Painstaking Lessons Of Tips About Income Statement Format In Cost Accounting

A format of an income statement is very important as it is the means of communication of operating results to outsiders.

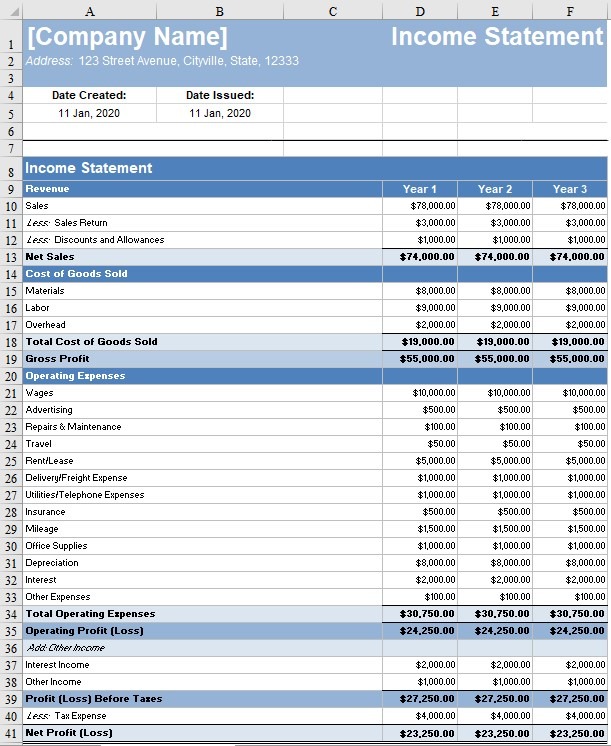

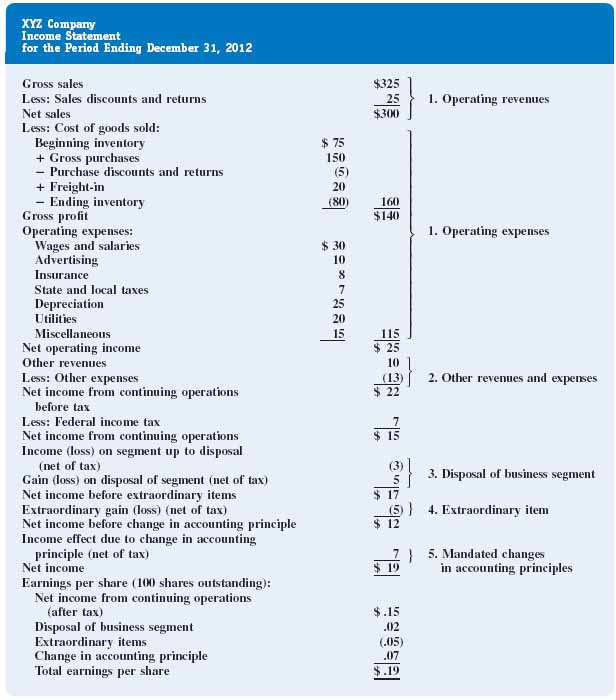

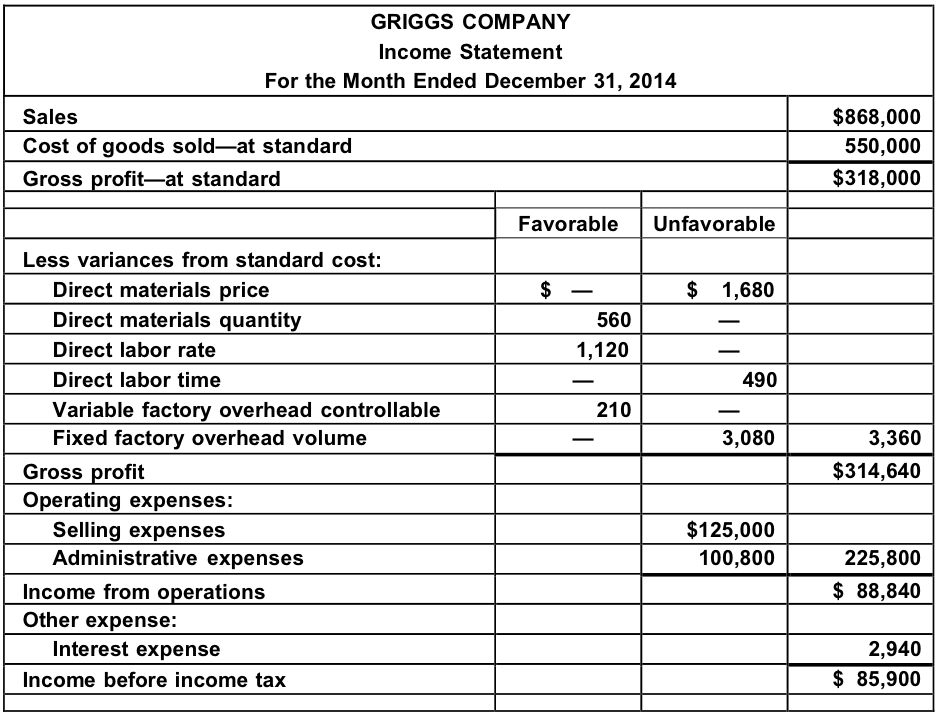

Income statement format in cost accounting. Income statement, also known as profit & loss account, is a report of income, expenses and the resulting profit or loss earned during an accounting period. Example of the traditional income statement It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. When a new york judge delivers a final ruling in donald j. In this video i have discussed the basic concepts of income statement used in cost accounting and manufacturing concerns#costaccounting#manufacturingconcerns.

Fundamentals of cost accounting a cost sheet is a statement prepared at periodical intervals of time, which accumulates all the elements of the costs associated with a product or production job. The data incorporated in cost sheet are collected from various statements of accounts which have been written in cost accounts. Examples of service businesses are medical, accounting or legal practices, or a business that provides services such as.

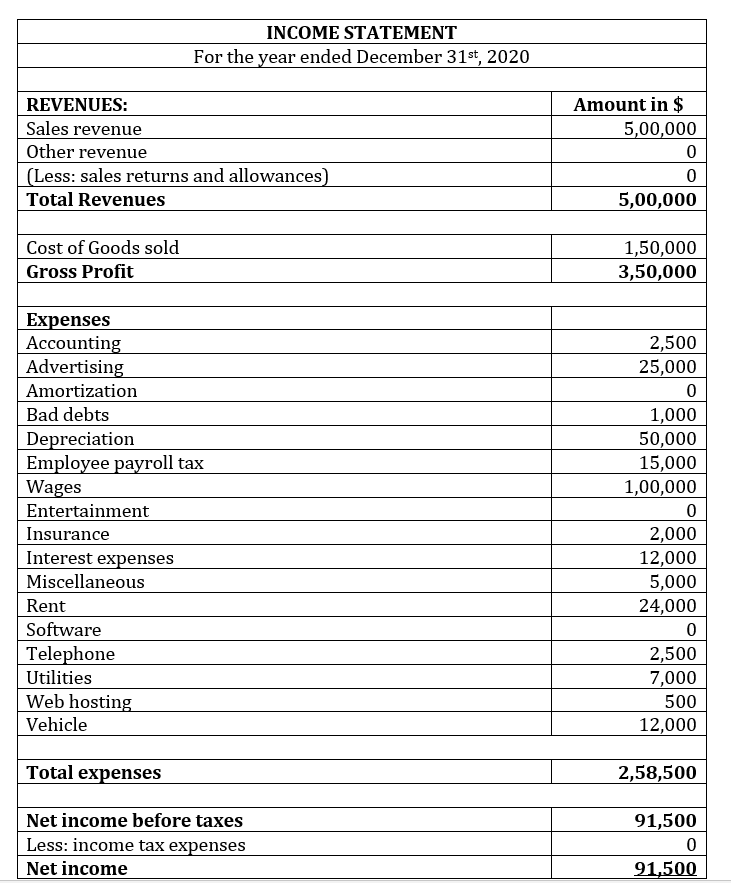

After that, all the business expenses are deducted from the total amount of revenue and other income. October 09, 2023 the income statement reports on the revenues, expenses, and profits of an organization. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions in penalties and new restrictions on.

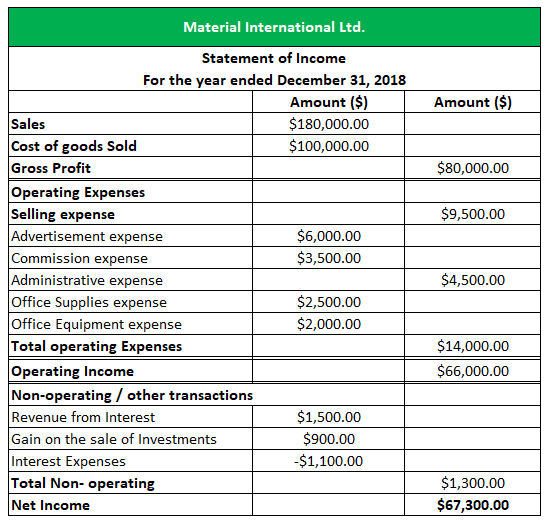

Let's take a look at how each would look like. Hence, the net income using fifo increases over time. The business also gained $1,500 from the sale of.

Income statements depict a company’s financial performance over a reporting period. What is the income statement format in accounting?

An income statement is a financial report detailing a company’s income and expenses over a reporting period. The income statement focuses on four key items: An income statement is a financial statement that reports a company’s revenues, expenses, gains, and losses over a specific period, typically a quarter or a year.

Also sometimes called a “net income statement” or a “statement of earnings,” the income statement is one of the three most important financial statements in financial accounting, along with the balance sheet and the cash flow statement (or statement of cash flows). This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. The format for the traditional income statement the basic format is to simply show the sales less the cost of goods sold equal gross profit.

In return, the business spent money on various activities, including wages, rent, transportation, etc., leading to $14,200 in expenses. Consider business xyz that earned $25,000 from the sale of goods and $3,000 as revenue from training personnel. This chapter presents the different accounts you may encounter in an income statement, examples for each type of business, and the.

Bryan sharpe, senior accountant at solar panels network usa, says: Sales on credit) or cash. And also show the gross profit less the selling and administrative expenses and that equals the operating income.