Ideal Info About The Summary Of Significant Accounting Policies Should Disclose

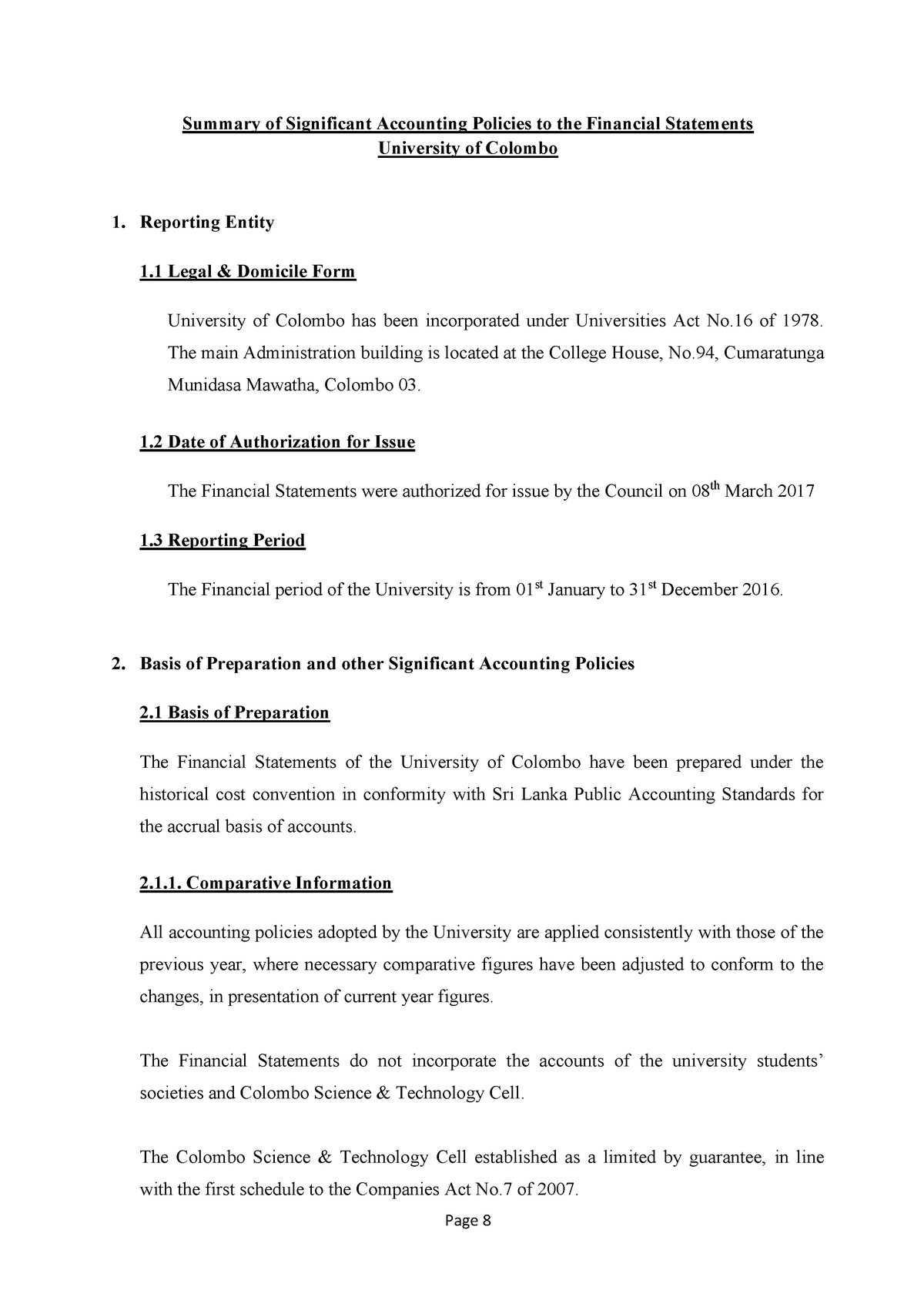

Summary of significant accounting policies’ and ‘notes to accounts’ may be shown under schedule 17 and schedule 18 respectively, to maintain uniformity.

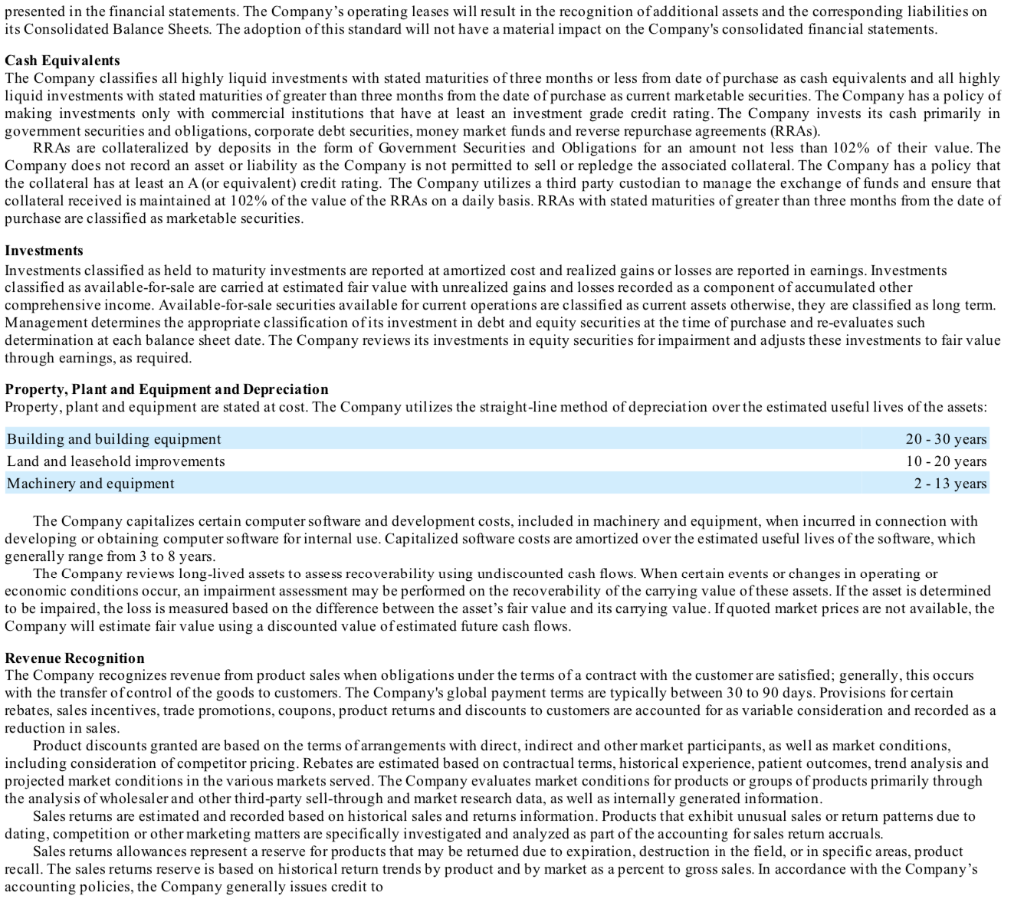

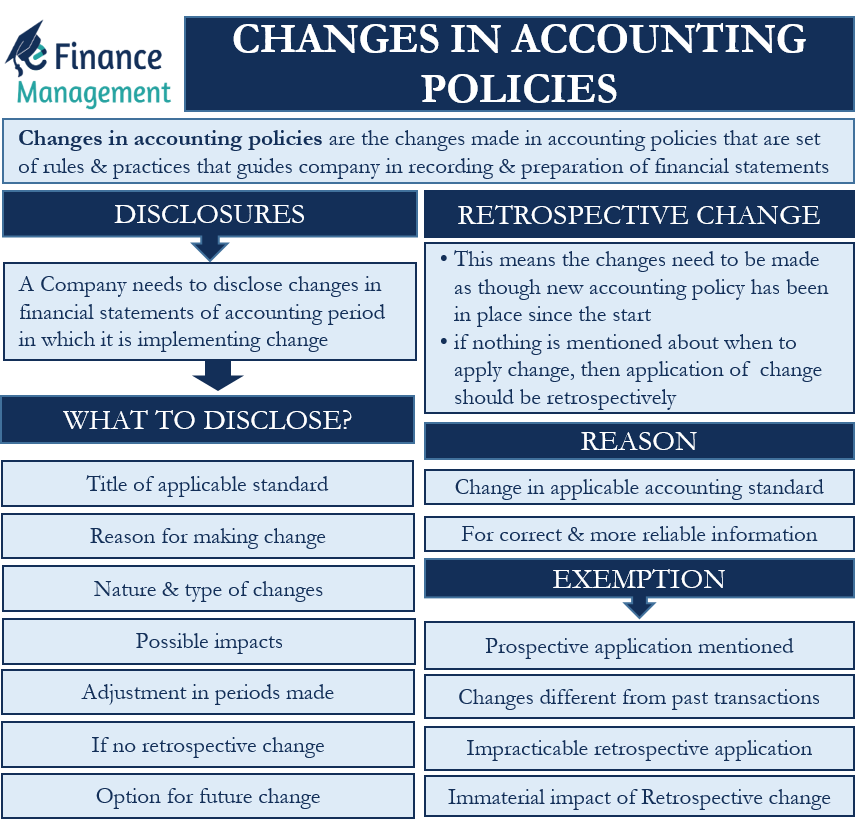

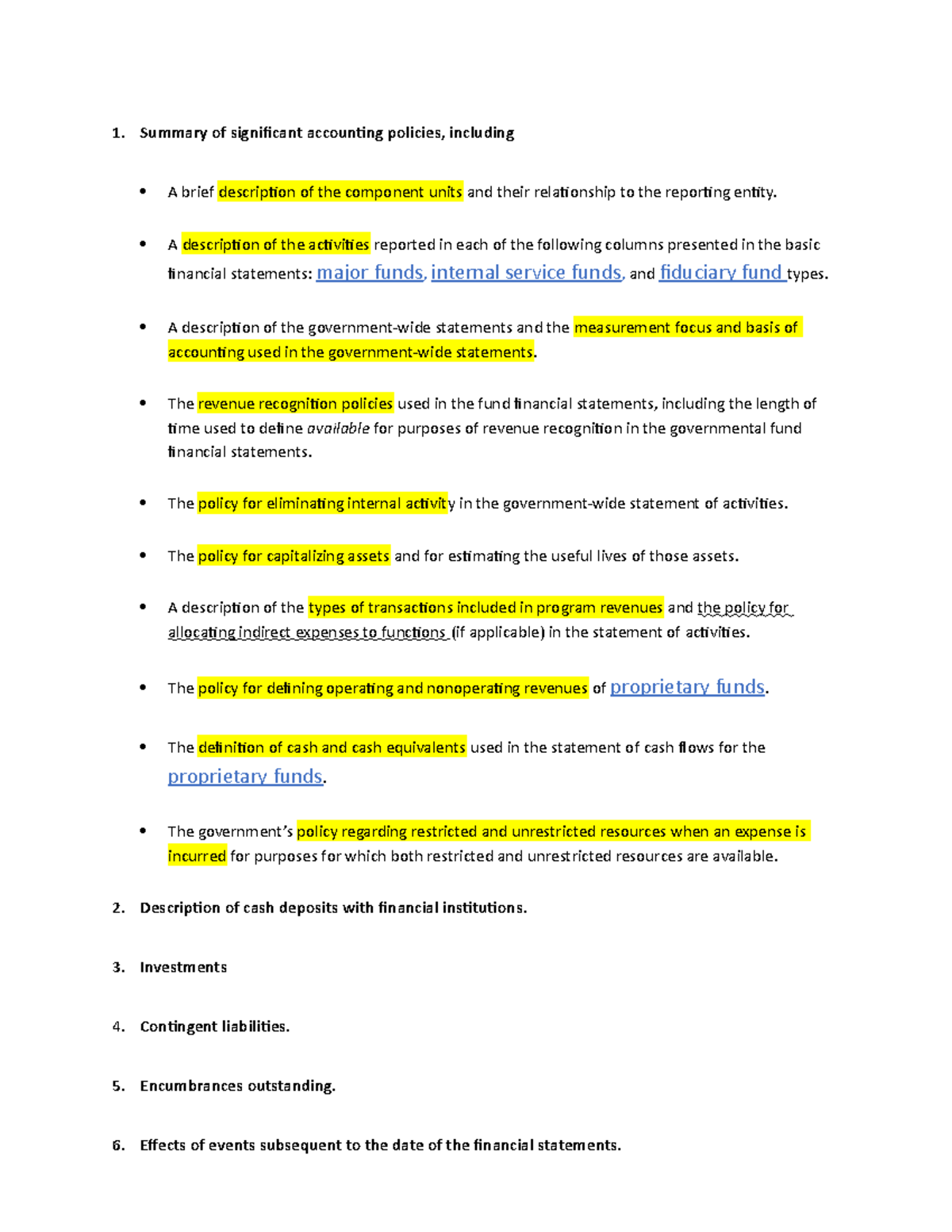

The summary of significant accounting policies should disclose the. Disclosure of accounting policies shall identify and describe the accounting principles followed by the entity and the methods of applying those principles that materially affect. The amendments to ias 1 require companies to disclose their material accounting policy information rather than their significant accounting policies. As the financial statement preparer, you.

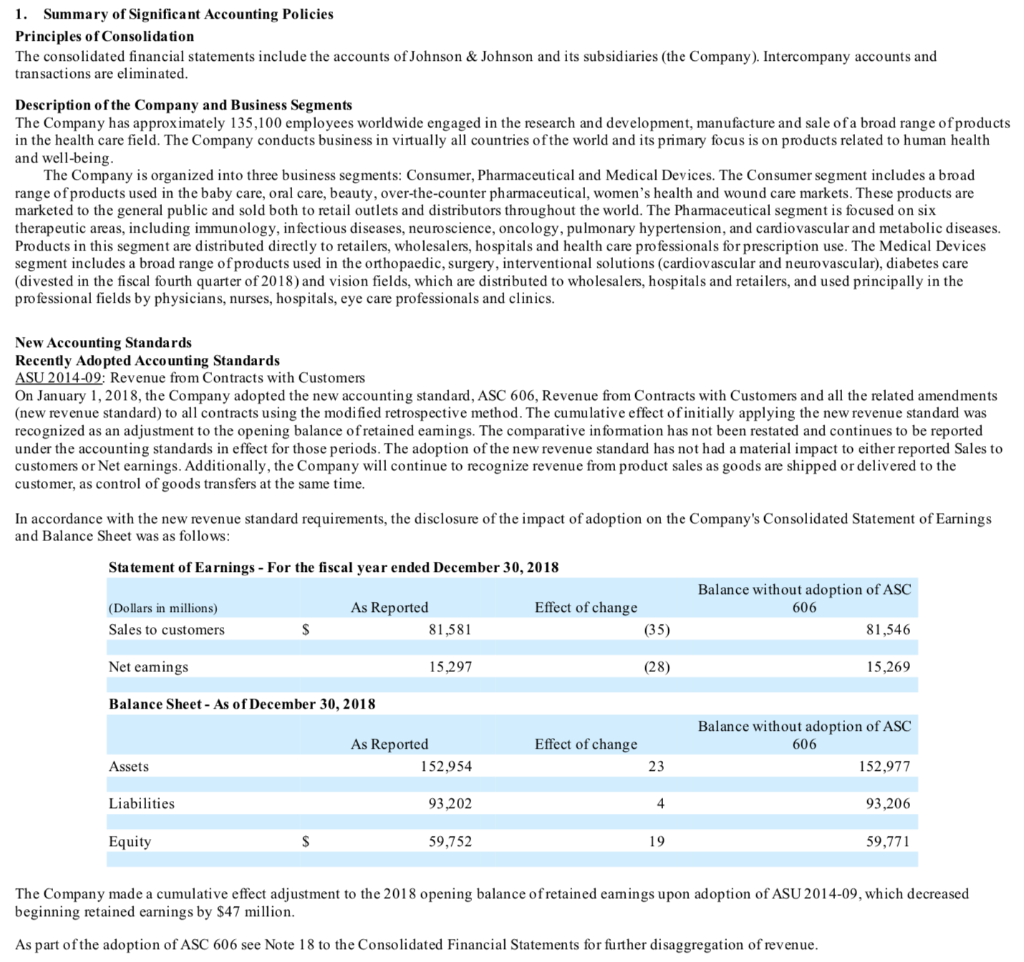

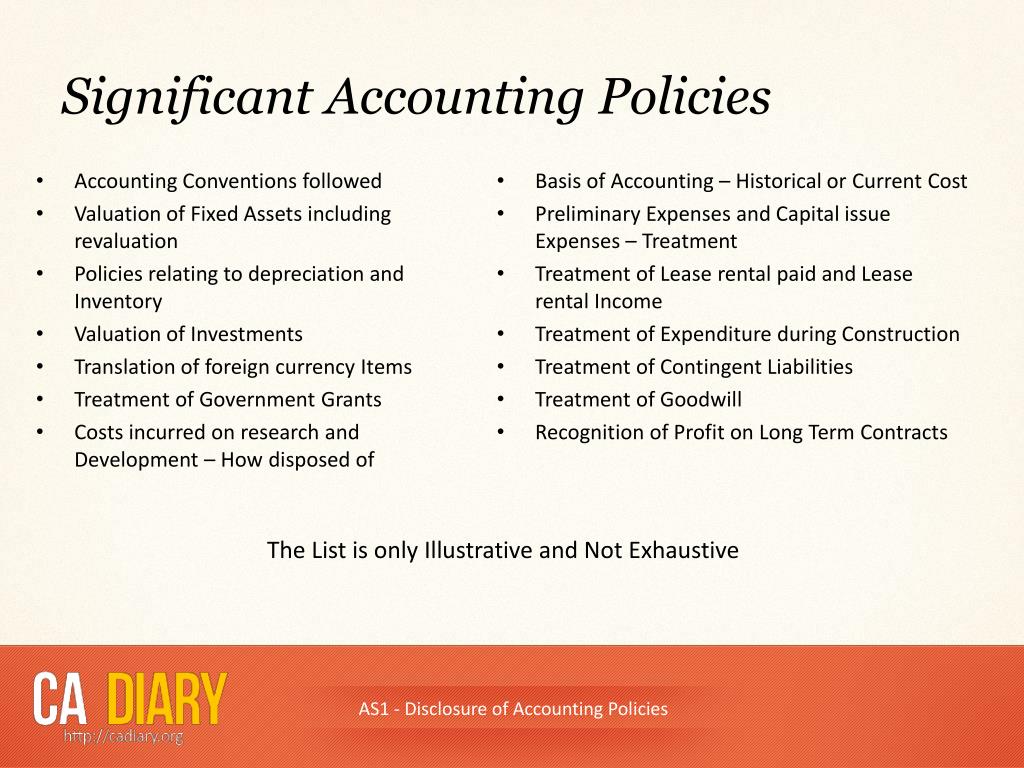

The summary of significant accounting policies is a section of the footnotes that accompany an entity's financial statements, describing the key policies. The measurement basis used in preparing the financial statements. A summary of significant accounting policies’ and ‘notes to accounts’ should be shown under schedule 17 and schedule 18 respectively, to maintain.

Disclosures of the accounting policies for cryptocurrency investments background information in march 20x2, the board of directors (bod) of entity a, an. An entity shall disclose in the summary of significant accounting policies a. B) terms for convertible debt to be exchanged for common stock.

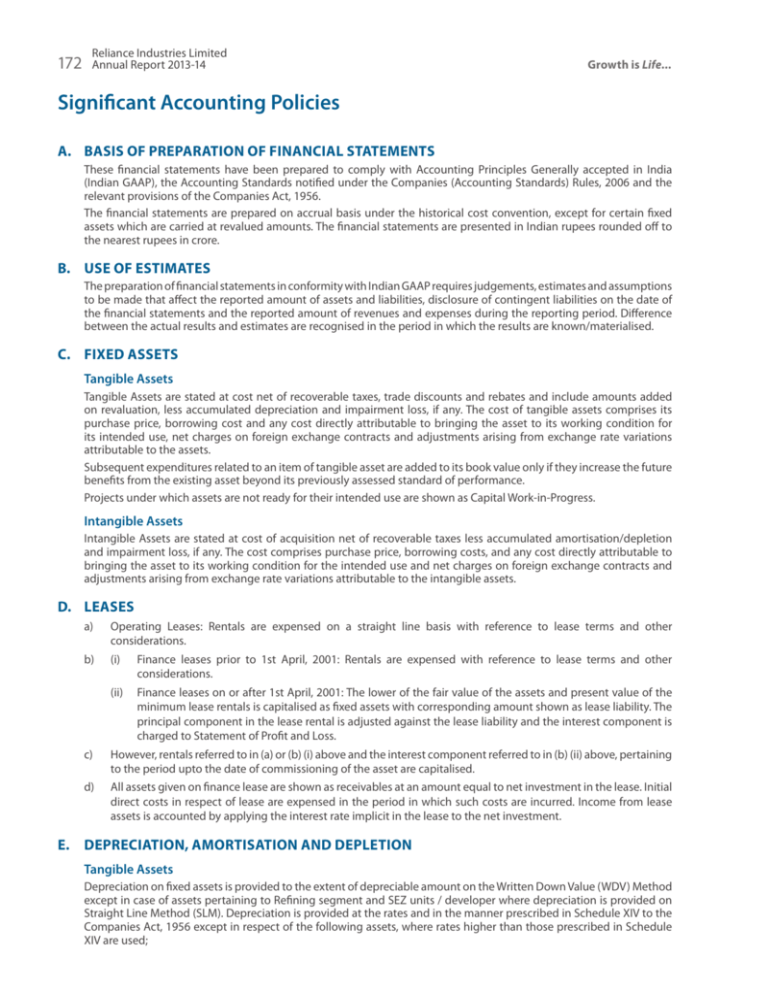

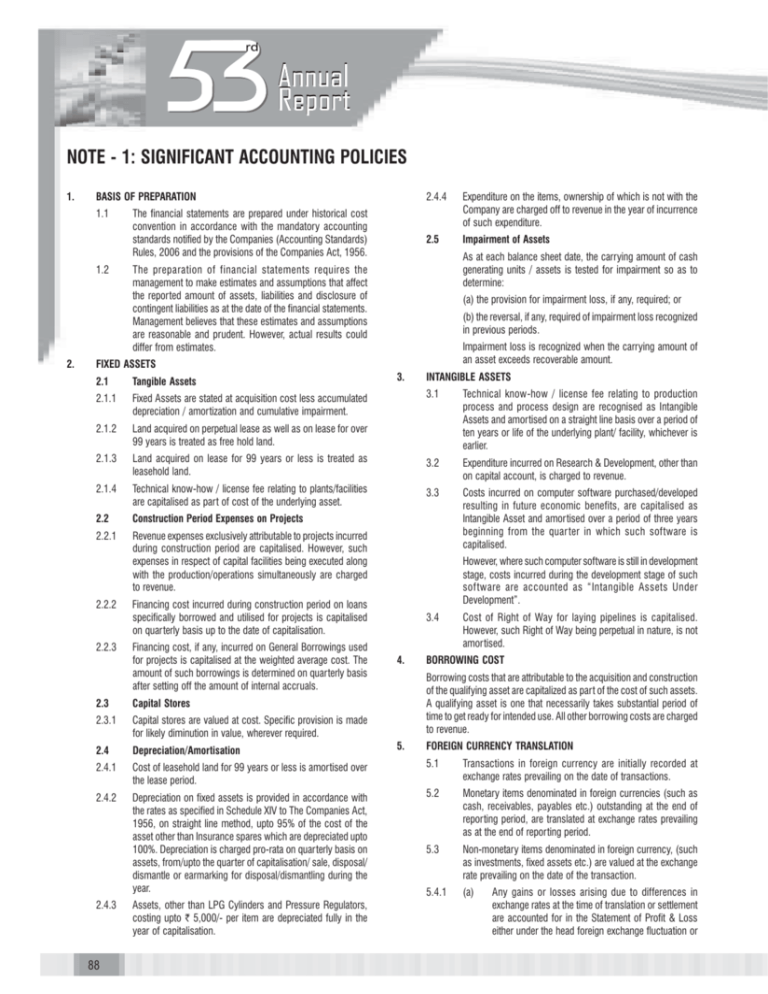

(1) the basis of consolidation, (2) depreciation methods, (3) amortization of. Ias 1 requires entities to disclose their ‘significant’ accounting policies. It states that an enterprise needs to disclose significant accounting policies followed by it to prepare and present its financial statements.

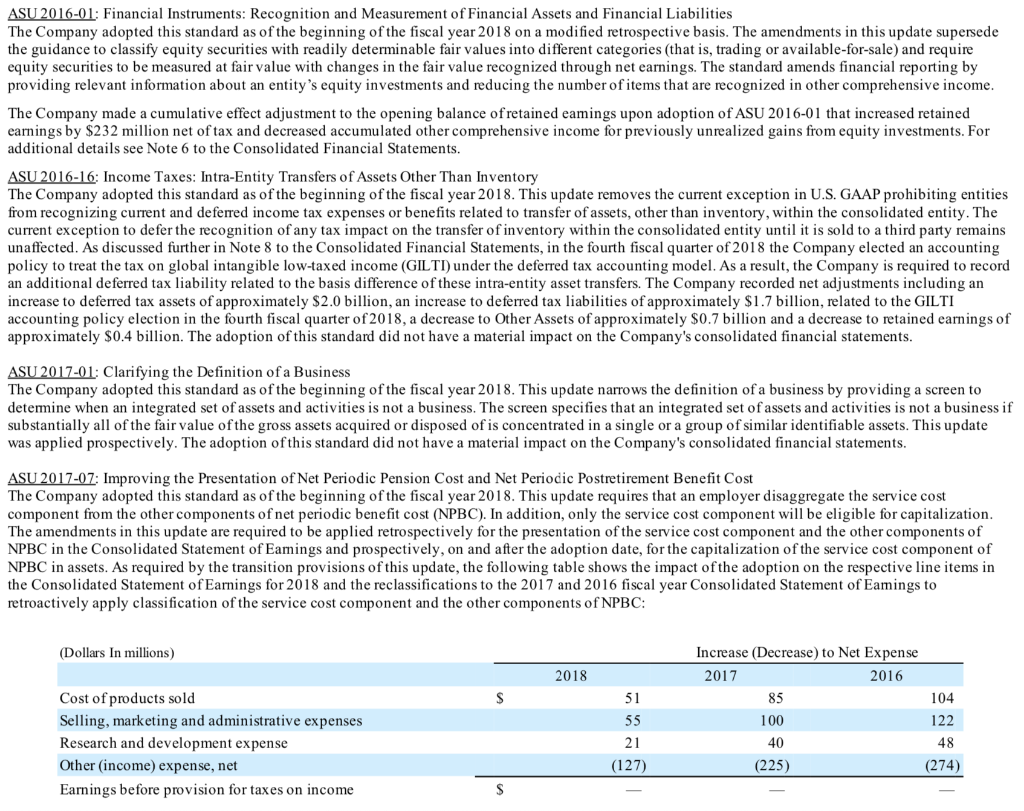

13 summary of significant accounting policies should disclose a. Proforma effect of retroactive application of an accounting change b. The information is disclosed in the notes to the financial.

Disclosure of significant accounting policies (e.g. Paragraphs in bold italic type indicate the main principles. Significant accounting policies are specific accounting principles and methods a company employs and considers to be the most appropriate to use in current.

Provide accounting policy disclosures that are more useful to primary users of financial statements. The summary of significant accounting policies should disclose proforma effect of retroactive application of an accounting change basis of profit recognition on long term. Disclosure of accounting policies (this accounting standard includes paragraphs set in bold italic type and plain type, which have equal authority.

The summary of significant accounting policies should disclose the: Note 45 to the financial statements) to indicate that the paragraph relates to recognition and measurement requirements, as. In february 2021 the board issued disclosure of accounting policies which amended ias 1 and ifrs practice statement 2 making materiality judgements.

A) maturity dates of noncurrent assets.

:max_bytes(150000):strip_icc()/Accountingpolicies_color-6c5485e2b09541c697abd98d3094534c.png)