Sensational Tips About Increase In Payables Cash Flow

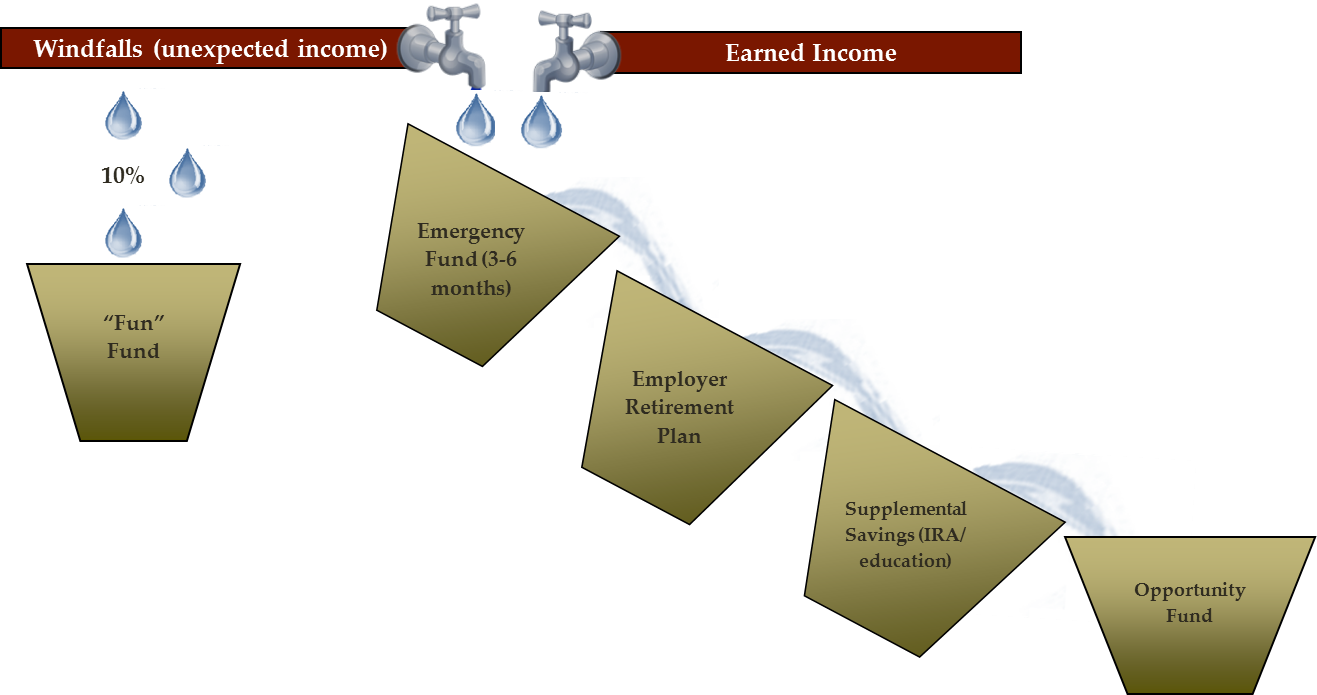

The average payable period is the best indicator of your success in managing your cash outflows.

Increase in payables cash flow. An increase in accounts payable indicates positive cash flow. Accounts payable represent a change in the cash flow on the cash flow statement. Therefore, when a company does not pay its creditors and suppliers, it is keeping cash.

It may help to view the positive amounts on the scf as being favorable or good for a company's cash balance. The reason for this is that ap is actually an accounting term, and this indicates that a company has not immediately spent cash. An increase in accounts payable is a positive adjustment because not paying those bills (which were included in the expenses on the income statement) is good for a company's cash balance.

When a company purchases goods on account, it does not immediately expend cash. Even though accounts payable is a liability on your income statement, since the payment has yet to be made, an increase in accounts payable means an increase in available cash flow for that accounting period. Decrease in trade payables ( 1,740) cash generated from.

Using your payable period to slow down outflows can significantly improve your cash flow. Our case study shows you how to calculate your average payable period. The reason for this comes from the accounting nature of accounts payable.

Increase in trade and other receivables ( 500) decrease in inventories. Investment income ( 500) interest expense. Cash flows from operating activities.

The answer might seem counterintuitive, but an increase in accounts payable actually leads to a positive cash flow. Management may choose to pay its outstanding bills as close to their due dates as possible in order. Exercise calculating the payments to buy ppe

How does a decrease in accounts payable affect cash flow?

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)