Fine Beautiful Tips About Income Statement Not Tax Ready

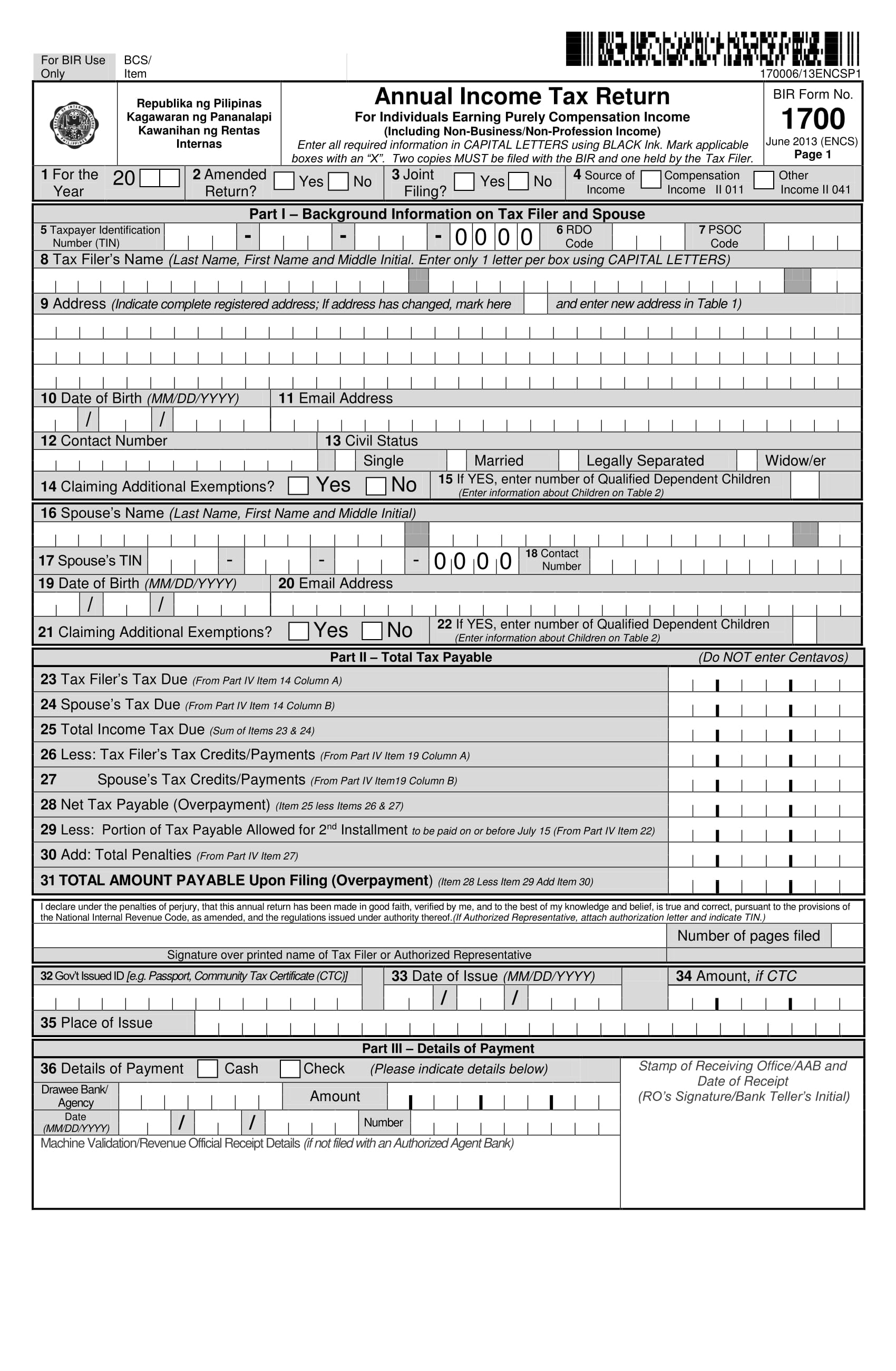

If your income statement information isn't marked as 'tax ready' by your employer, you will see a red box in ato online services that says 'not tax ready'.

Income statement not tax ready. Both are from the same employer. 0 kudos 2 replies 2. Your income statement is not tax ready you shouldn’t lodge your tax return yet because your income statement is not tax ready.

If you lodge before the statement is 'tax ready', you may have to amend your tax return. This is what i did in myob. It says on the ato website that employers have until the 14th to make the statements tax ready so hopefully by the end of the.

Income statement not tax ready if your income statement is not tax ready. However if your employer finalises it and has different numbers to. If you file on paper, you should receive your income tax package in the mail by this date.

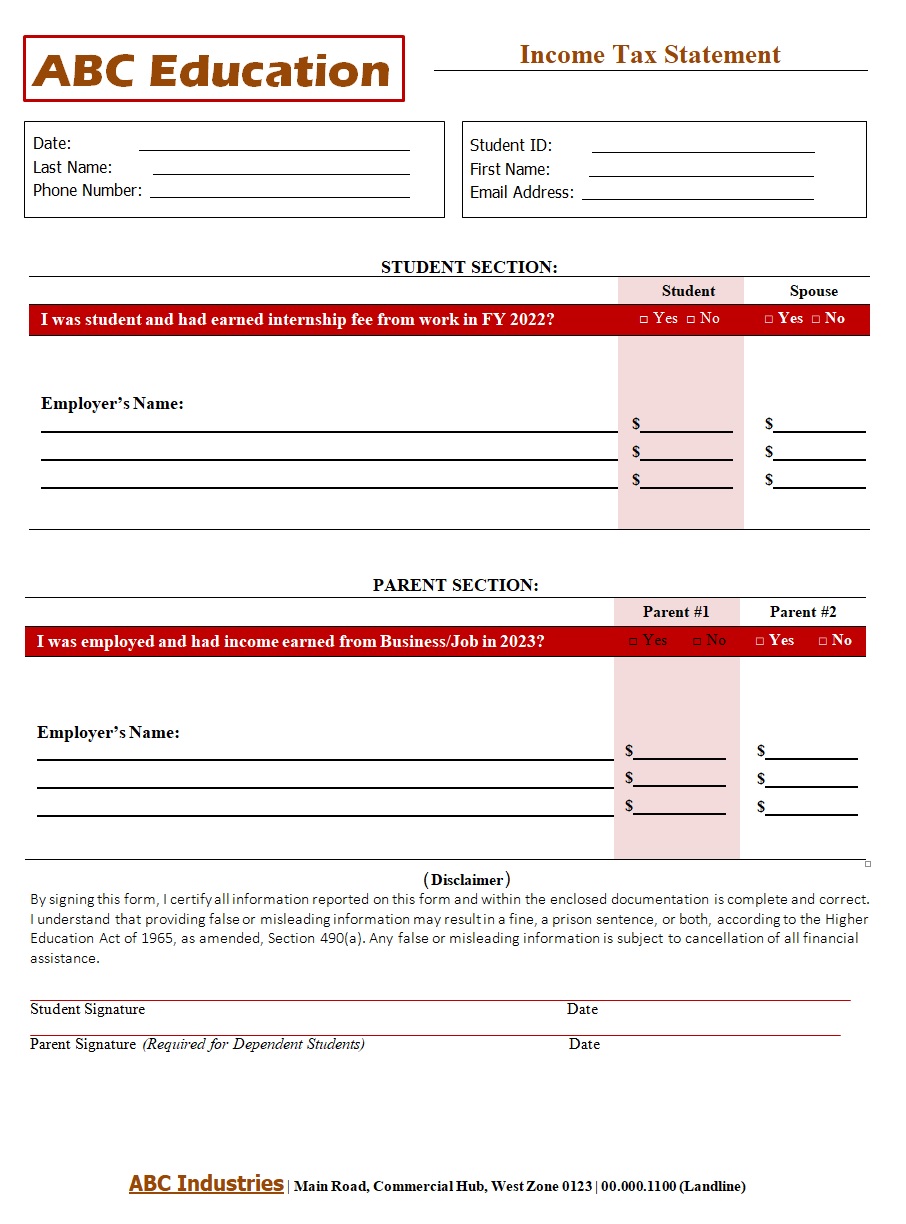

Tax code does not exist error. An income statement is the document prepared by your employers where you can see your income for the financial year. You will be able to access this information through your ato online services via mygov.

Even though it says not tax ready, you can still lodge. When your employer finalises your super and tax details, it will display the status tax ready. You will instead receive an income statement.

My mum’s income statement is not tax ready, what can we do? We will make it clear to them that their income statement is not 'tax ready'. Not tax ready and your tax return.

Trump a crushing defeat in his civil fraud case, finding the former president. After the end of the financial year, when your income statement has been finalised by your employer, the status will change to 'tax ready'. One says it is tax ready and the other says it isn't.

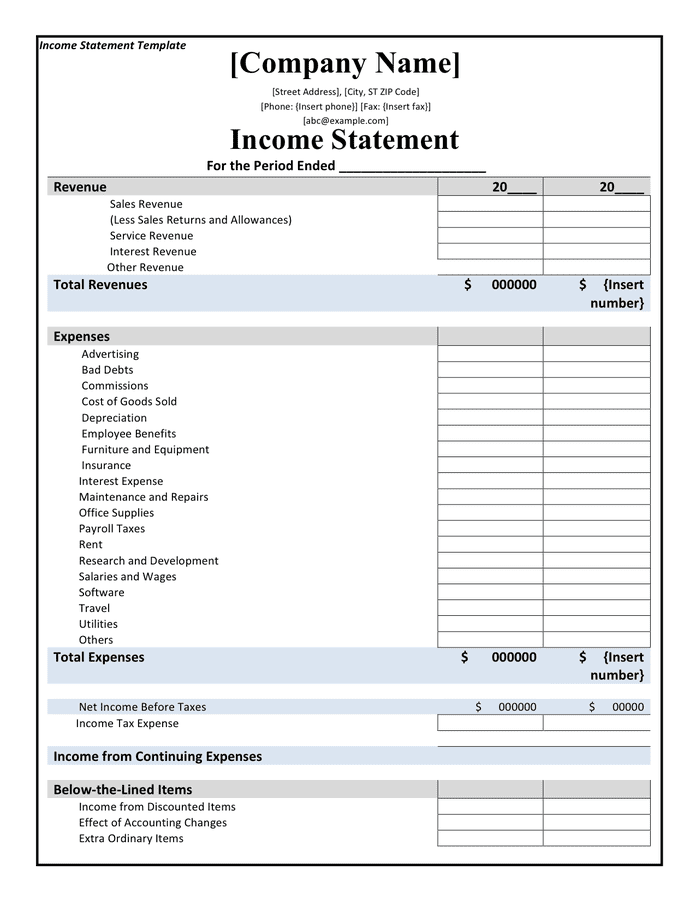

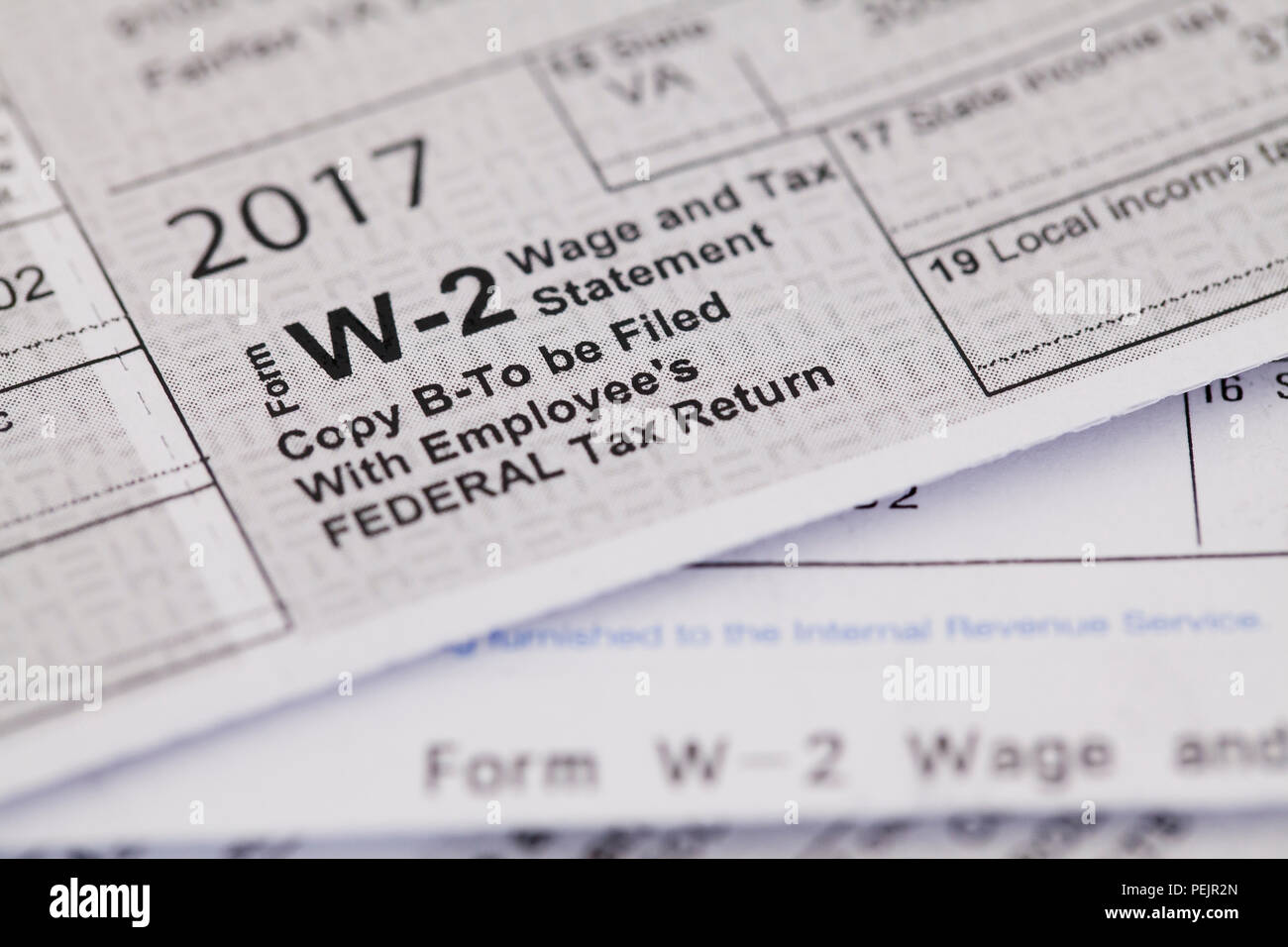

You may need several different documents depending on your sources of income, but here are a few common ones: July 2019 i’ve told my staff to finalise their tax returns with the income statement as it is because i know it won’t change. We recommend waiting until your income statement is tax ready before.

A new york judge on friday handed donald j. For 2023, the standard deduction is $13,850 for married filing separately and single filers. Head of household filers have a standard deduction of $20,800 for the 2023.

Can you tell me which field this may be affecting and is this why the income statements are not tax ready. Blick rothenberg, the leading tax and advisory firm, was one institution to say a 1p cut in the basic rate of income tax was a likely option. Thanks to everyone who responded.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)