Build A Info About Direct Costing Income Statement

This income statement looks at.

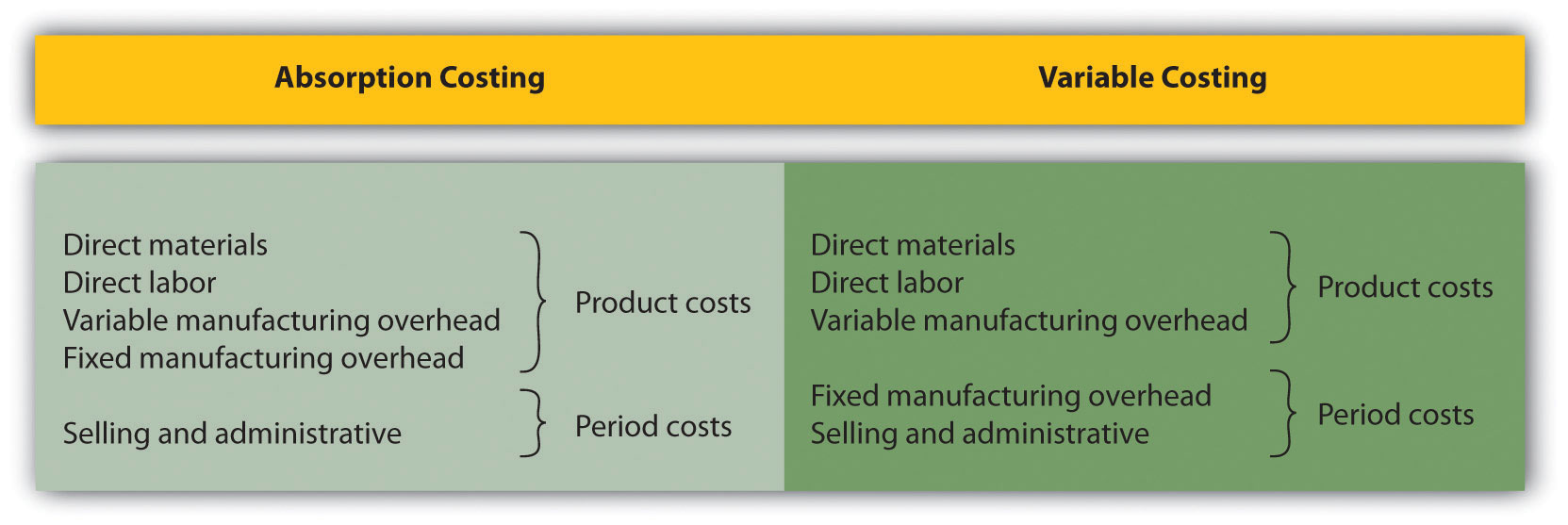

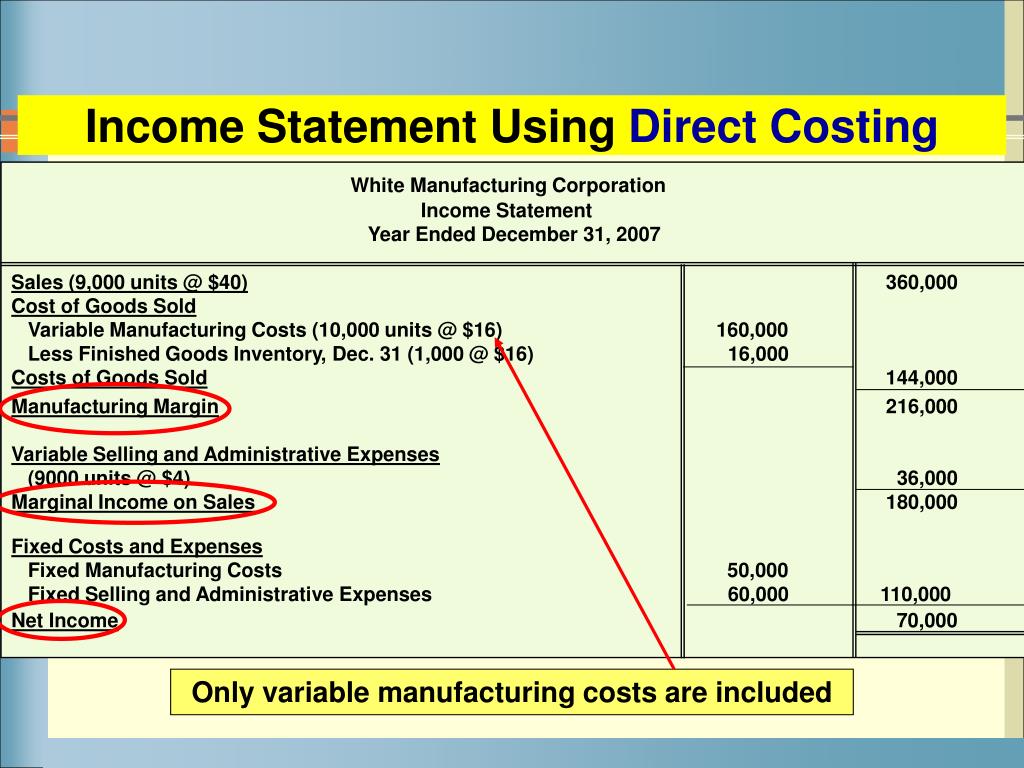

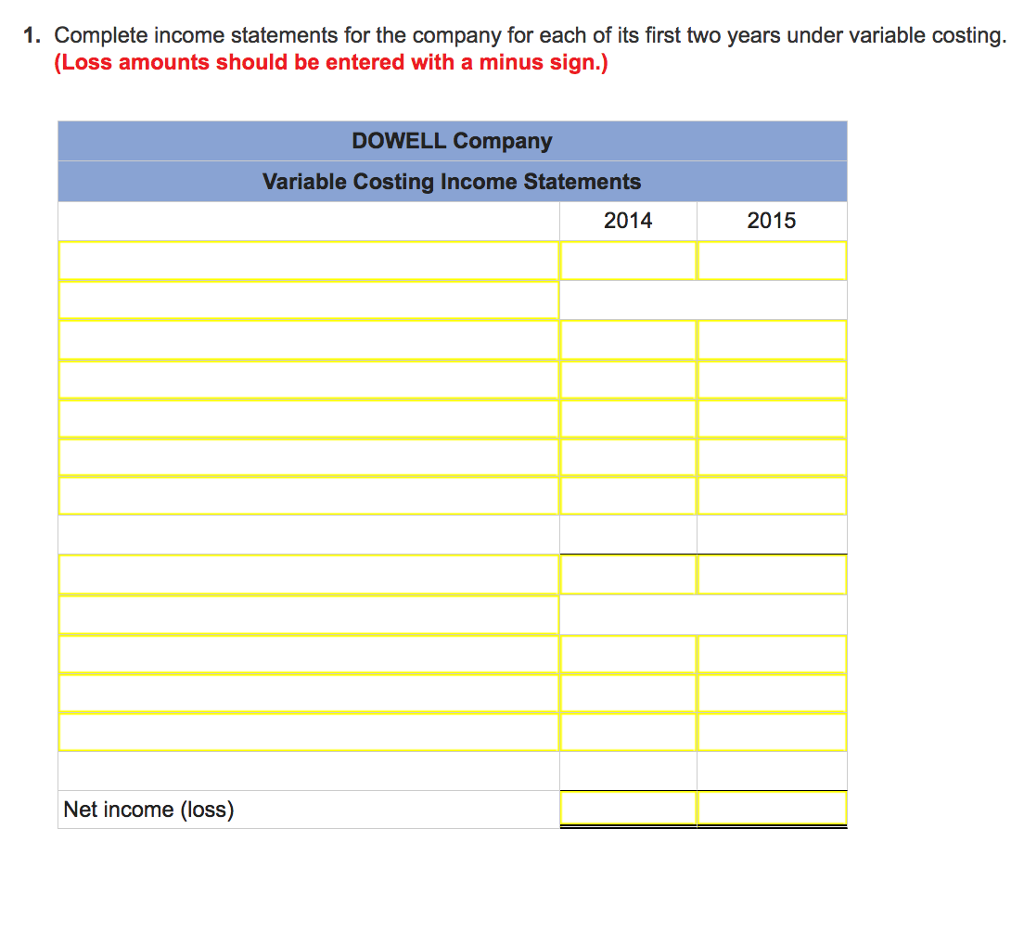

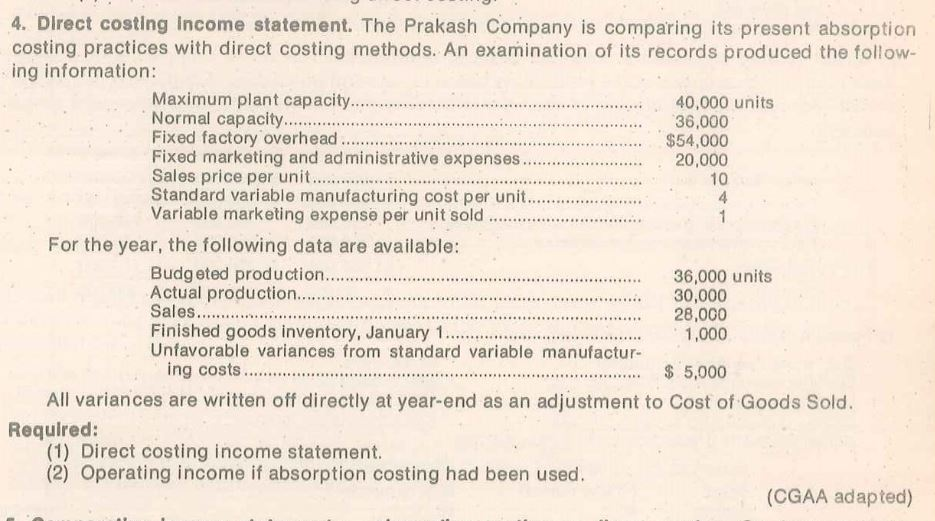

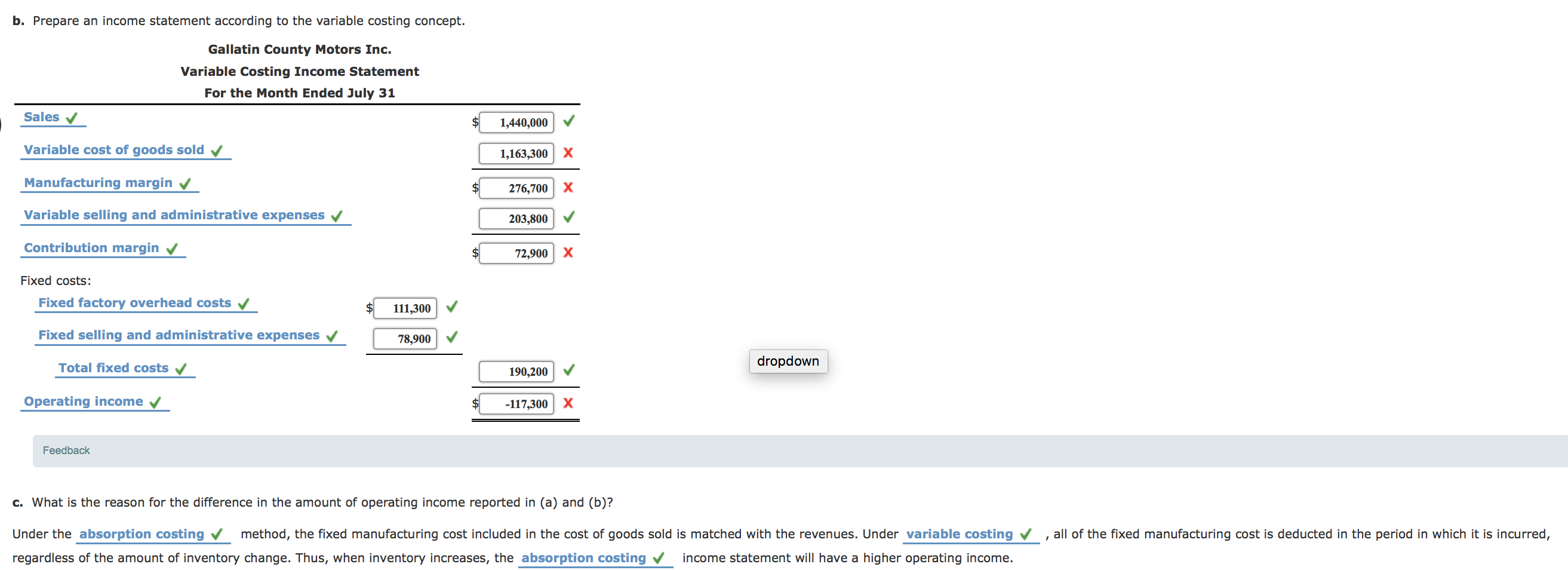

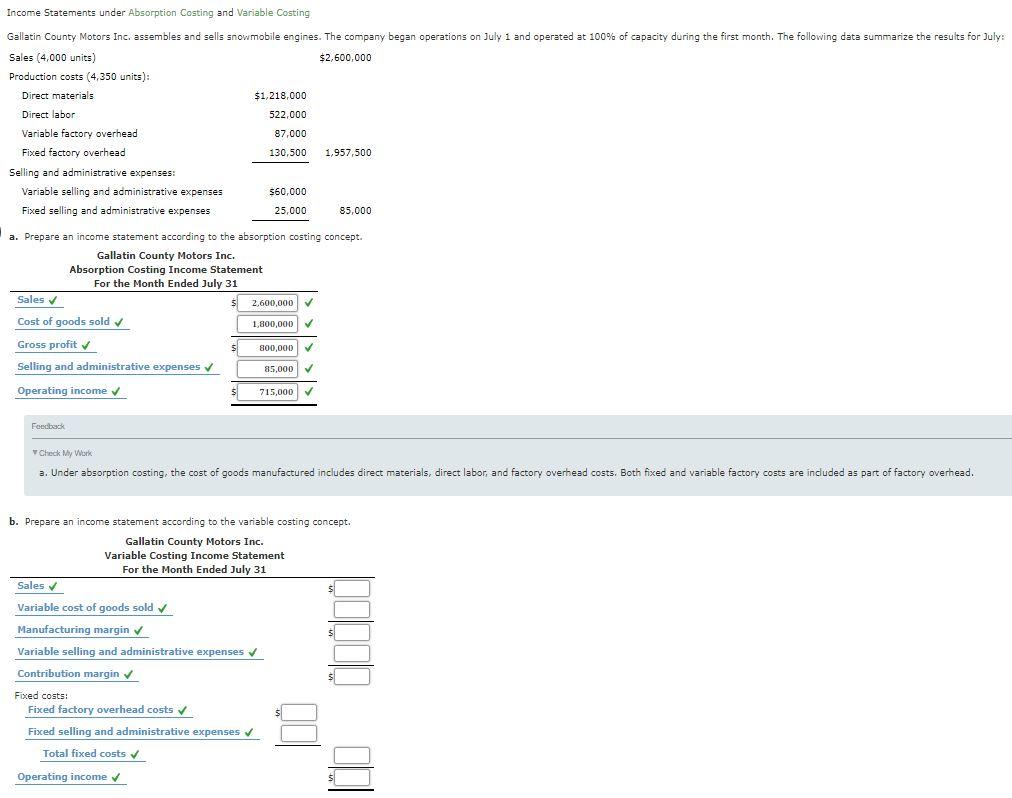

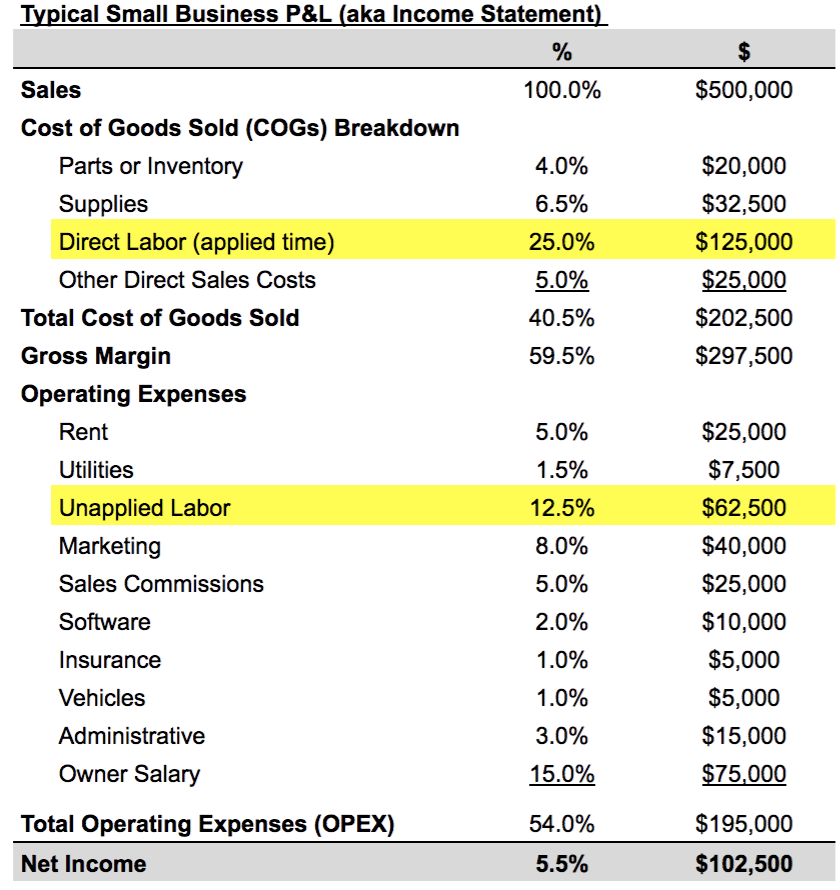

Direct costing income statement. A method where only the variable manufacturing costs are assigned to inventory and the cost of goods sold. Direct costs are most easily illustrated through examples, such as: Profit & loss item direct/indirect costs amount ($) revenue:

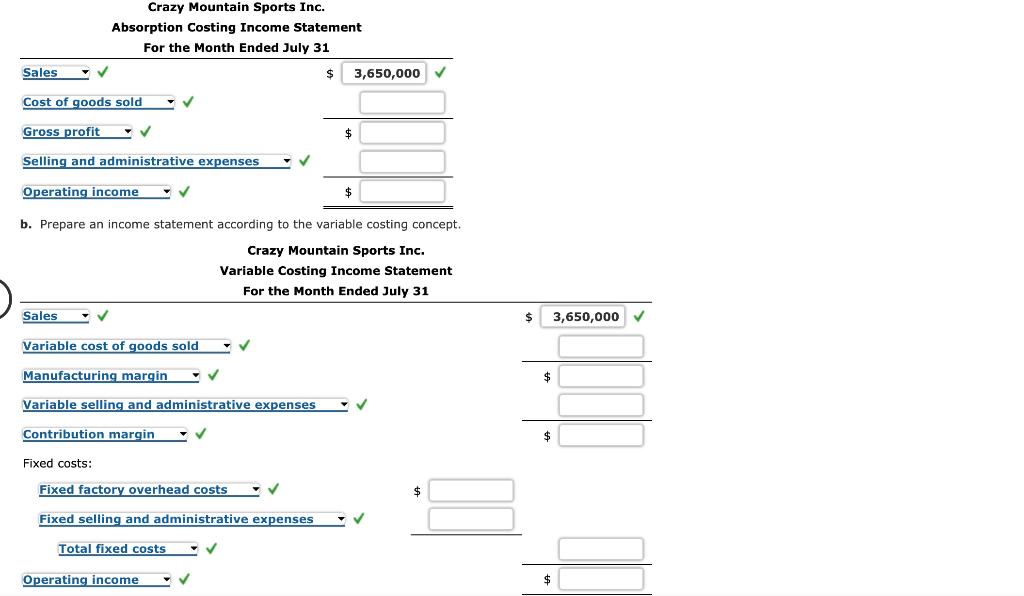

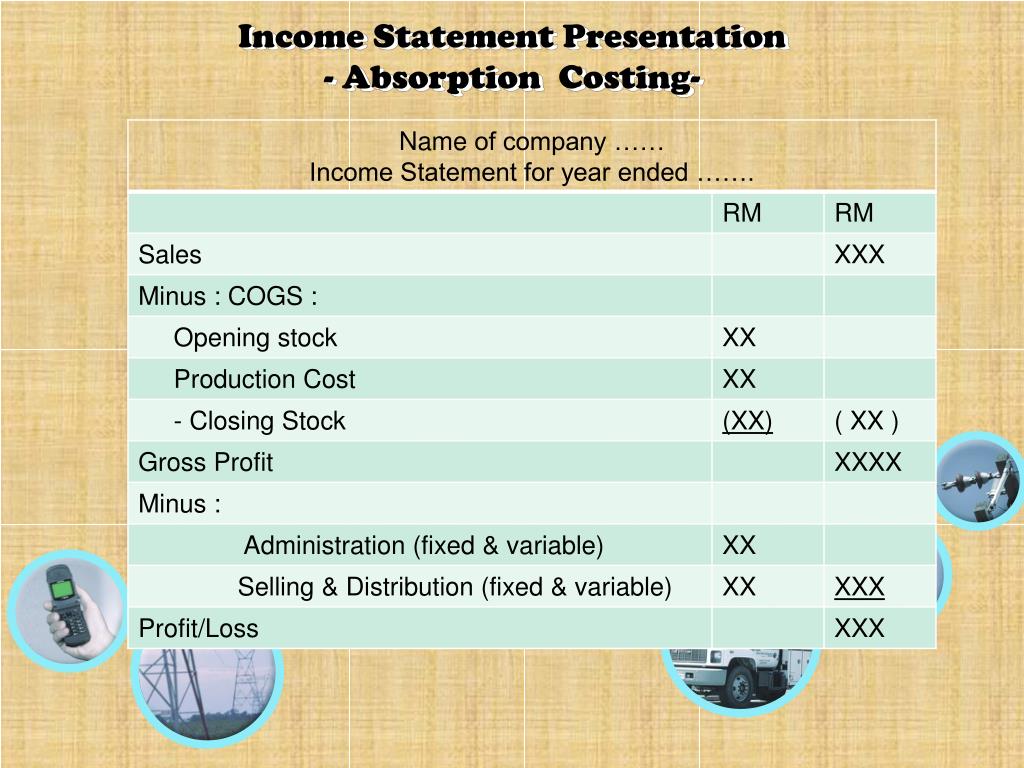

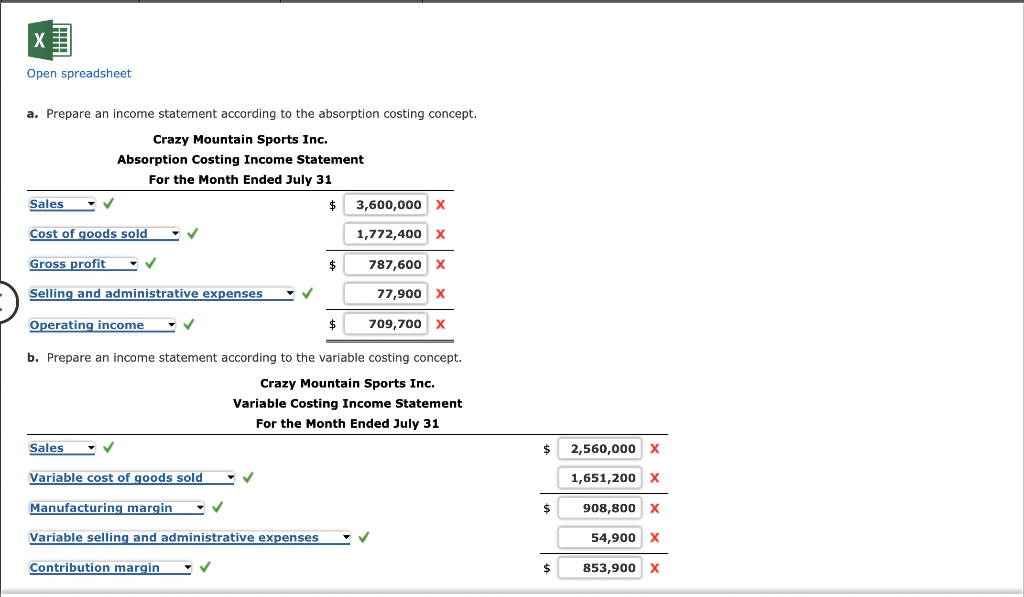

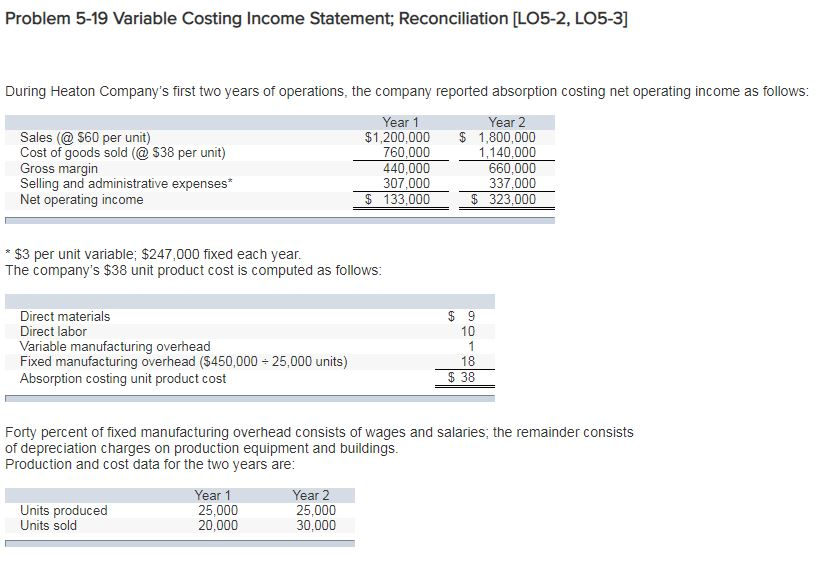

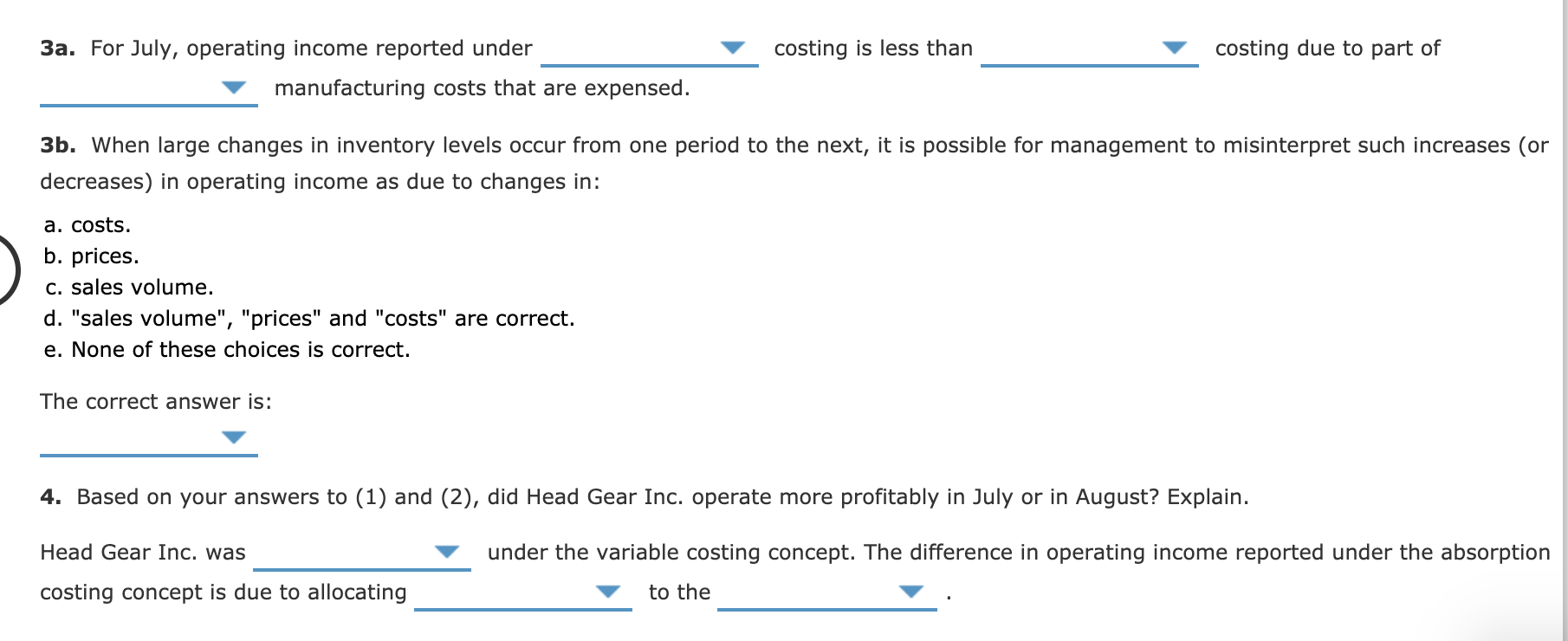

Income statement under absorption costing. Examples of variable costing income statement. (a) draft the budgeted income statement for the year ending 31 march 2018 according to the direct costing method, if inventory is valued according to the fifo method, and if.

Following are the examples are given below: The costs actually consumed when. Variable costing (also called marginal costing) is a costing method in which fixed manufacturing overheads are not allocated to units produced but are charged.

Updated march 11, 2022 reviewed by margaret james fact checked by suzanne kvilhaug what is a direct cost? In brief, direct costing is the analysis of incremental costs. Direct costing method is a costing technique used in managerial accounting, where only direct costs are considered while determining the total cost of production.

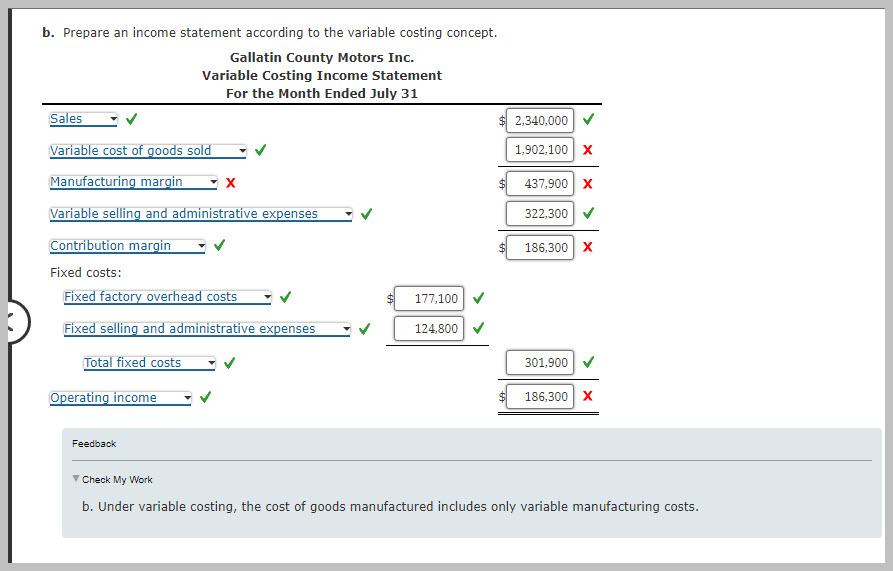

Income statement under marginal costing. The marginalproduction cost of an item is the sum of its direct materials cost,direct labour. An ltd is in the manufacturing business;

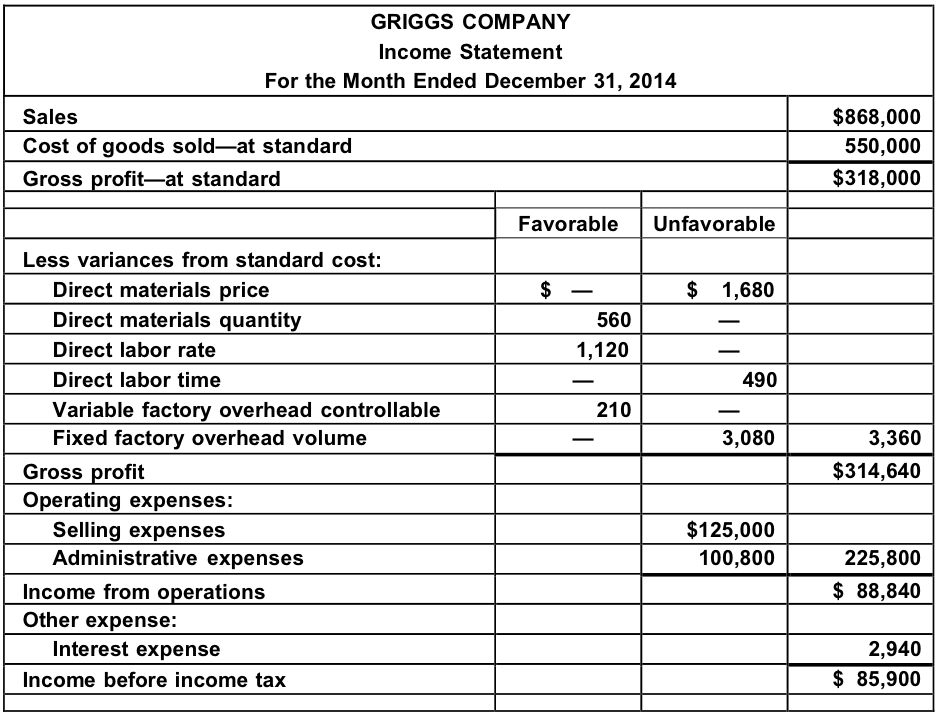

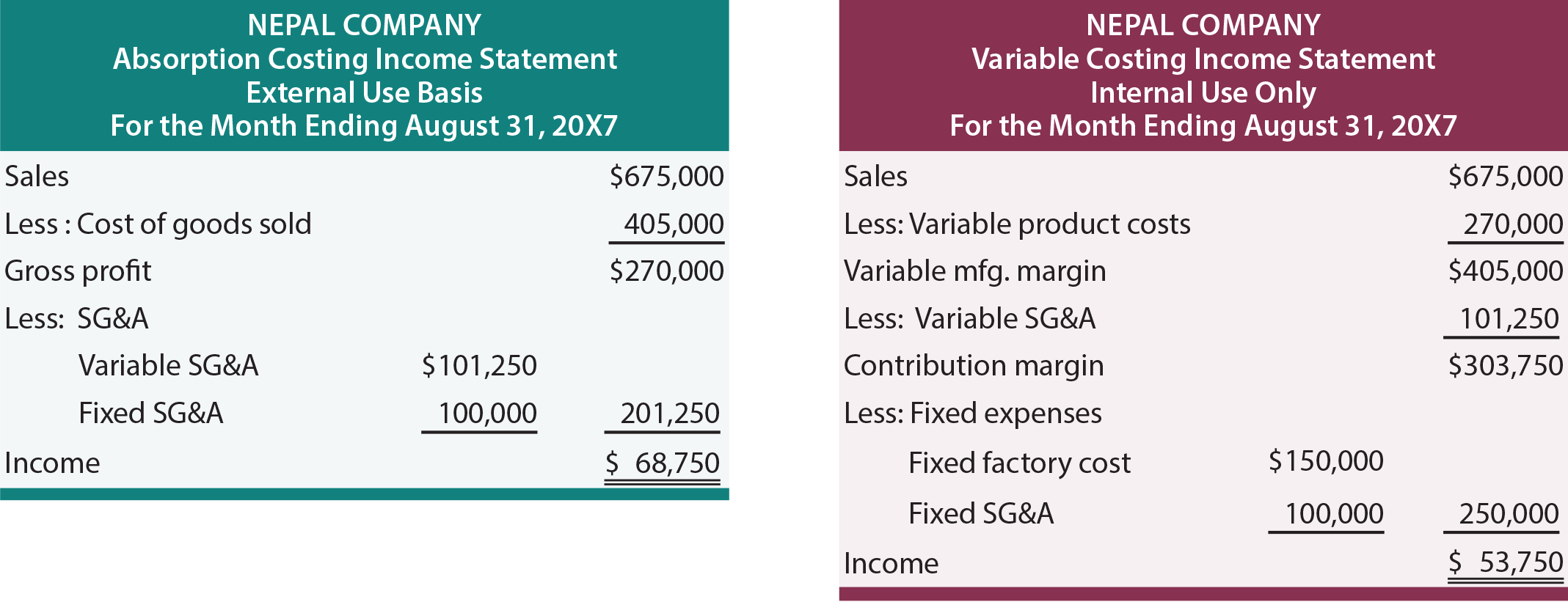

The traditional income statement, also called absorption costing income statement , uses absorption costing to create the income statement. Example of direct & indirect costs; It is seen that variable costs are deducted first from the sales revenue to arrive at the contribution margin.

This method focuses on the variable costs that are directly related to the. Variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense in the period received. It involves determining the product cost for a specific product without considering fixed costs.

Usually, variable costing includes direct expenses involved in the production. Direct costs refer to the cost of operating core business activity—production costs, raw material cost, and wages paid to factory staff. Fixed manufacturing costs are viewed.

As is shown on the variable costing income statement, total sales is matched with the total direct costs of generating those sales. A direct cost is a price that can be directly tied to the production. Therefore, we should use variable costing when determining whether to accept this special order.

As a result, when using an absorption statement, it is common to find that the expense on the income statement is smaller. Direct costing and absorption costing are two quantitative accounting models that are used by the decisionmakers of the firm for two different purposes — for internal. Such costs can be determined by.