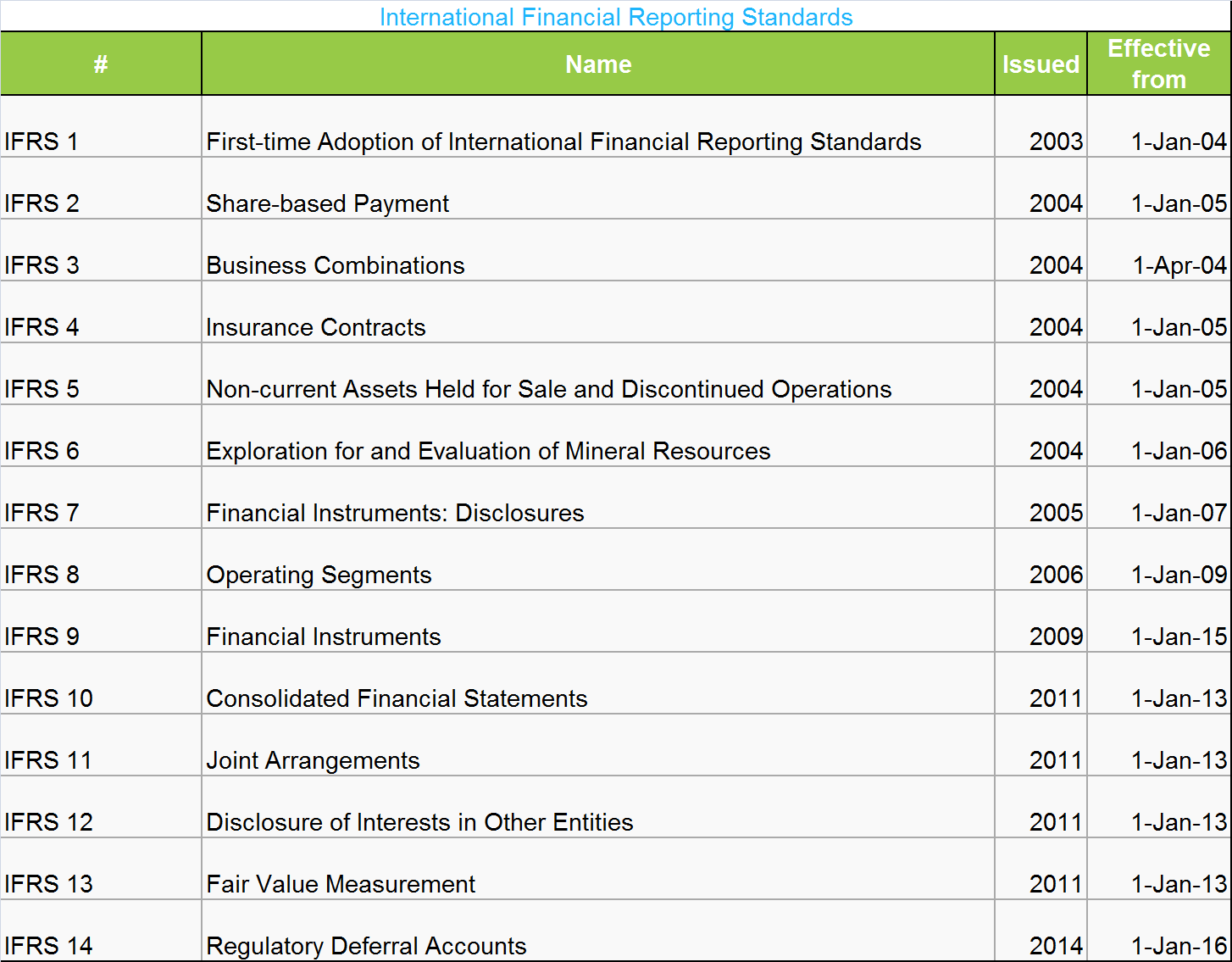

Top Notch Tips About Ifrs For Accounts Receivable

Accounts receivable is a current asset account (remember that “current” means they are due within 1 year) shown on the statement of financial position (ifrs)/ balance sheet (aspe).

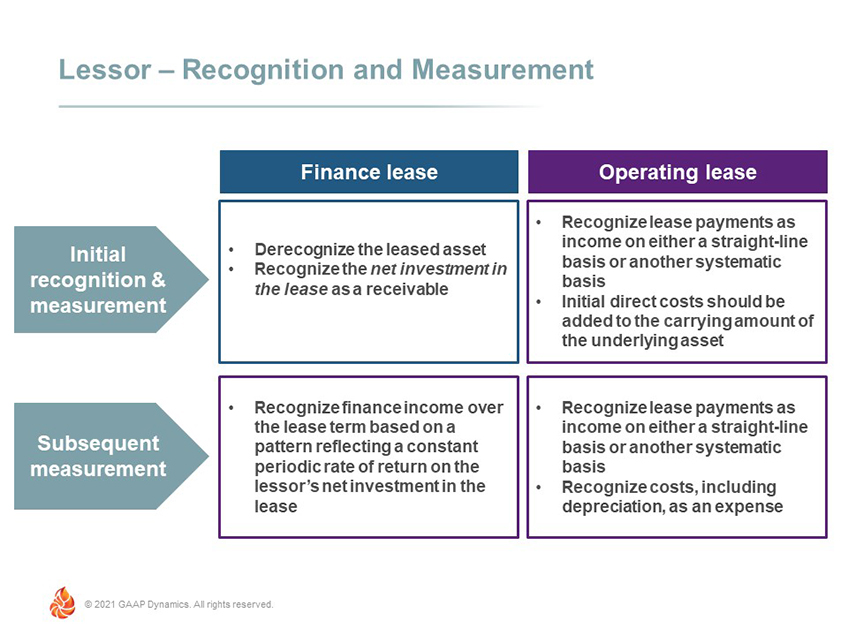

Ifrs for accounts receivable. From a lessor perspective, at the inception of the lease, a lessor classifies a lease as either an operating lease or a finance lease. This practical guide provides guidance for corporate engagement. This account represents money that is owed to the company by.

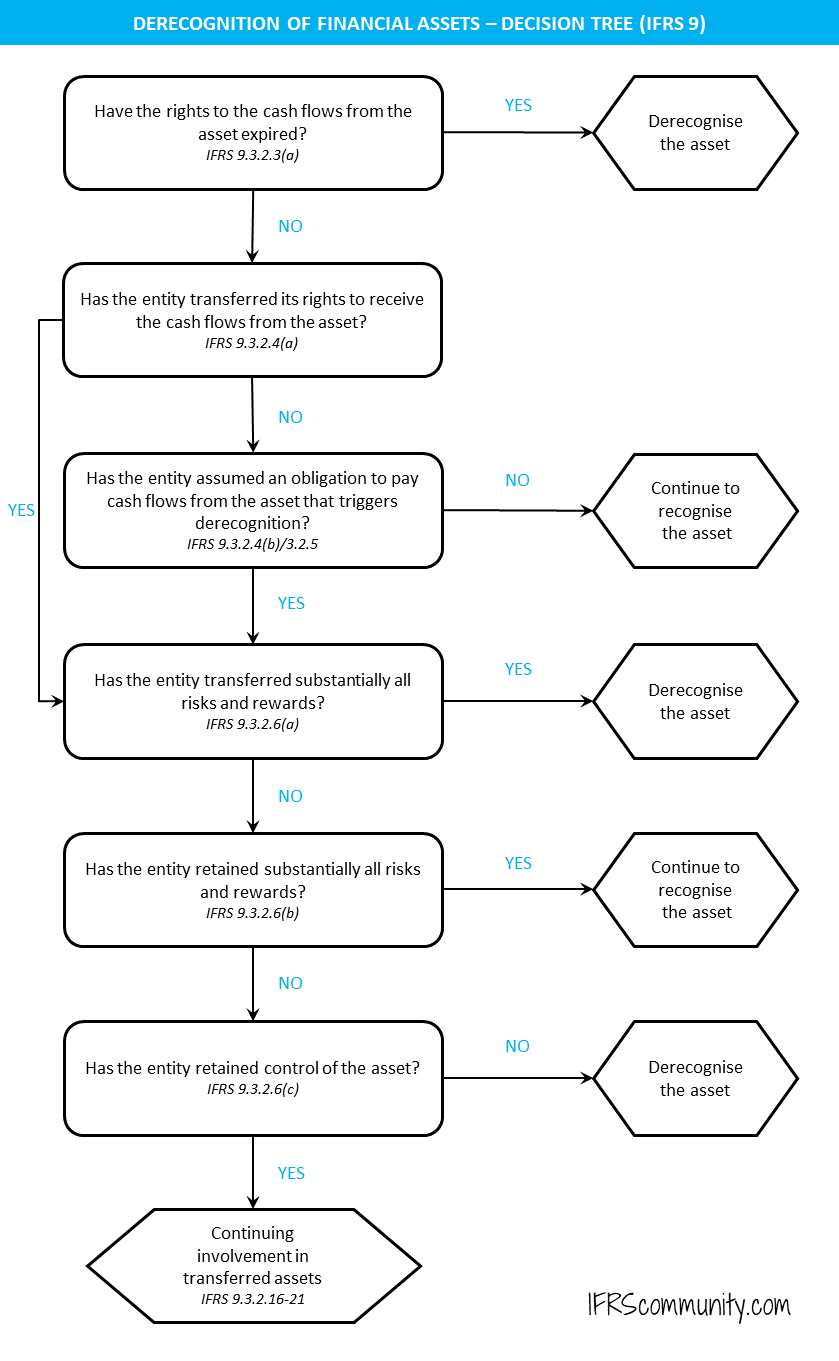

Leases within the scope of ias 17 leases; The entry to record the allowance would be: Factoring (ifrs 9) last updated:

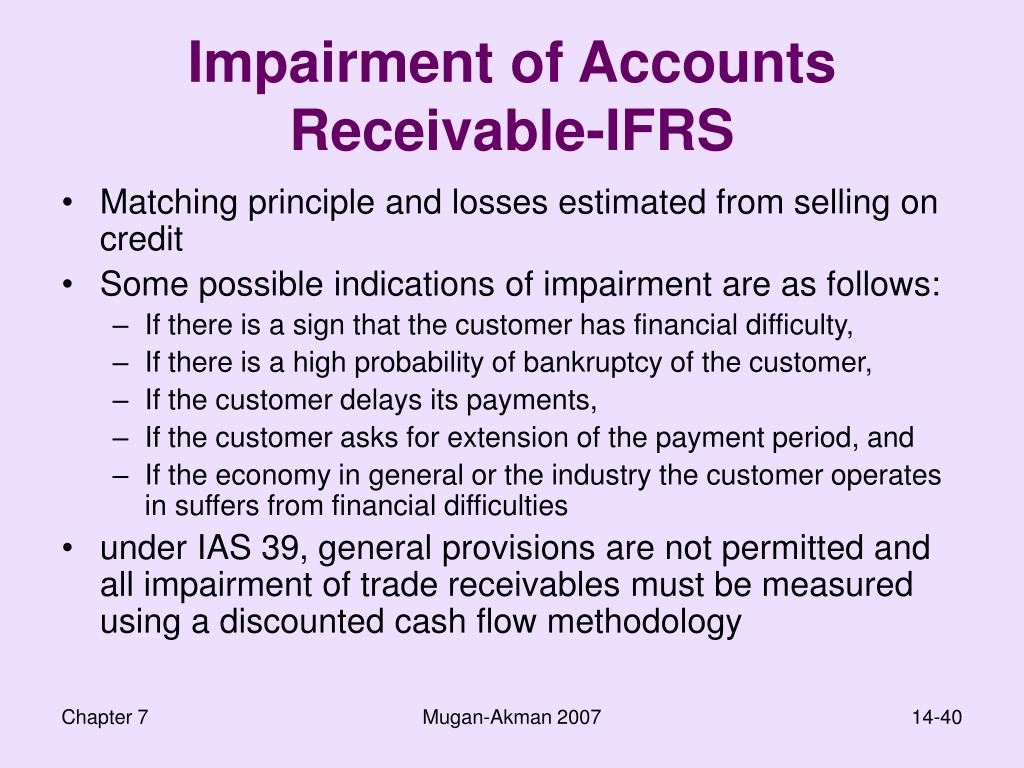

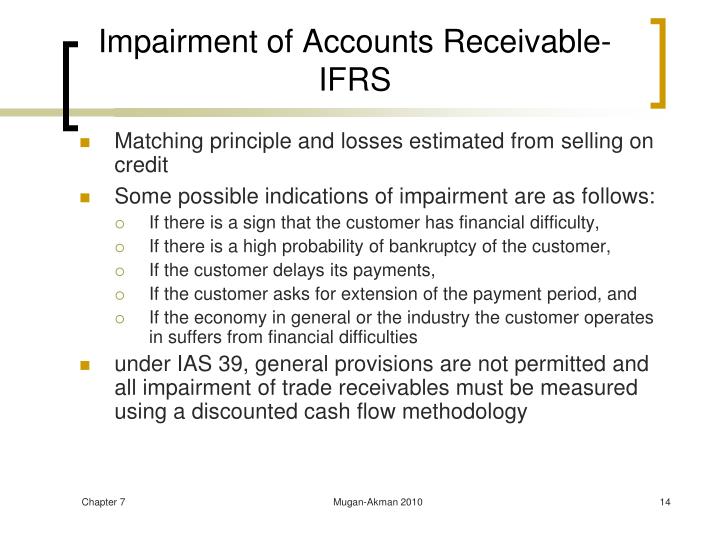

Ifrs 9 requires entities to recognise expected credit losses for all financial assets held at amortised cost or at fair value through other comprehensive income, including accounts receivable balances. A lease is classified as an. Ifrs 9 financial instruments requires companies to measure impairment of financial assets, including trade receivables, using the expected credit loss model.

Receivables are asset accounts applicable to all amounts owing, unsettled transactions, or other monetary obligations owed to a company by its credit customers or debtors. Ifrs 9 is effective for annual periods beginning on or after 1 january 2018 with early application permitted. Ifrs requires that loans and receivables be accounted for at amortized cost, adjusted for allowances for doubtful accounts.

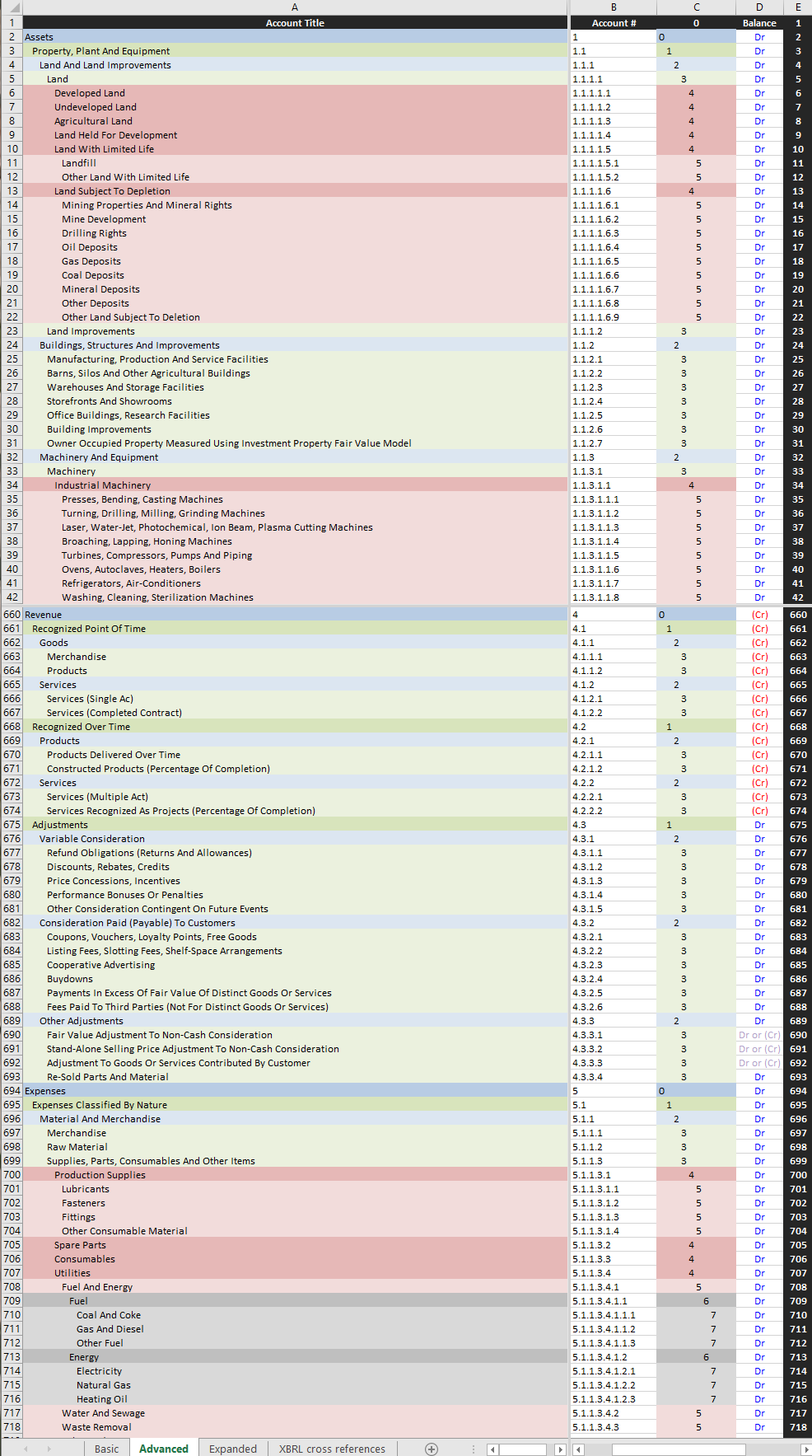

Ifrs chart of accounts. 31 mar 2023 us ifrs & us gaap guide classification is not driven by legal form under ifrs, whereas legal form drives the classification of debt instruments under us gaap. The simplified approach is mandatory for trade receivables or contract assets resulting from transactions that fall within the scope of ifrs 15 and do.

Ifrs 15 revenue from contracts with customers applies to all contracts with customers except for: From january 1, 2018, in ifrs 15, detailed guidelines have been given to recognize account receivables and when the same is needed to be debited or credited. To fill this void, this site has been publishing coas since 2010.

The board proposed to carry out this clarification through an amendment to the. The ifrs ic received a submission about how an entity that issues insurance contracts (insurer) accounts for premiums receivable from an intermediary. The standard includes requirements for recognition and measurement, impairment, derecognition and general hedge.

In the fact pattern described, a policyholder has paid the premiums to an intermediary when. This chart of accounts is suitable for use with ifrs. In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of india (irdai) has announced the reconstitution of its expert committee dedicated to the.

Ifrs 9 'financial instruments' issued on 24 july 2014 is the iasb's replacement of ias 39 'financial instruments: Ifrs sometimes refers to these allowances as provisions. Ifrs.org) does not define an ifrs coa.

31 dec 2018 overview of ifrs 9 classification and measurement technical considerations business model assessment (held to collect/sell) key considerations portfolio segmentation leverage Financial instruments and other contractual rights or obligations within the scope of ifrs 9 financial instruments,. The ifrs ic concluded that there is an accounting policy choice that premiums receivables remain in the measurement of a group of insurance contracts under ifrs 17 until recovered or settled in cash (view 1) or it is removed from the.