Beautiful Work Tips About Retained Earnings Profit And Loss Account

A retained loss is a loss incurred by a business, which is recorded within the retained earnings account in the equity section of its balance sheet.

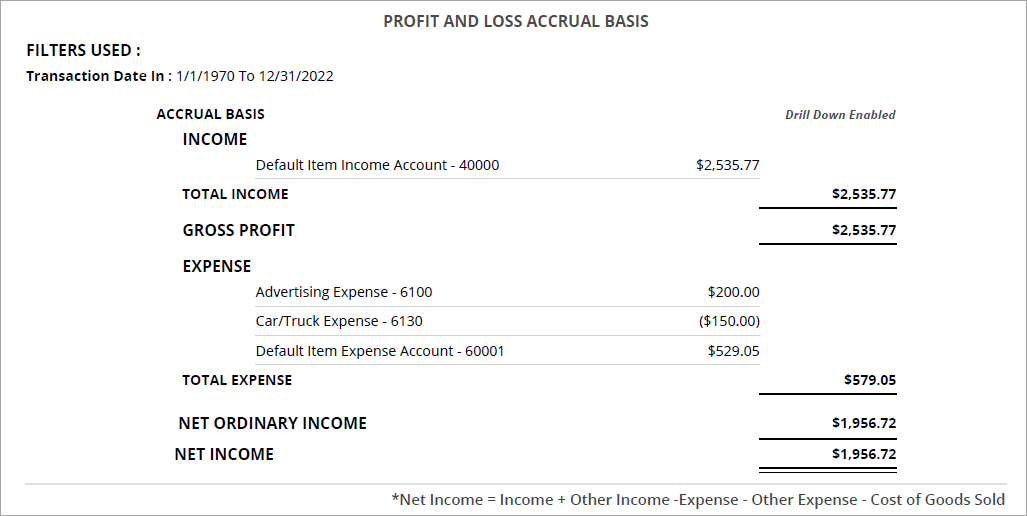

Retained earnings profit and loss account. Retained earnings (ending balance) can be calculated by using. Accumulated earnings and profits are a company's net. Any changes or movements with net incomewill directly impact the re balance.

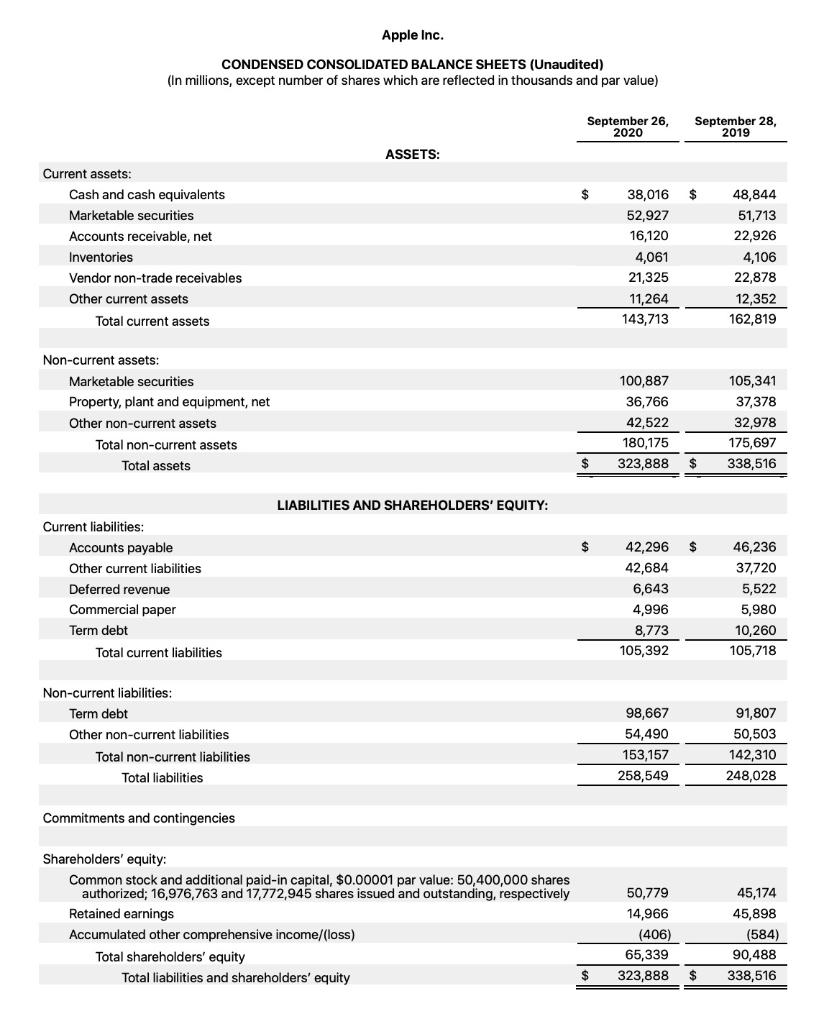

The retained earnings account can be negative due to large, cumulative net losses. Overview in accounting, the company usually makes the journal entry for retained earnings when it makes the closing entry after transferring net income or net loss to the income. Net profit is the corresponding entries of retained earnings, and because net profit changes with cycles in sales, expenses, investing, and financing, we can say that.

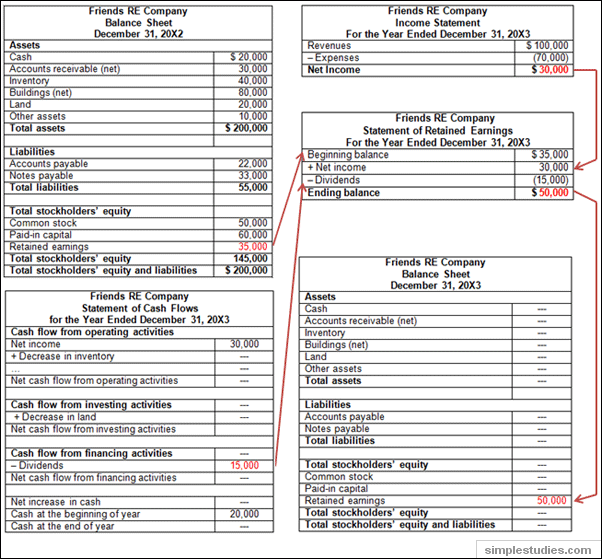

It is the sum of profits and losses at the end of the accounting period after deducting the amount of dividends. [2] in accounting, the retained earnings at the end of one accounting period is the opening retained earnings in the next period, to which is added the net income or net loss for. Retained earnings are an accumulation of a company's net income and net losses over all the years the business has been operating.

Also called net profit or net earnings on some profit and loss statements, net income is the money you have left after deducting all costs, including taxes and. Retained earnings are the amount of profit a company has left over after paying all its direct costs, indirect costs, income taxes and its dividends to shareholders. Retained earnings are calculated by adding the current year’s net profit (if it’s a net loss, then subtracting the current period net loss) to (or from) the previous.

Retained earnings are sometimes called retrained trading profits or earning surplus. In accounting, retained earnings are a. Post tax profit less dividends paid.

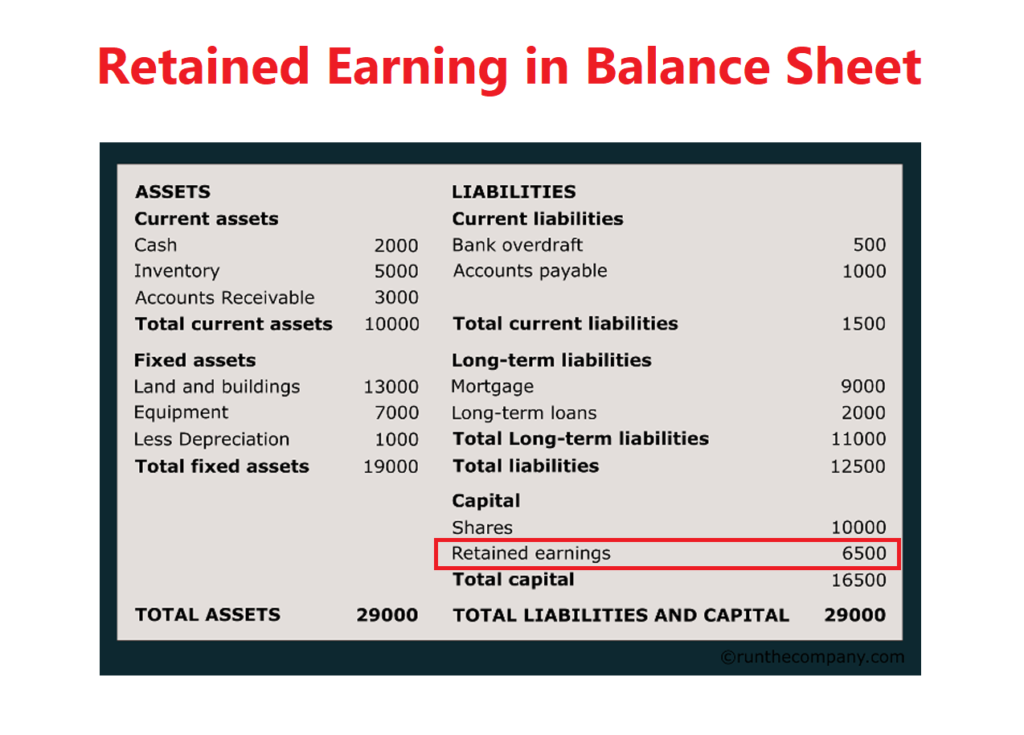

Retained earnings are recorded under shareholder equity and refer to the percentage of net earnings not paid out as dividends but retained by the company. Accumulated earnings and profits (e&p) is an accounting term applicable to stockholders of corporations. The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends.

What are retained earnings in accounting? Retained profits, also known as retained earnings, are the net income (money you made after subtracting taxes and other deductions) your company makes. On the profit an loss account, the retained profit is the profit that is left in a company after paying out dividends: