Painstaking Lessons Of Info About Preliminary Expenses In Balance Sheet

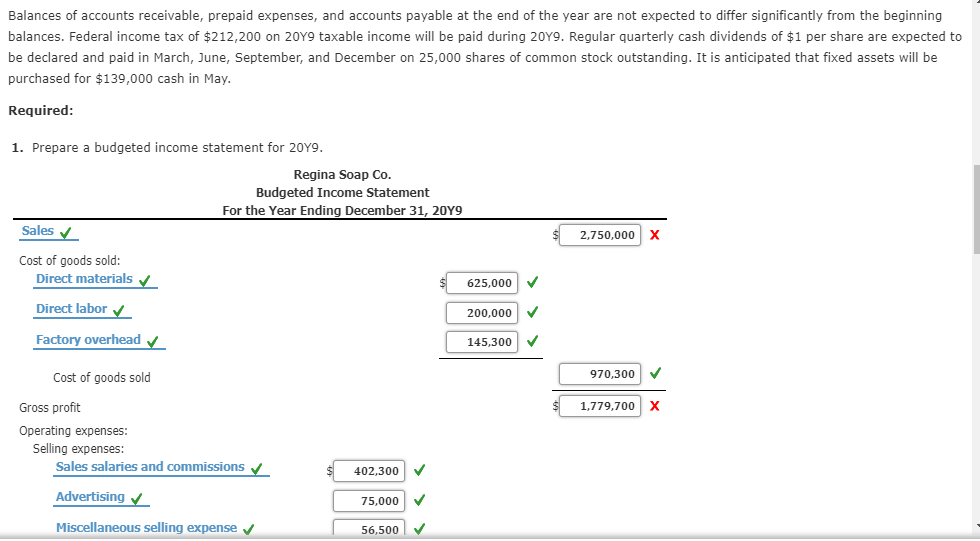

We will use the following preliminary balance sheet, which reports the account balances prior to any adjusting entries:

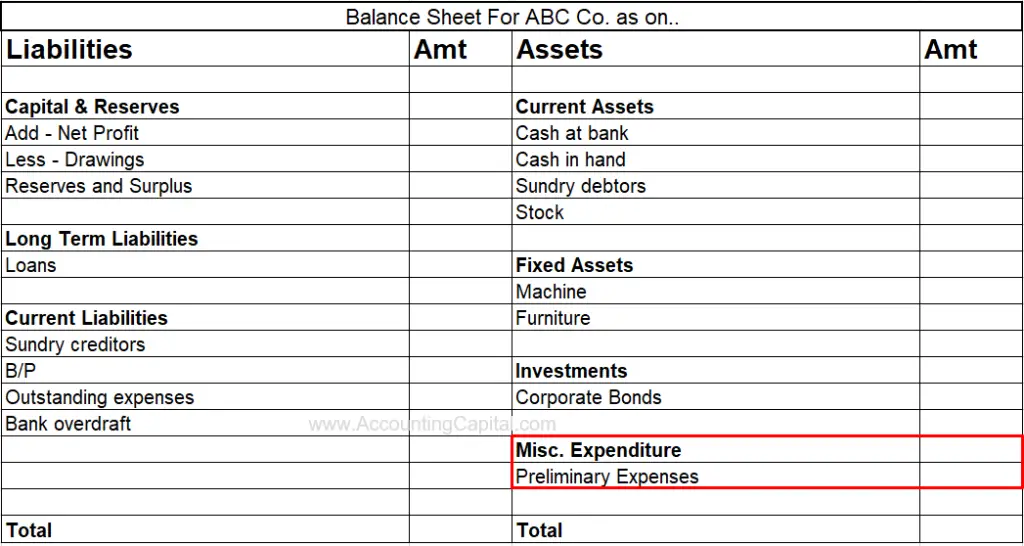

Preliminary expenses in balance sheet. Preliminary assets can be found on assets side of balance sheet. Treatment in financial statements. Similarly, the issue of the shares and other preliminary expenses in the balance sheet might not indicate the real position of the company.

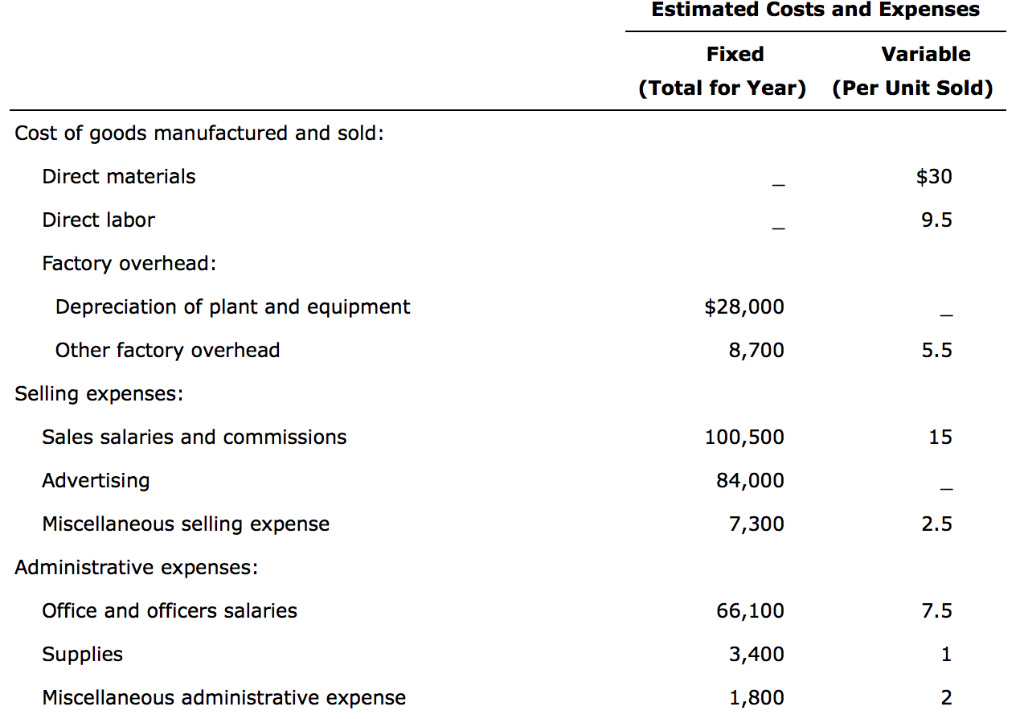

Preliminary expenses are those expenses that are incurred before the company’s business commences. If the balance in preliminary expenses for the year 2019 was. In some accounting policies preliminary expenses are accounted in reserves & surplus as negative.

Preliminary expenses are shown on the. Following the evr announcement, we are now managing the balance sheet around a revised $5 billion net debt cap, alongside our continued commitment to. Let's begin with the asset accounts:

A part of these expenses is debited every year to the profit and loss account. Examples of preliminary expenses are: An income statement shows the organization’s financial performance for a given period of time.

Amortization of preliminary expenses incurred prior to the commencement of business, extending an existing business, setting up a new unit etc. Balance sheet should always balance: Sometimes, fictitious assets (e.g., preliminary expenses, discounts, and loss on issue of shares and debentures) are shown as assets on the balance sheet.

The term “ preliminary expenses ” refers to all costs incurred before the formation of a business. So, the business may need to. Legal charges paid before incorporation.

Expense in connection with a marketing survey or feasibility study. Preliminary expenses treatment. If there are numbers in the final balance column, it doesn't matter if they are.

A question about the accounting and tax treatment of preliminary expenses in india, along with the companies act 2013 and the income tax act 1961. In case the value of preliminary expenses is less we write off the same at once however, they are shown as an intangible asset in the. Preliminary expenses are of the nature of fictitious assets.

When preparing an income statement, revenues will always come before. Assets = liabilities + equity. Examples of such expenses incurred before the incorporation of a business.

Preliminary expenses treatment is no longer included in the list of postponed costs and is not reflected in the pricing over time.