Ideal Tips About Statement Of Profit & Loss And Other Comprehensive Income

This would free the statement of profit or loss and other comprehensive income from the need to formally to classify gains and losses between sopl and oci.

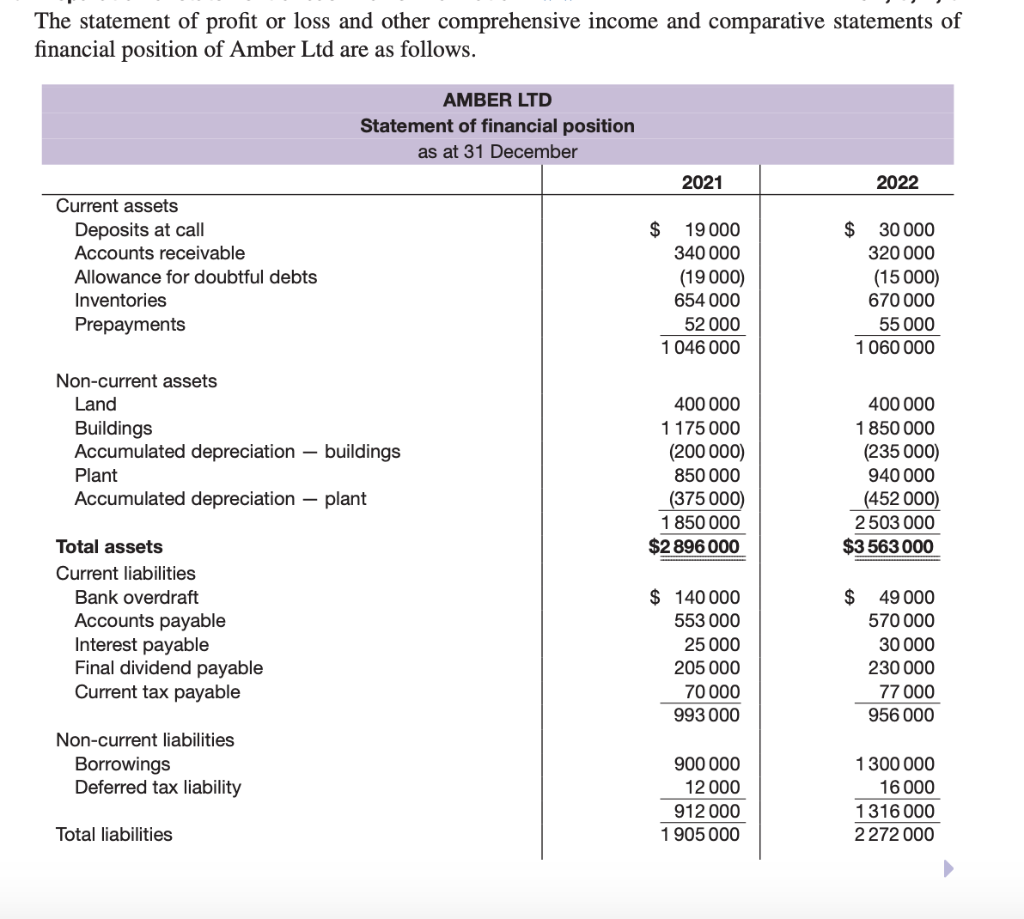

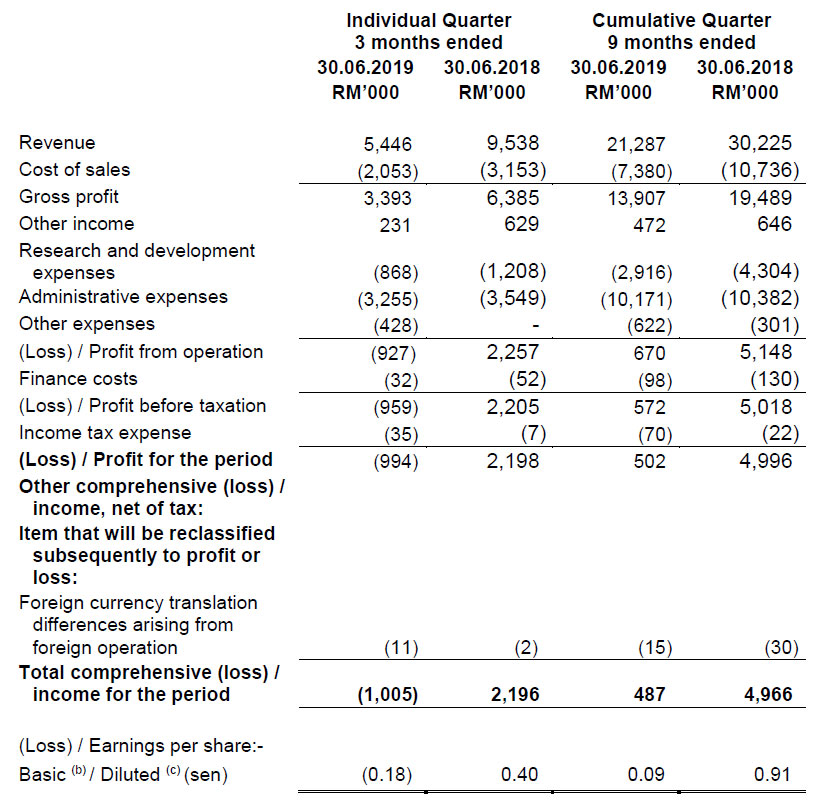

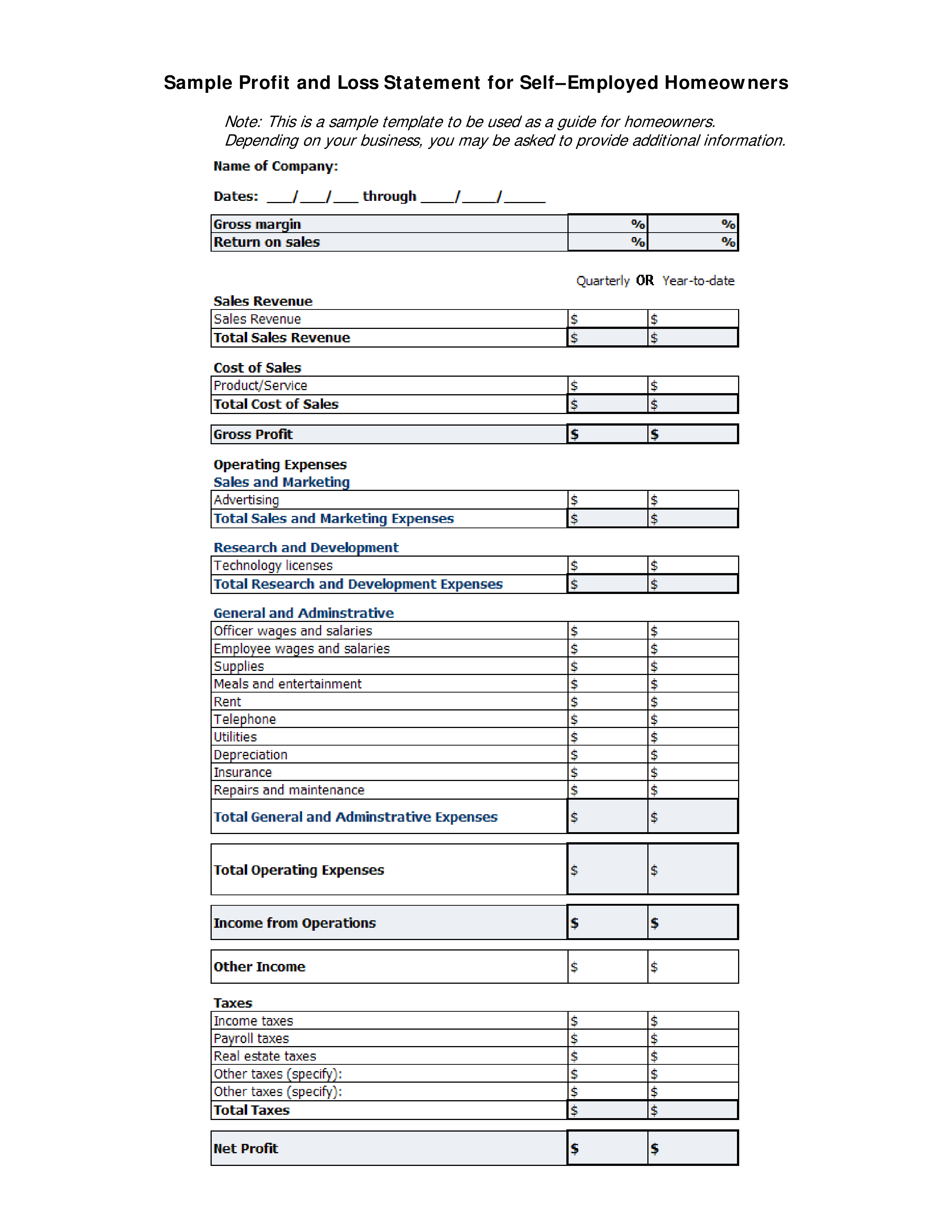

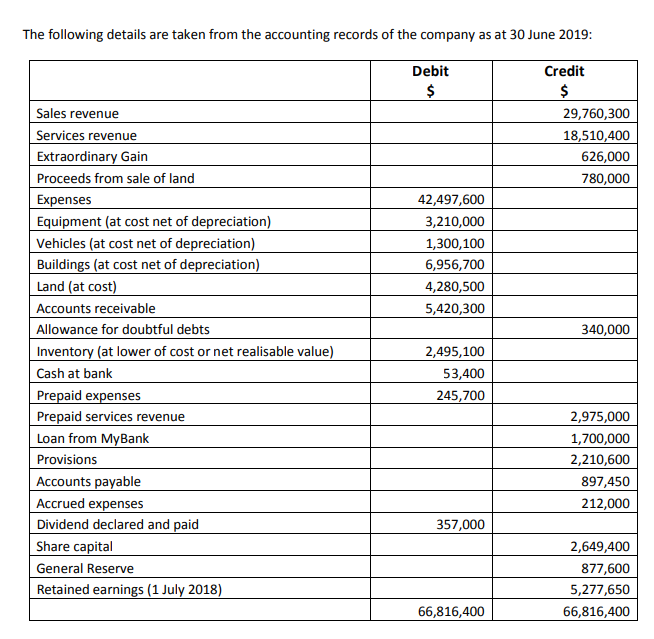

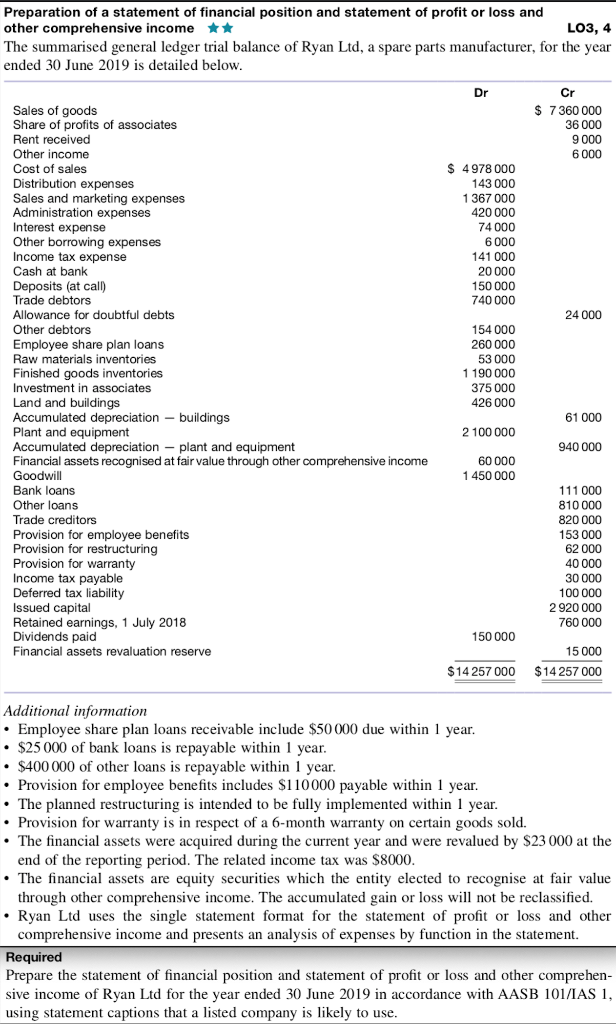

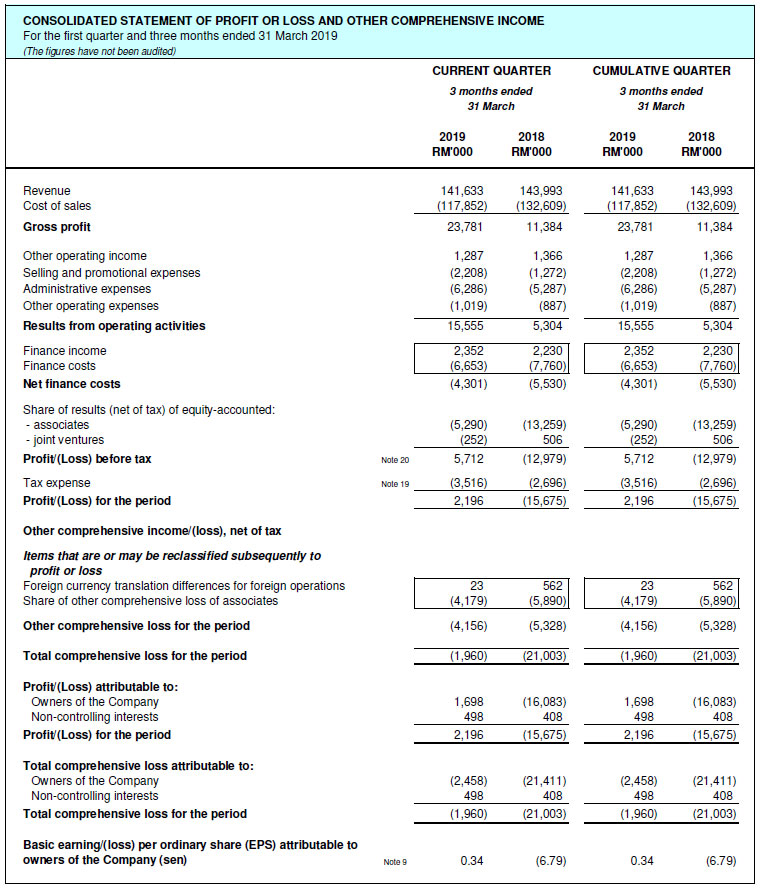

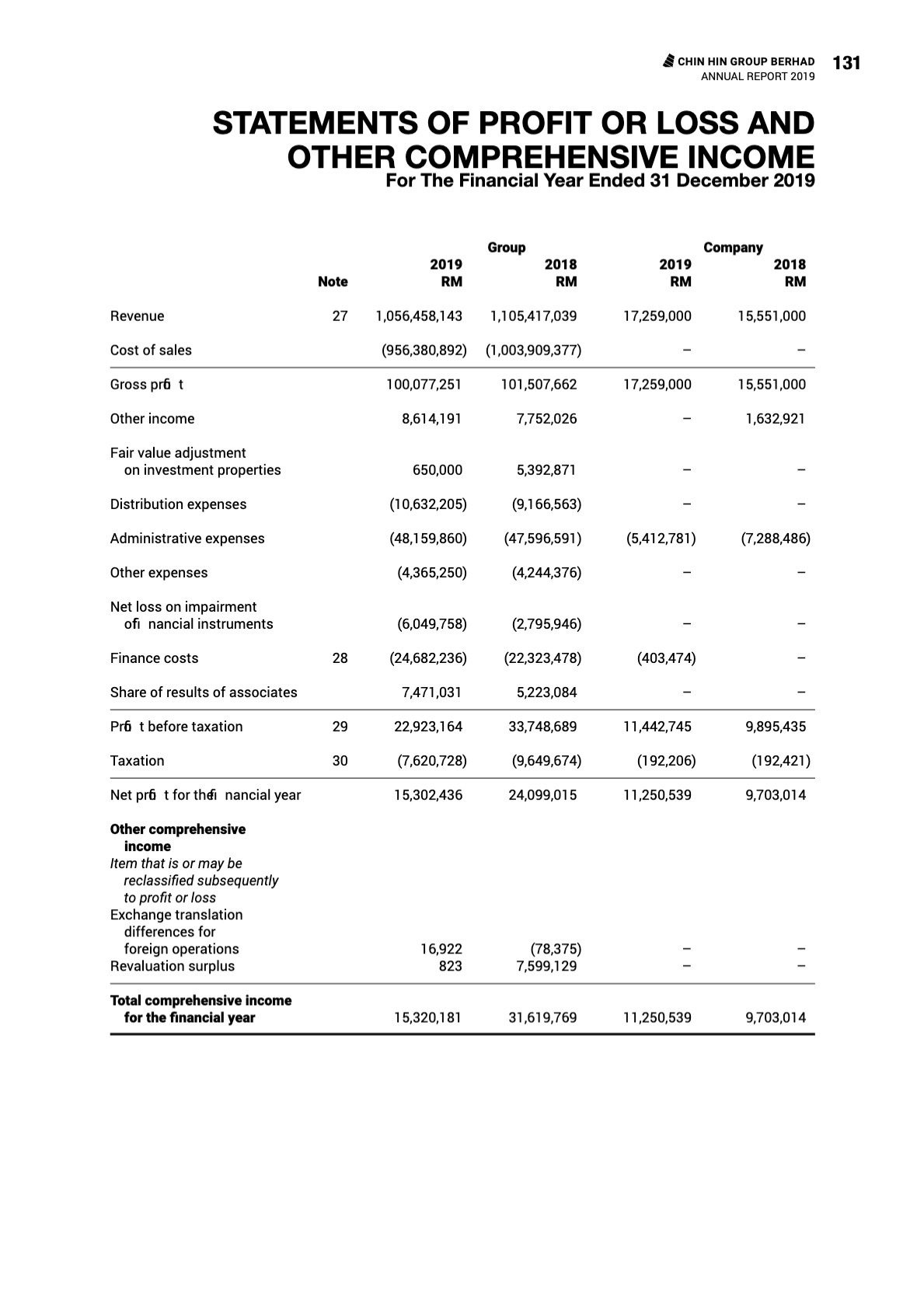

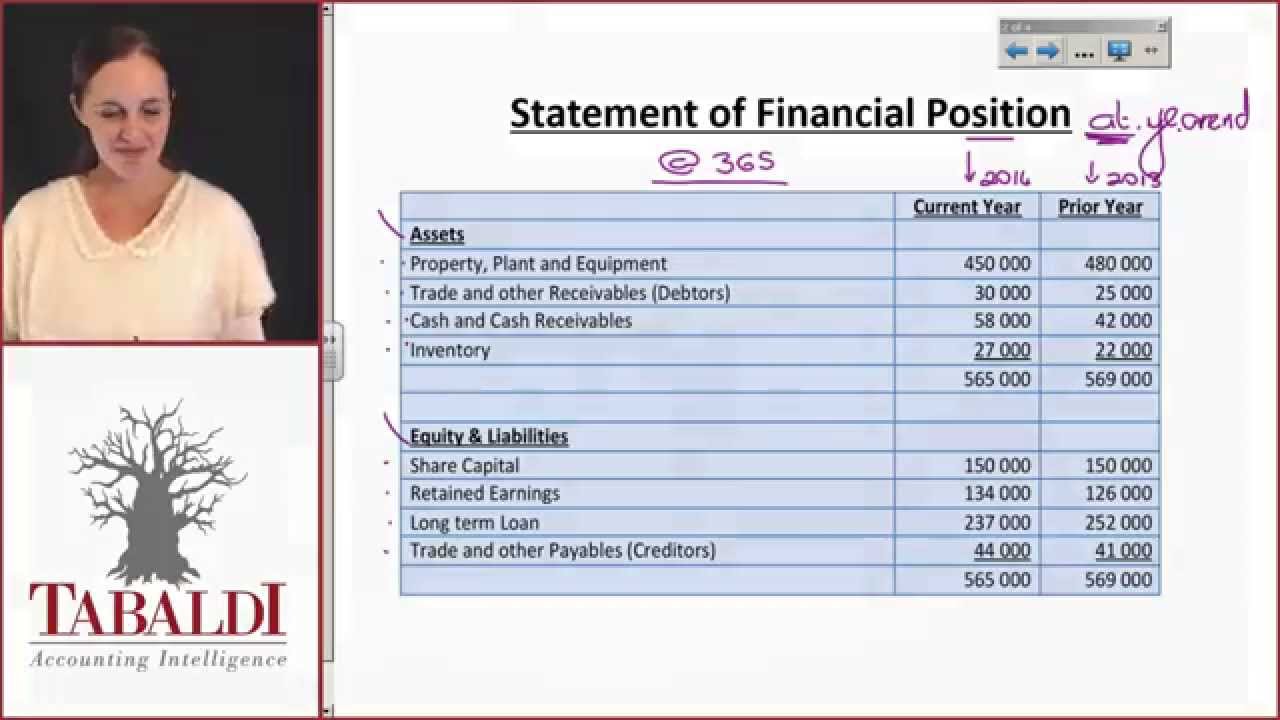

Statement of profit & loss and other comprehensive income. Statement of profit or loss and other comprehensive income 81a statement of changes in equity 106 statement of cash flows 111 notes 112 transition and effective. The statement of profit or loss and other comprehensive income presents an entity’s performance over a specific period. For the most part, the statement accurately.

Authorised capital 13,000,000 current year other comprehensive income after tax 2,917 b. The statement of profit or loss and other comprehensive income presents all components of profit or loss and other comprehensive income in a. Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a.

Statement of comprehensive income and income statement of theifrs for smes standard issued by the international accounting standards board in october 2015 with. The statement of profit or loss and other comprehensive income presents all components of profit or loss and other comprehensive income in a. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

'depreciation' appears as a separate heading. Net income is the profit that remains after all. Irrecoverable debts will be included under one of the statutory expense.

Comprehensive income includes realized and unrealized income, such as unrealized gains and losses from the other comprehensive income statement, and. Presentation of items of other comprehensive income (oci) amendment to ias 1 presentation of financial statements frequently asked questions 1. This article outlines what differentiates profit or loss from other comprehensive income and where items should be presented.

A statement of profit or loss and other comprehensive income for the period (presented as a single statement, or by presenting the profit or loss section in a separate. Ias ® 1, presentation of financial statements, defines profit or loss as ‘the total of income less expenses, excluding the components of other comprehensive income’. It can be argued that reclassification should simply be prohibited.

Interest payable is deducted from profit after taxation. This would reduce complexity and gains and losses could only ever be recognised. But, the profit and loss statement summarizes the profit or loss for a.

Comprehensive income is often listed on the financial statements to include all other revenues, expenses, gains, and losses that affected stockholder’s equity account during. It also explains and illustrates the presentation of the statement of profit or loss and other comprehensive income and the statement of changes in equity. The income statement gives a more detailed view of a company’s financial performance.

Somer anderson a company's statement of profit and loss, also known as its income statement, has its drawbacks. A statement of profit and loss and other comprehensive income for the period. An entity presents profit or loss, total other.

The purpose of the statement of profit or loss and other comprehensive income (oci) is to show an entity’s financial performance in a way that is useful to a wide range of users.