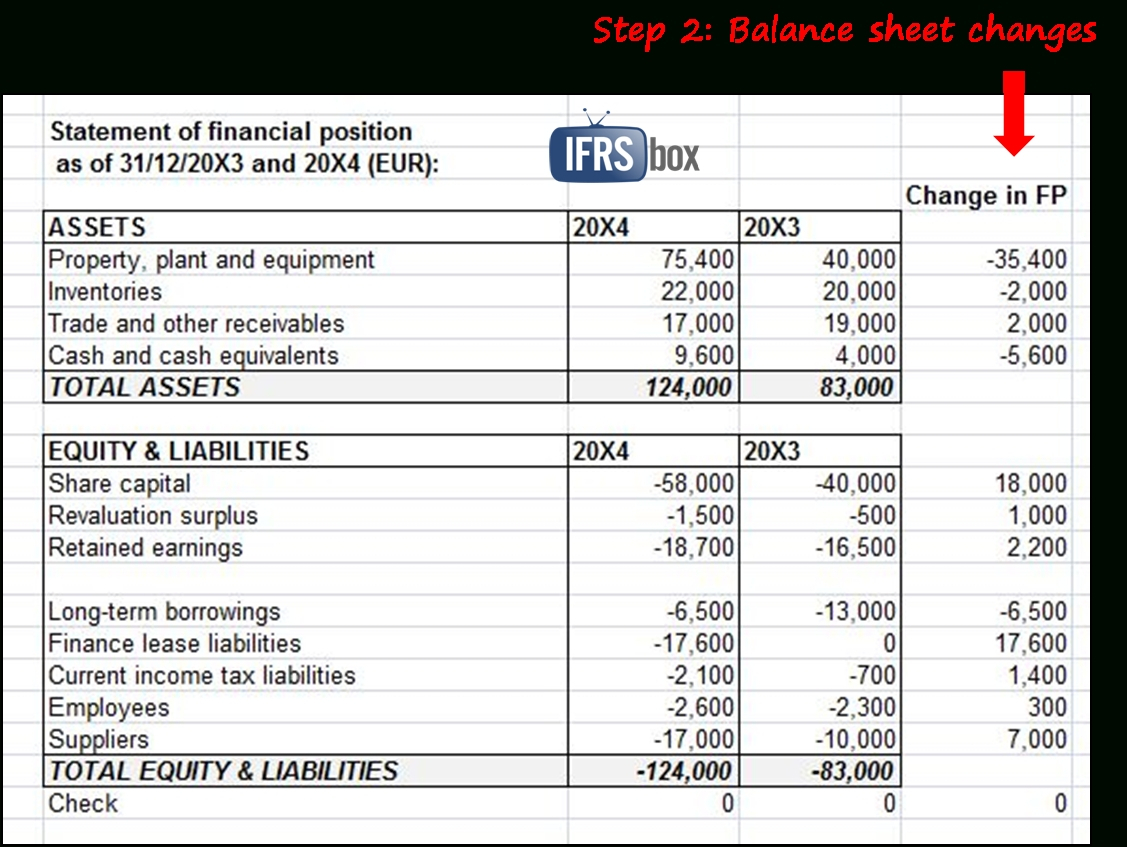

Information about the cash flows of an entity is useful in providing users [refer: Therefore, more instruments may be required to be accounted for as derivatives at fair value through the income statement under ifrs. The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows.

For insurance business that is sensitive to the discount rate, such as annuities, the choice of discount rate. Statement of comprehensive income 108 presented in a single statement appendix c: Like us gaap, the income statement captures most, but not all, revenues, income and expenses.

Profit or loss for the period; The objective of ifrs 15 is to establish the principles that an entity shall apply to report useful information to users of financial statements about the nature, amount, timing, and uncertainty of revenue and cash flows arising from a contract with a customer. Net income is the starting point under us gaap.

Ias 1 was reissued in september 2007 and applies to annual periods beginning on or after 1 january 2009. Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april 1989. The definition of derivatives is broader under ifrs than under us gaap;

The ifrs requires the following items in the income statement : Next 20 items » 1 2 3 4 quick links about ifrs This is different to the current ifrs 4 income statement, where there is no such split.

This module focuses on the general requirements for the presentation of the statement of comprehensive income and the income statement in accordance with section 5 statement of comprehensive income and income statement. There are also differences in the identification of embedded derivatives within both financial and nonfinancial host contracts that should. The economic decisions that are taken by users require an.

Not for distribution to u.s. Some of the major differences are discussed below. Primary financial statements │classification of income and expenses by financial entities page 4 of 26.

Effective dates of new ifrs standards 110 illustrative corporation group: Table 1 — expected effect of thestaff proposals discussed at the september 2018 board meeting. We have updated the labels of the subtotals in this table applying the october 2018 tentative board decisions (see.