Fabulous Info About Startup Company Balance Sheet

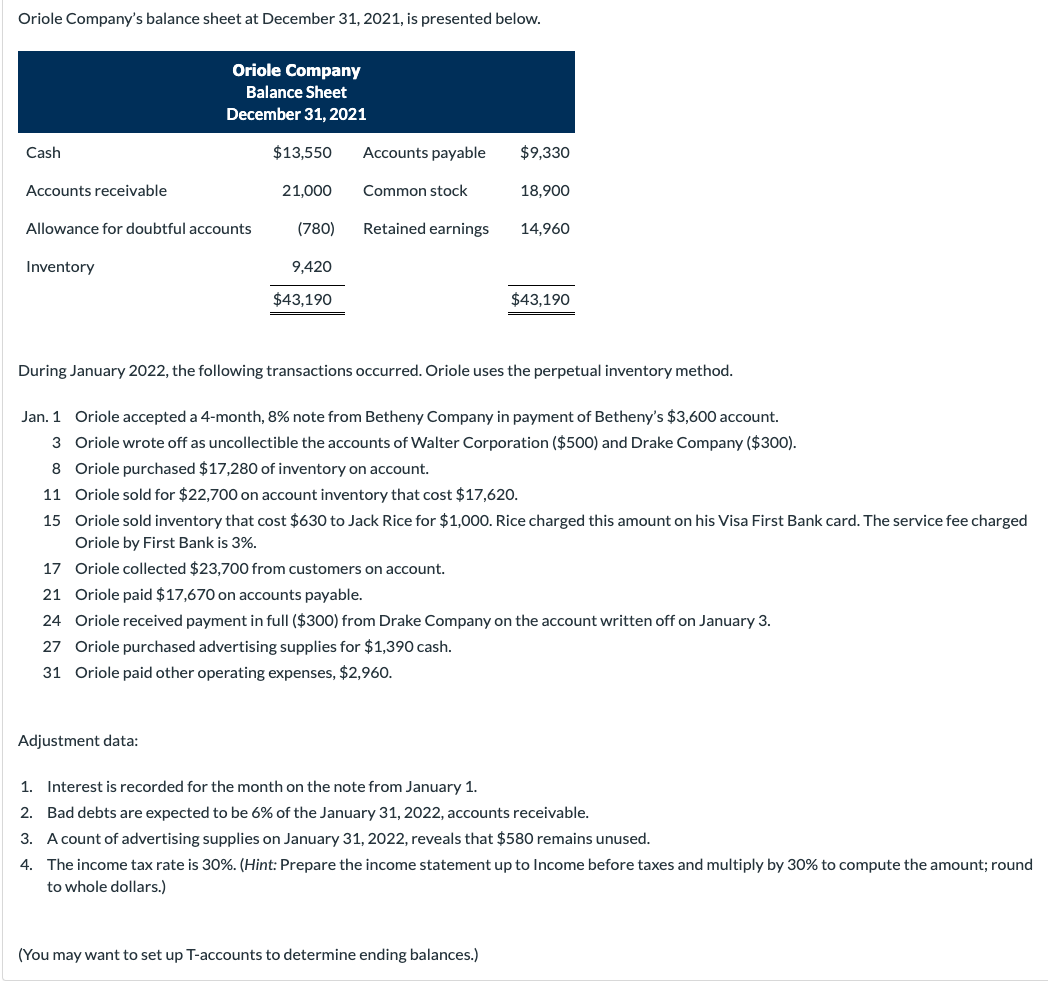

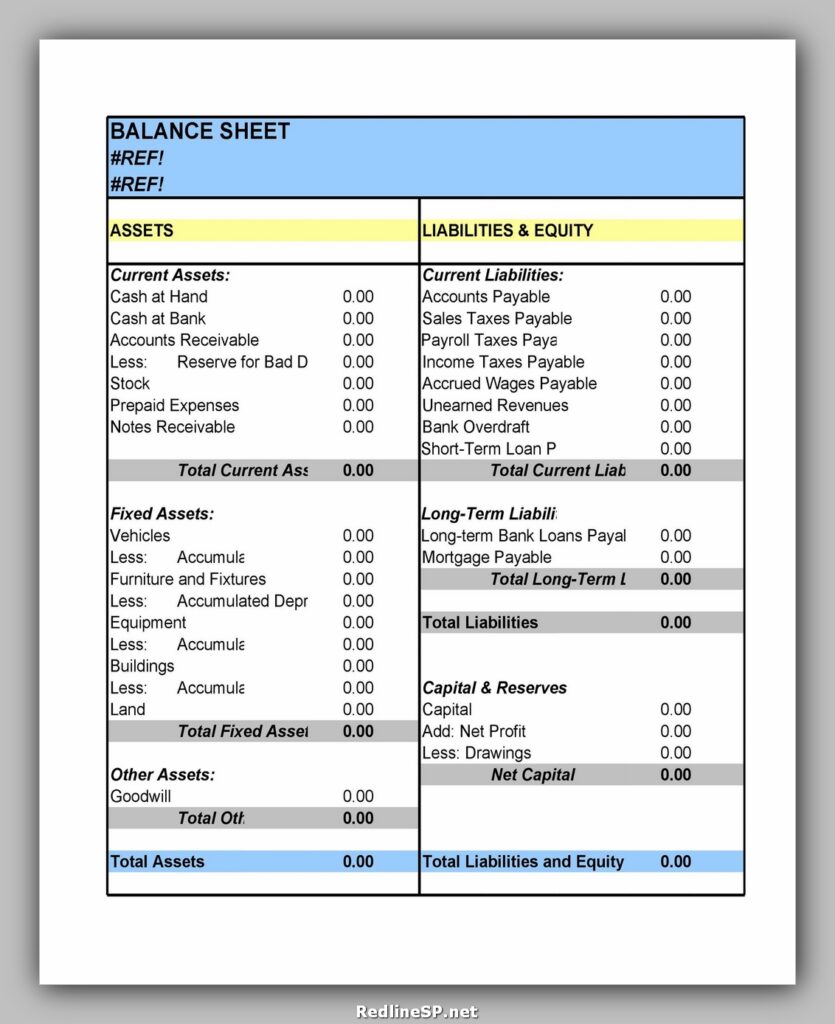

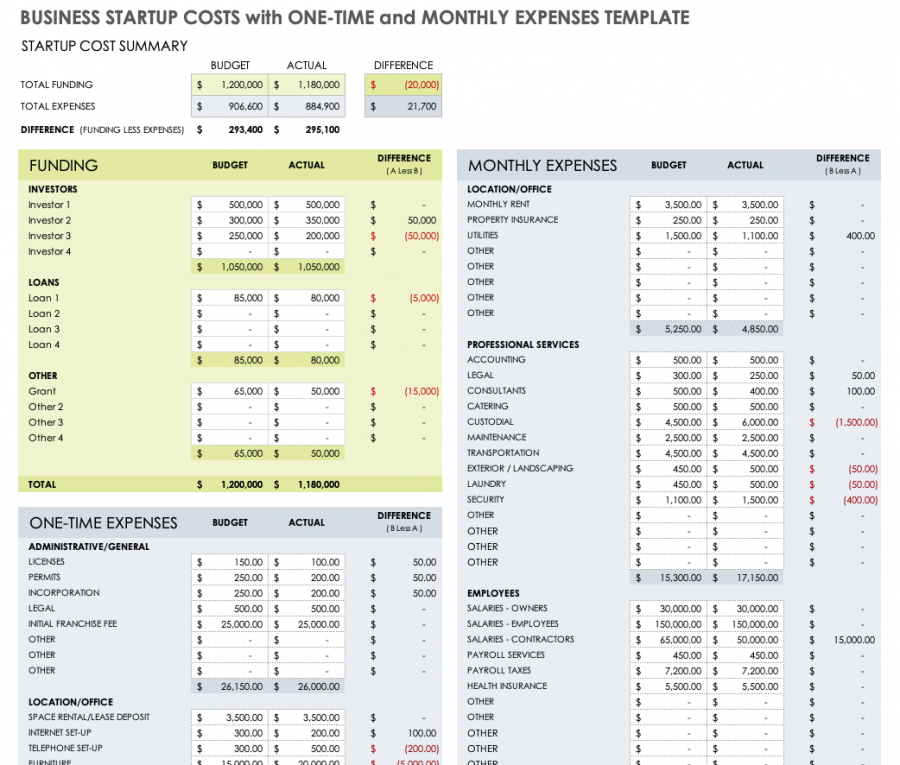

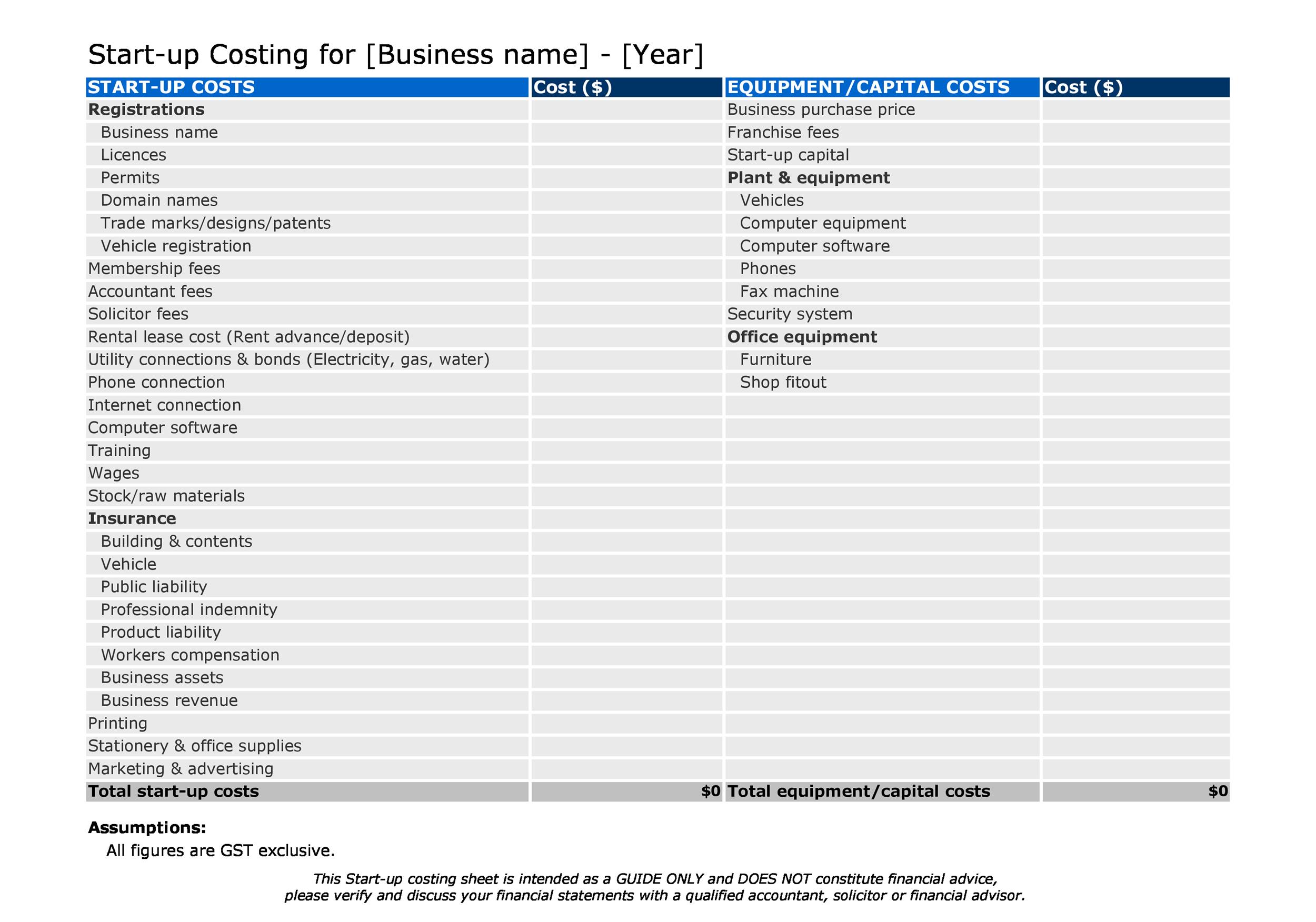

Otherwise, the following will be manual ways to build the balance sheet.

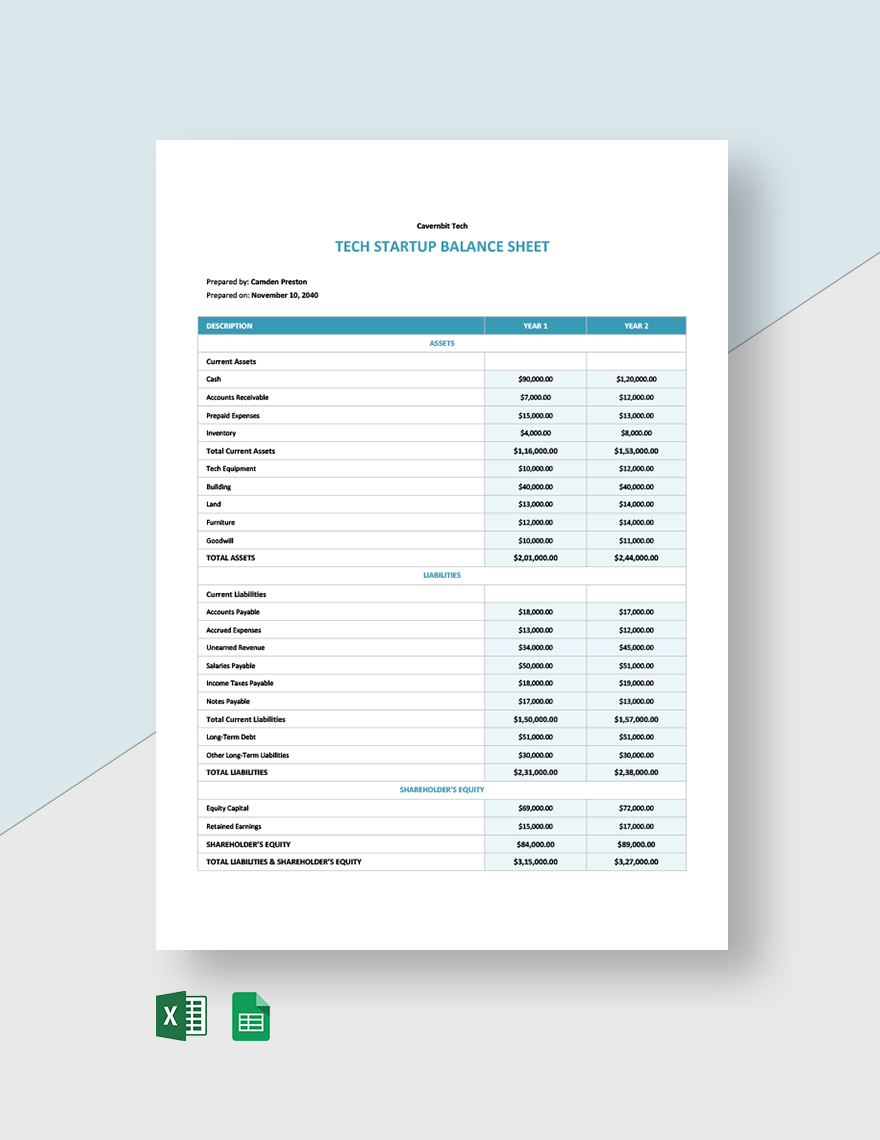

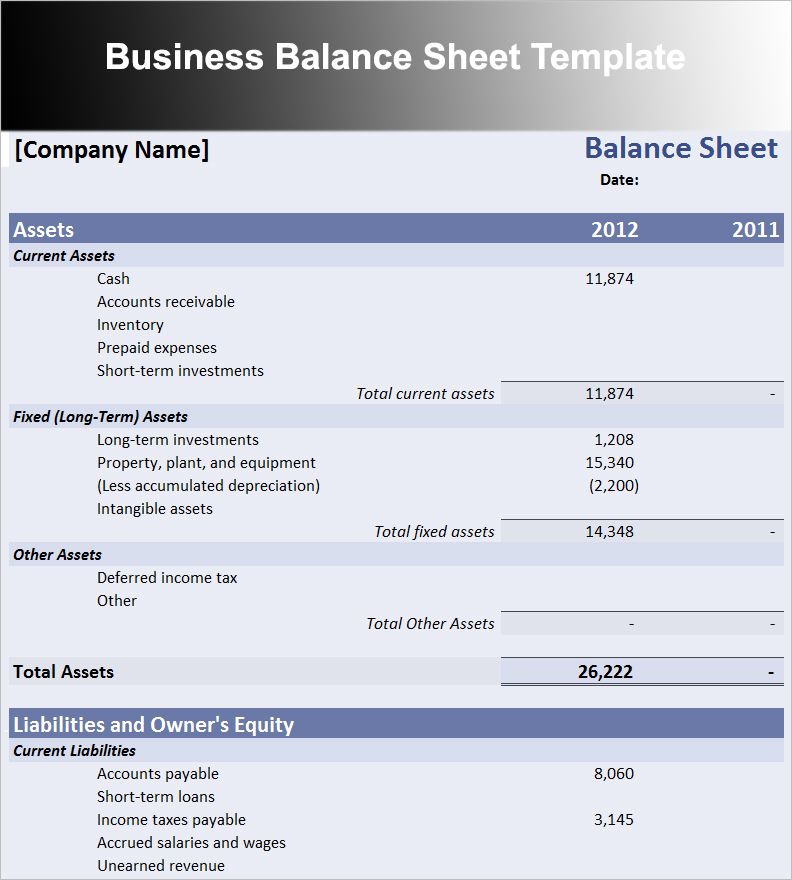

Startup company balance sheet. A balance sheet is an overview of what the company owns, owes, and the total amount of shareholder equity. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. That is, the totals must balance.

Fundamentally, you should view balance sheets as a way to court investors and present an optimistic financial view of your startup. Most companies complete a balance sheet at the end of the fiscal year, commonly a few weeks after it has. The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly us$9 trillion by the summer of 2022, using bond purchases to stabilise markets and provide stimulus beyond the near zero federal funds rate then in place.

The balance sheet makes a case for your company’s financial health and future net worth using these details: There are three primary components of a balance sheet: The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near $9 trillion reached in early 2022.

There are 2 ways that startups record equity on the balance sheet. The complicated structure and mathematical overlaps of a balance sheet might overwhelm you.enjoy refreshingly easy payments, deposits, credit cards, and expense tracking— all in one place.learn more. A balance sheet covers a company’s assets as defined by its liabilities and shareholder equity.

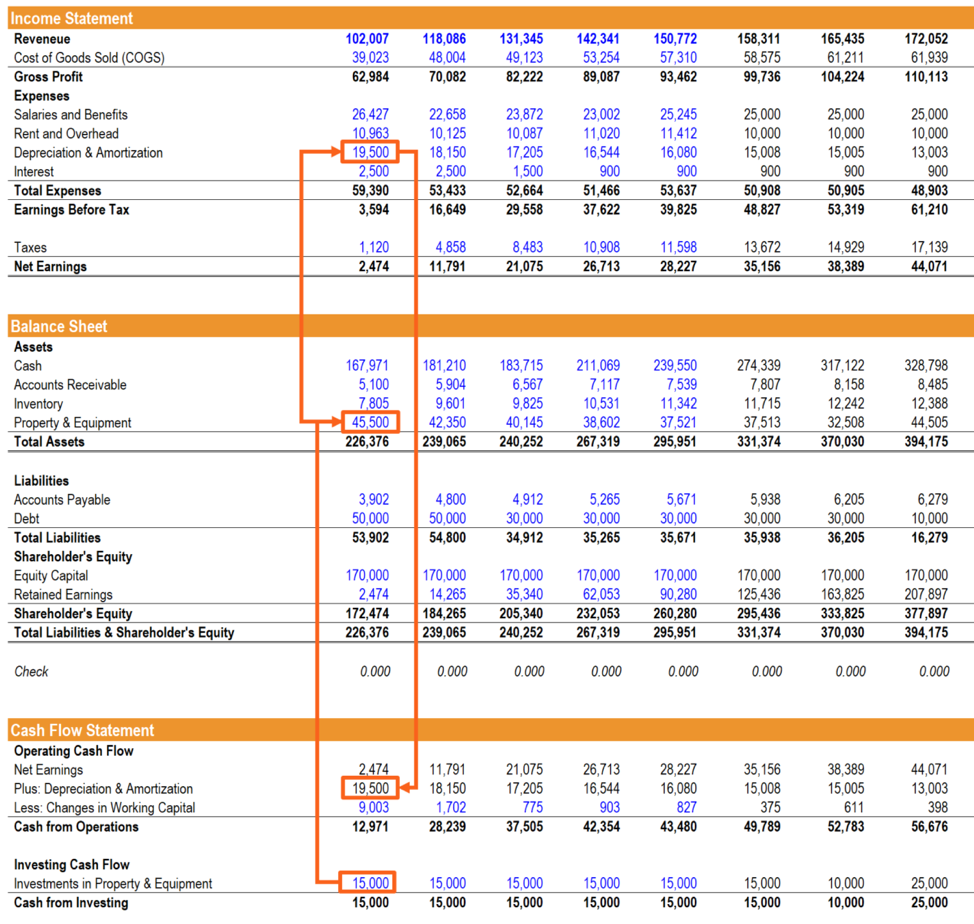

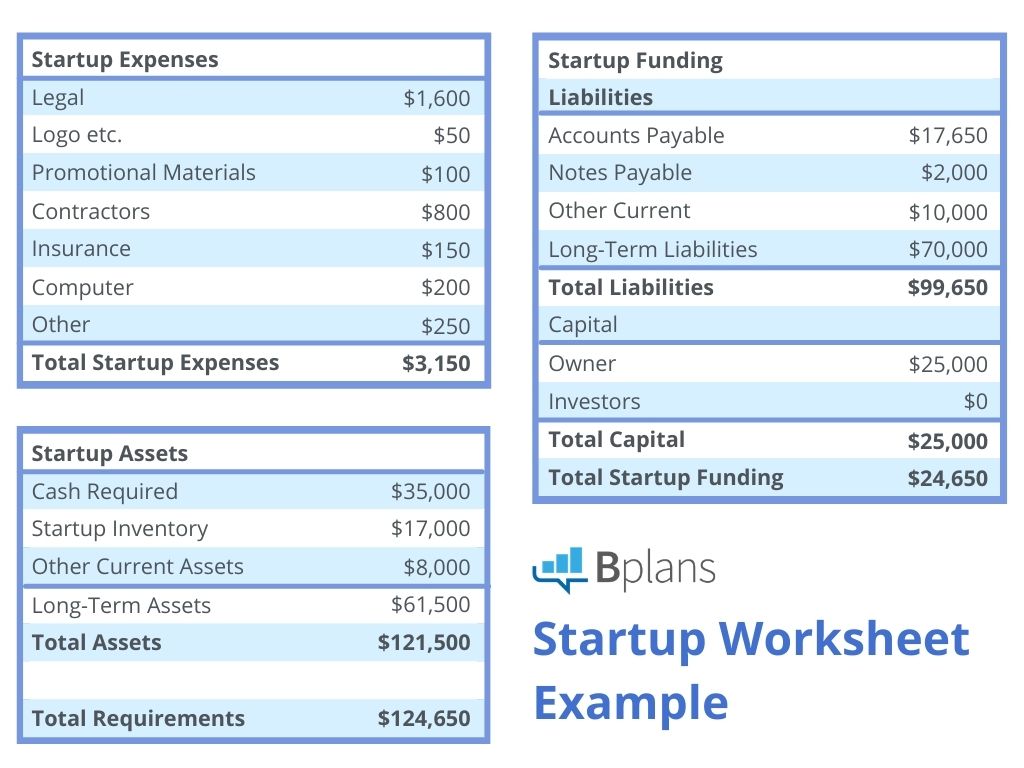

Using the wrong data can lead to a balance sheet that does not balance. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. In this post and the associated youtube short we are going to explore the balance sheet by walking through a simple example for a startup.

In other words, a balance sheet shows what a business owns, the amount that it owes, and the amount that the business owner may claim. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. Inventory of goods, property, and.

Exercises can help provide context for abstract concepts. Startup companies can also compare future balance sheets with the initial balance sheet to identify financial trends. The company’s total assets must equal the sum of the total liabilities and total owners’ equity;

The current size of the fed‘s balance sheet is us$7.7 trillion. It provides an overview of a company’s ability to pay off its liabilities, including loans, debts, and other financial obligations. This balance sheet template simplifies the balance sheet process by asking plain language questions and then a balanced balance sheet will be generated from those answers.

Understanding the essence of a balance sheet. The importance of a balance sheet in your startup balance sheets are a necessary tool, especially if you’re interested in attracting outside capital for your startup. The balance sheet is based on the fundamental equation:

Understanding share equity in a balance sheet. Assets = liabilities + equity. Reading and crafting a balance sheet;