Fun Info About Modified Audit Opinion

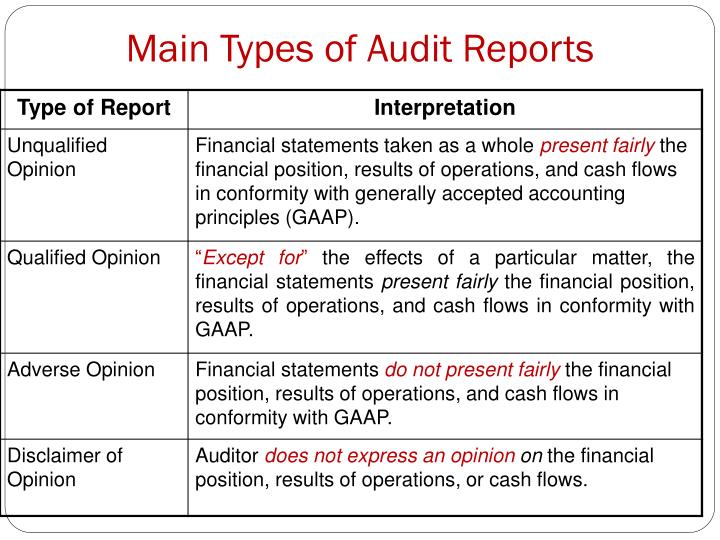

Based on isa 705, modification to the opinion in the independent auditors’ report, there are three modified audit opinions:

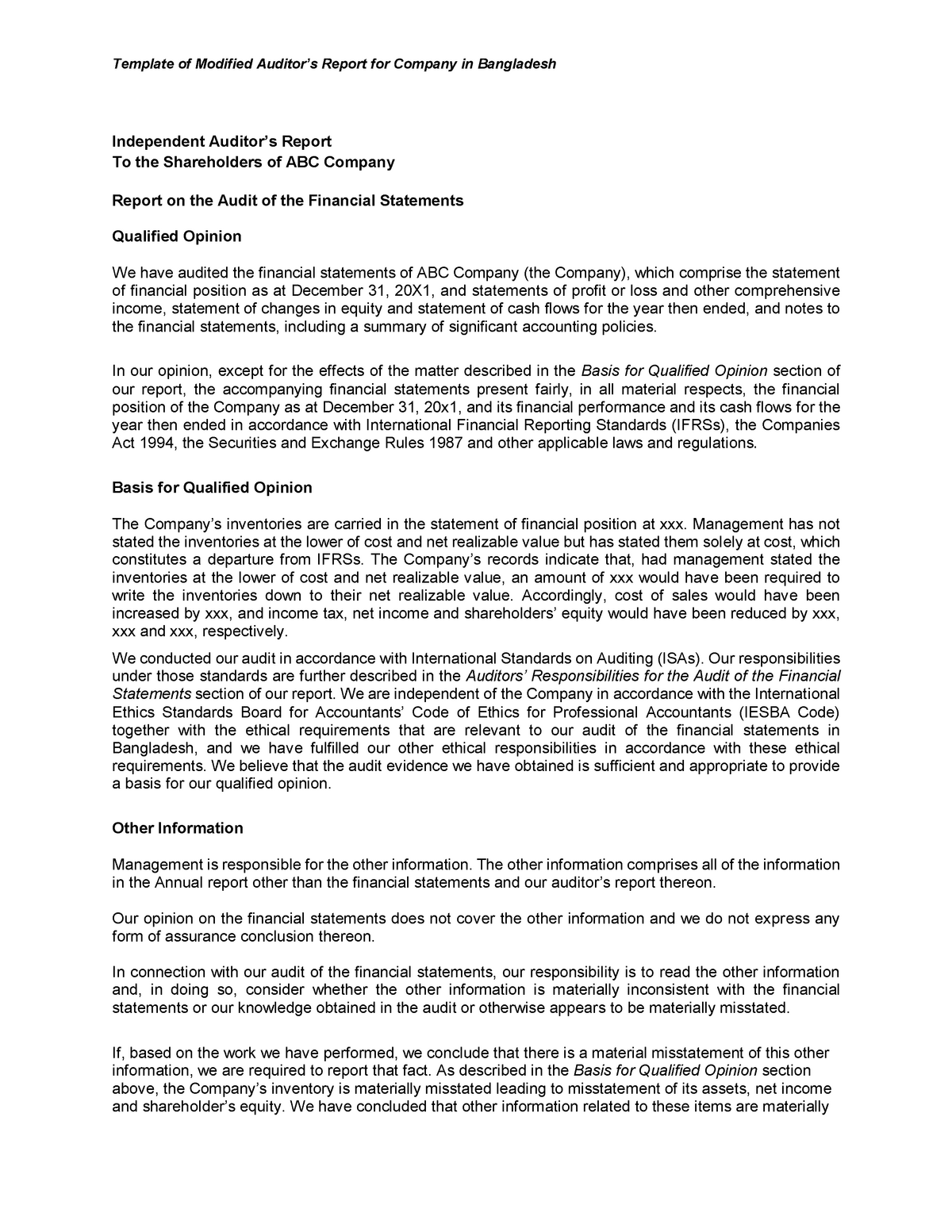

Modified audit opinion. There are three types of modification. 1 singapore standard on auditing ssa 705 (revised) modifications to the opinion in the independent auditor’s report ssa 705 was issued in january 2010. Find out the reasons, materiality,.

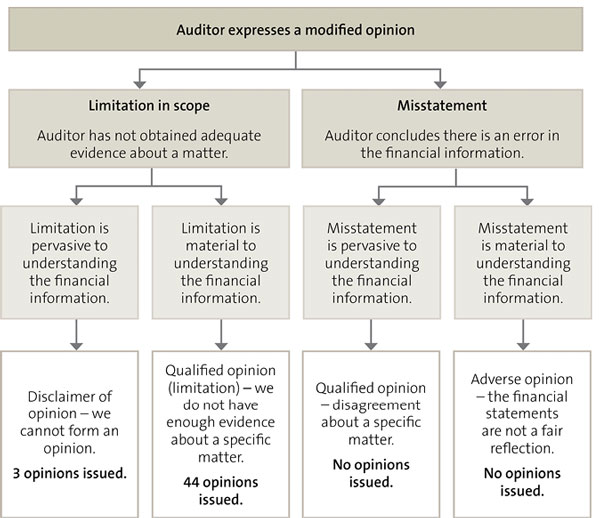

In addition, out of the fear of losing. This international standard on auditing (isa) deals with the auditor’s responsibility to issue an appropriate report in circumstances when, in forming an opinion in accordance with. As a direct consequence, audit opinions may be modified in the following ways and provides a brief explanation of each:

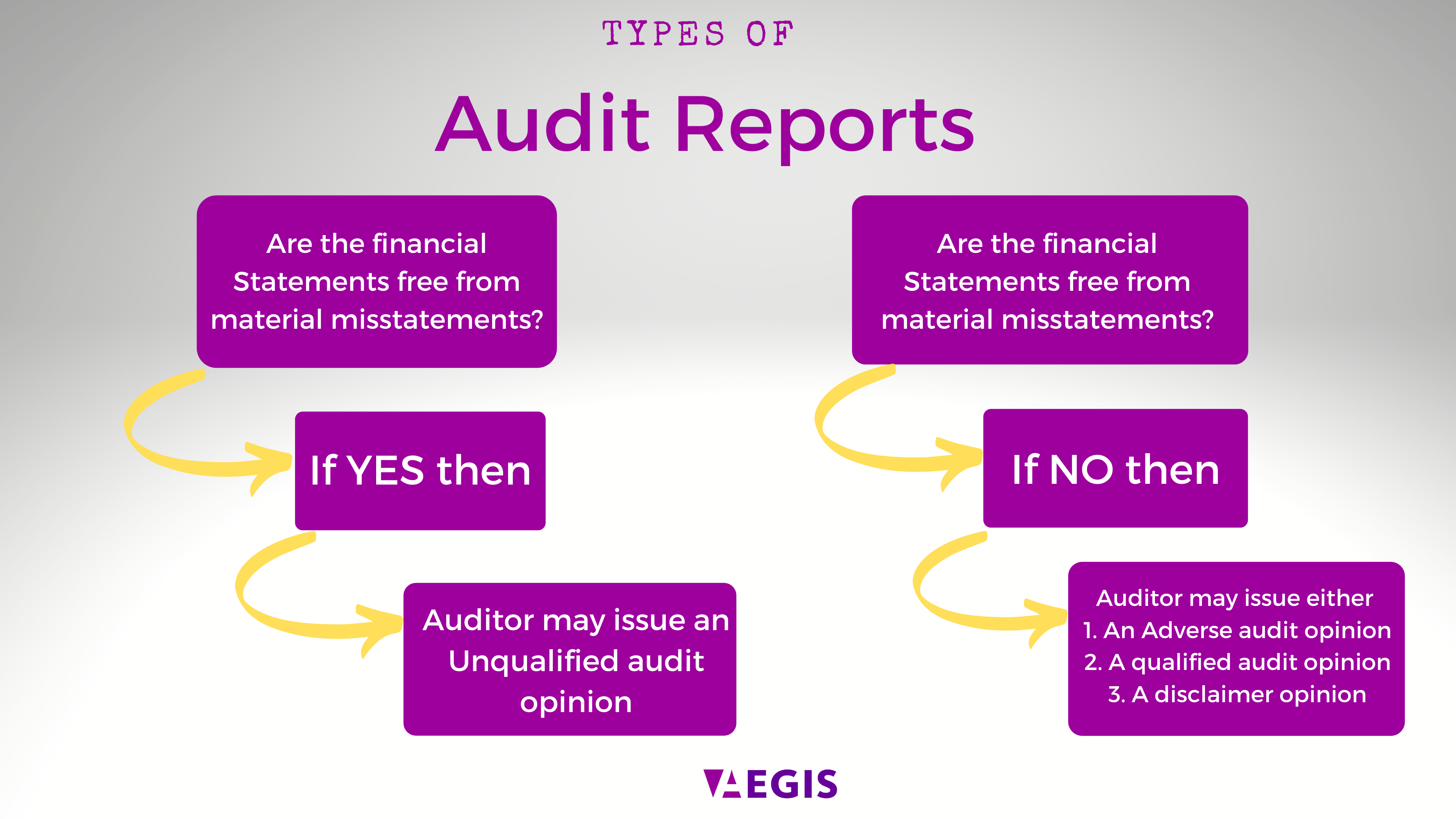

Modified audit opinion has been largely based on opinion shopping, that is, the likelihood of auditor turnover following maos (lu & tong ,2003;li &wu,2002;huang,2010) [1,2,3]. Their use depends upon the nature and severity of the matter under consideration. (i) qualified (ii) adverse (iii) disclaimer.

Usually, a modified opinion will be described as qualified, adverse, or given as a disclaimer of opinion. Types of modified opinions.02 this section establishes three types of modified opinions, namely, a qualified opinion,an adverse opinion,and a disclaimer of. International standard on auditing 705 modifications to the opinion in the independent auditor’s report (effective for audits of financial statements.

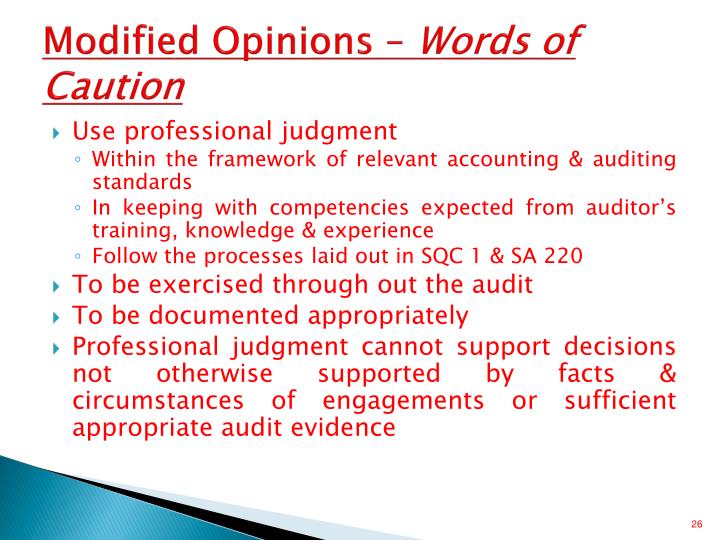

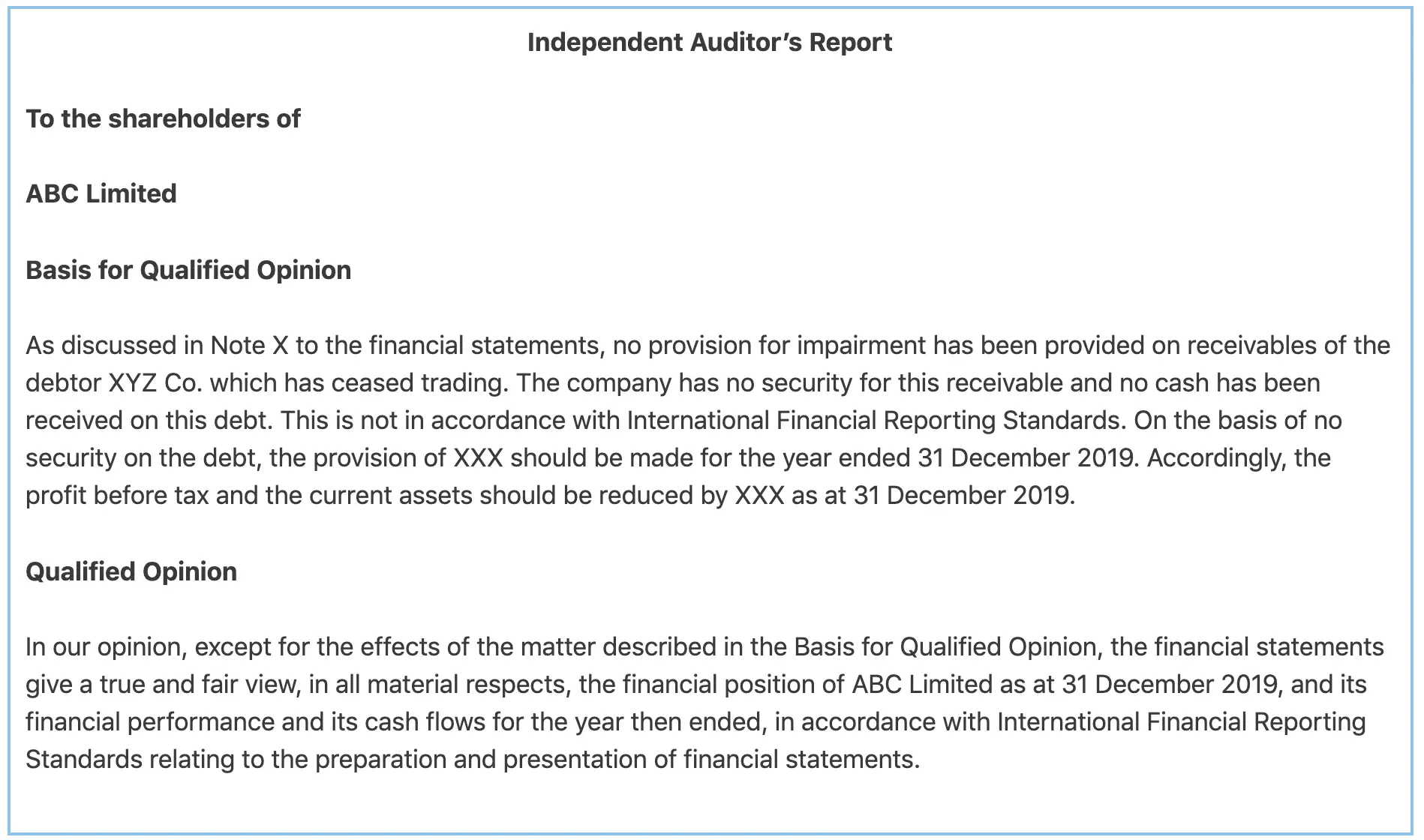

When the auditor modifies the audit opinion, the auditor shall use the heading “qualified opinion,” “adverse opinion,” or “disclaimer of opinion,” as appropriate, for the. Technical helpsheet issued to help icaew members to identify the various changes that may need to be made to audit reports under international standards of. If modified audit opinions have an adverse impact on credit availability, one would expect that a change from having institutional debt to not having institutional.

Types of modified opinions 2. This sa establishes three types of modified opinions, namely, a qualified opinion, an adverse opinion, and a disclaimer of opinion. Usually, a modified opinion will be described as qualified, adverse, or given as a disclaimer of opinion.

Learn how to modify an audit opinion when the auditor concludes that the financial statements are materially or pervasively misstated. When the auditor modifies the audit opinion, the auditor shall use the heading qualified opinion, adverse opinion, or disclaimer of opinion, as appropriate, for the. The purpose of this paper is to review the empirical literature on value relevance of audit reports by providing current evidence on the market reaction to.

The qualified opinion the adverse opinion the.