Best Info About Income Statement For New Business

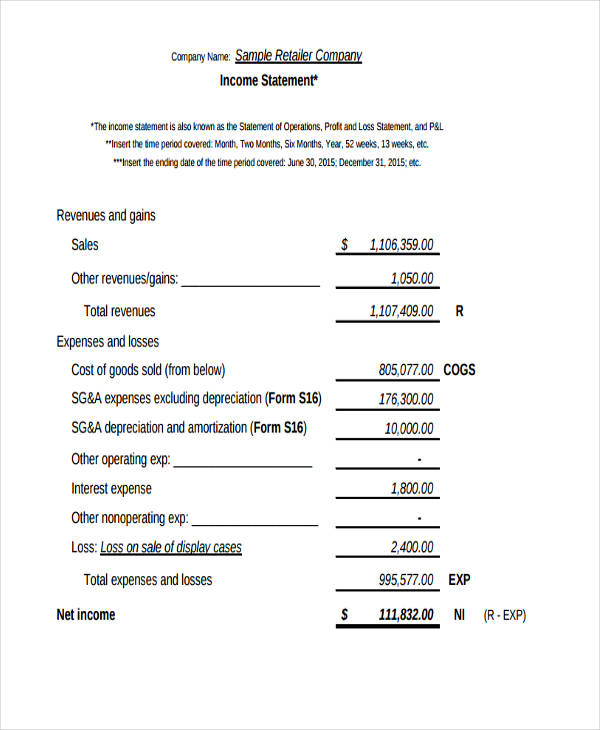

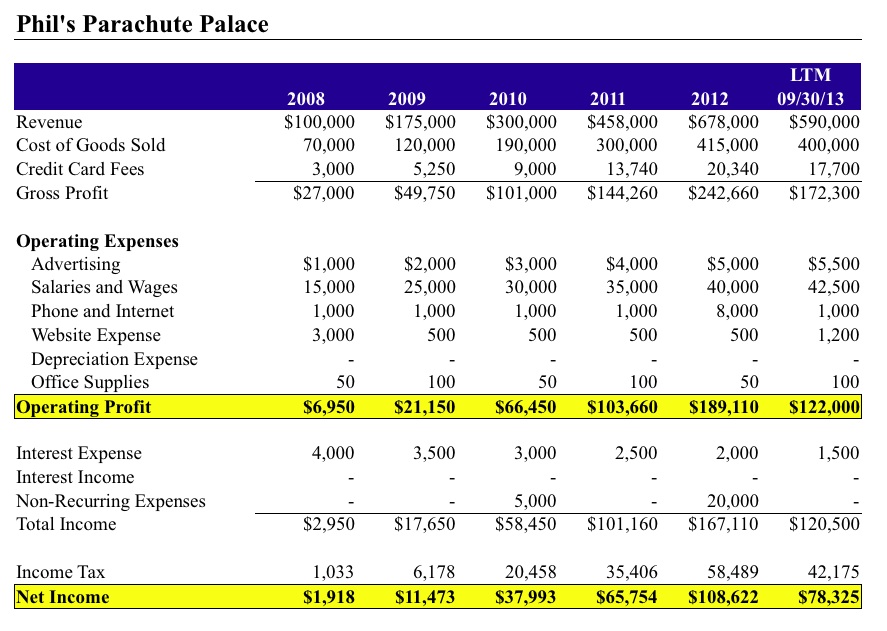

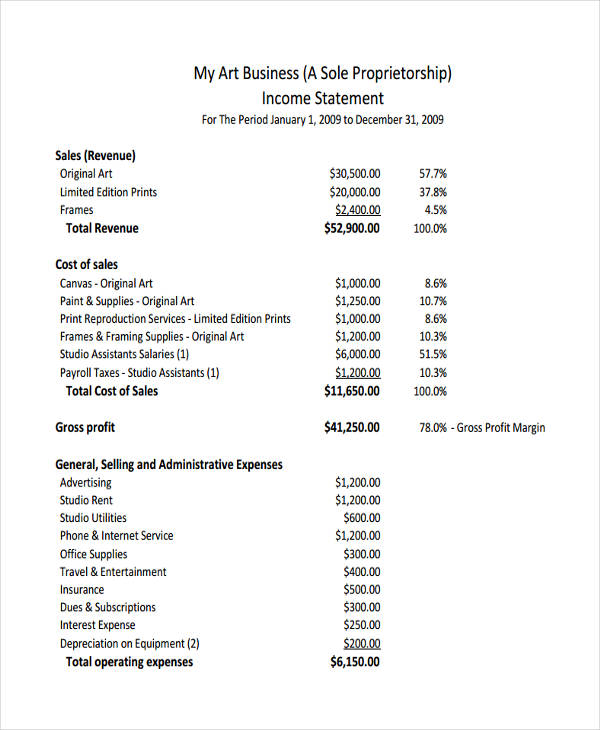

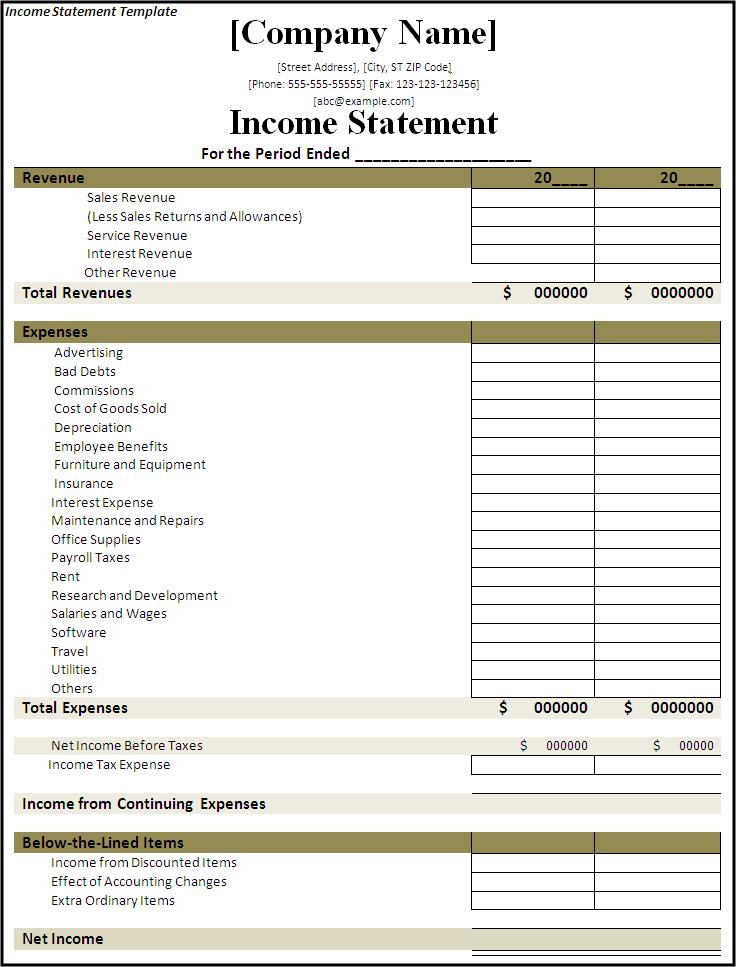

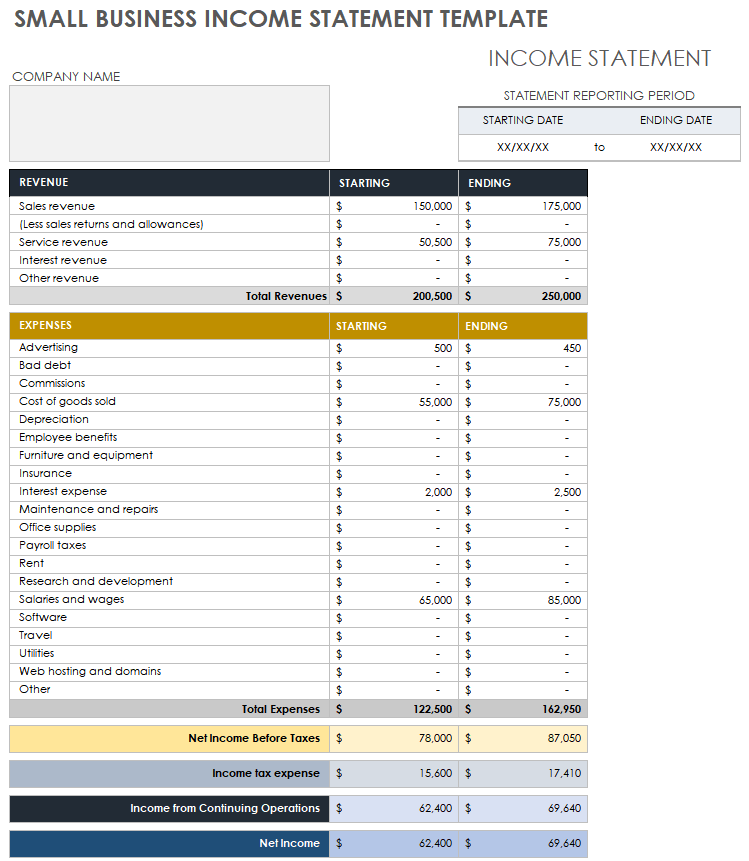

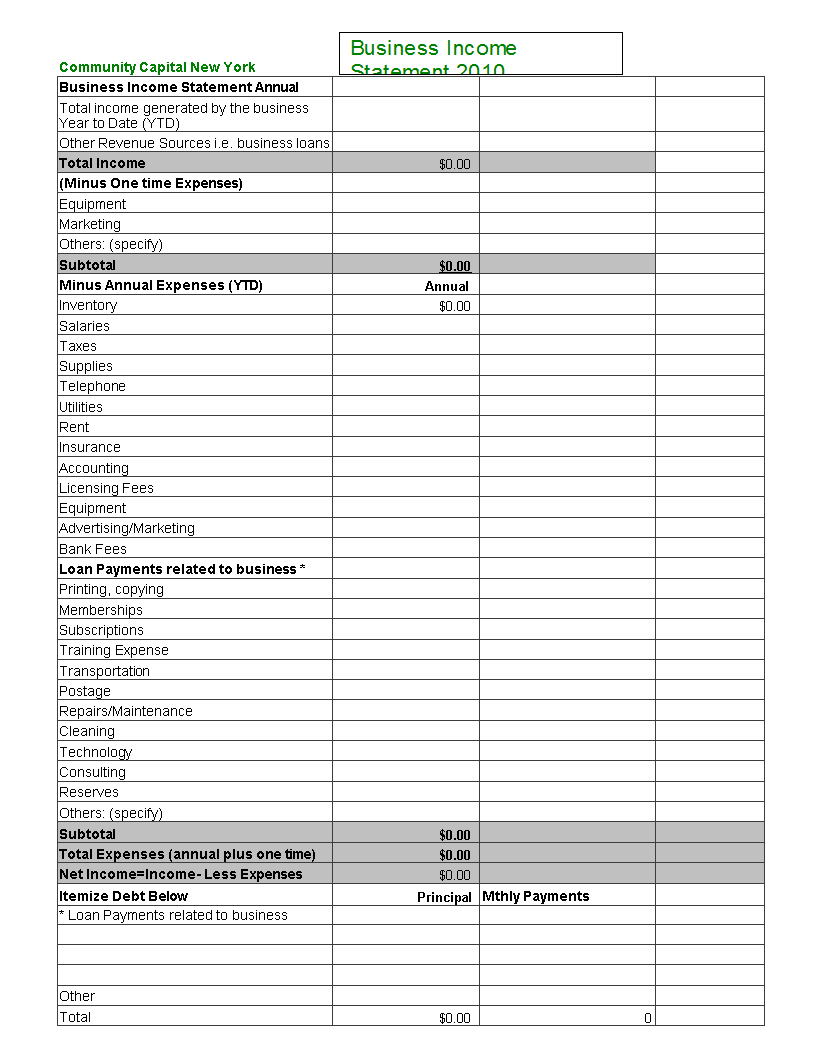

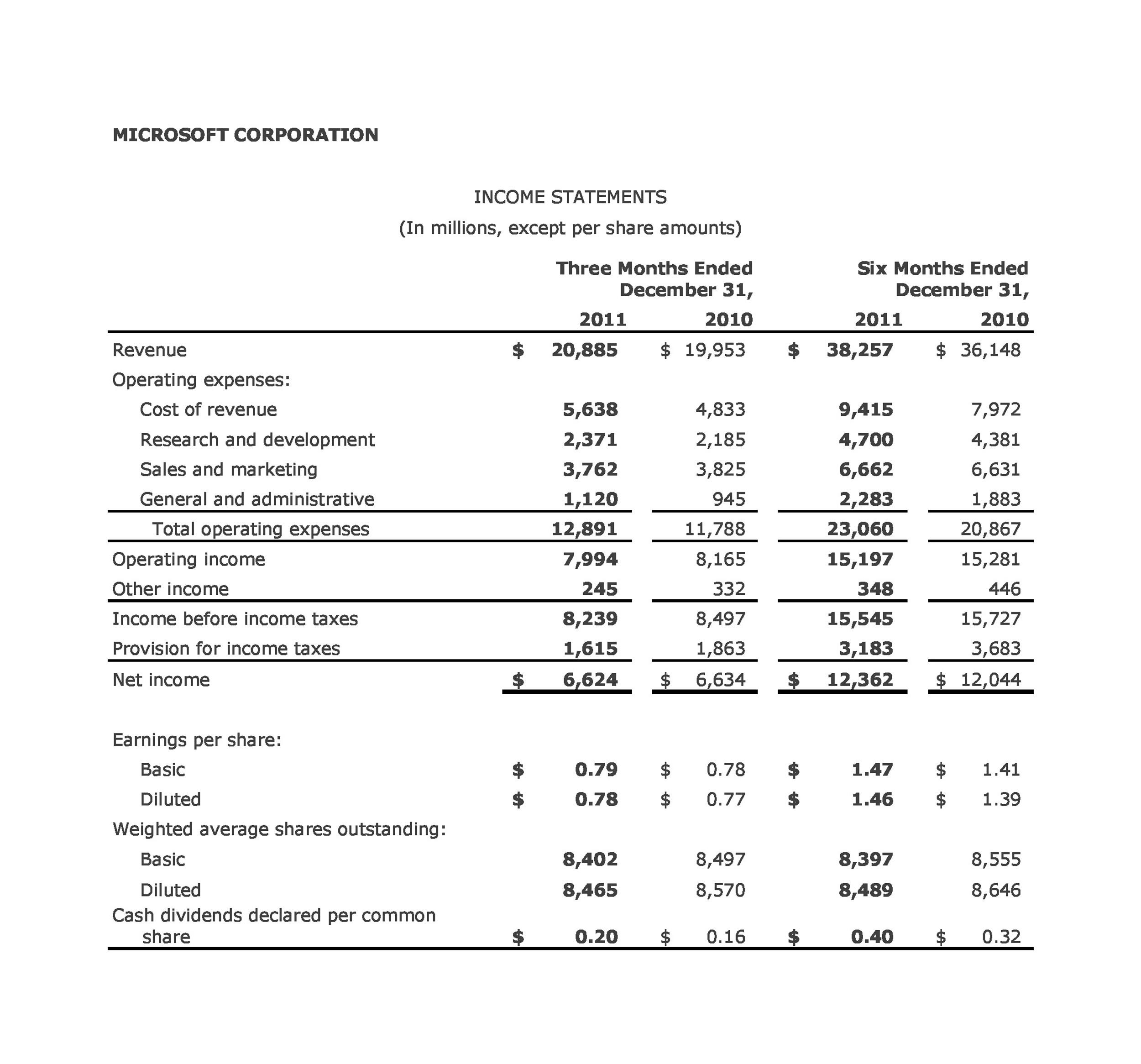

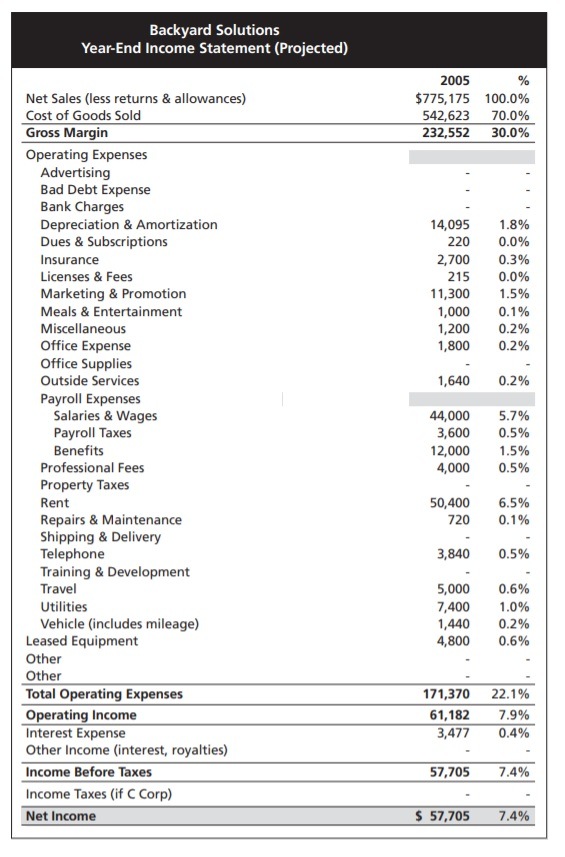

It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

Income statement for new business. Add the total revenue as the top line in your income statement. Income from operations of $652 million; Fallon / afp via getty images.

Revenue, expenses, gains, and losses. The income statement focuses on four key items: A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to.

It answers the question, “how profitable is your business?” It tells the financial story of a business’s operating activities. What is an income statement?

Identify sources of revenue, as well as gains (from investments, for example) identify company expenses and losses incurred over the same period. It shows your revenue, minus your expenses and losses. Use this income statement template to calculate and assess the profit and loss generated by your business over three years.

Lawrence wong, delivered the budget statement for the financial year 2024. Find the income statement function. Shannon stapleton/getty images.

16, 2024 updated 9:59 a.m. An income statement, also called a profit and loss statement, lists a business’s revenues, expenses and overall profit or loss for a specific period of time. An income statement is the financial story of your business—a monthly, quarterly, or annual tally of revenue minus expenses.

Revenue generated from the sale of goods and services; Within an income statement, you’ll find all revenue and expense accounts for a set period. An income statement is also known as a profit and loss statement, profit and loss account.

A private jet takes off from lax in 2023. The income statement calculates the company’s net income or net profit by taking into account its earnings, gains, expenses, and losses over a period. As noted, some accounting software may refer to the income statement as a profit and loss (or p&l) statement, so don’t get confused.

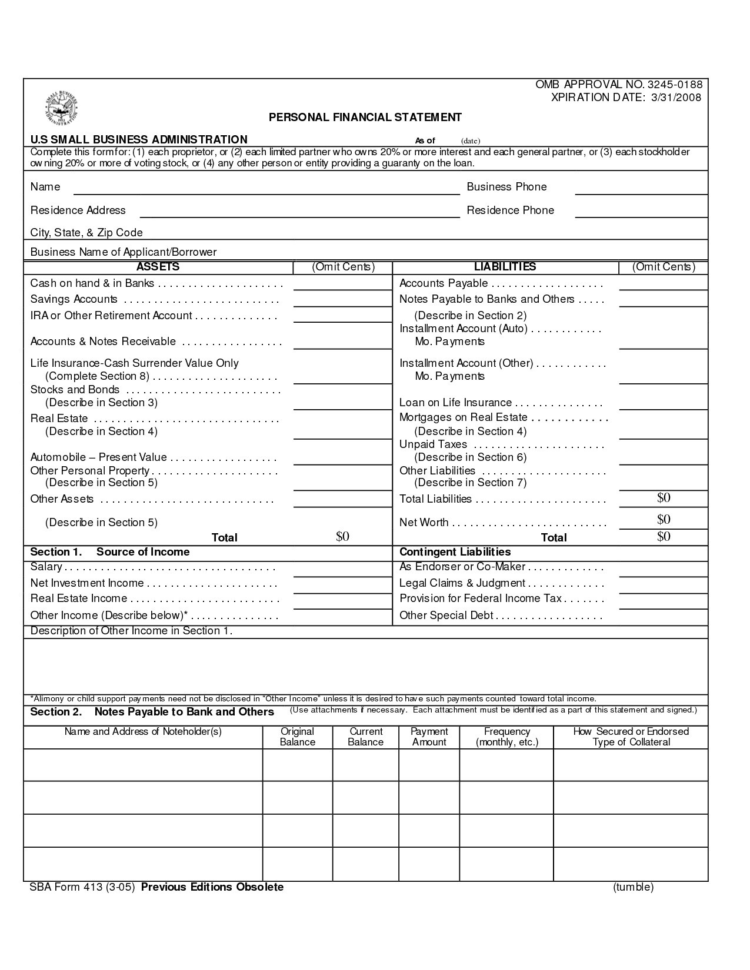

A balance sheet, on the other hand, only lists the fiscal situation on a specific date. Here's what you need to know: An income statement includes a company’s revenue, expenses, gains, losses and profit for a specific accounting period.

This includes all the money earned from business products, services, and revenue streams, even if you haven’t received every payment. The pro forma income statement is a document that is a way to show your company's income if you exclude some costs. An income statement is a document that tracks a business's revenue and expenses over a set period of time.

![Small Business Accounting Guide [StepbyStep]](https://www.deskera.com/blog/content/images/2020/10/income-statement-example.png)

![Complete Guide to Statements [+ examples and templates]](https://www.deskera.com/blog/content/images/2020/06/Screenshot-2020-06-29-at-1.49.31-PM.png)