Divine Info About Interest Paid In Profit And Loss Account

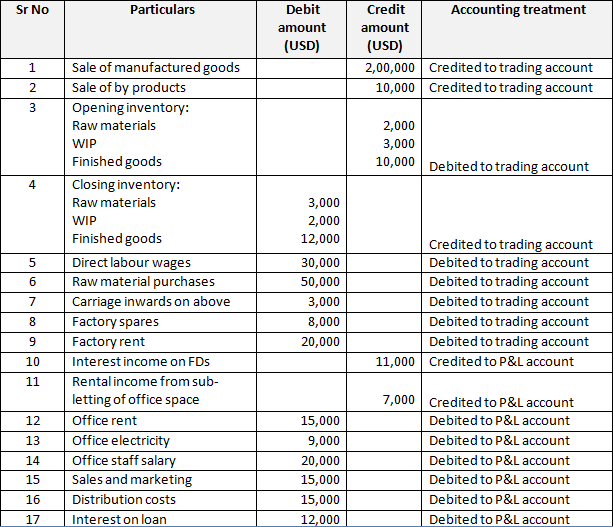

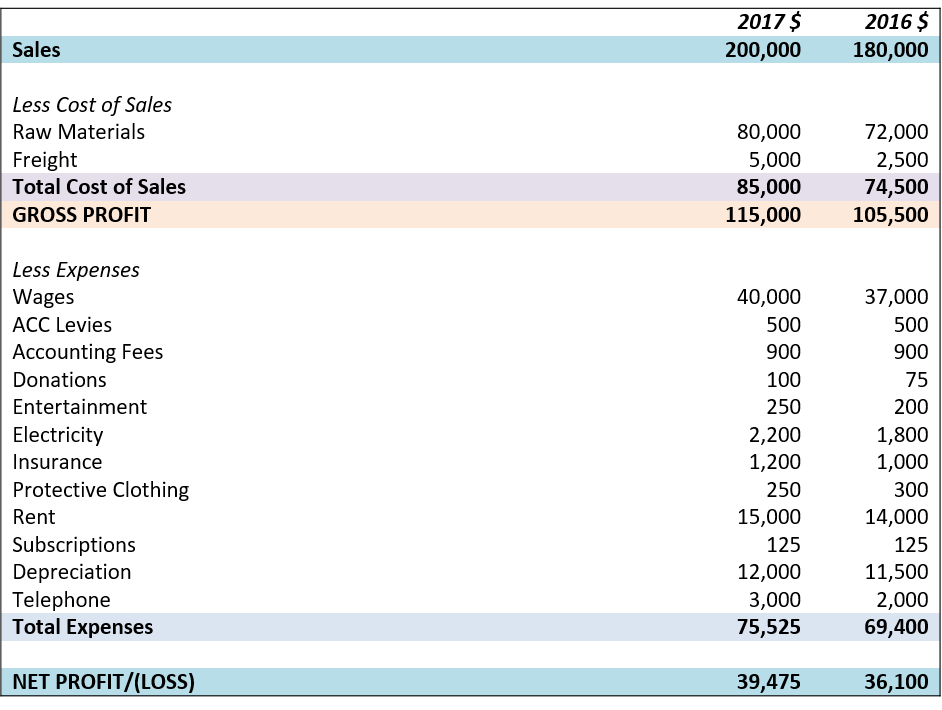

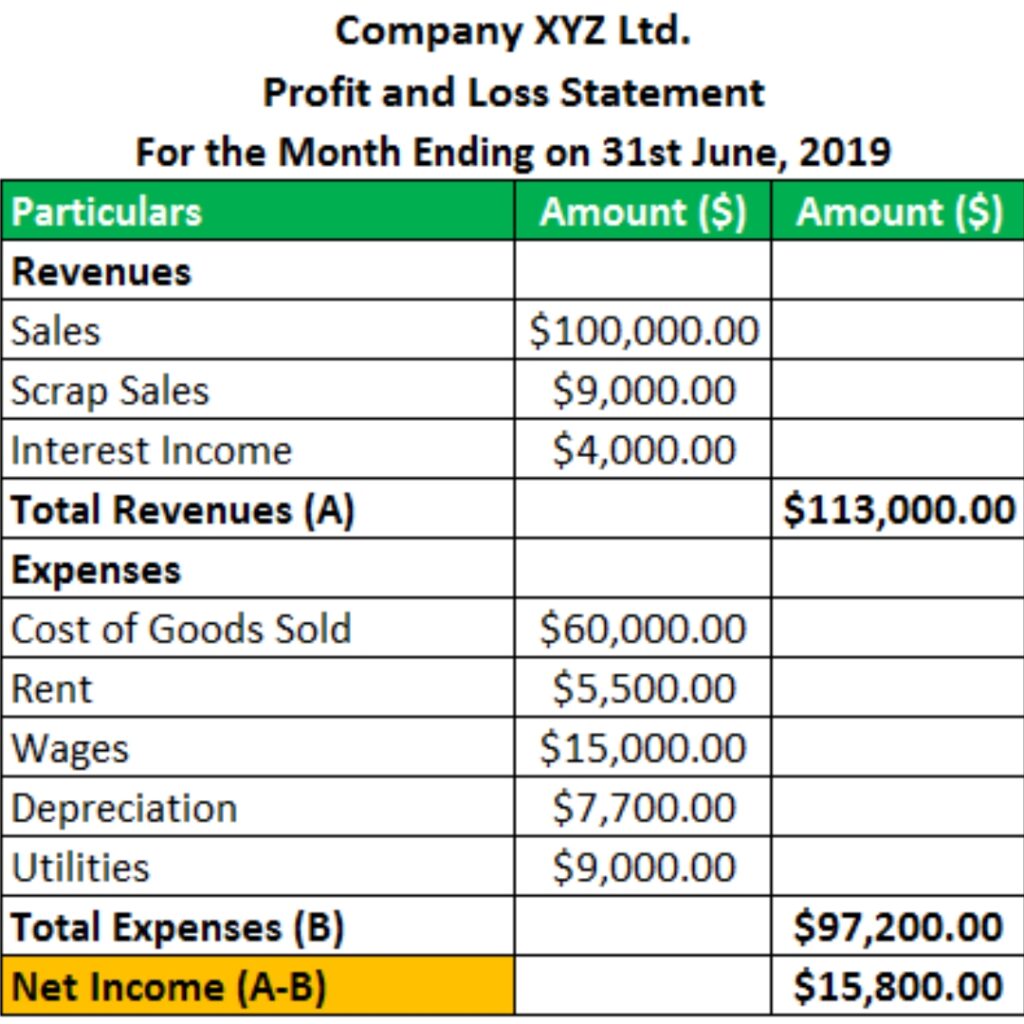

Profit & loss account the trading account reflects the gross profit or loss of the business.

Interest paid in profit and loss account. It will include the amount of interest paid as well as payable. The rate of interest is a prefix value to the debenture, say 9% debentures and, therefore, is payable even if the company incurs a loss. Net loss transferred from p&l account, 2.

The ban on applying for loans from banks registered or chartered in new york could severely restrict trump's ability to raise cash. This gives you a net profit figure. In addition to the $354.9 million.

A bank’s profit is equal to its interest income minus any interest it pays on loans or customer deposits and operating expenses, and minus taxes. Failure to file either of these correctly can result in you paying. This represents interest paid on loans.

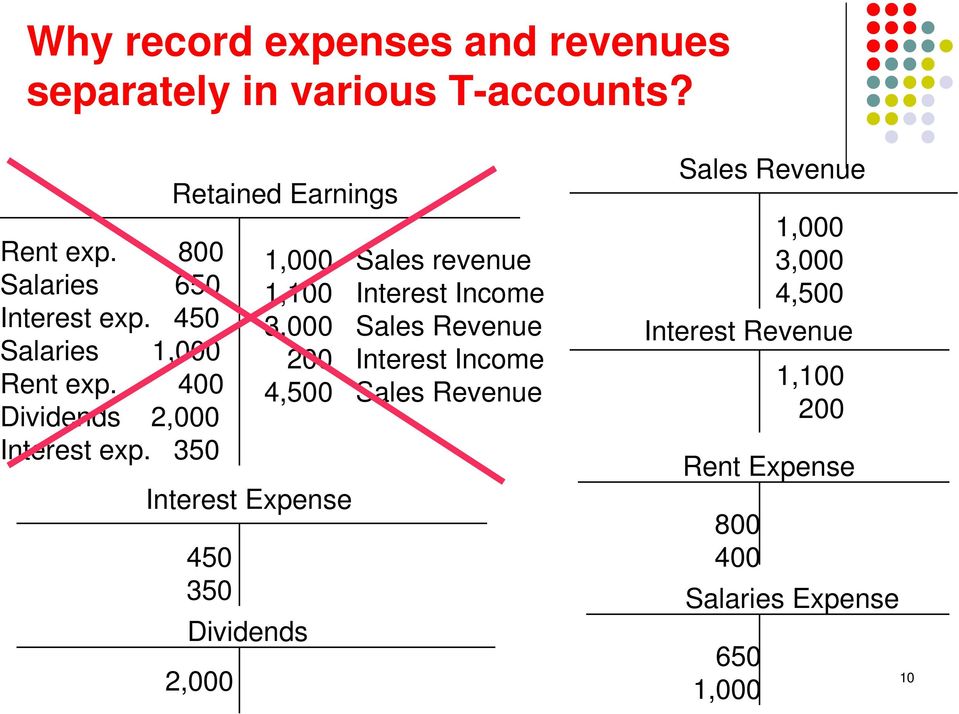

Profit and loss account is made to ascertain annual profit or loss of business. Where would i put finance costs (bank charges, bank interest paid, and charges from our factor finance company). Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period.

It is a charge against profit. A balance sheet provides both investors and creditors with a snapshot as to how effectively a company's management uses its resources. Shannon stapleton/getty images.

The profits shown in your profit and loss account are used to calculate both income tax and corporation tax. All the items of revenue and expenses. It is often listed separately because the interest expense does not reflect on the trading of the business.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Explain p&l a/c objectives and importance. Finally, the ncbs hold a.

Transfer of profit to reserves, 3. The judge's ruling orders former president donald trump and his company to pay $354 million in fines, plus almost $100 million in interest, and restricts trump's. Profit & loss account shows the net profit or loss earned by the.

A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364. Interest, therefore, is typically the last item before taxes are deducted to arrive at net income. From the operating profit, you take any interest charges you might be paying on bank loans or bank charges.

Our accounting package deducts them before. The interest is a finance cost in the statement of. Only indirect expenses are shown in this account.