Real Tips About Interest Received In Cash Flow Statement

Some of the answers from revision kit clearly state that interest received goes to investment activities section of the statement of cash flow, whereas some other answers put interest received/paid in operating activities.

Interest received in cash flow statement. Same is the case with interest received that entity has the option to. Cash flows related to the foreign subsidiary will be translated, using the exchange rate on the date of cash flow. Section 7 to frs 102 requires the cash flow statement to be prepared using only three cash flow classifications:

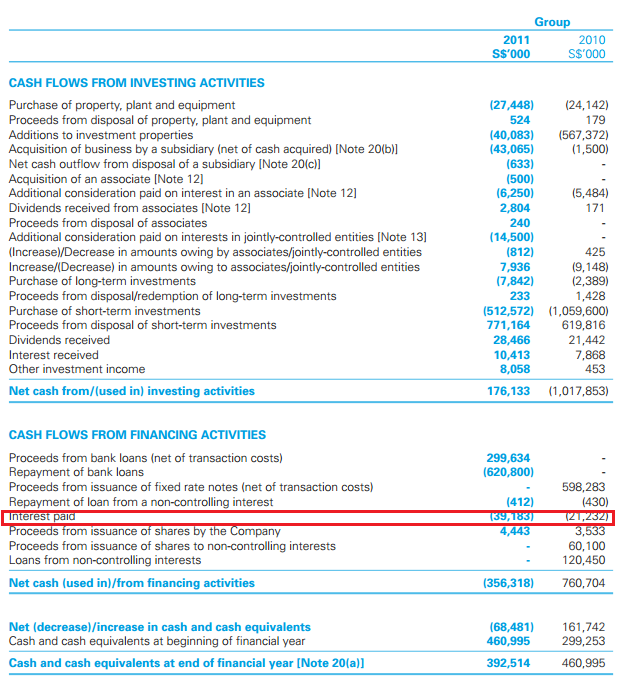

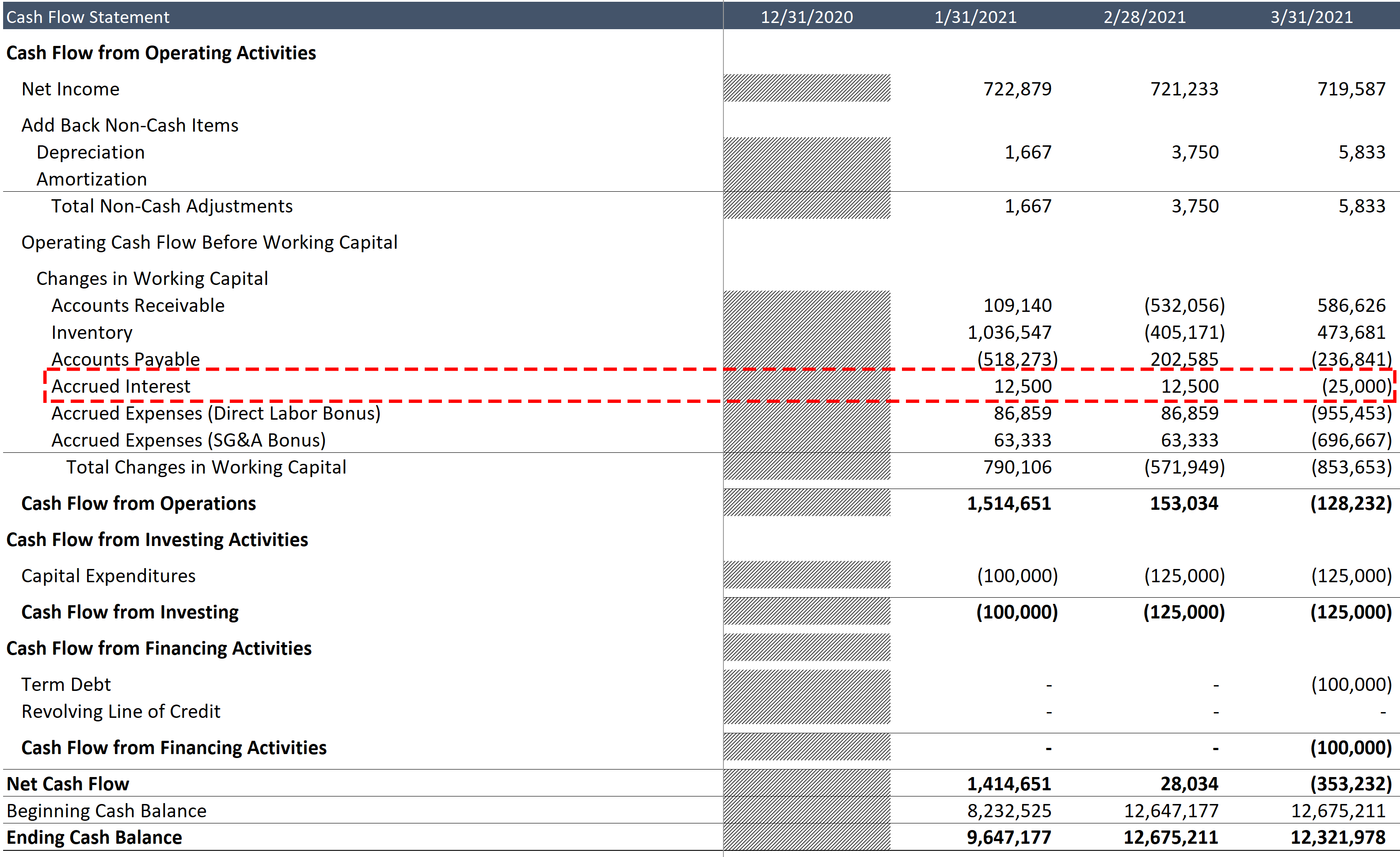

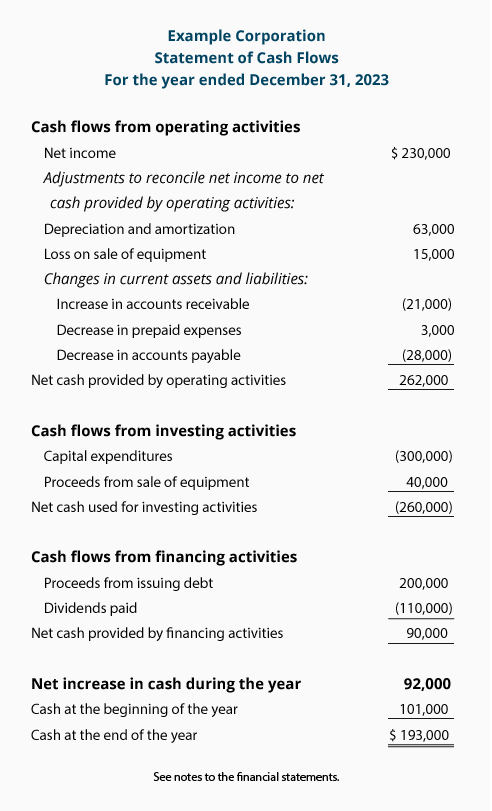

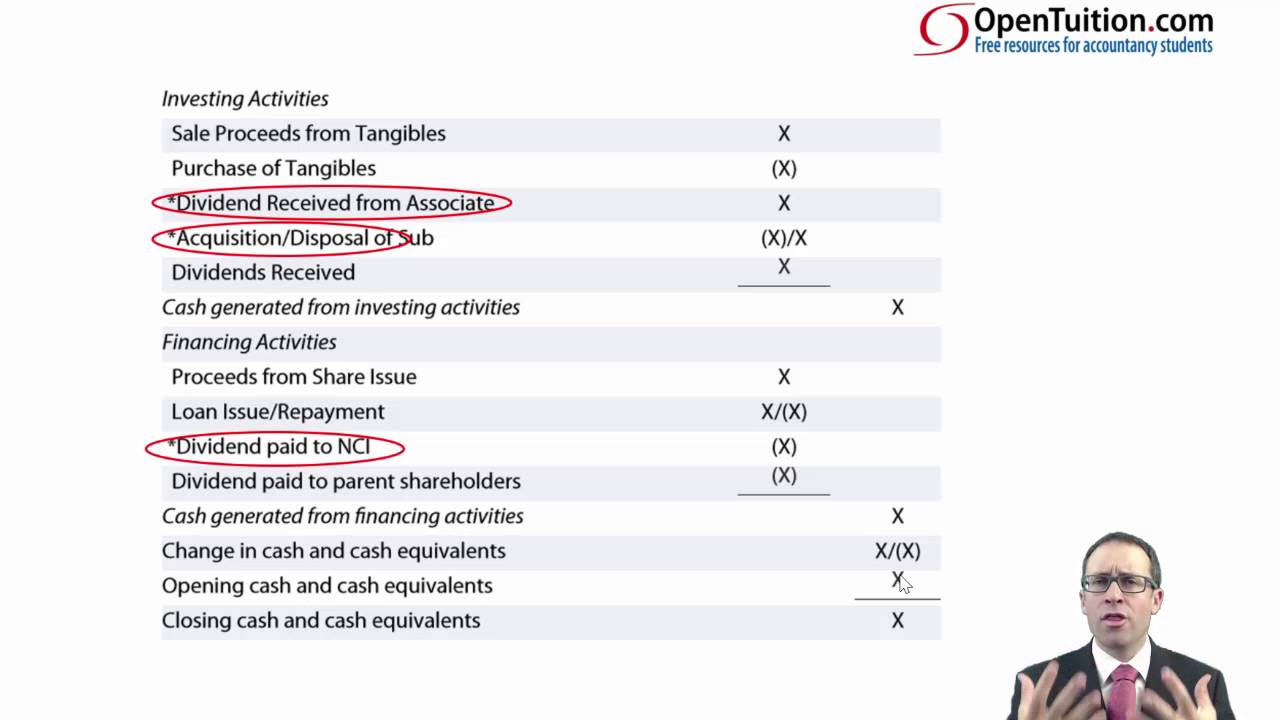

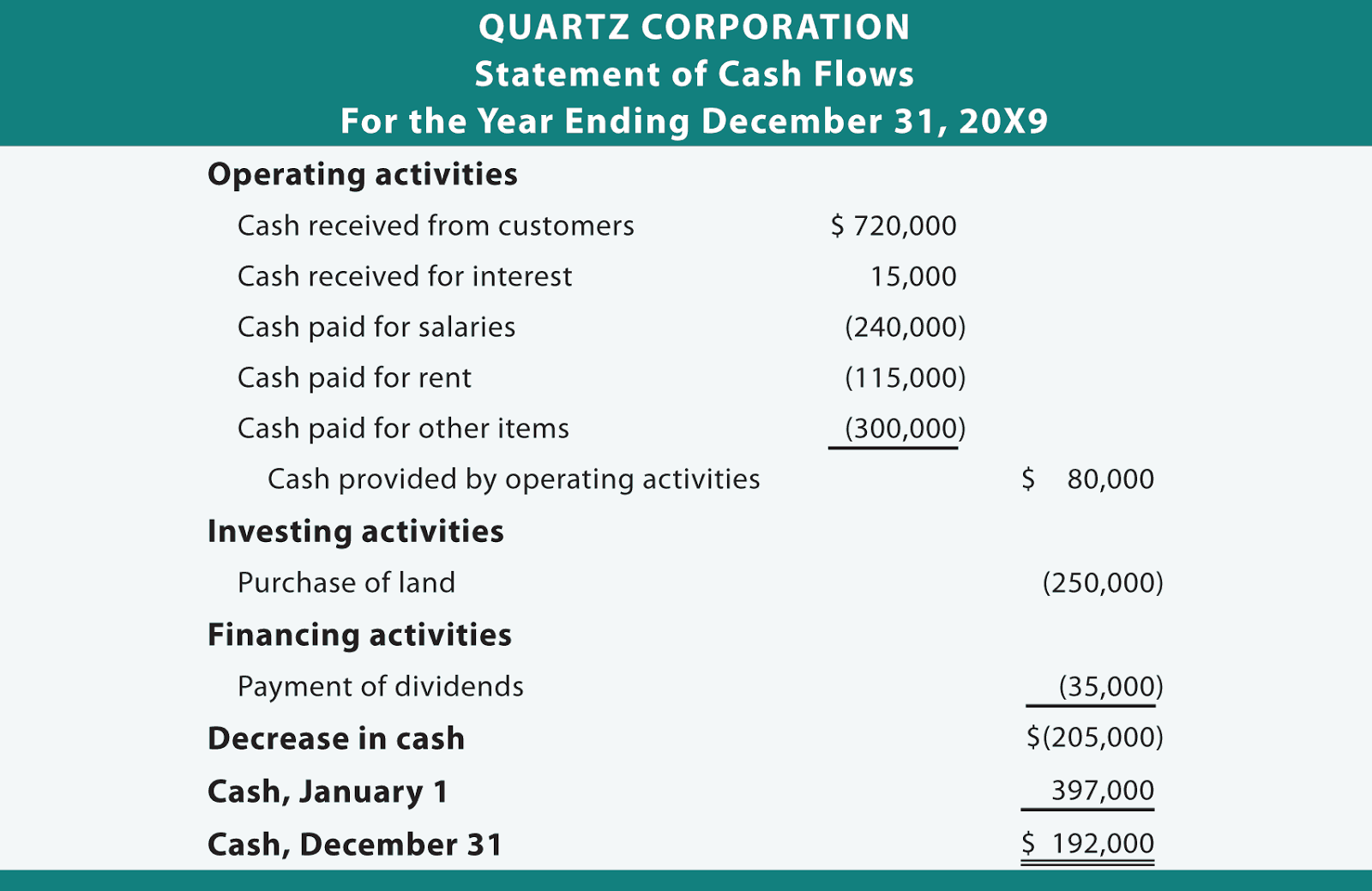

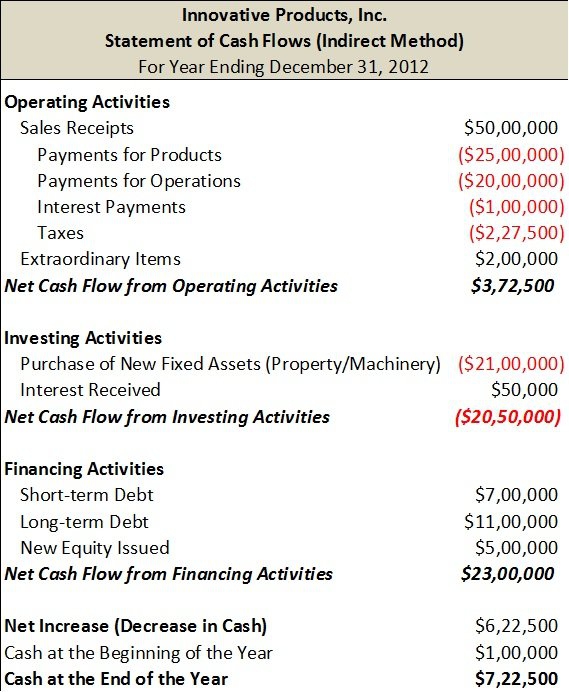

Cash flows from operating activities. Interest and dividends received should be classified in either operating or investing activities. Interest paid will appear in the statement of cash flow when the cash is actually paid to the creditors.

11 tips to generate cash flow when interest rates are high. We will use these names interchangeably throughout our explanation, practice quiz, and other materials. Other potential cash flow statement differences.

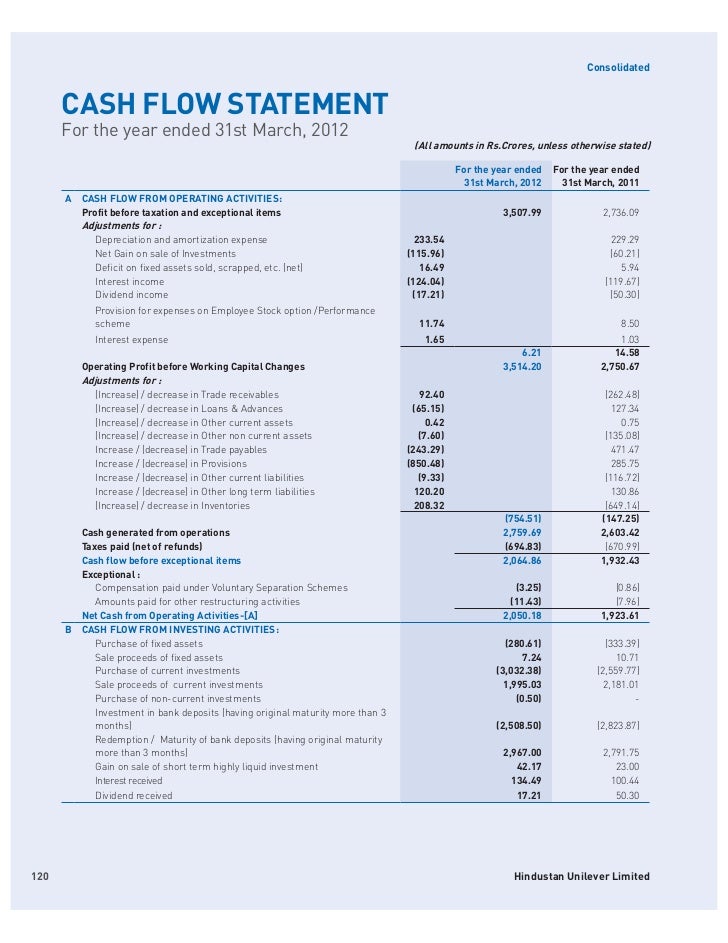

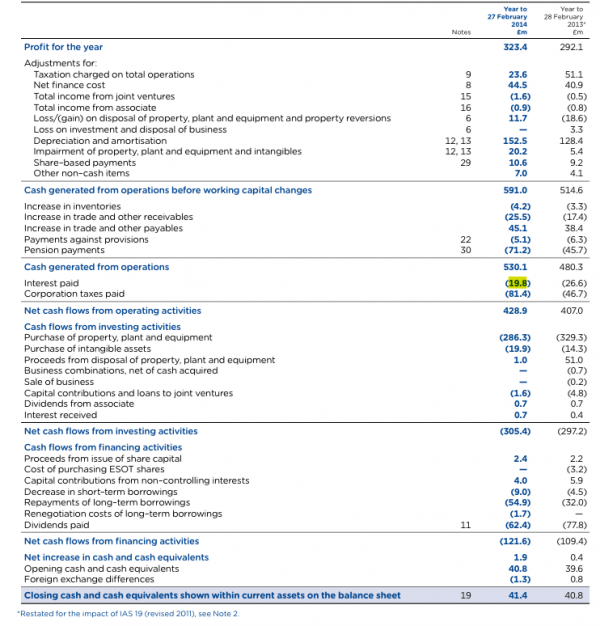

Many companies present both the interest received and interest paid as operating cash flows. If a company's business operations can generate positive cash flow, negative overall cash flow. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities.

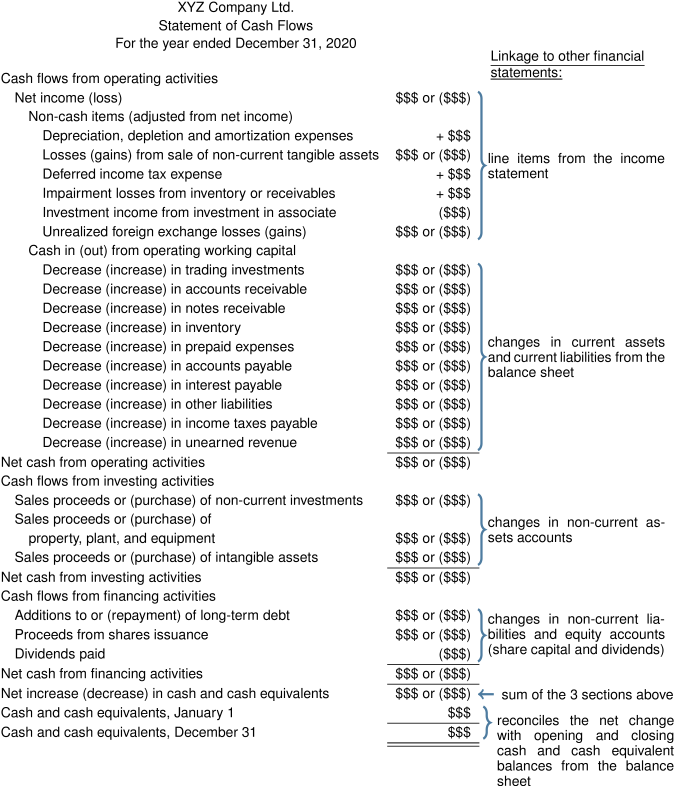

What is the explanation to these different approaches and how are we supposed to treat interest received/paid at the. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Under ifrs, there are two allowable ways of presenting interest expense or income in the cash flow statement.

Rental properties have been one of the largest real estate industry sectors to be hit by the increase in interest rates. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

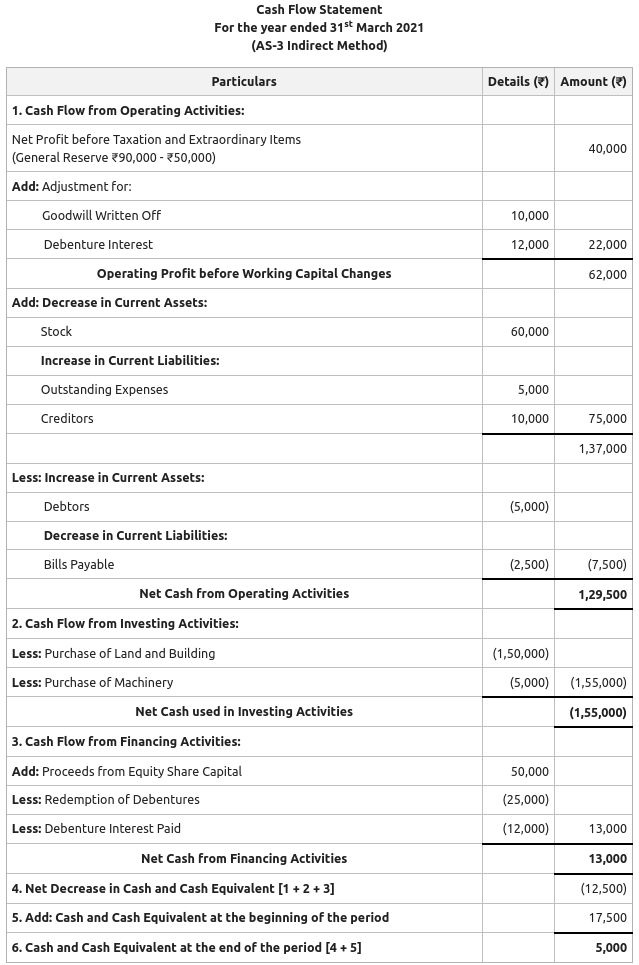

Entity a, a manufacturing company, opts to present interest received under operating activities in the statement of cash flows. The article will explain how to calculate cash flows and where those cash flows are presented in the statement of cash flows. Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities.

Interest expense on the income statement since the net profit or loss reported on your company’s cash flow statement already accounts for the interest expenses your business paid during. Proceeds from issue of share capital. Interest expense is the expense line item that will appear on the income statement.

It is relevant to the fa (financial accounting) and fr (financial reporting) exams. The cash flow statement is required for a complete set of financial statements. Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500.

Cash flow for the month. Payment of lease liabilities ( 90) dividends paid [2] ( 1,200) [2] this could also be shown as an operating cash flow. Interest paid ( 270) income taxes paid ( 900) net cash from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)