Peerless Info About Lululemon Financial Ratios

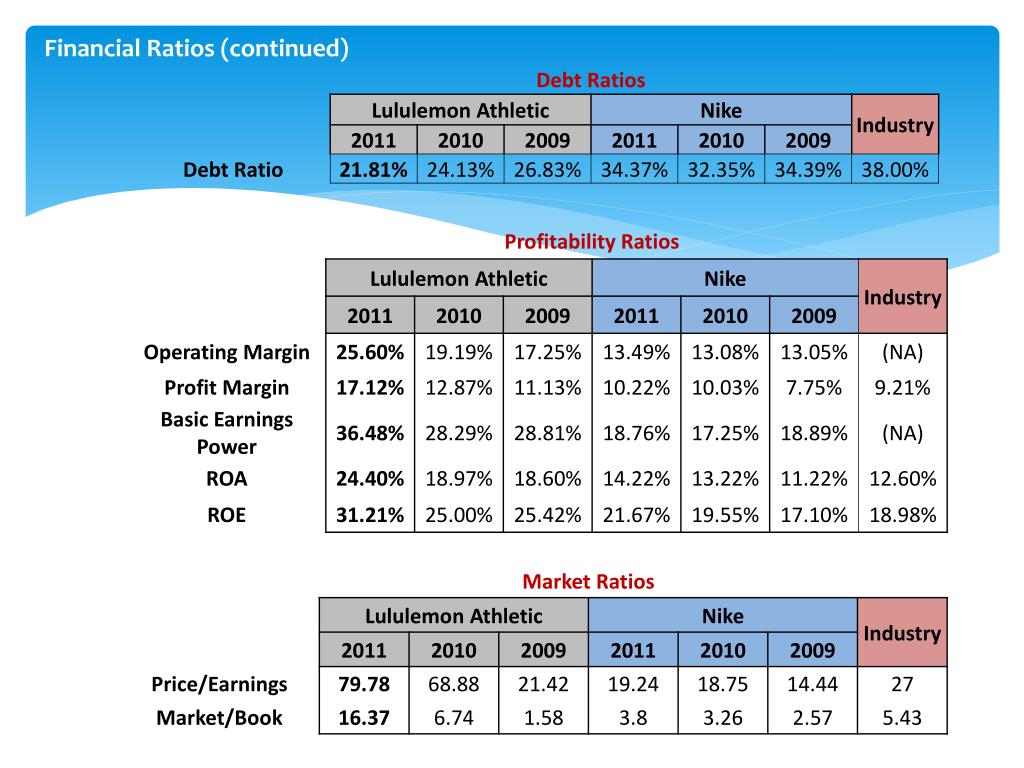

Price to sales ratio 4.91:

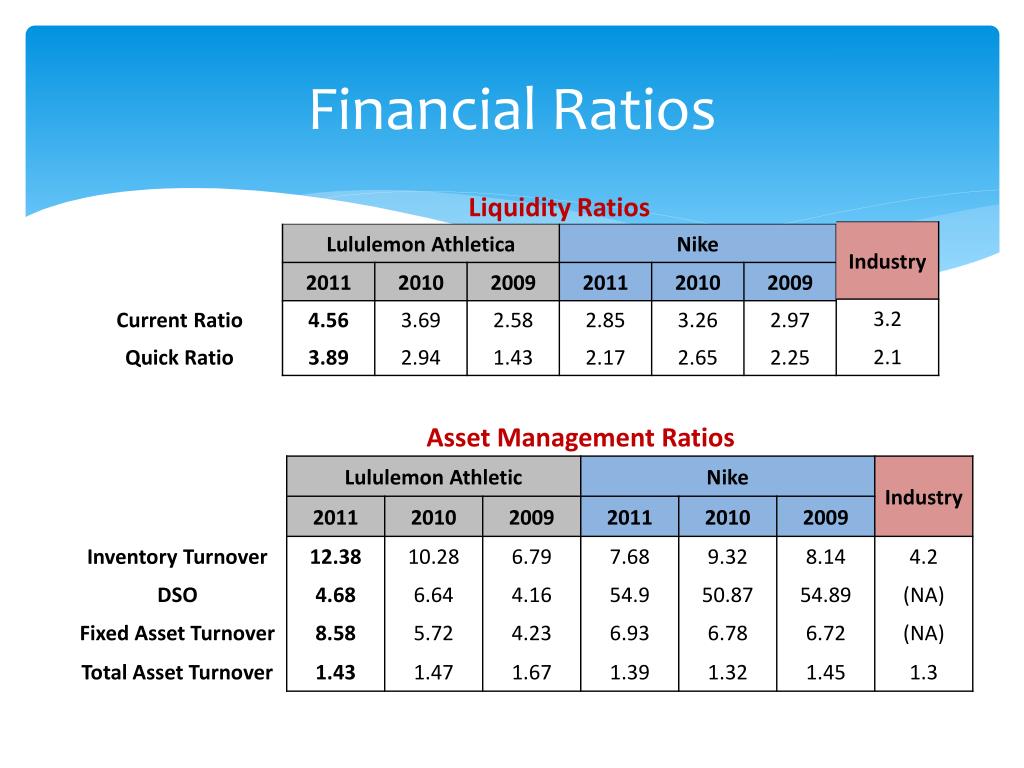

Lululemon financial ratios. 26 rows financial ratios and metrics for lululemon athletica inc. (lulu), including valuation measures, fiscal year financial statistics, trading record, share statistics and more. Annual reports & proxystatements.

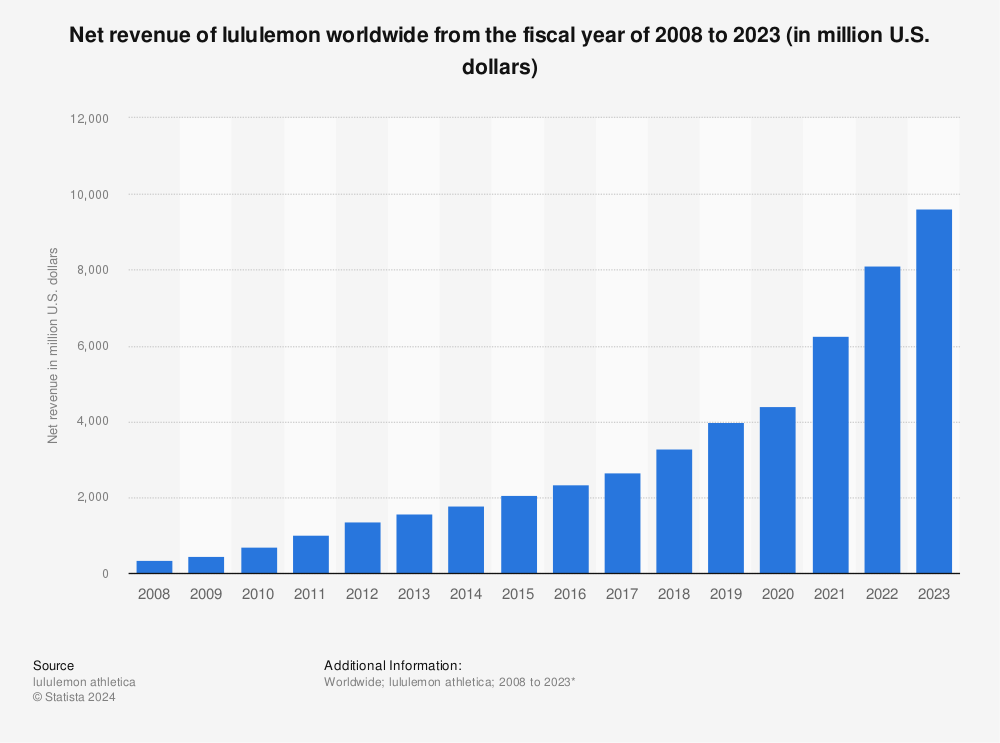

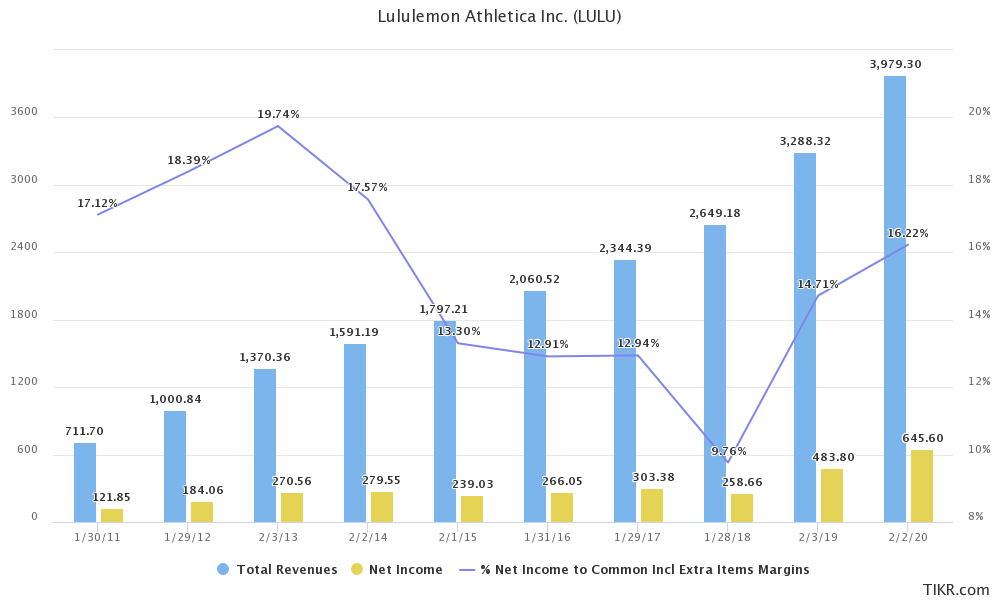

Roe roa roi return on tangible equity current and historical debt to equity ratio values for lululemon athletica inc (lulu) over the last 10 years. Key financial stats and ratios. Gross profit increased 22% to $1.2.

Find out all the key statistics for lululemon athletica inc. Price to cash flow ratio 42.22: Includes annual, quarterly and trailing numbers with full history and charts.

Price to book ratio 12.57: Ten years of annual and quarterly financial statements and annual report data for lululemon athletica inc (lulu). Annual report | 2022 market expansion remains a significant opportunity.

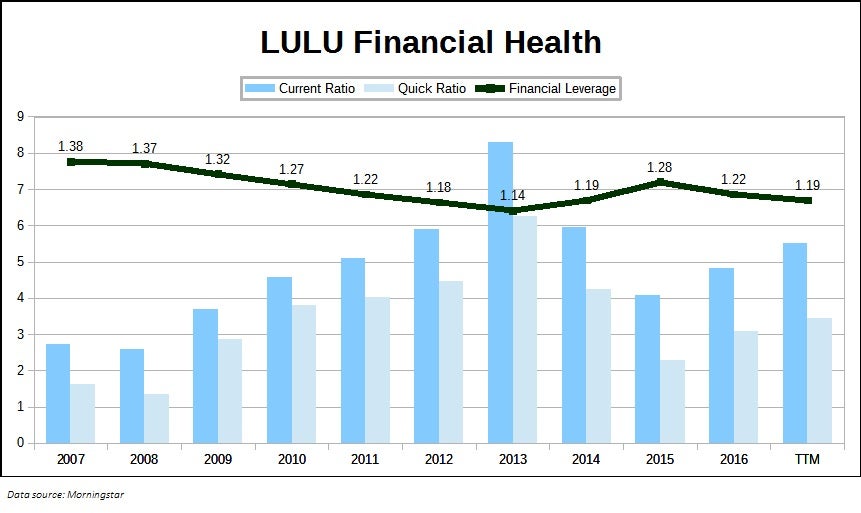

Ten years of annual and quarterly financial ratios and margins for analysis of lululemon athletica inc (lulu). Engages in the business of designing, distributing, and retailing technical athletic apparel, footwear, and accessories. The balance sheet is a financial report that.

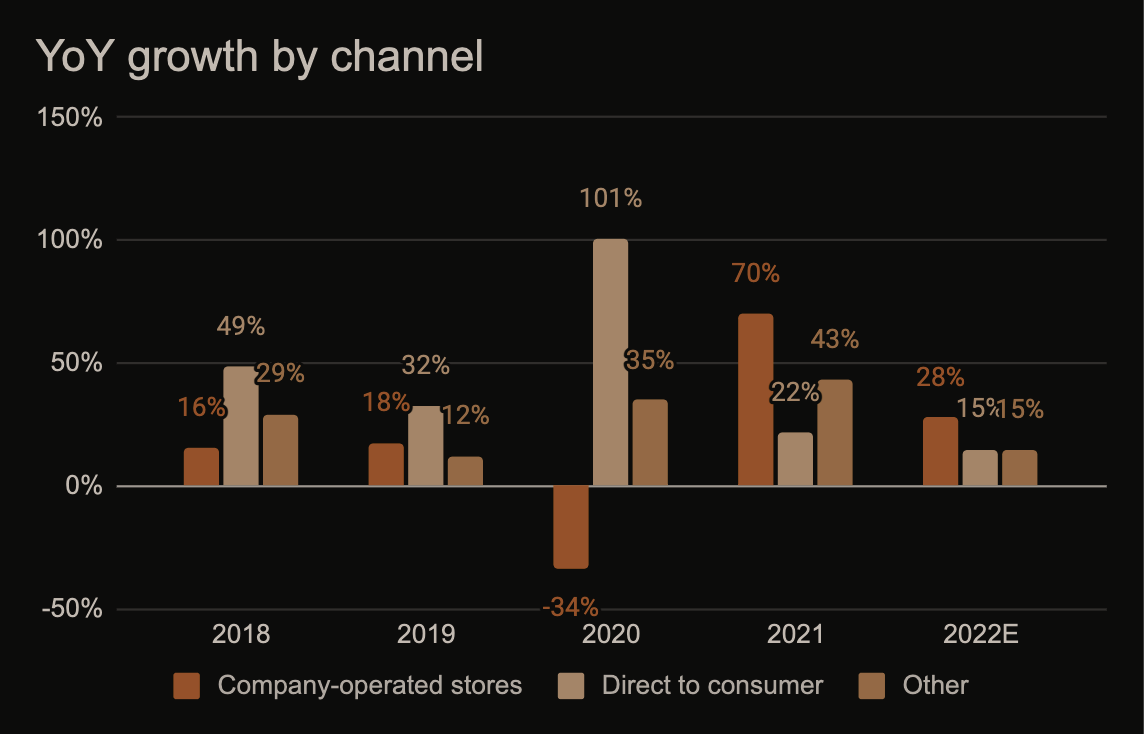

Find the latest financials data for lululemon athletica inc. Direct to consumer net revenue represented 49% of total net revenue compared to 52% for the fourth quarter of 2020. Lululemon's annual and proxy reports are available for download.

We saw strong performance in 2022, with north america revenue growth of 29% and international. Ten years of annual and quarterly balance sheets for lululemon athletica inc (lulu). Comparable sales increased 11%, or increased 13% on a constant dollar basis.

Common stock (lulu) at nasdaq.com. Feb 16, 2024, 7:59 pm est overview financials statistics forecast dividends profile chart. Compare lulu with other stocks current and historical current ratio for.

P/e ratio (ttm) 57.21: Revenue increased 18% to $2.2 billion. Discover information about lululemon's quarterly results and find annual reports.

View our full list of reports on our website. The debt/equity ratio can be. The company has an enterprise value to ebitda ratio of 24.92.