Matchless Info About Journal To Trial Balance

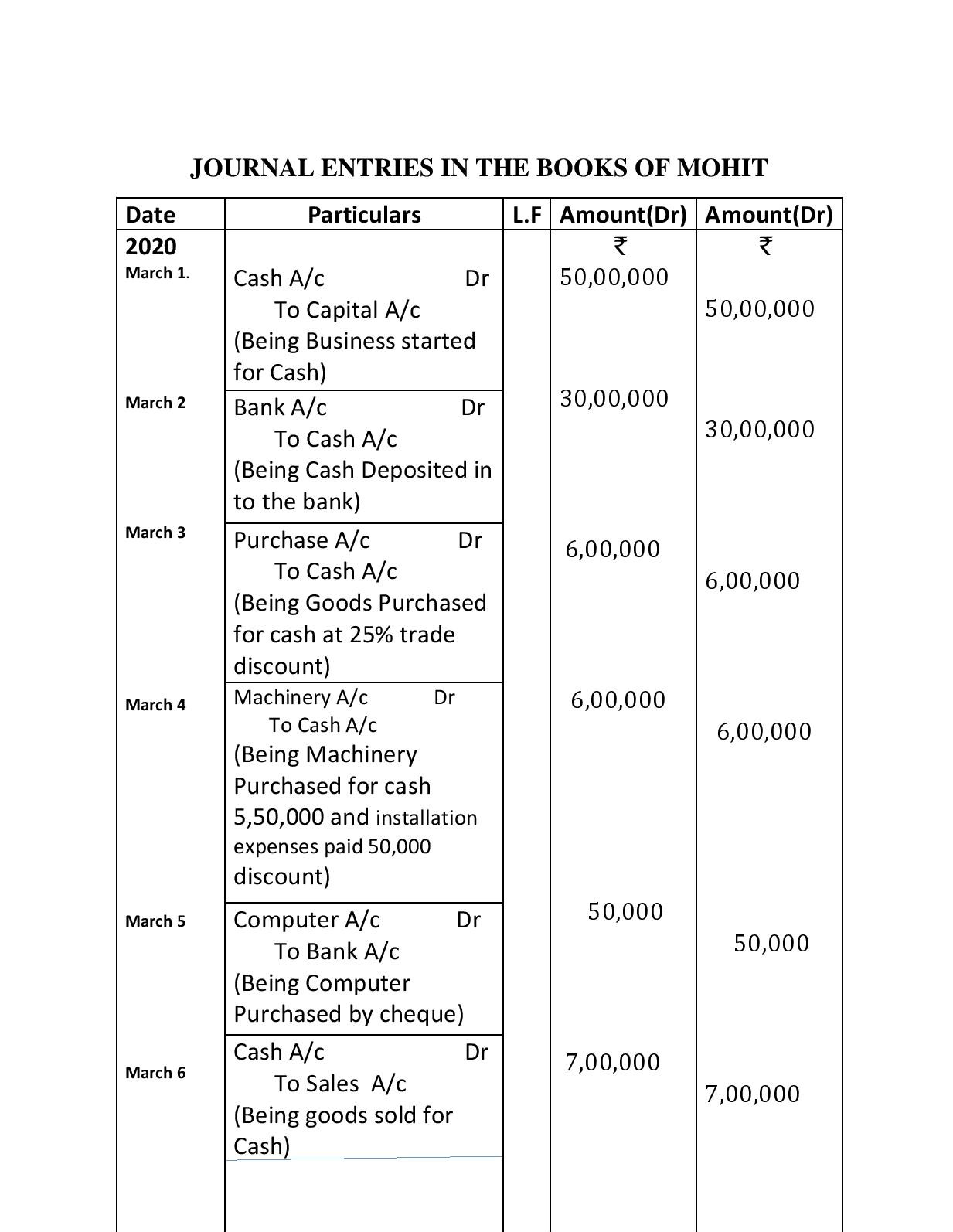

A journal entry is the recording of a business transaction in the journal.

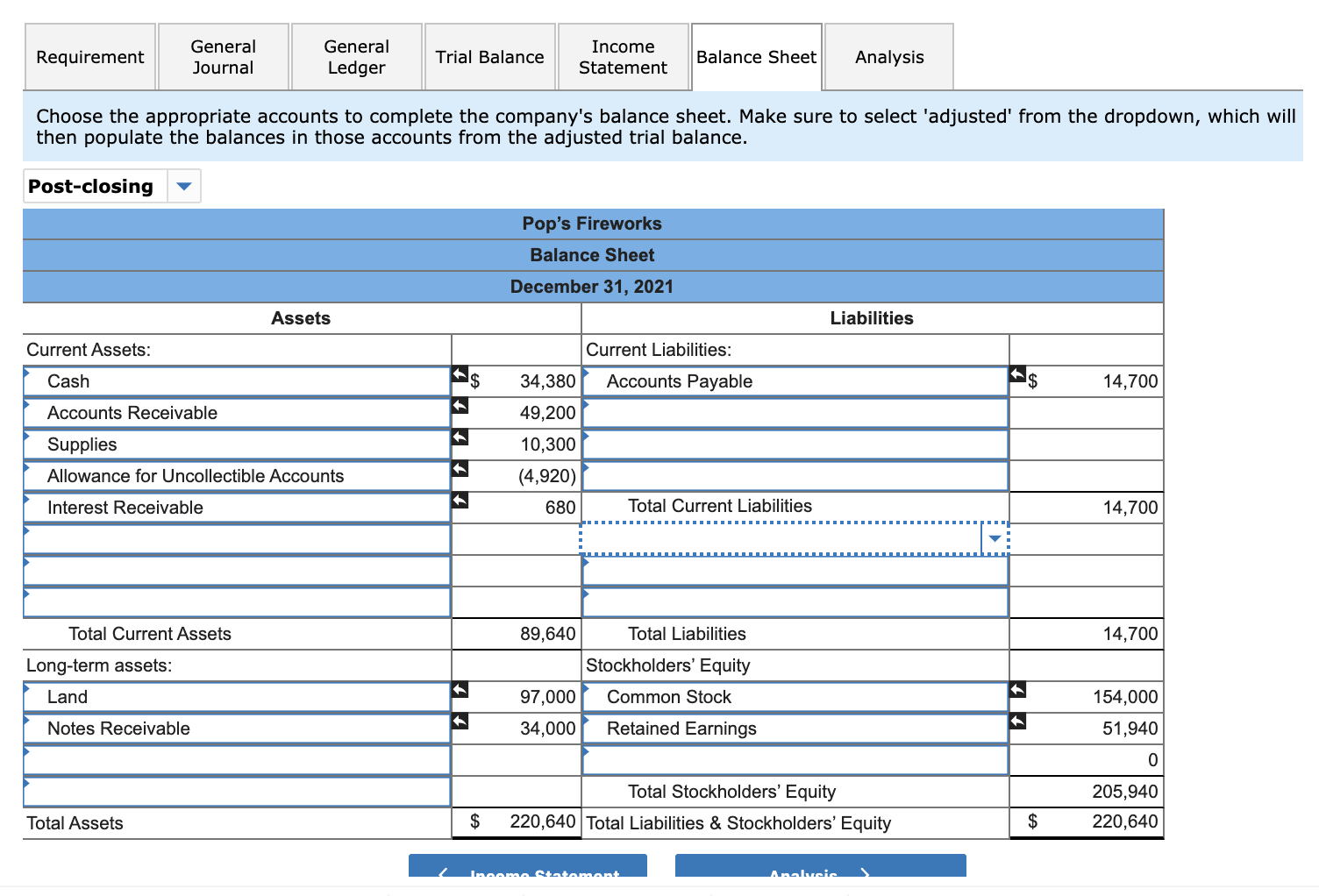

Journal to trial balance. The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock. The accounting equation is a = l + e, or assets equal liabilities plus equity. In one example, the attorney general's legal team showed that trump's triplex in his eponymously named.

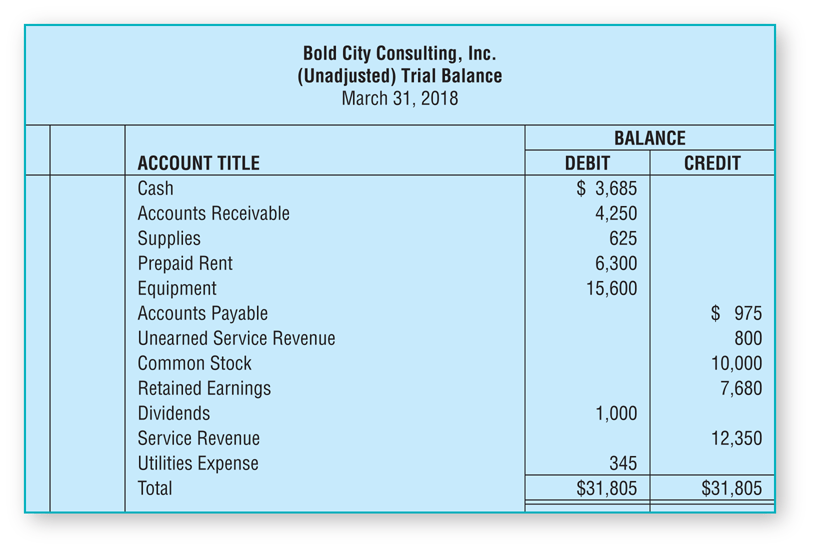

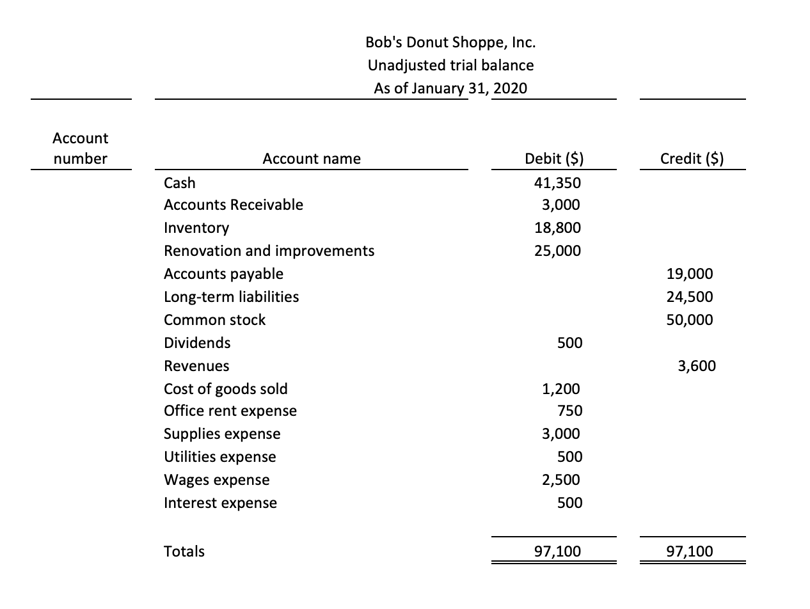

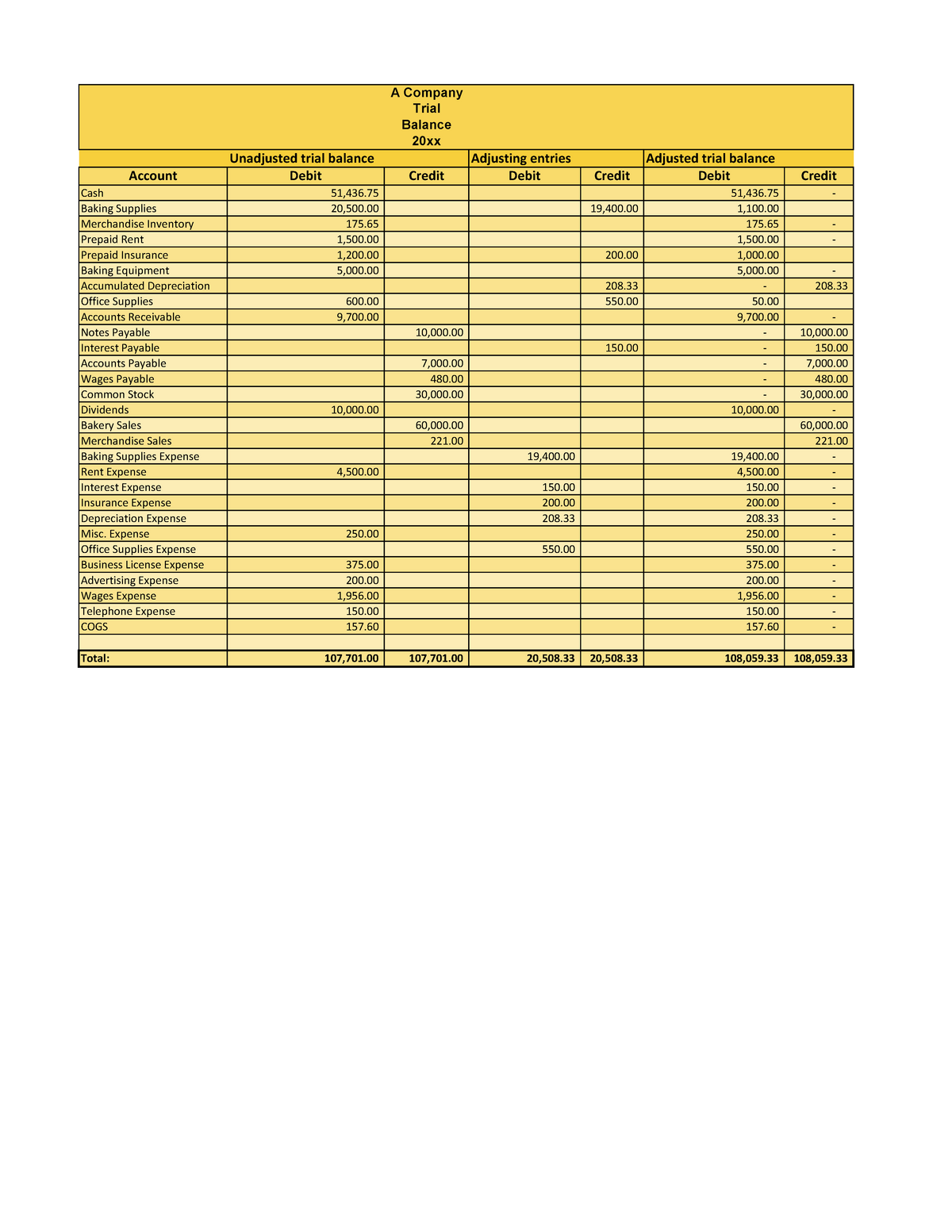

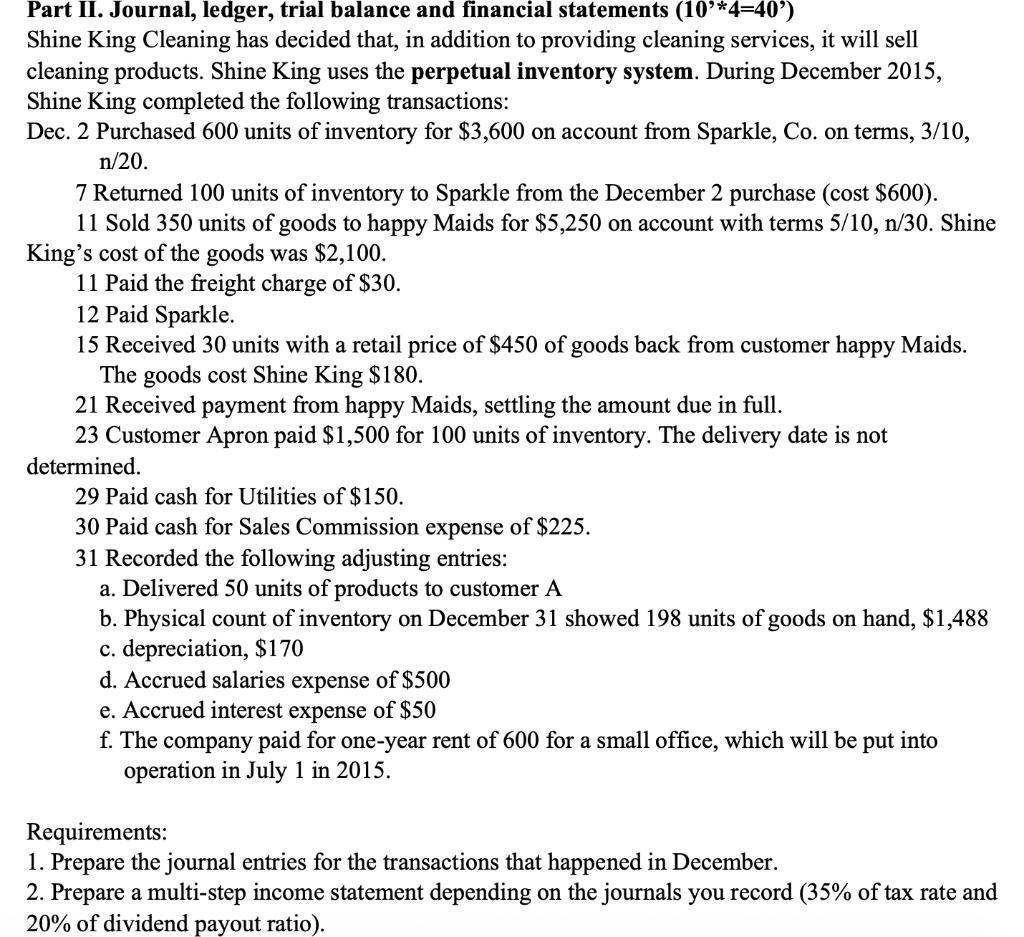

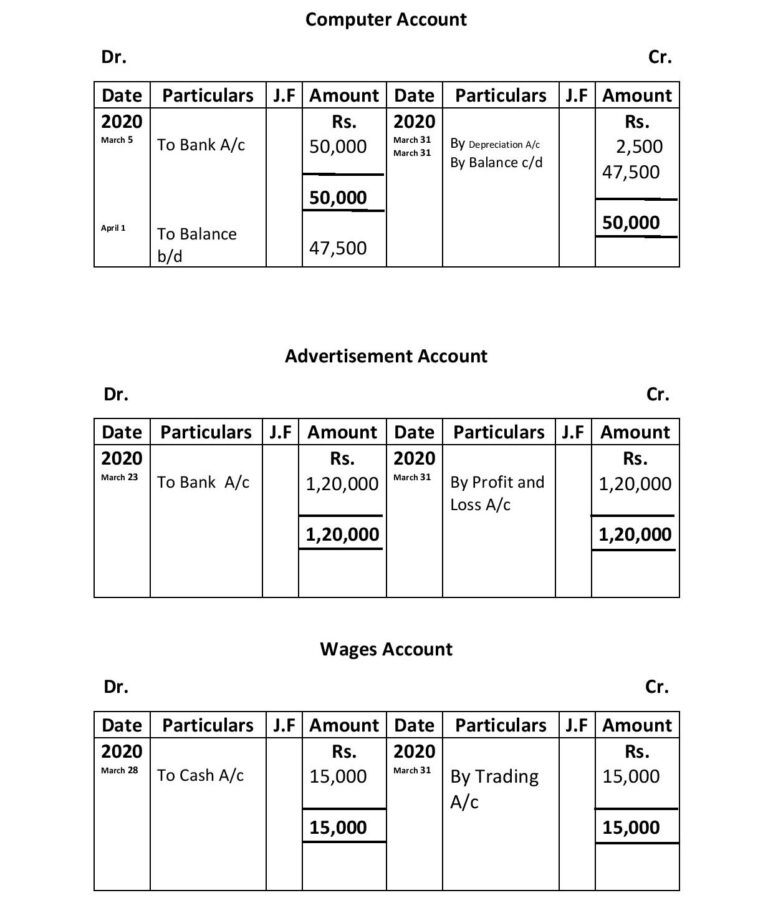

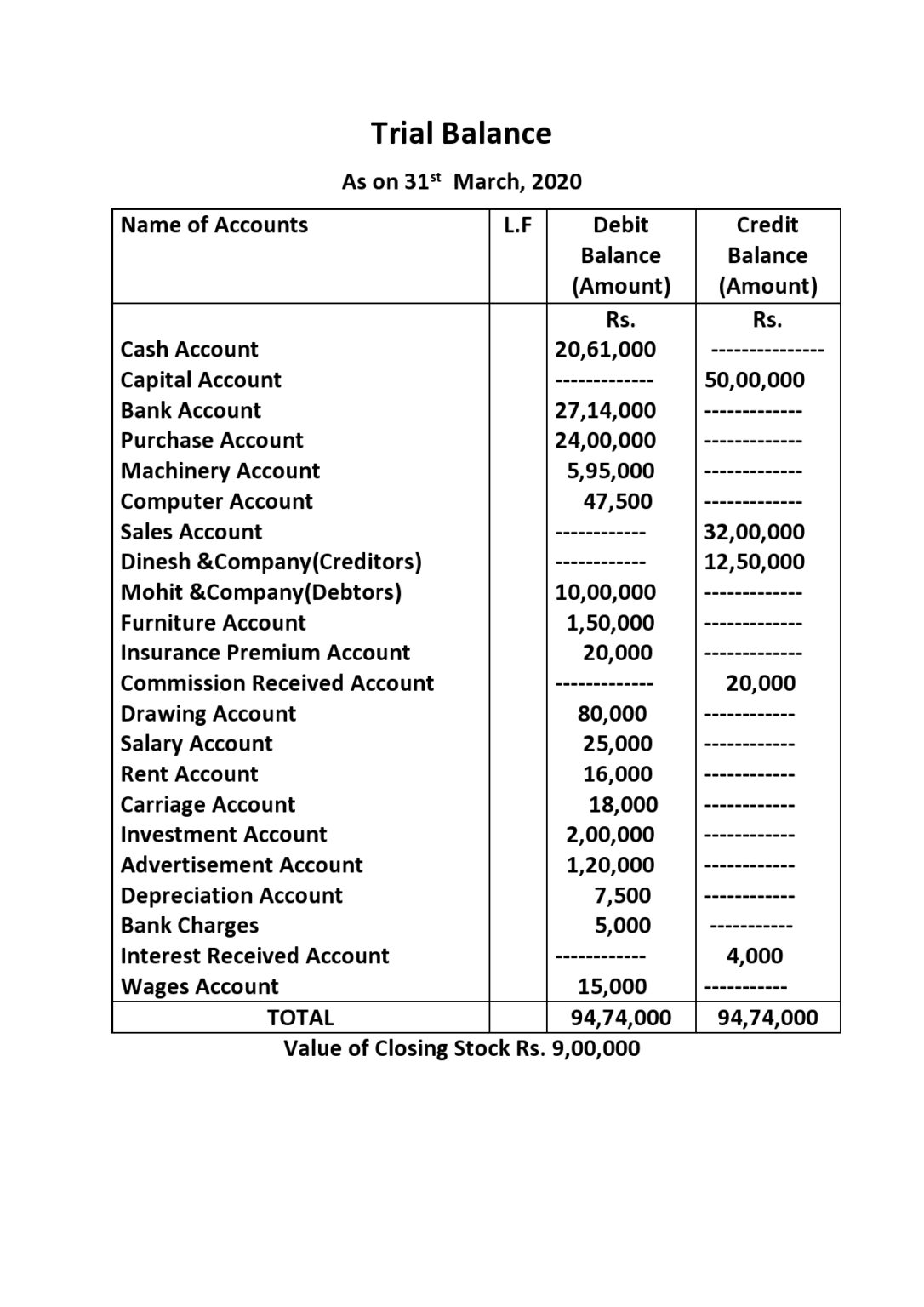

The following section uses the kids learn online (klo) transactions recorded in chapter 2 of the aaa textbook to demonstrate how to record transactions in the journal, post information to the ledger, prepare a trial balance and financial statements. This is done to determine that debits equal credits in the recording process the trial balance is the first step toward recording and interesting your financial results. Once the account balances are known, the trial balance can be calculated as shown:

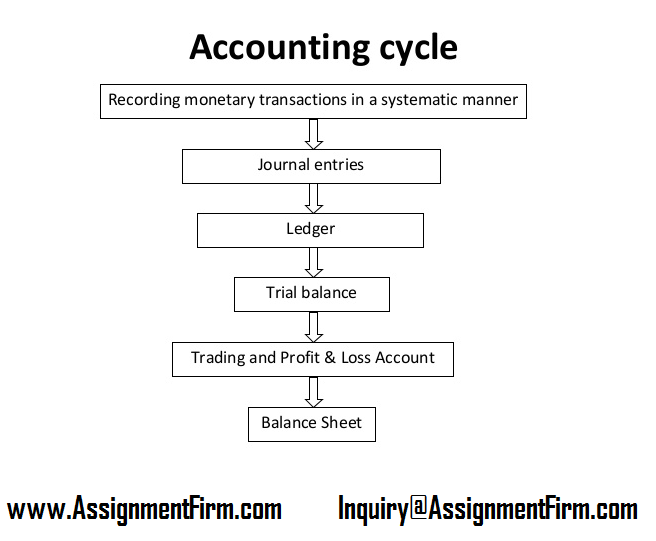

The accounting process involves a series of steps followed by business entities. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions. In this topic, we also cover how to prepare journal, ledger, and trial balance with practical problems and solutions.

As with the unadjusted trial balance, transferring. The main steps in the accounting process are described in fig. This trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first five steps in the cycle.

Step 4, preparing an unadjusted trial balance; When a new york judge delivers a final ruling in donald j. Your turn magnificent adjusted trial balance go over the adjusted trial balance for magnificent landscaping service.

Documents shown during trial ranged from spreadsheets to signed financial statements. Before we record the adjusting entries for klo, you might question the purpose of more than one trial balance. A journal is a chronological (arranged in order of time) record of business transactions.

A trial balance is a listing of all accounts (in this order: 16, 2024 4:35 pm et. Accounting > trial balance.

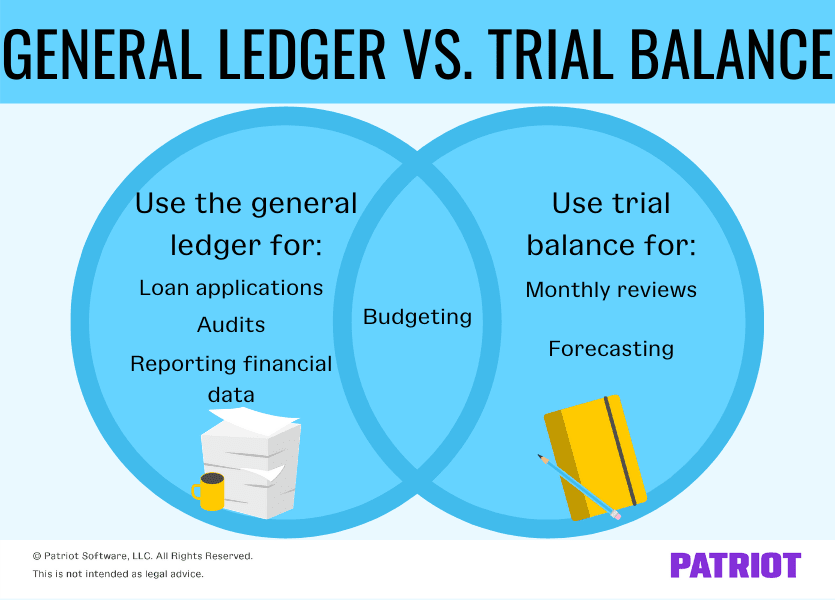

It lists the titles of all the accounts in a business’ general ledger in a column on the left, followed by the debit or credit balance of each account. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. The steps are identifying economic transactions, classifying them, recording them in journals, posting to ledgers, preparing trial balance, preparing adjusting entries and adjusted trial balance, preparing income statement, and finally preparing the.

The rate of mild or more pvl after tavi was higher in the notion trial (53% after 5 years) 17 compared with more recent trials using newer delivery systems and thv designs (15.3% and 20.8% after 4 and 5 years, respectively). A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

We will illustrate this later in the chapter. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. 2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses;