Neat Info About Cash Flow In Financial Statement

Let’s look at what each section is showing.

Cash flow in financial statement. Pick n pay will embark on a rights issue to raise up to r4bn to stabilise the company, which faces financial dire problems. A company's cash flow can be categorized as cash flows from operations,. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf.

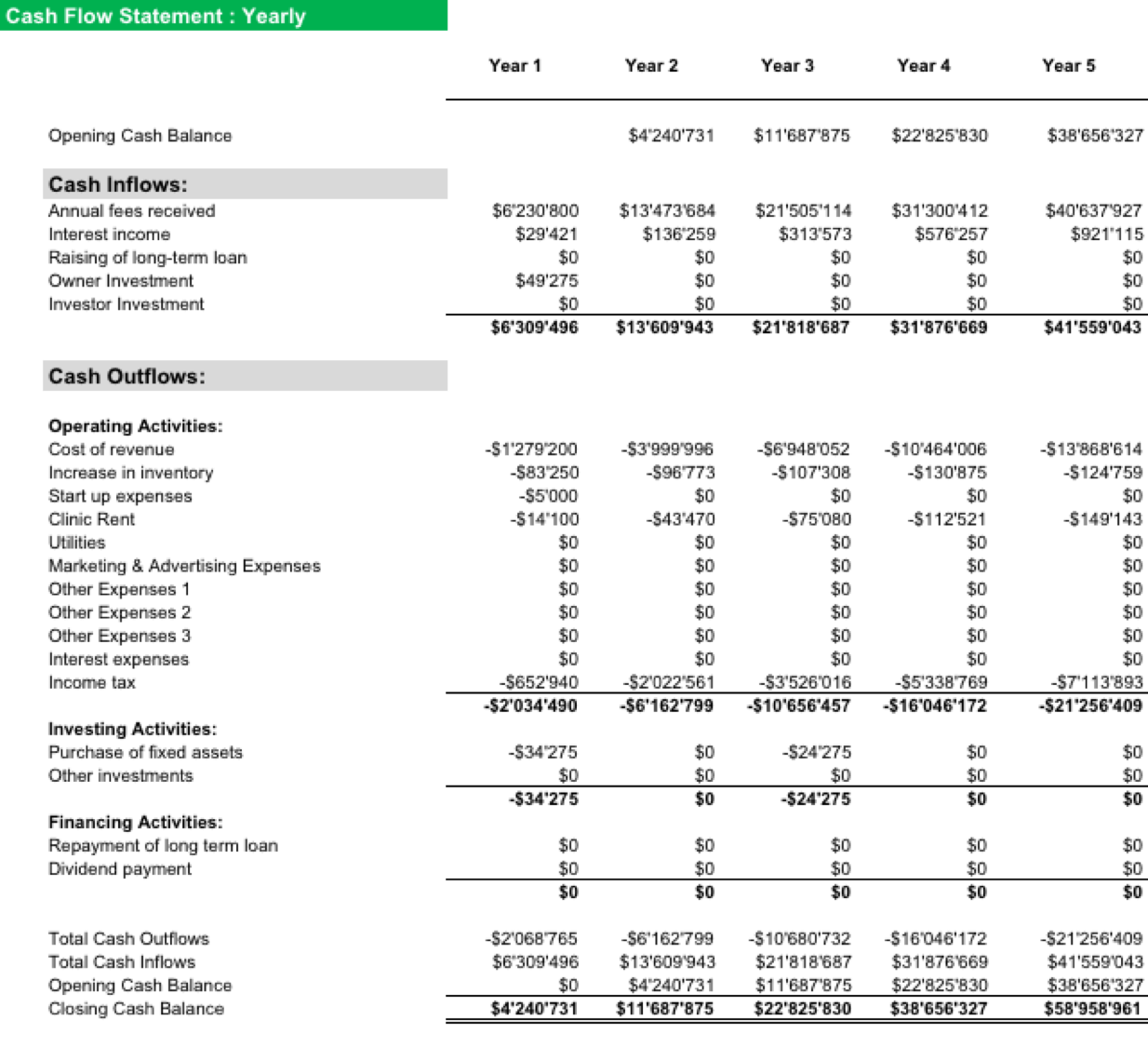

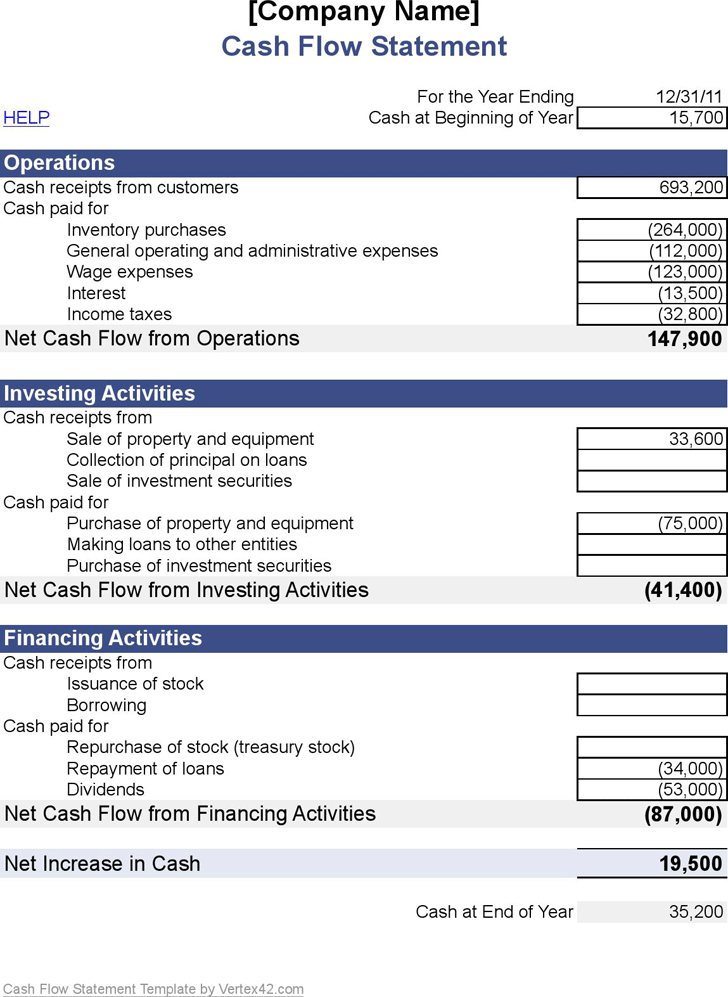

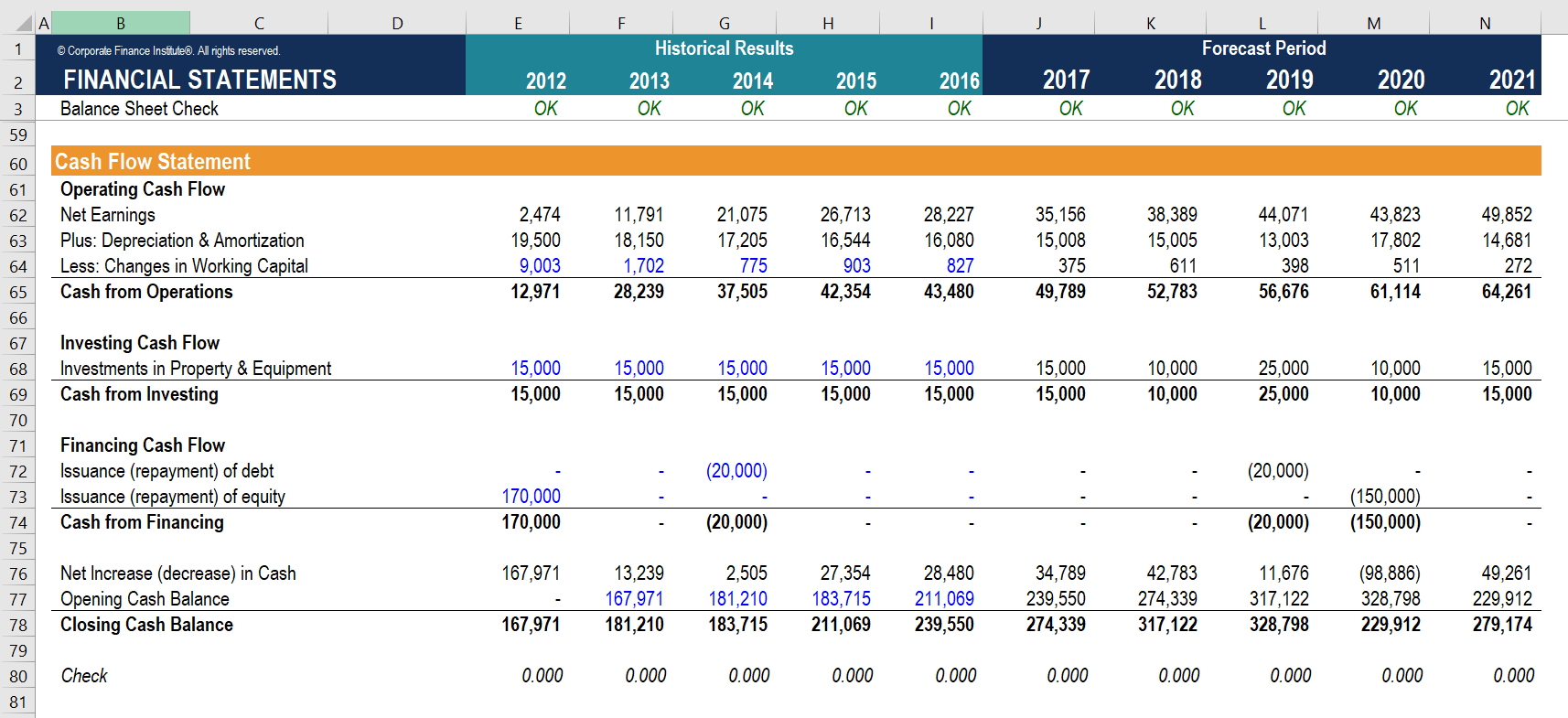

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Cash flow statement example. By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via.

Operating activities financing activities investing activities. Cash flow statement sections 1.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. These three core statements are intricately linked to each other and this guide will explain how they all fit together. Best for line of credit:

A cash flow statement (cfs) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period. A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. B l premium.

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. According to the online course financial accounting: It is relevant to the fa (financial accounting) and fr (financial reporting) exams.

In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. What is a cash flow statement? Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities.

Subsequently, i would compute multiple financial ratios, including those. I would need access to the most recent financial statements and stock price data from yahoo finance in order to evaluate kroger's financial statements and assess if the stock price is overvalued or undervalued. Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time.

It can also tell you how well your. The cash flow statement recognises three major business activities for cash flow: The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period.

A statement of cash flows is a financial statement that depicts all cash inflows and outflows from a company’s operations, investments, and financing activities in a specified period. Like all financial statements, the statement of cash flows has a heading that display’s the company name, title of the statement and the time period of the report. Best for lower credit scores:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)