Painstaking Lessons Of Tips About Income And Expense Summary Account

The income summary account is a temporary account used with closing entries in a manual accounting system.

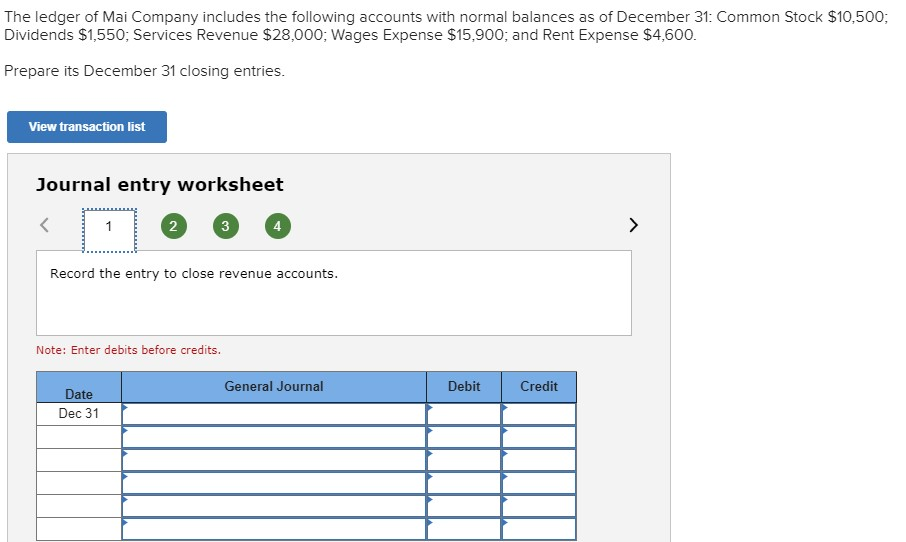

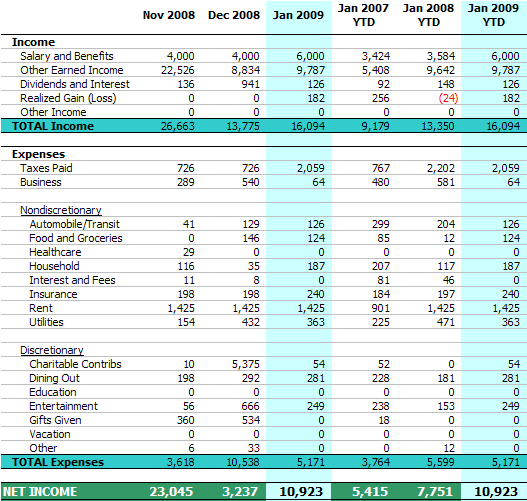

Income and expense summary account. A closing entry is a journal entry made at the end of the accounting period in which data is moved into the permanent accounts on the balance. The p&l account, when published as a financial statement, is a summary of all the income and expense accounts that reflect the year’s trading transactions. As you will see later, income summary is eventually closed to capital.

Income summary account is typically used at the end of an accounting period to record the net income or net loss of the period. It is prepared with the objective. Read running payroll for details of.

The income statement is a permanent account that reflects the revenue and expenses of a company for a given. Income summary account is a temporary account used in the closing stage of the accounting cycle to compile all income and expense balances and determine net. A new registered account designed to allow eligible individuals to contribute up to $8,000 per year, with a lifetime.

That’s when the revenue and expense accounts are closed. The net amount transferred into the income summary account. The income summary account is a temporary account used to store income statement account balances, revenue and expense accounts, during the closing entry step of the.

The income summary account is a temporary account used to close all income and expense accounts at the end of an accounting period. The first income tax month is 6 april to 5 may inclusive, the second income tax month is 6 may to 5 june inclusive, and so on. Closing the income summary account.

The company only uses this account at the end of the period to clear. An income summary is a crucial financial statement used in accounting to compile and summarize the revenue and. The following are some of the differences:

The income summary account is temporary. Of the 23,369 business jets in service around the world, most—a whopping 14,999—are registered in the u.s., according to an analysis by airbus. Closing the expense accounts—transferring the debit balances in the expense accounts to a clearing account called income summary.

Definition of income summary account. The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period. Introduction to income summary.

For example, if a company has. The final step would be to close this income summary account. It is used to close income and expenses.

An income summary is a temporary account that consolidates temporary accounts, indicating profit or loss at the end of an accounting period. The new first home savings account (fhsa) is. The income summary is a temporary account that its balance is zero throughout the accounting period.