Beautiful Work Tips About Net Profit Operating

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Company b, with a gross profit of.

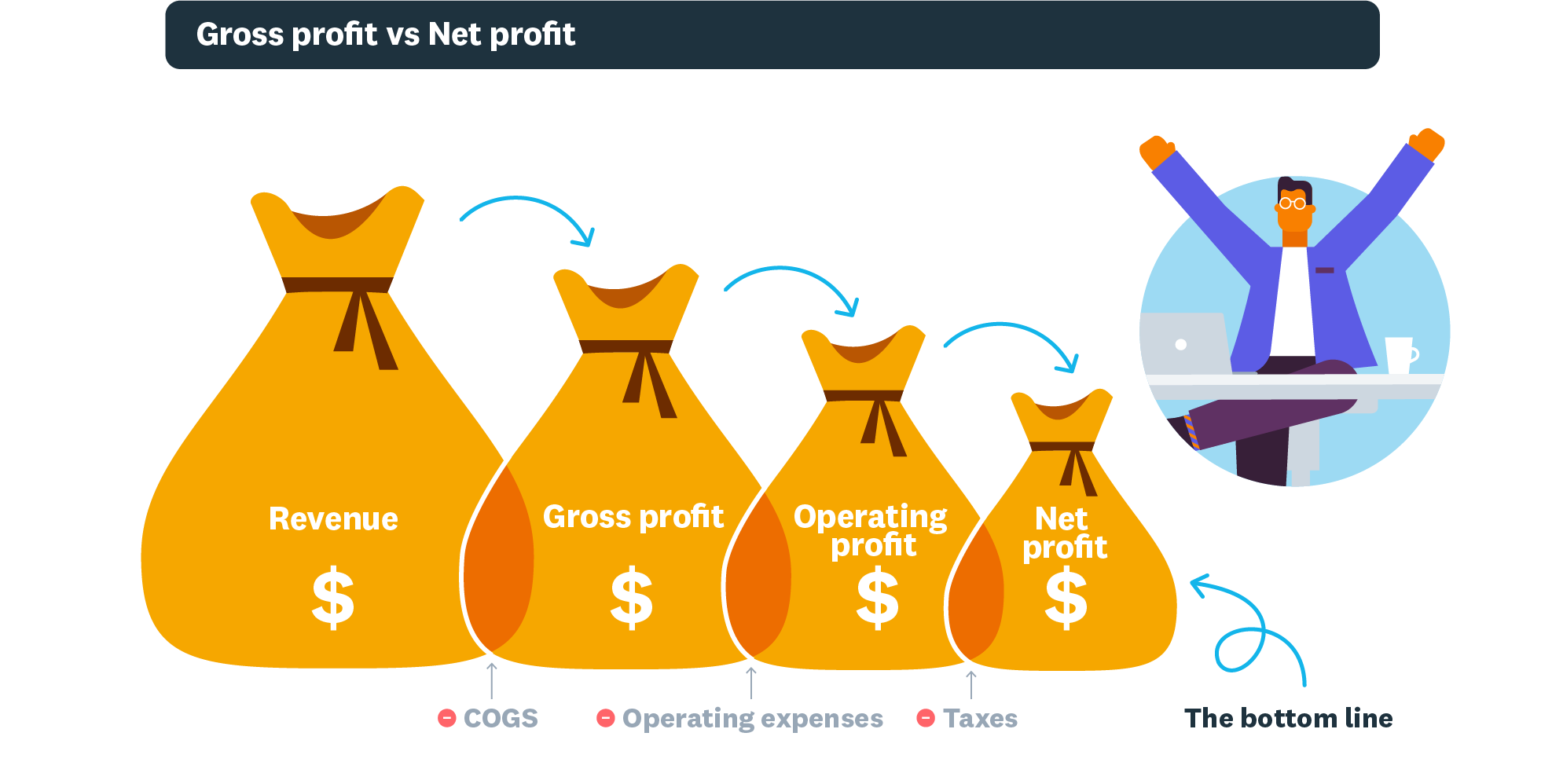

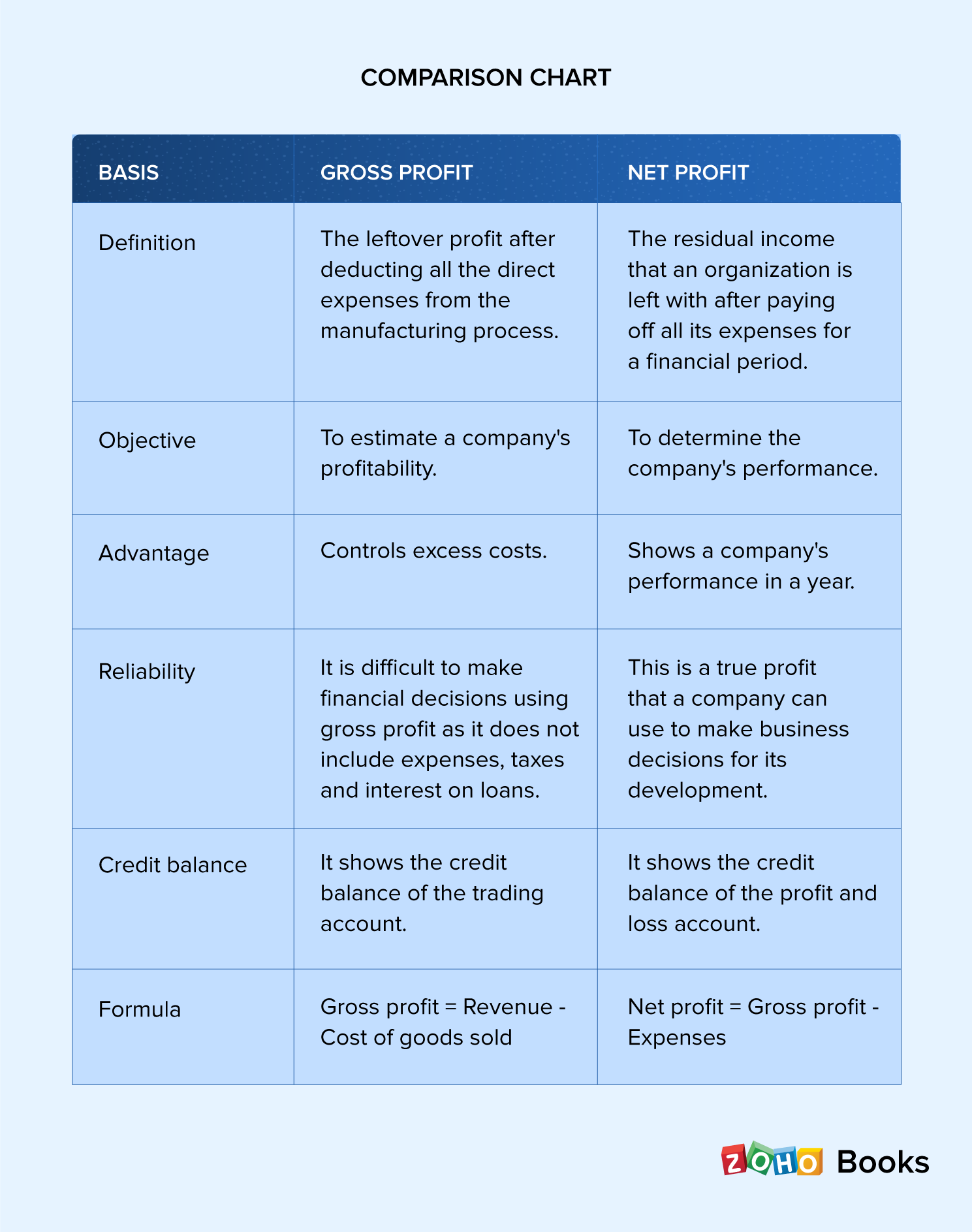

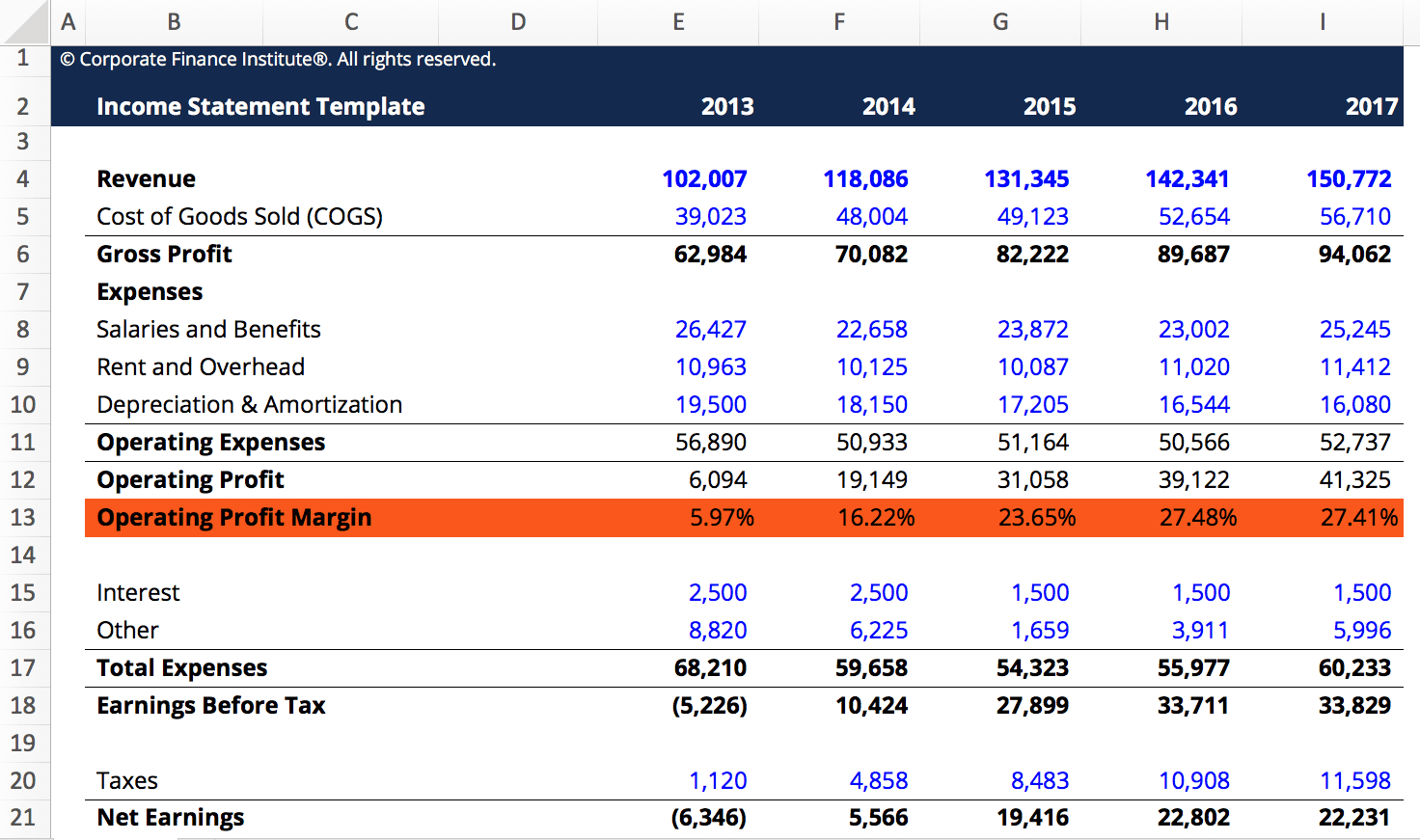

Net profit operating profit. The concept of operating profit is easier to understand with an example of how it works. Both profit metrics show the level of profitability for a company, but they differ in important ways. Q1 leads with the highest net profit at $68,000 and operating profit at $100,000, while q4 sees the lowest net profit.

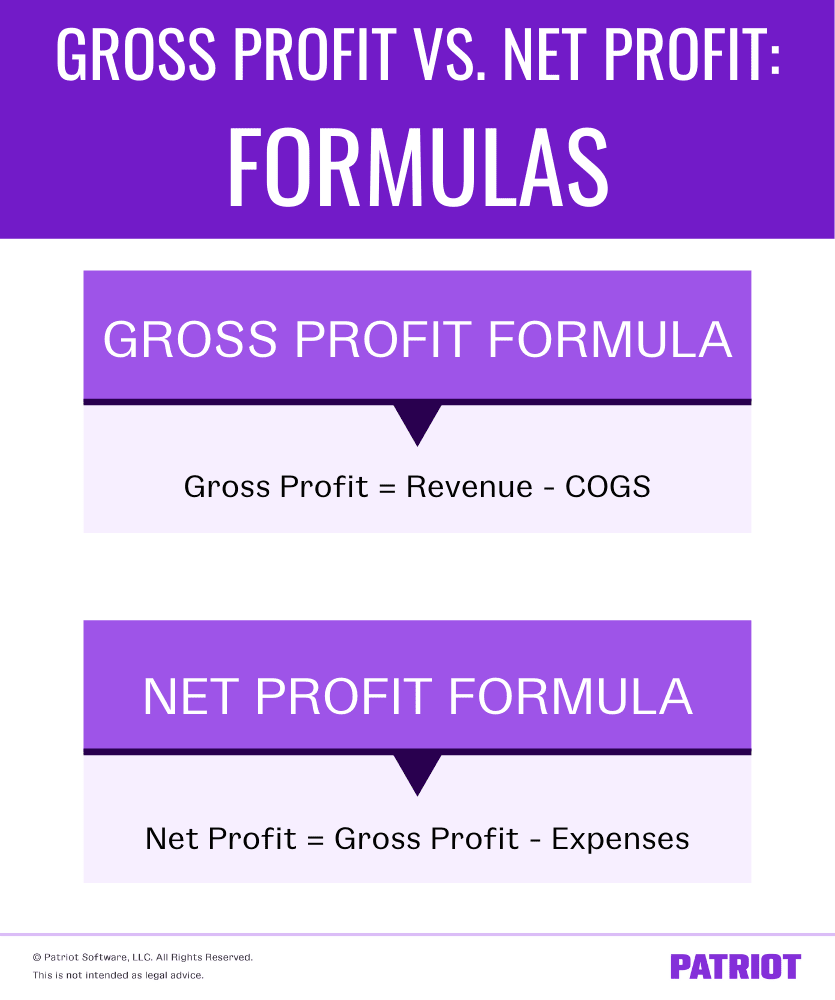

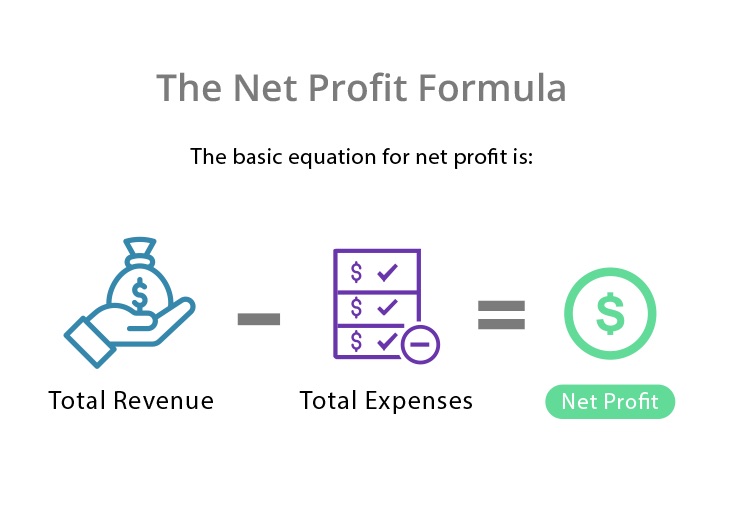

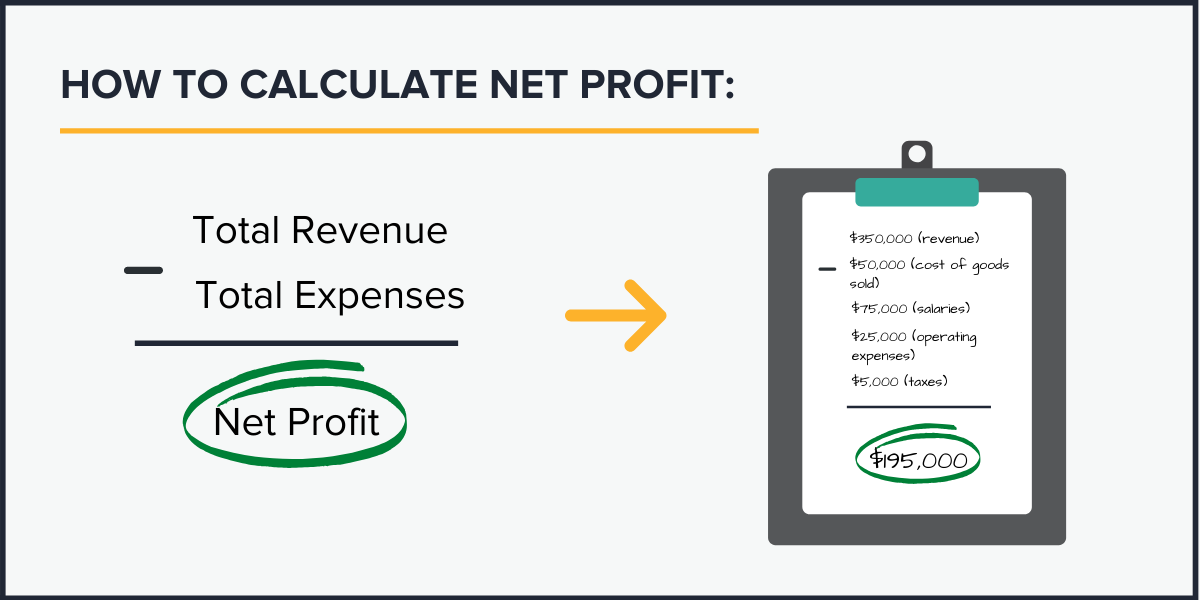

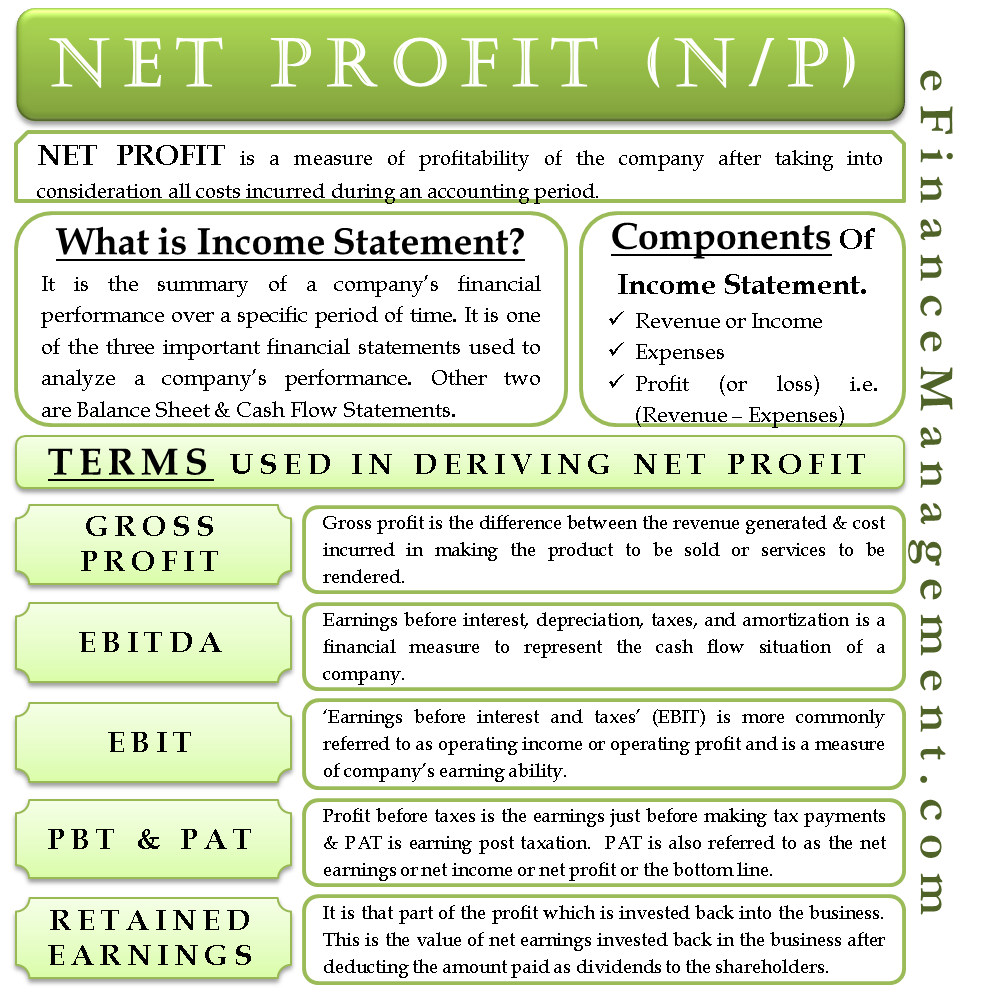

Net profit (also called net income or net earnings) is the value that remains after all expenses, including interest and taxes, have been deducted from revenue. Profit operating profit and net profit: Normally, if a supplier got its increase, woolworths buys for $2.20 and sells for $3.30.

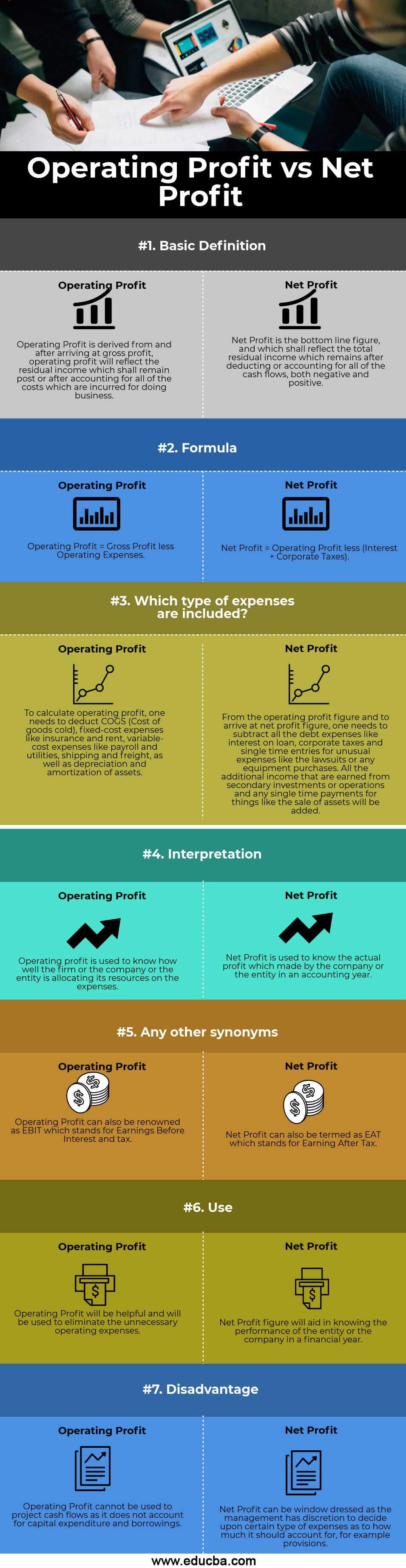

Operating profit tells you how. Key differences difference between gross, operating and net profit business is carried out with an aim of earning profit. Operating profit is the profit a company makes on its primary business functions.

It gets a 33 per cent gross profit margin. Operating profit measures a company’s profitability from its core business operations, while net income reflects the overall profitability after accounting for all. This was mainly due to a 9.1% rise in fuel costs, which account for.

Anuruddika jayathilaka university of sri jayewardenepura discover the world's. It works as an incentive to the entrepreneur, for the risk. The allocation of asset costs over their useful life (though this is added back to calculate ebitda).

Toyota's operating profit for the three months to dec. Operating profit is obtained by subtracting operating expenses from gross profit. Operating profit margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and interest.

The operating profit margin is then calculated by dividing the operating profit. Operating profit removes operating expenses like overhead and other indirect costs as well as accounting costs like depreciation and amortization. Operating profit shows a company's earnings after all expenses are taken out except for the cost of debt, taxes, and.

Woolworths keeps its 33 per. The calculation below illustrates how to calculate operating profit, starting. 31 totalled 1.68 trillion yen, up 75.7% a year earlier and beating the average 1.3 trillion yen profit estimate in a.

The operating profit is a measure of a company’s profitability from its core business activities, excluding the effects of discretionary items such as interest expense. Two important terms found on any company's income statement are operating profit and net income.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash-TheBalance-profit-margin-types-calculation-3305879-Final-a32cbd7586444188acec18d268837433.jpg)

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)