Can’t-Miss Takeaways Of Info About Wages In Balance Sheet

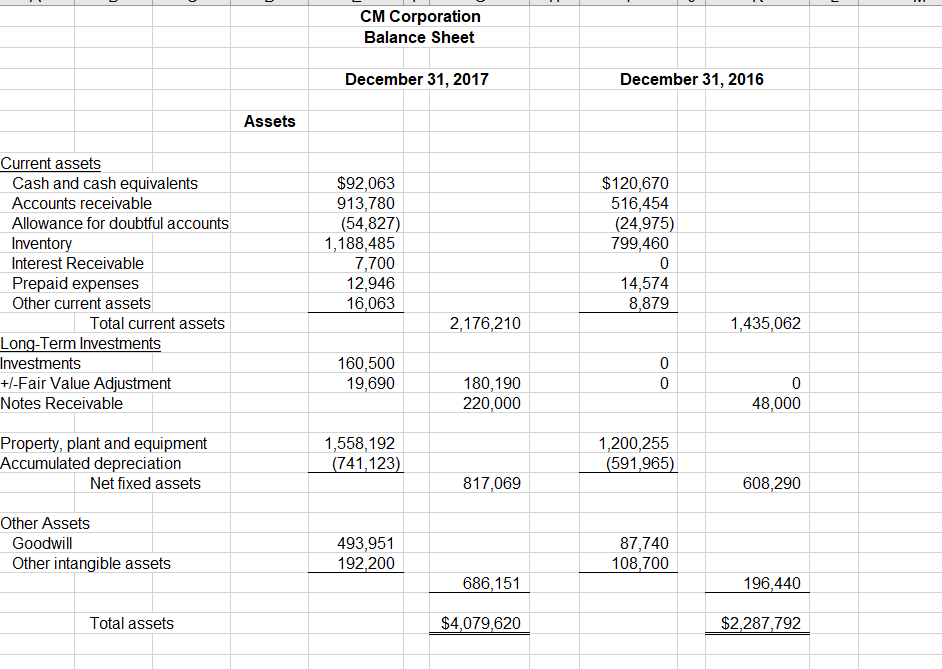

Salaries do not appear directly on a balance sheet, because the balance sheet only covers the current assets, liabilities and owners equity of the company.

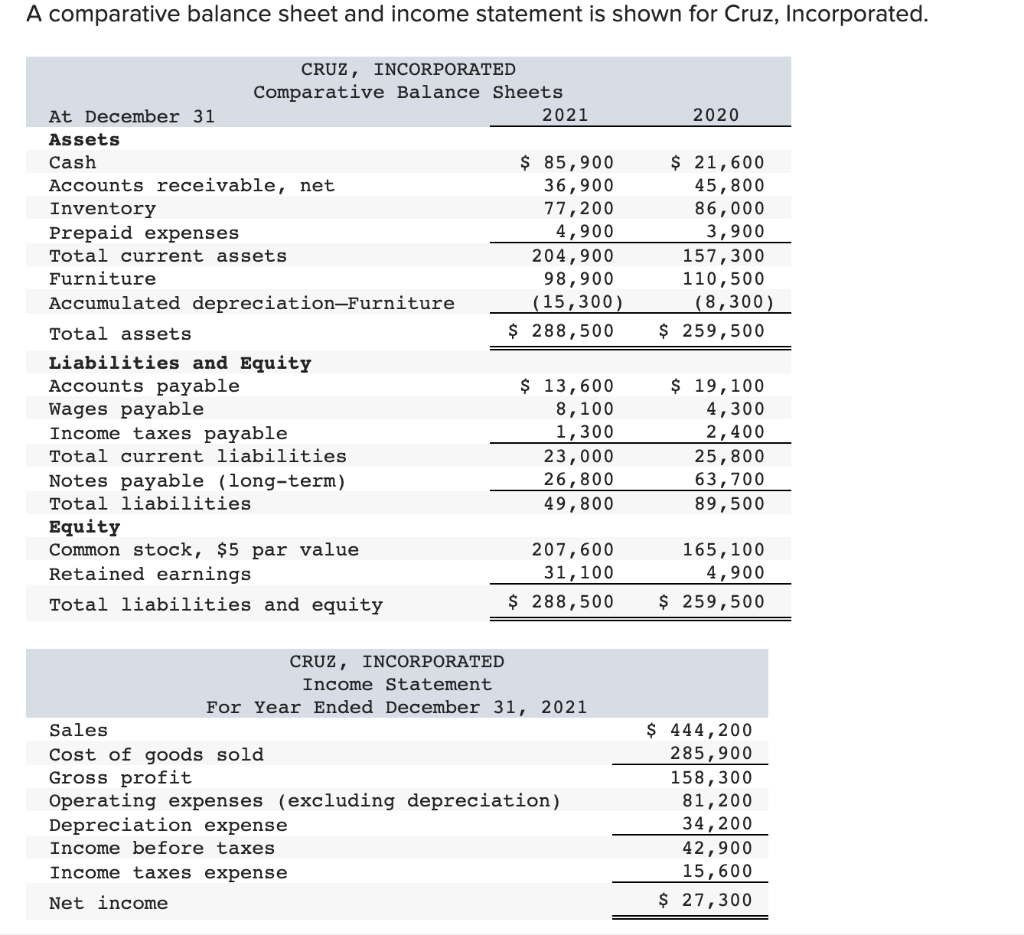

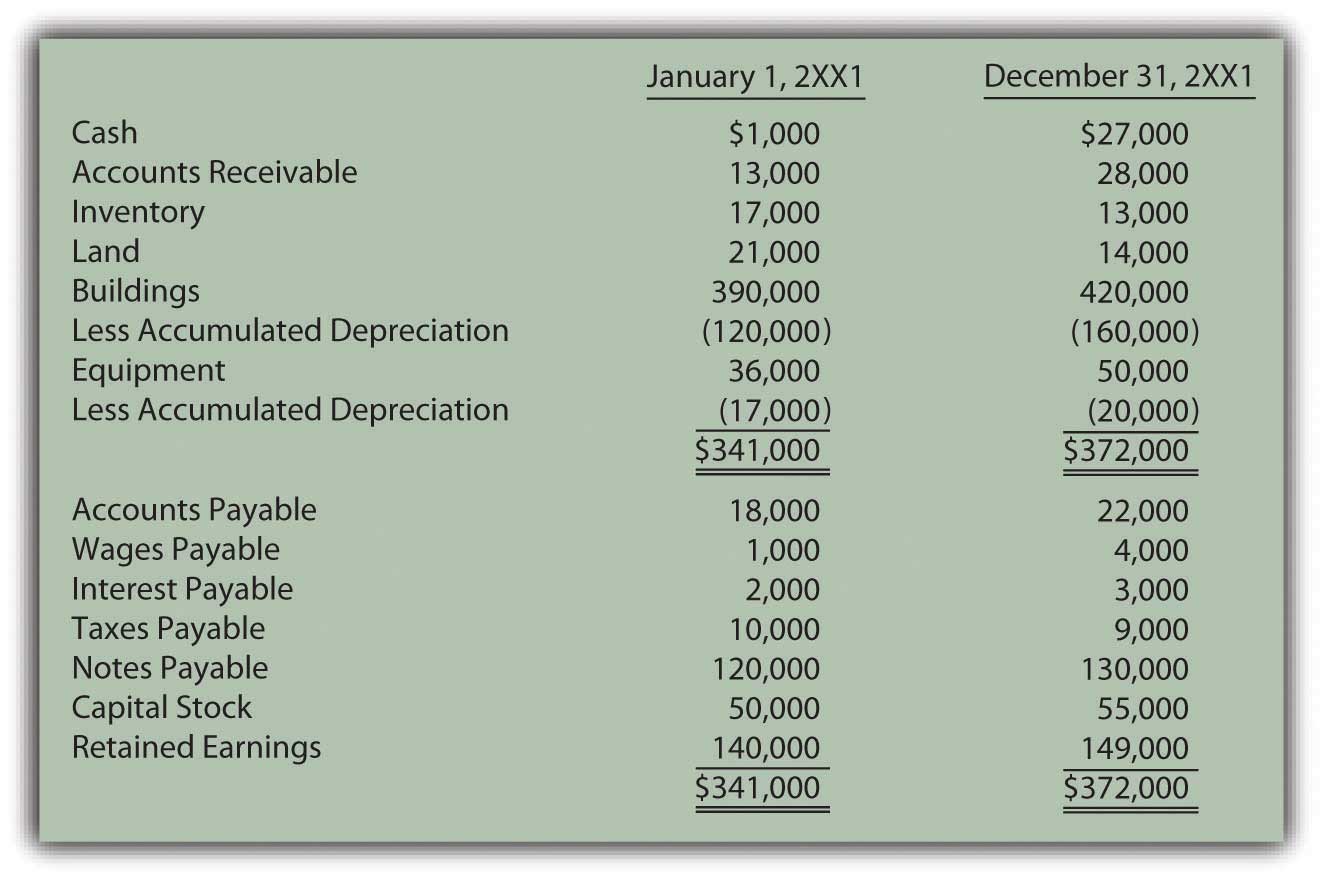

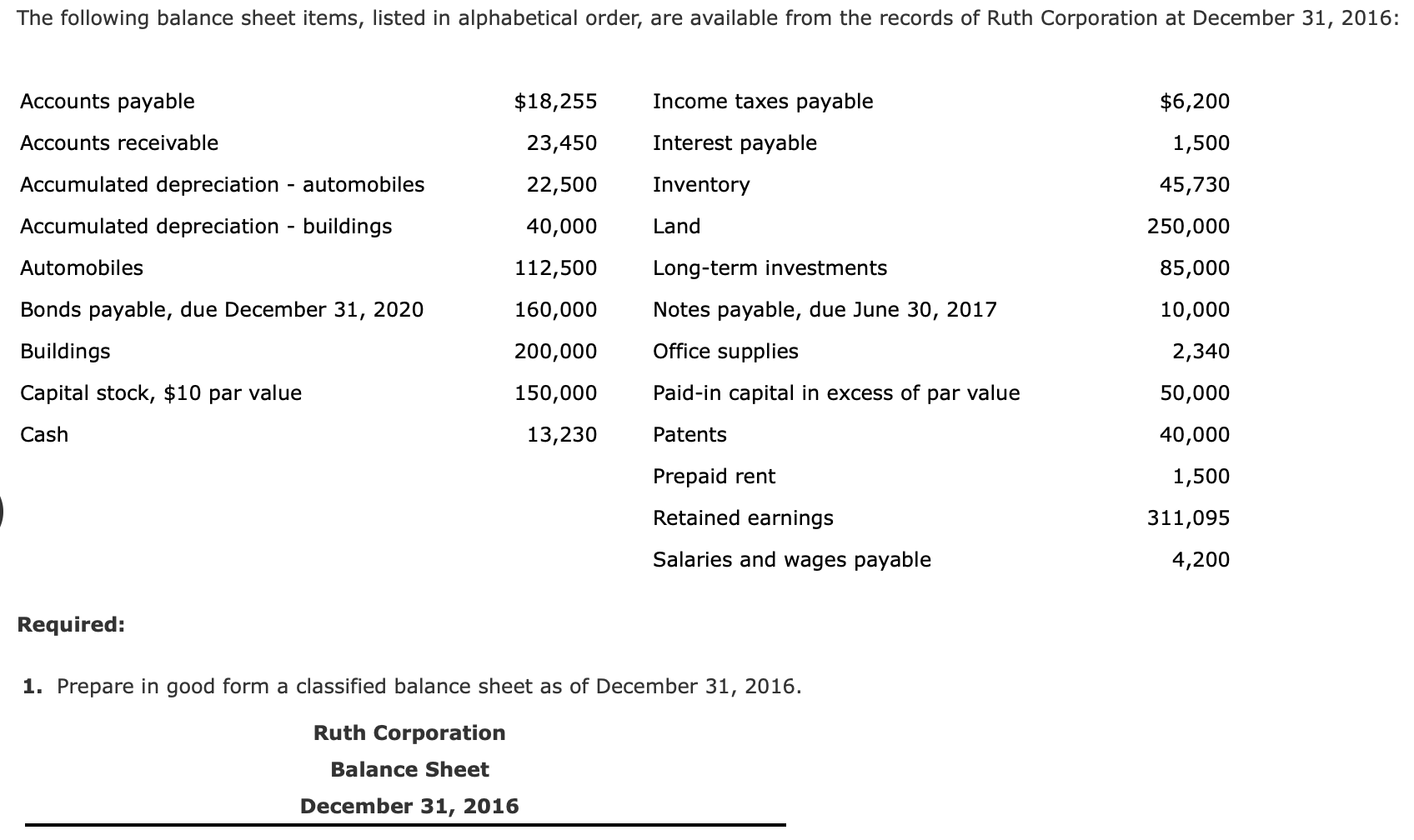

Wages in balance sheet. Wage expense on the income statement. What is the balance sheet? The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

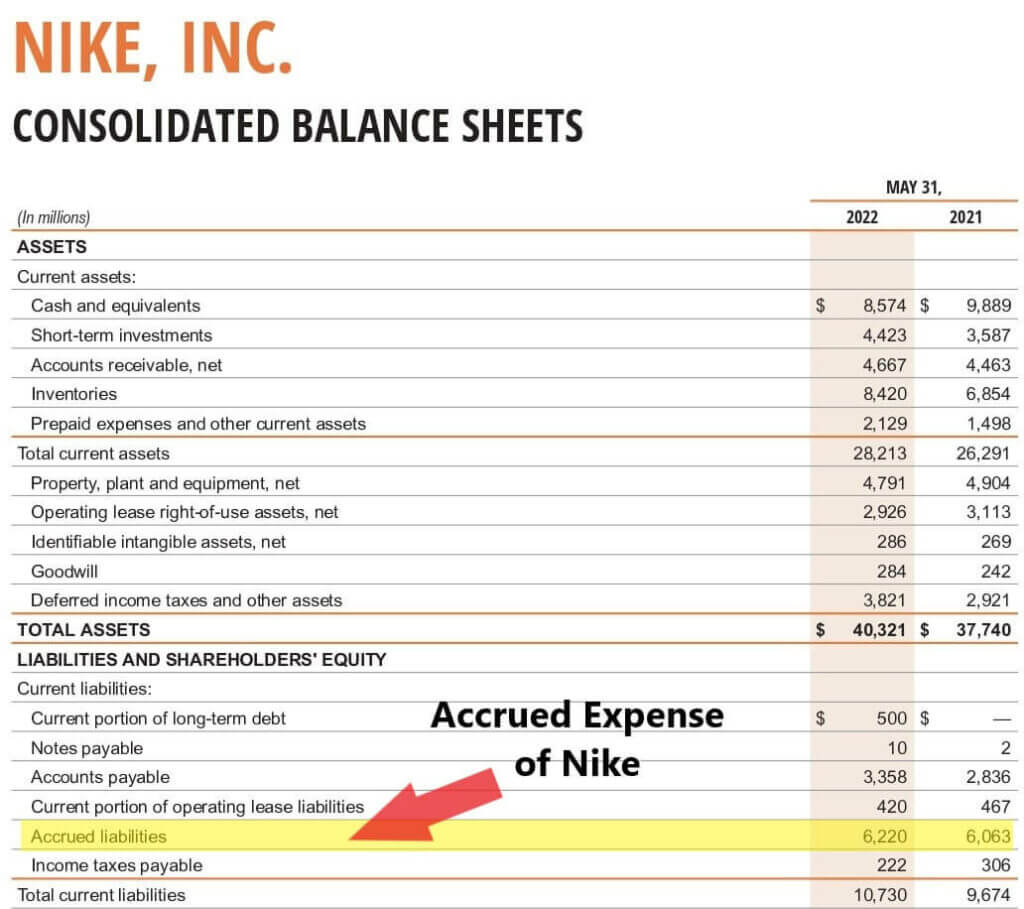

Assets = liabilities + owner’s equity. February 20, 2024 at 4:44 pm pst. However, labor expenses appear on the balance sheet as well, and in three notable ways:

Most students learn that labor and wages are a cost item on the profit and loss statement (p&l). For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year. Balance sheets are typically prepared and distributed monthly or quarterly depending on the.

The balance sheet is one of the three main financial statements , along with the income statement and cash flow statement. At the end of each payroll period, you should update your accounts to include any payments relating to your employees, for example wages, national insurance (ni), paye and pension contributions. A balance sheet includes a summary of a business’s assets, liabilities, and capital.

The balance sheet shows the assets, liabilities, and owner’s equity of a business on a given date. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. Wages expense is an income statement account.

Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company. The company computes wages of an employee by taking the pay rate per hour x number of hours worked. The balance in this account is typically eliminated early in the following reporting.

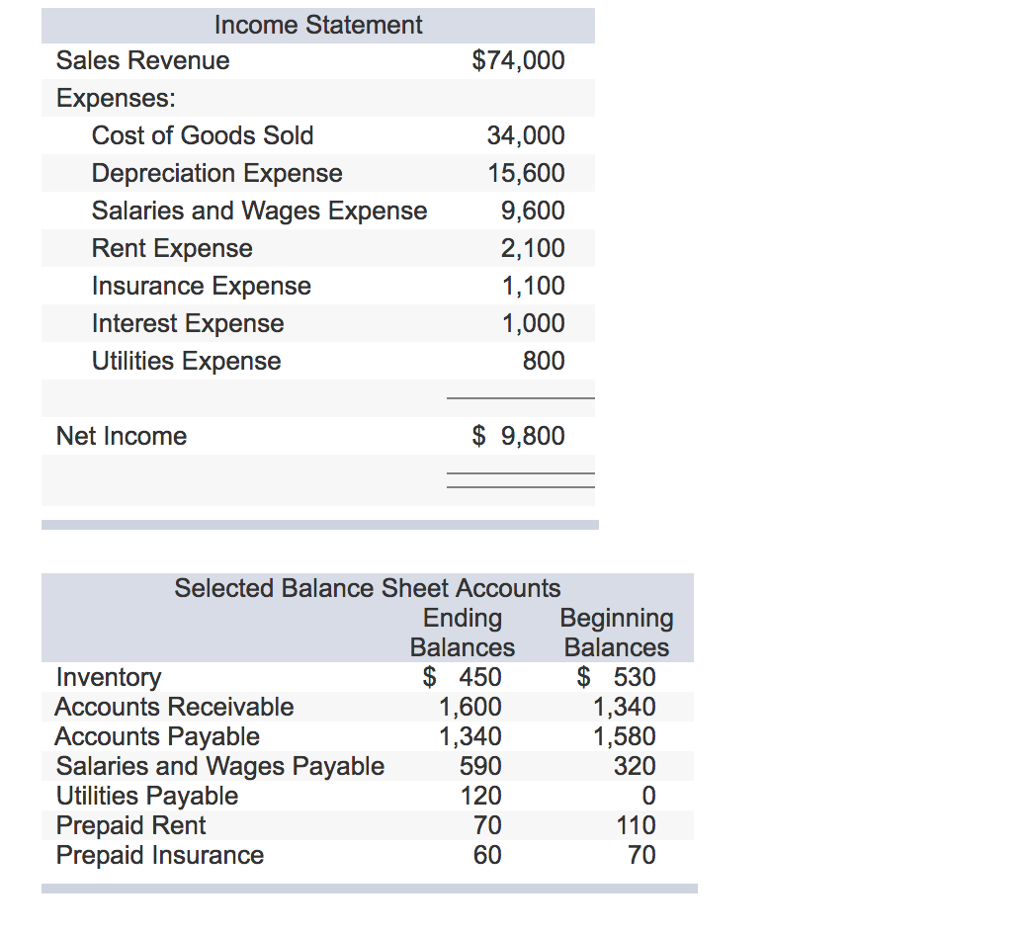

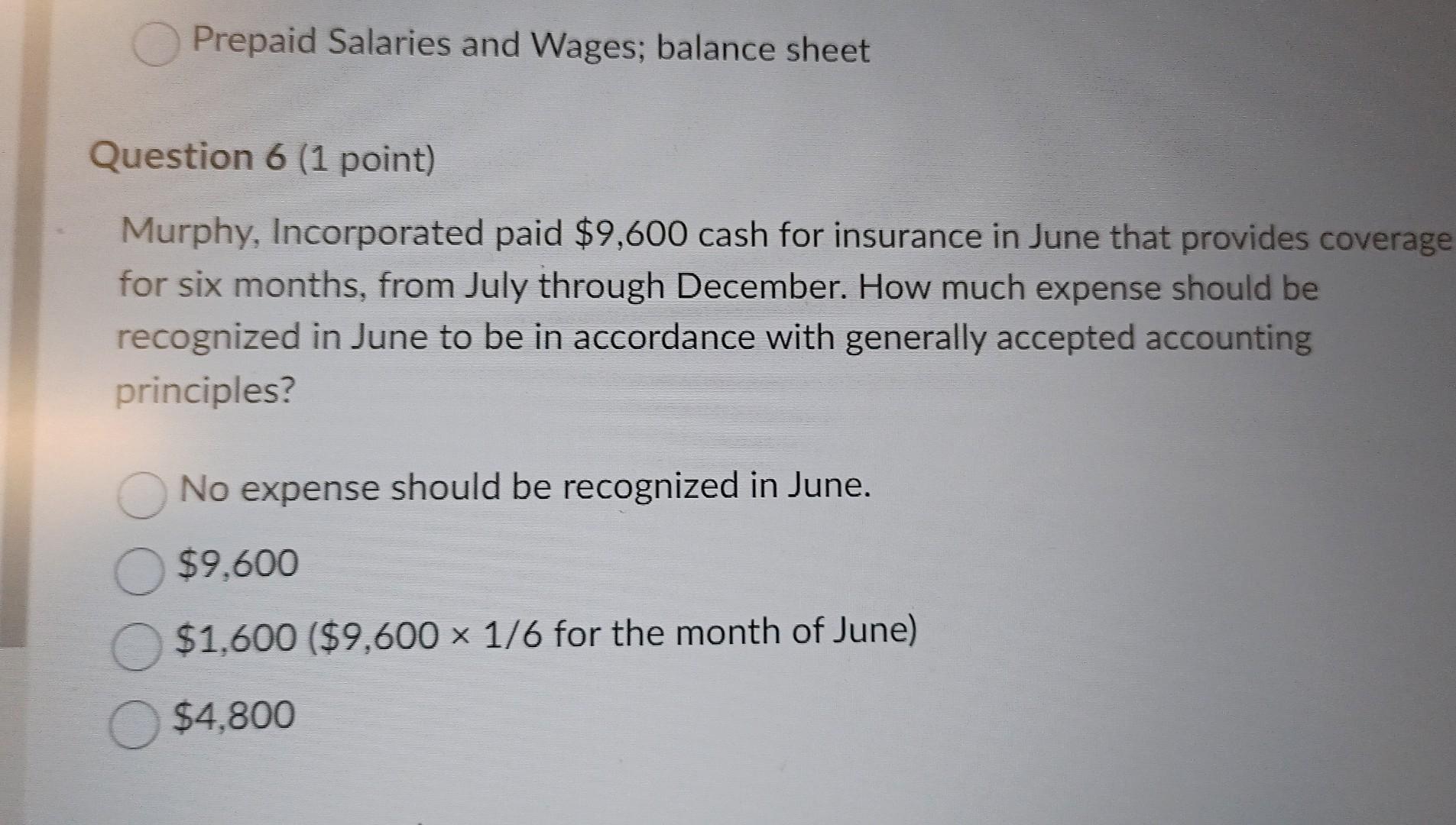

The salary expense for the month of january is $12,000. The week’s worth of unpaid salaries and wages is actually a liability that you will have to pay in the future even though you haven’t yet spent the cash. An accrued wage is incurred and recognized on the income statement per the matching principle—in spite of the fact that the employees have not actually been paid—to abide by the reporting guidelines established per accrual.

Liability is an obligation between one party and another not yet completed or paid for in full. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Balance sheets provide the basis for.

This adjusting entry increases both the payroll expenses reported on the income statement and the accrued payroll expenses that appear as a liability on the balance sheet. Selling, general administration, etc.) are part of the expenses reported on the company's income statement. Employees 3, 4, and 5 are paid $15 per hour.

While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. A company also lists any long. Wage expense on the income statement is typically combined with similar expenses, as shown below.