Exemplary Info About Net Cash Outflow Formula

Net cash flow formula explained.

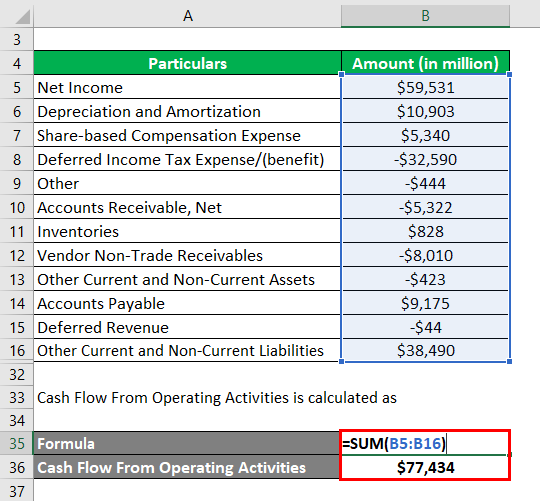

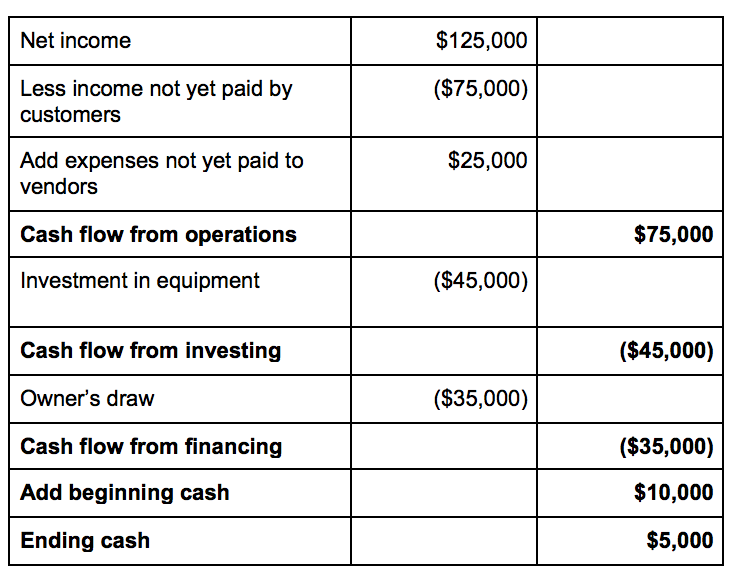

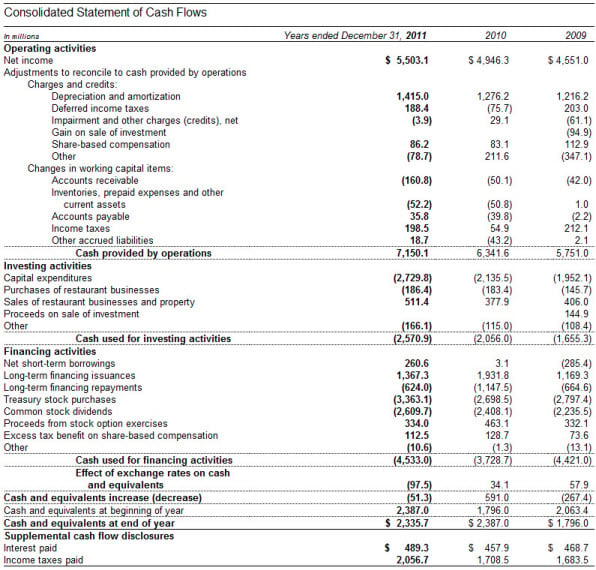

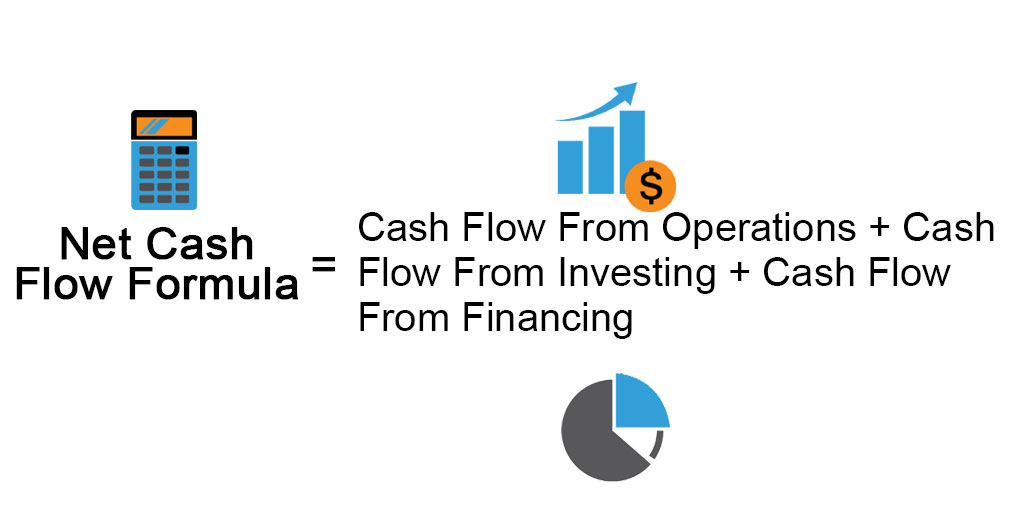

Net cash outflow formula. The net cash flow formula is a very useful equation as it allows the firm or the company to know the amount of cash generated, whether it’s positive or negative. Customer payments sale of goods or services loan receipts cash dividends interest earned fixed asset sales Net cash flow = operating activity cash flow (cfo) + investment activity cash flow (cfi) + financing activity cash flow (cff) to get cfo, cfi, and cff, you’ll look at your cash inflow and outflow.

In other words, it is the difference between a company’s cash inflow and outflow during the reporting period. What does cash outflow mean? What is the net cash flow formula?

Cash flow can be defined as the flow of money in and out of businesses during a period and needs to be monitored closely. It is calculated by subtracting a company's total liabilities from its total cash. How to calculate net cash flow?

Ncf= net cash flows from operating activities + net cash flows from investing activities + net cash flows from financial activities The term “net cash flow” refers to the cash generated or lost by a business over a certain period of time, which may be annual, quarterly, monthly, etc. Alternatively, it can also be calculated by applying the below formula, which provides a detailed picture of cash flow activities.

David kindness what is net cash? Conceptually, the net cash flow equation consists of subtracting a company’s total cash outflows from its total cash inflows. While the receipt of money is known as cash inflow, any movement of cash out of the business is called cash outflow.

What is the net cash flow formula? Also, the firm can bifurcate the same into three major activities. Put simply, ncf is a business’s total cash inflow minus the total cash outflow over a particular period.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

.gif)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)