Lessons I Learned From Info About Prepaid Income In Profit And Loss Account

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset.

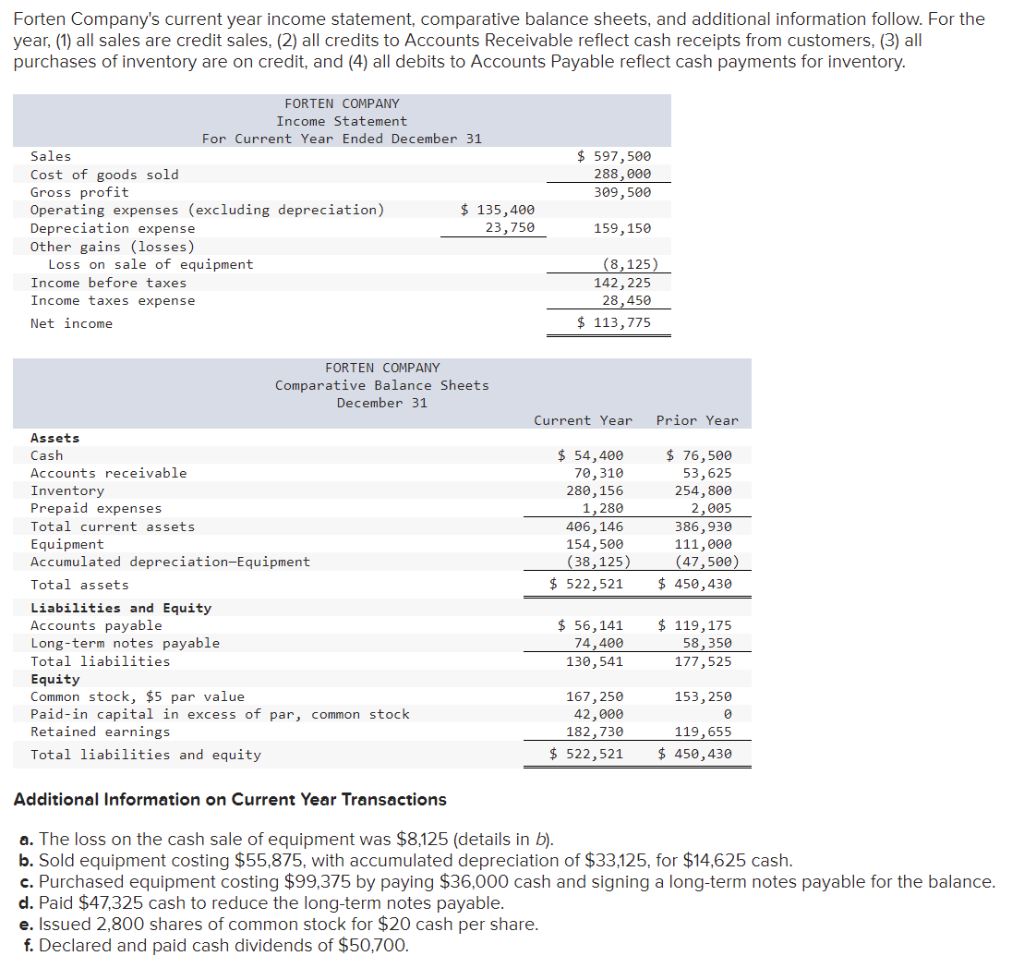

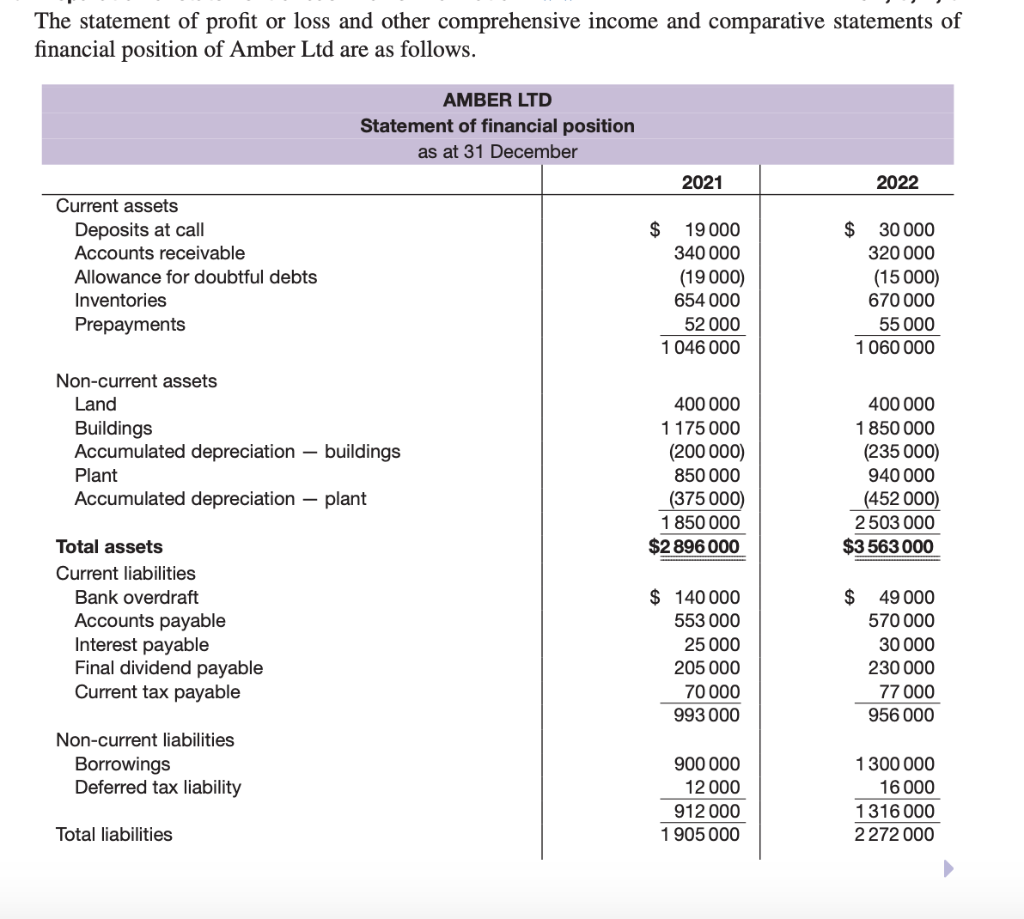

Prepaid income in profit and loss account. Following accounting entry is required to account for the prepaid income: Balance of profit and loss appropriation account. This article looks at what differentiates profit or loss from other comprehensive income and where items should be presented.

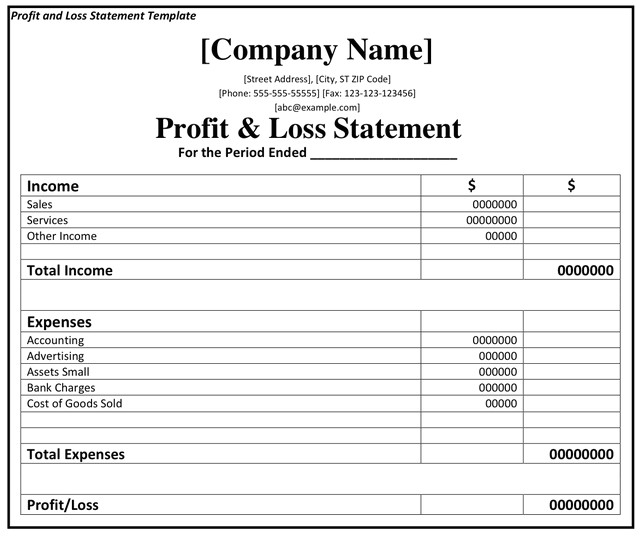

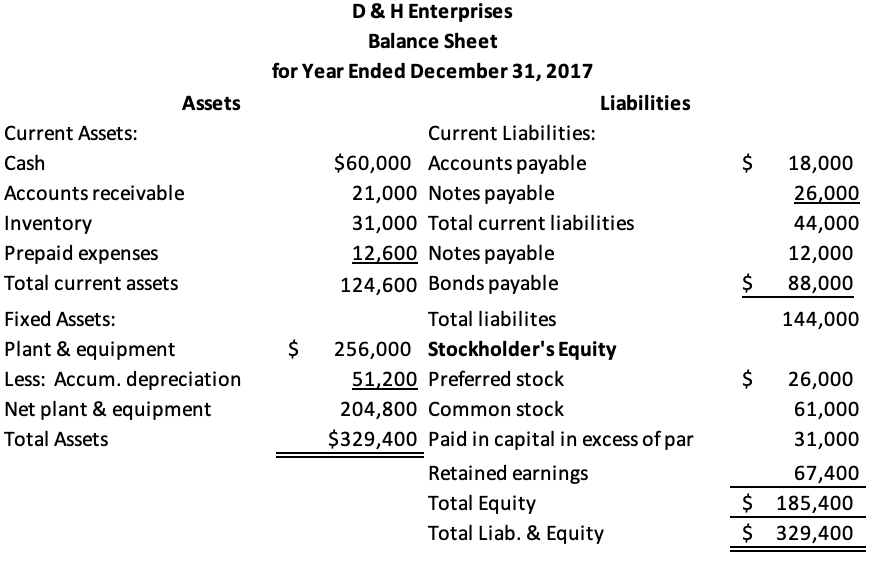

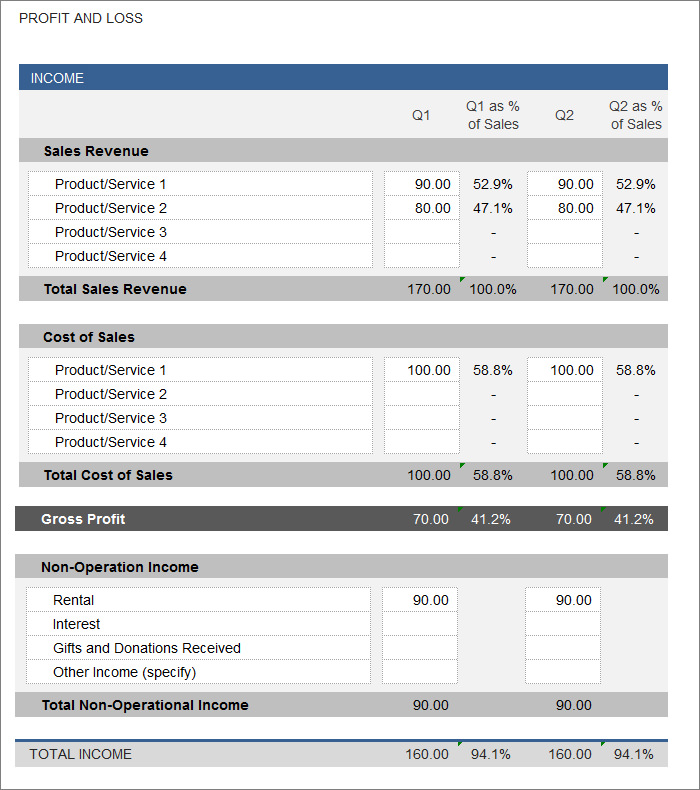

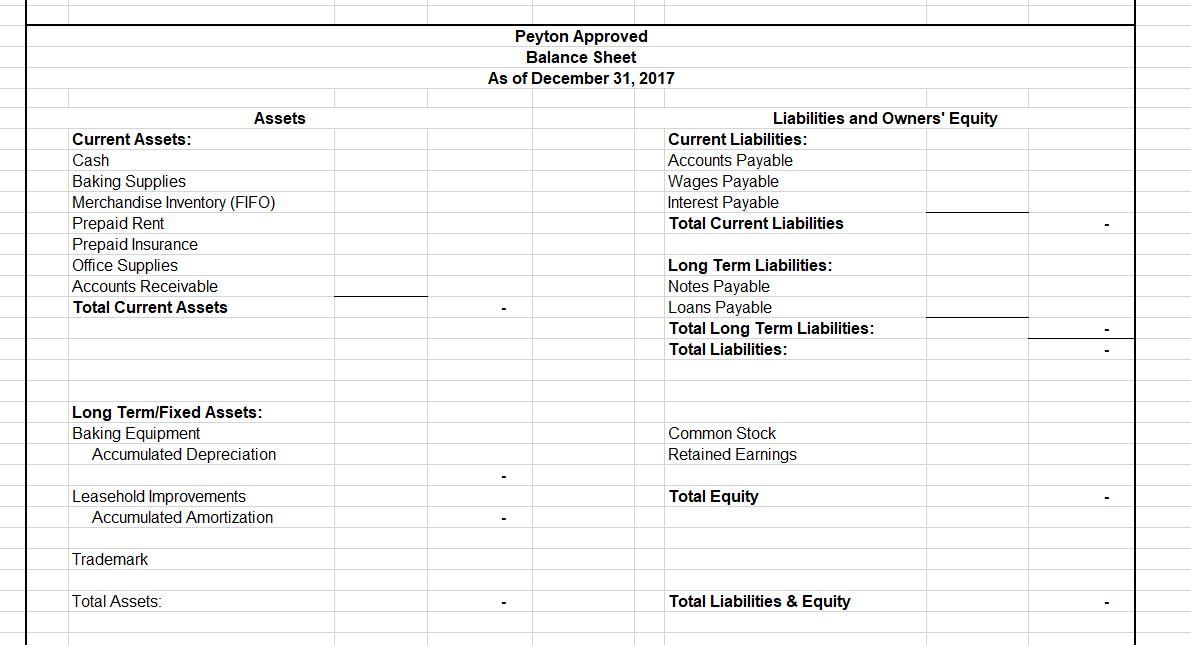

What is the profit and loss statement (p&l)? Profit and loss statement (p&l): Income statement (profit & loss account) balance sheet;

What is prepaid income? To expenses a/c (individually) (being the accounts of all the expenses closed) 2. As the benefits of the expenses are recognized, the related asset.

A profit and loss account shows the revenue close revenue the income earned by a business over a period of time from selling its goods or services. Prepaid income is funds received from a customer prior to the provision of goods or services. Prepaid expenses represent prepayment of an expense and hence it is debited and the cash account is credited.

Rental income is a flat rate of £1,200 per month and will therefore always be £14,400 on the statement of profit or loss bank payments will be made on 31 st. Shows how much revenue the company earned, what expenses were incurred in generating that. Prepaid income is revenue received in advance but which is not yet earned.income must be recorded in the accounting period in which it is earned.

In other words, a profit and loss statement is a handy tool that allows you to scrutinize the financial health (or lack thereof) of your company. Interestingly, a p&l statement goes by. During the year if outstanding and prepaid salary is to be shown in the profit and loss accounts as we have to know actual profit and loss of the financial year.

Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period. This records the prepayment as an asset on the. What is profit & loss.

A profit and loss statement (p&l) is a financial statement that summarizes the revenues, costs and expenses incurred during a. And costs of a business. Profit and loss account a/c:

April 5, 2023 a profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to. Profit & loss account is also known as p&l a/c, profit & loss statement, income statement or income and expense statement. Structure of the profit and loss statement ;

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)