Awe-Inspiring Examples Of Info About Purpose Of Preparing Cash Budget

:max_bytes(150000):strip_icc()/cashbudget-resized-1e57d018a48848828a0d06e7ca92dbf5.jpg)

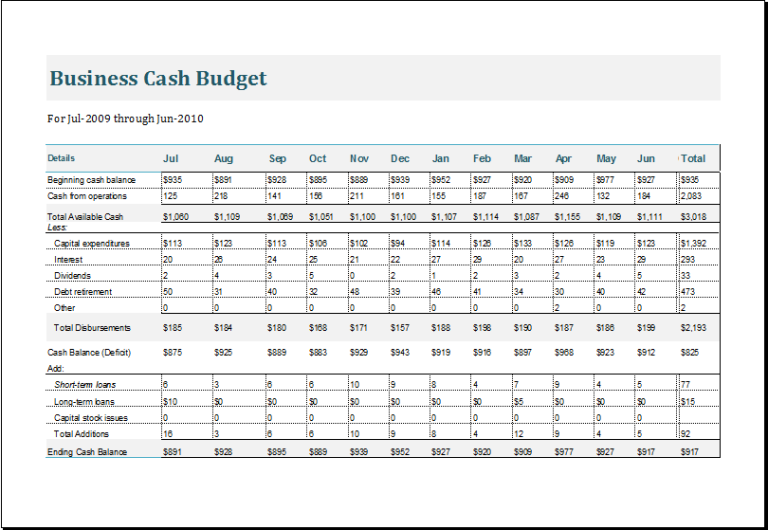

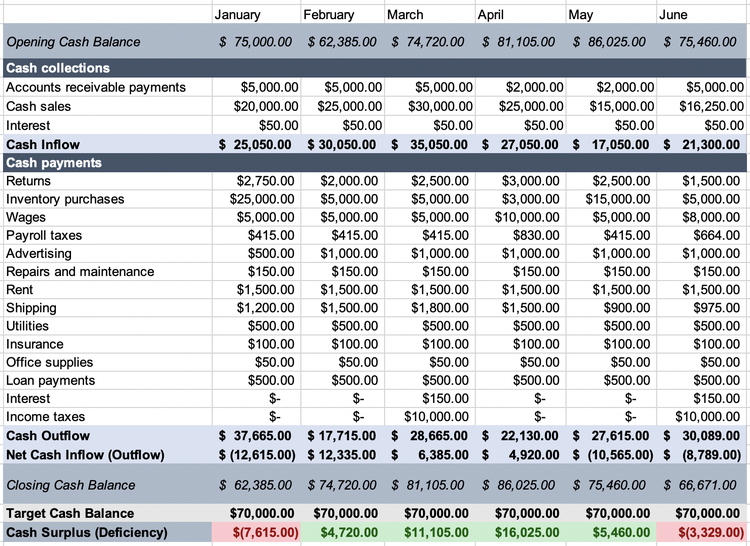

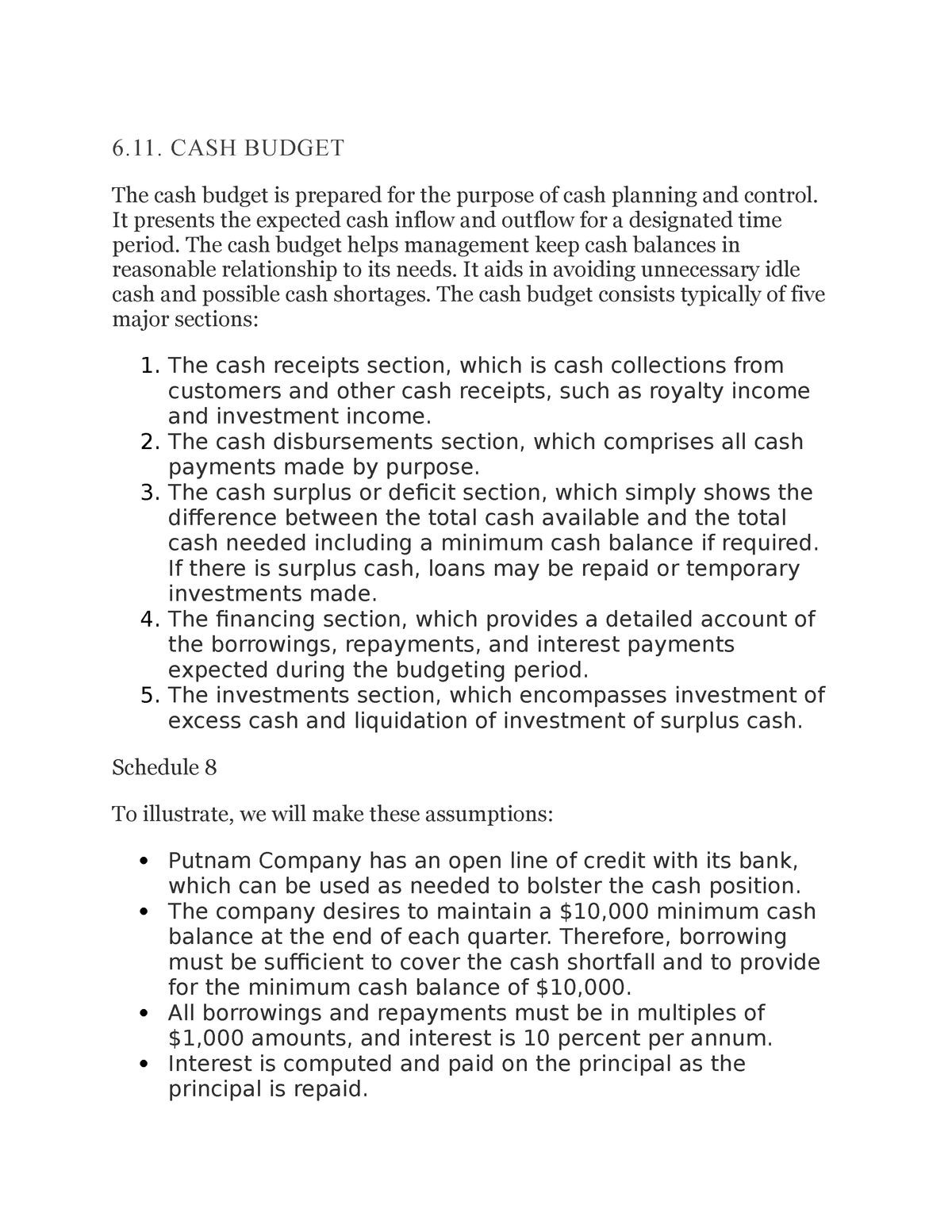

A cash budget is a document that estimates a business' cash flows over certain periods, such as weekly, monthly or annually.

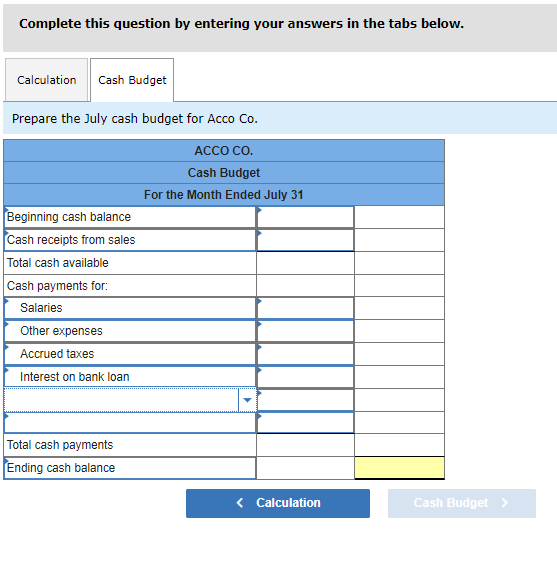

Purpose of preparing cash budget. But, this budget is prepared after the preparation of all other. Second, the receipts from sales are entered on the. The other name of cash budget is finance budget.

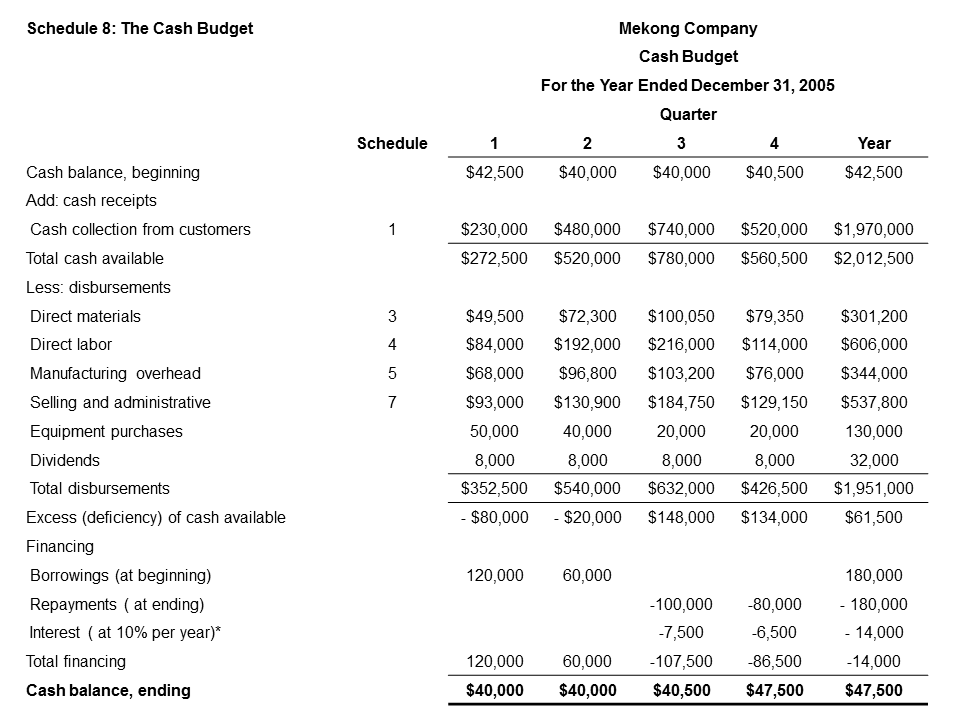

The cash budget is prepared in the following way: The cash budget provides a company insight. Explanation the cash budget is a type of budget that estimates cash inflows and the use of cash during a specific period.

By matas pranckevicius content manager, relay jul 26, 2022 most small business owners know they need to stick to a budget, but many don’t know where to. What is the main purpose of preparing a cash budget? Secondly it helps in evading possible cash shortages and idle cash, thirdly it assist management in.

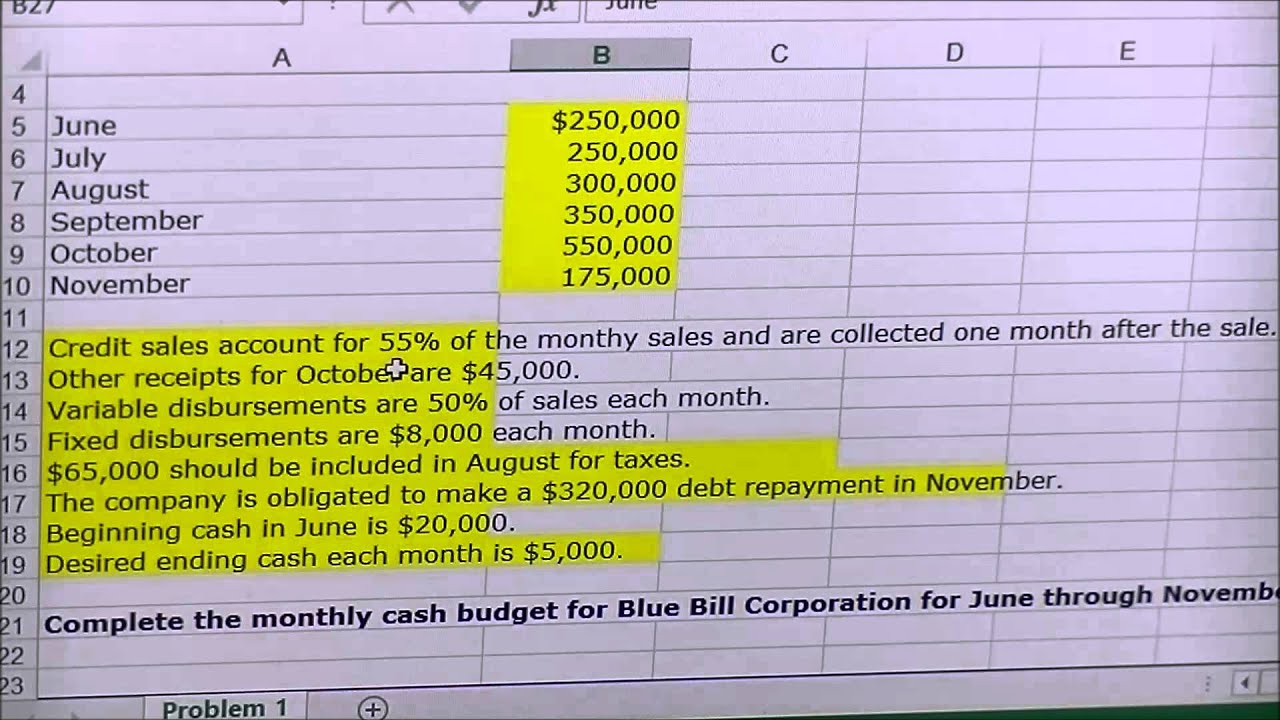

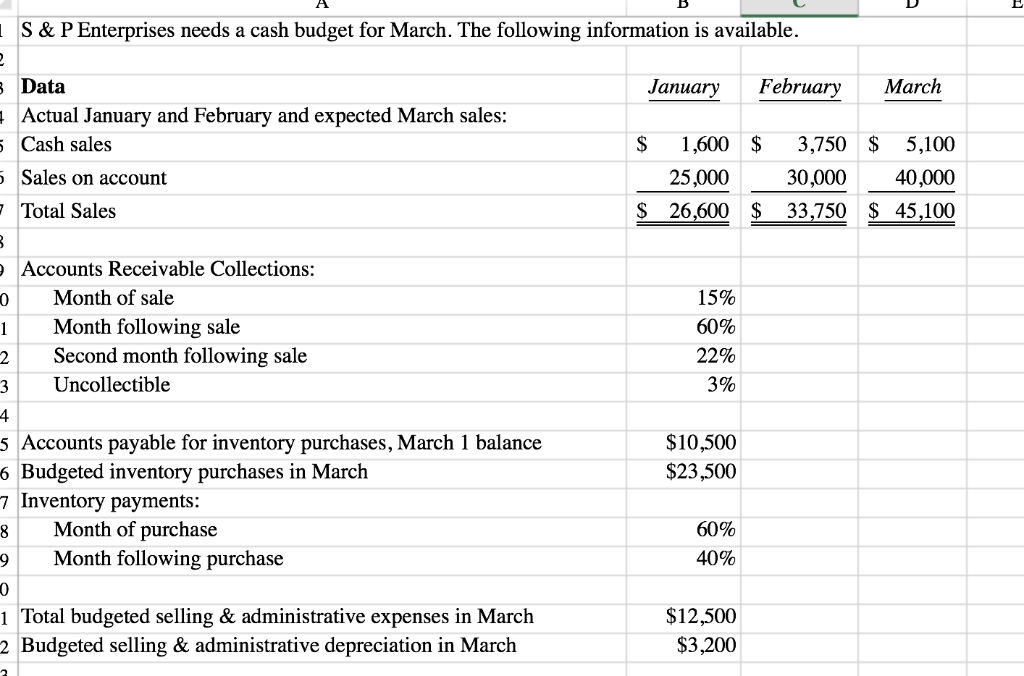

The preparation of a cash budget involves the following steps: Your business can use a cash budget to determine whether it has sufficient cash to continue operating over the given. Three methods of preparing a cash budget are outlined below:

Its primary purpose is to provide the status of the company’s cash position at any point of time. The cash budget determines firm’s ability settling its liabilities and expenses. Cash budget is an extremely important tool available in the hands of a finance manager for planning fund requirements and for controlling cash position in the firm.

The cash budget allows management to predict short falls in the company’s cash balance and correct the problems before payments are due. First, the capital invested is entered as a receipt in month 1. This budget is used to assess whether the entity has sufficient cash to continue operating over the given time frame.

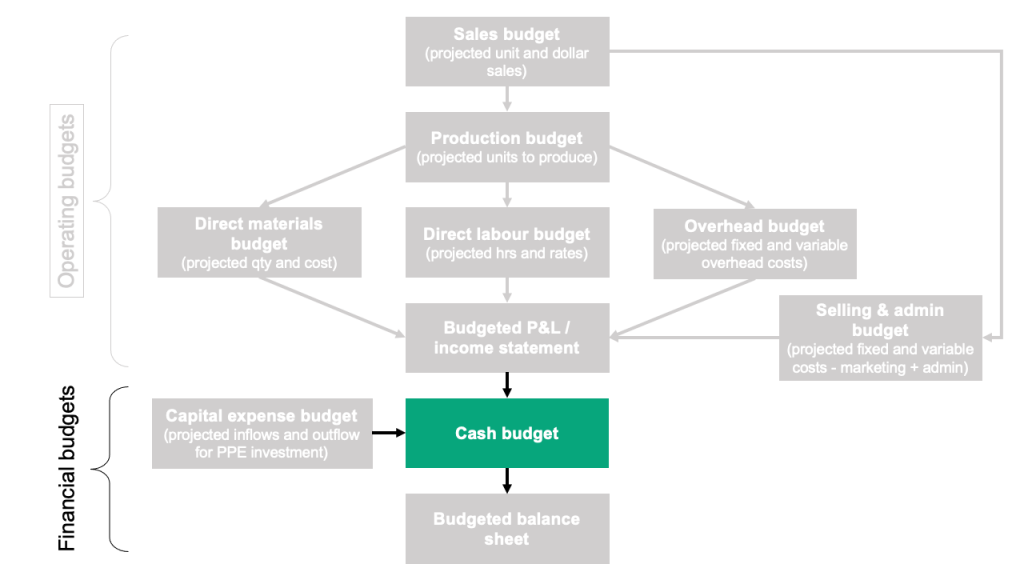

Preparing a cash budget has a. A business creates a cash budget as part of the company’s master budget. Cash receipts we can prepare the cash receipts schedule based on how the company expects to collect on sales.

The master budget encompasses the complete budgeting process, including creating a. This budget is the most important of all the functional budgets. We know, from past experience, how.

A cash budget is an estimation of the cash flowsof a business over a specific period of time. this could be for a weekly, monthly, quarterly, or annual budget. This helps the company make critical decisions such as creating. The primary purpose of a cash budget, also known as a cash flow projection, is to help you plan and strategize to be able to cover upcoming expenses.

Receipt and payment method adjusted profit and loss method balance sheet method receipt and.