Formidable Info About Pro Forma Equity

There are four main types of pro forma statements.

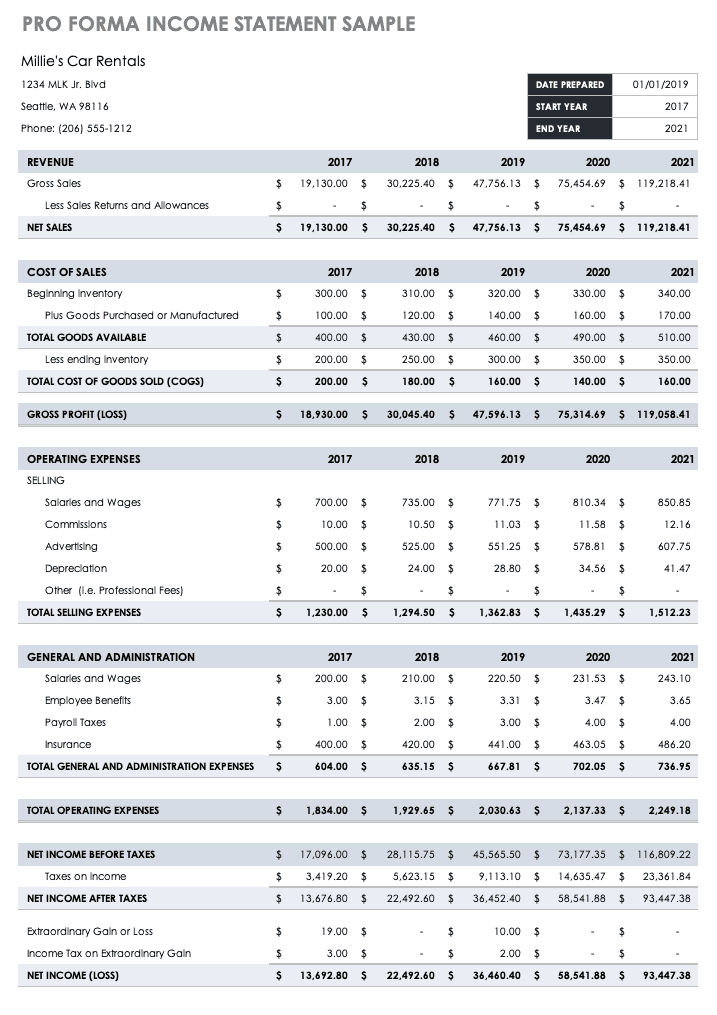

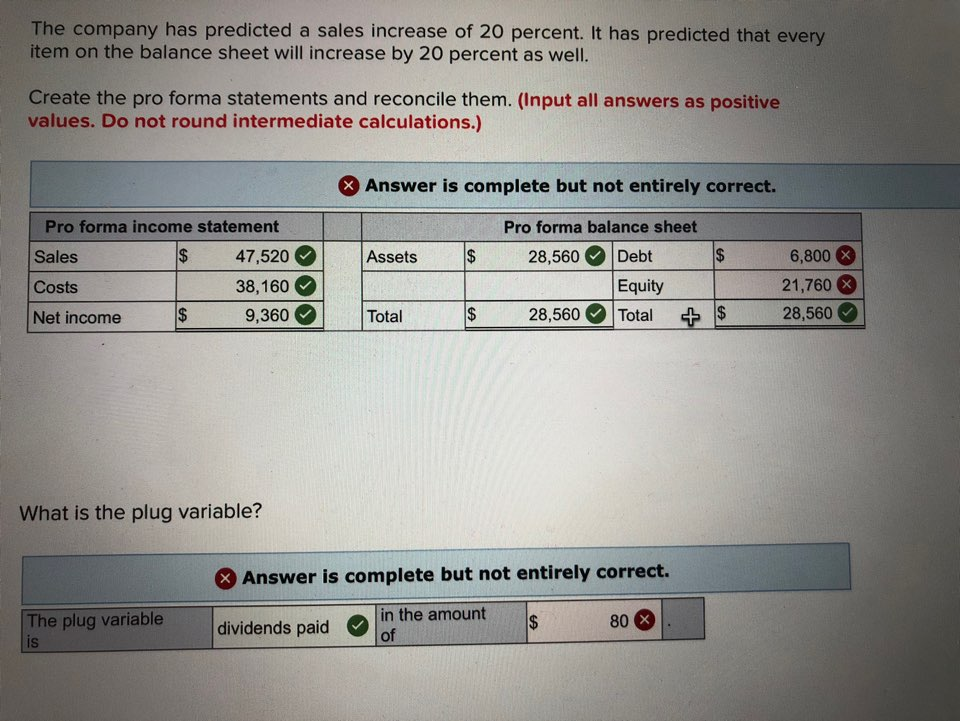

Pro forma equity. Consequently, pro forma statements summarize the projected future status of a company, based on. There are three main documents in pro forma financial statements: A pro forma is a set of financial statements that predicts the expected future performance of a company.

Additionally, if a recapitalization transaction is determined to be more akin to the repurchase of equity interests through the issuance of new equity interests, and afforded prospective treatment in the eps computation (as discussed in fsp 7.6.4), pro forma eps giving effect to the exchange should be presented for the latest year and interim period. Pro forma is the sum of all earnings divided by all shares outstanding to get pro forma eps. 1 overview we are pleased to present this publication, pro forma financial information:

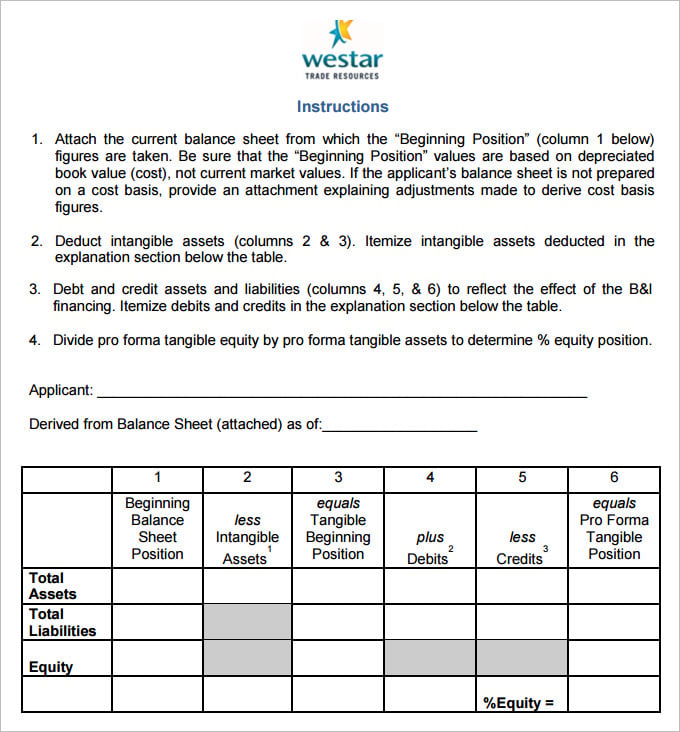

A pro forma uses hypothetical data or other assumptions about a company’s future values, such as revenue and expenses, to forecast future financial performance, especially future growth. Pro forma financial information (pro formas) presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an earlier time. Pro forma is latin for “as a matter of” or “for the sake of form.” it is used primarily in reference to the presentation of information in a formal way, assuming or forecasting pieces of information that may be unavailable.

Pro forma equity means the new common units to be issued under the sample 1 based on 1 documents examples of pro forma equity in a sentence for so long as solus owns (directly or indirectly) at least 8% of the pro forma equity, solus shall be entitled to designate one individual to serve on the new holdco board. What does pro forma mean? In the online course financial accounting , pro forma financial statements are defined as “financial statements forecasted for future periods.

A simple agreement for equity, or safe, is an agreement for equity when a future round is raised, usually a series a. Pro forma eps = (acquirer’s net income + target’s net income)/(acquirer’s shares outstanding + new shares issued) = (6,000+3,000)/(3,000+700) It evaluates the current ownership structure and predicts the.

Types of pro forma statement. The pro forma models the anticipated results of the transaction, with particular emphasis on the projected cash flows, net revenues and taxes. In this ongoing series, a number of different m&a experts from the global offices of rödl & partner present an important term from the specialist language of the mergers and acquisitions world, combined with some comments on how it is used.

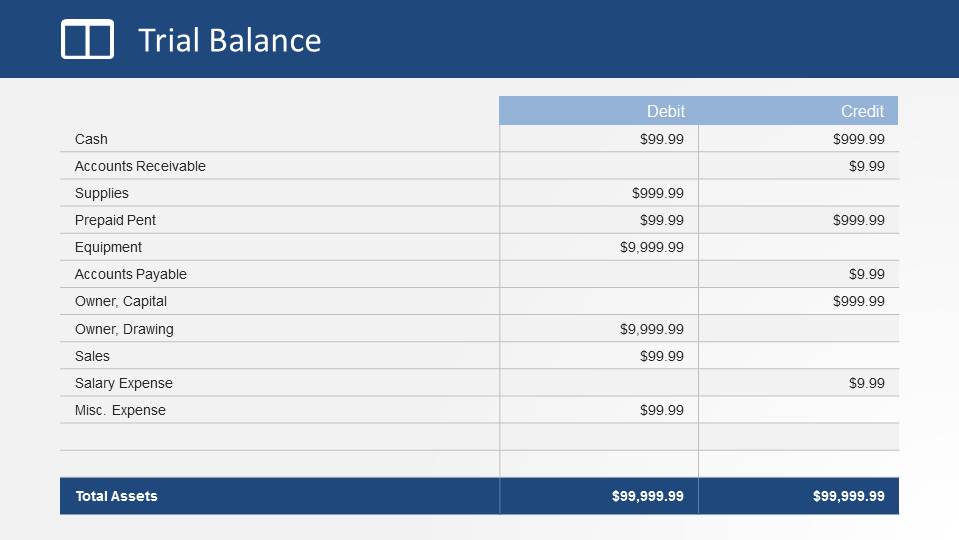

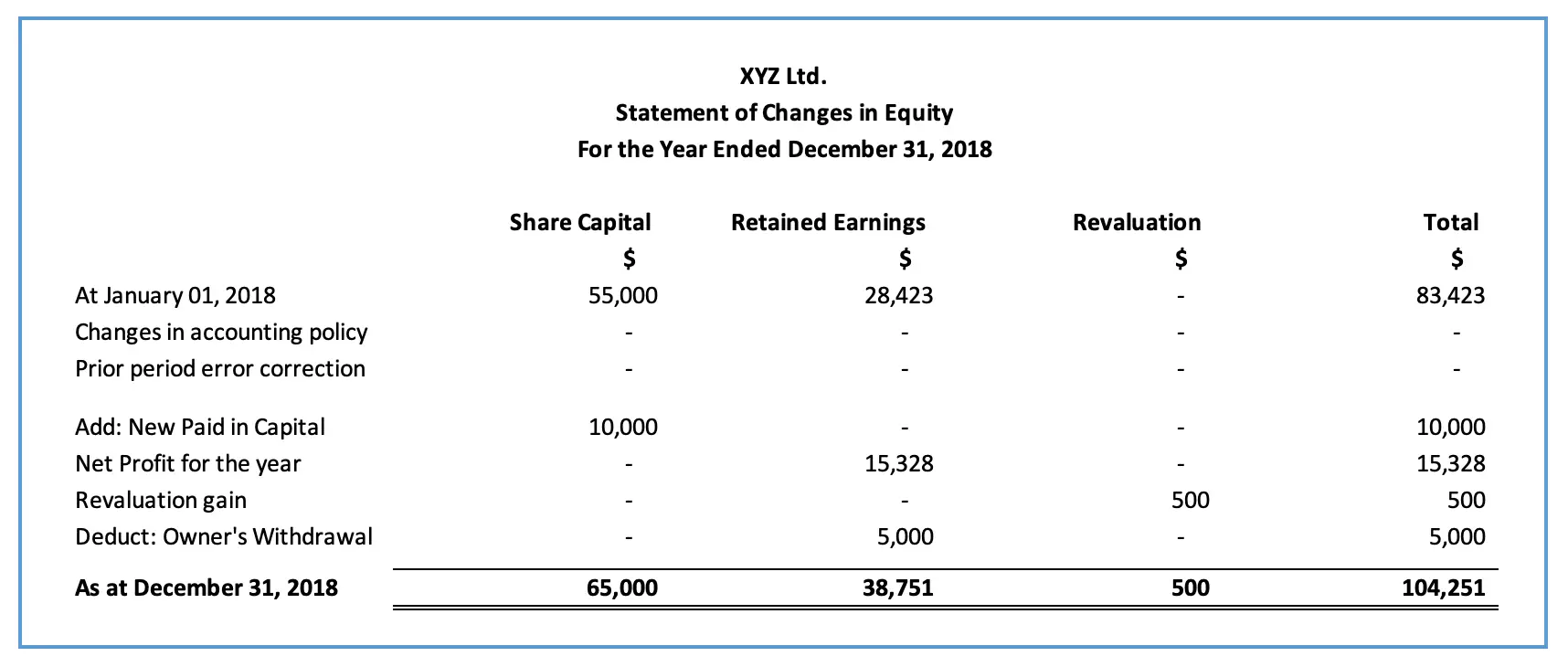

Pro forma financials may not be. A pro forma financial statement leverages hypothetical data or assumptions about future values to project performance over a period that hasn’t yet occurred. Of the four main financial statements, only the statement of changes in equity is not used in pro forma.

Equity financing involves issuing stock to investors in exchange for a portion of company profits. Hence they should be an integral part of any business plan. A pro forma cap table is a fundamental instrument that allows investors and entrepreneurs to envision the future ownership structure of a business after an investment round or other equity event.

Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. 8 pro forma fy2023 revenue, based on orica’s audited consolidated financial statements for the year ended 30 september 2023, and terra insights and cyanco management reported. While they all fall into the same categories—income statement, balance sheet, and cash flow statement—they differ based on the purpose of the financial forecast.

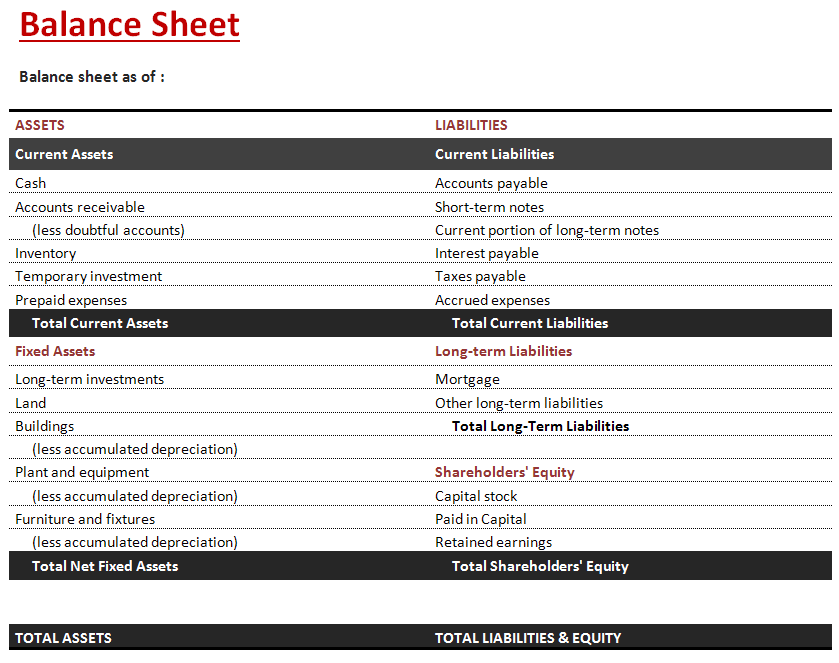

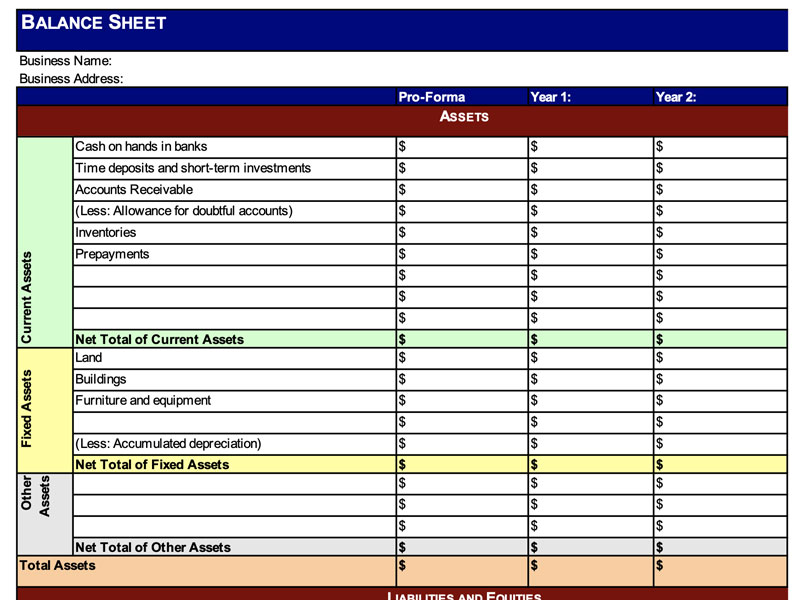

A pro forma balance sheet, along with a and a are the basic financial projections for a business. Growing just for the sake of growing doesn’t always yield favorable income for the firm. Balance sheets, income statements, and statements of cash flow.