Recommendation Tips About Bank Reconciliation Proforma

The bank's record of the bank account.

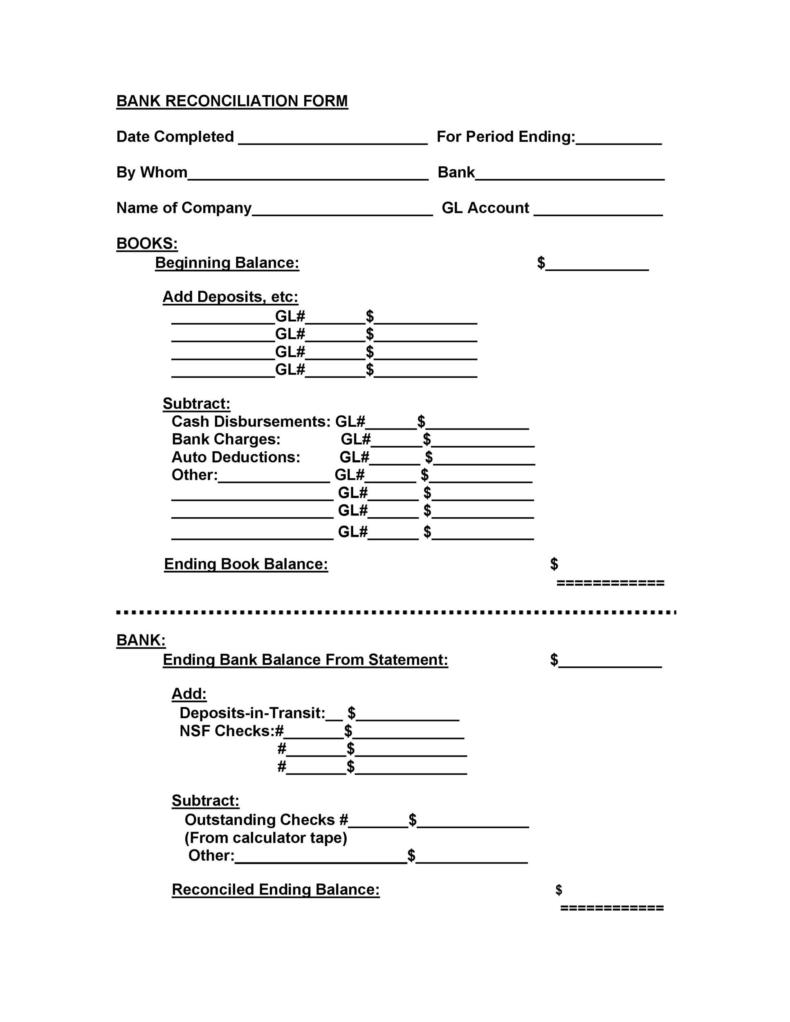

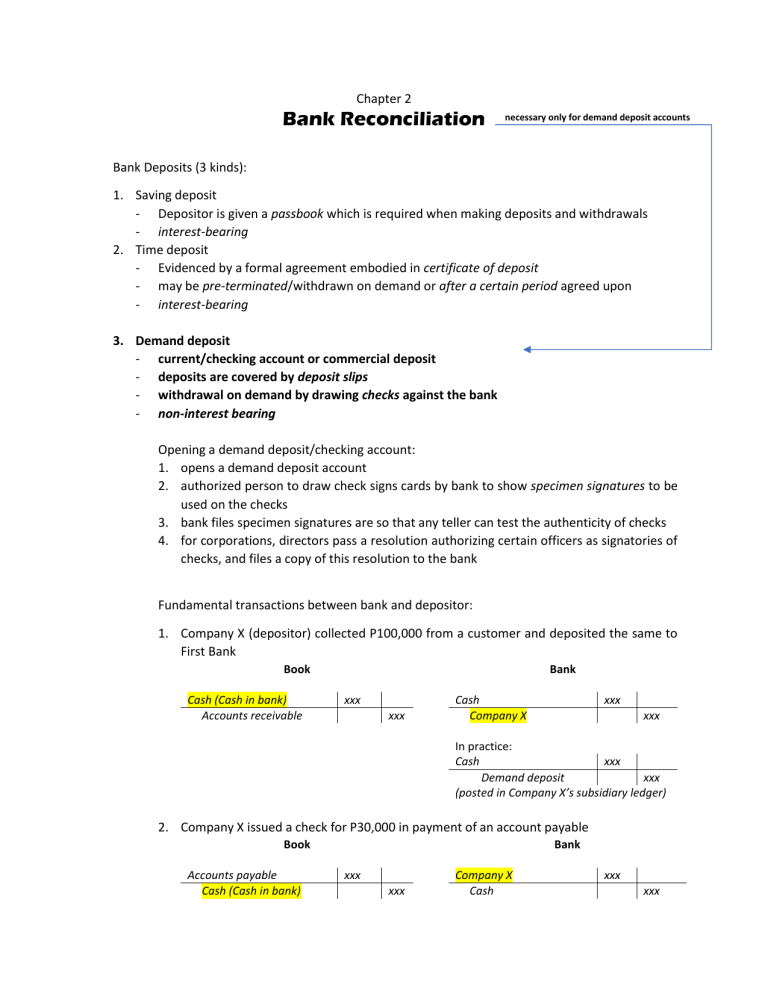

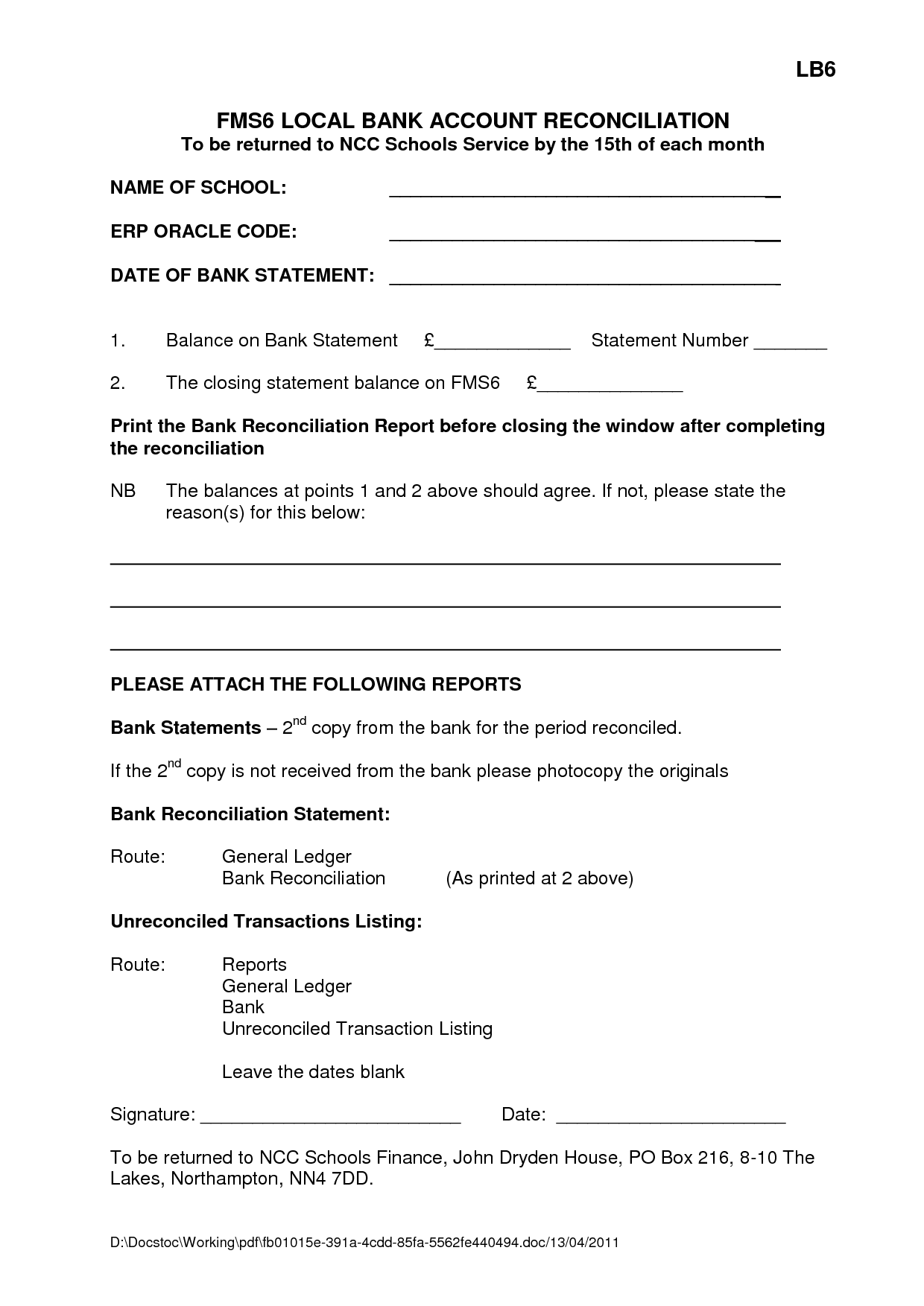

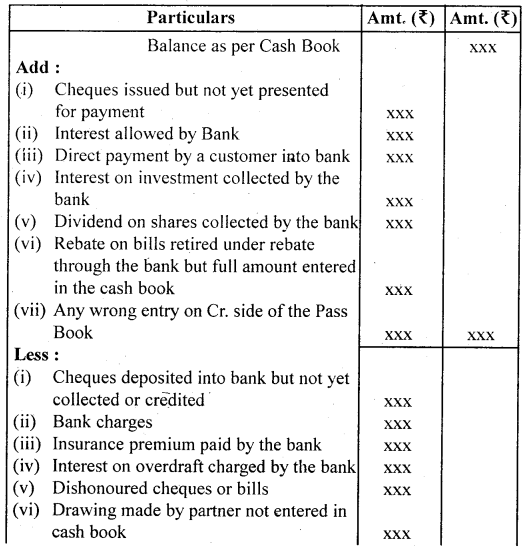

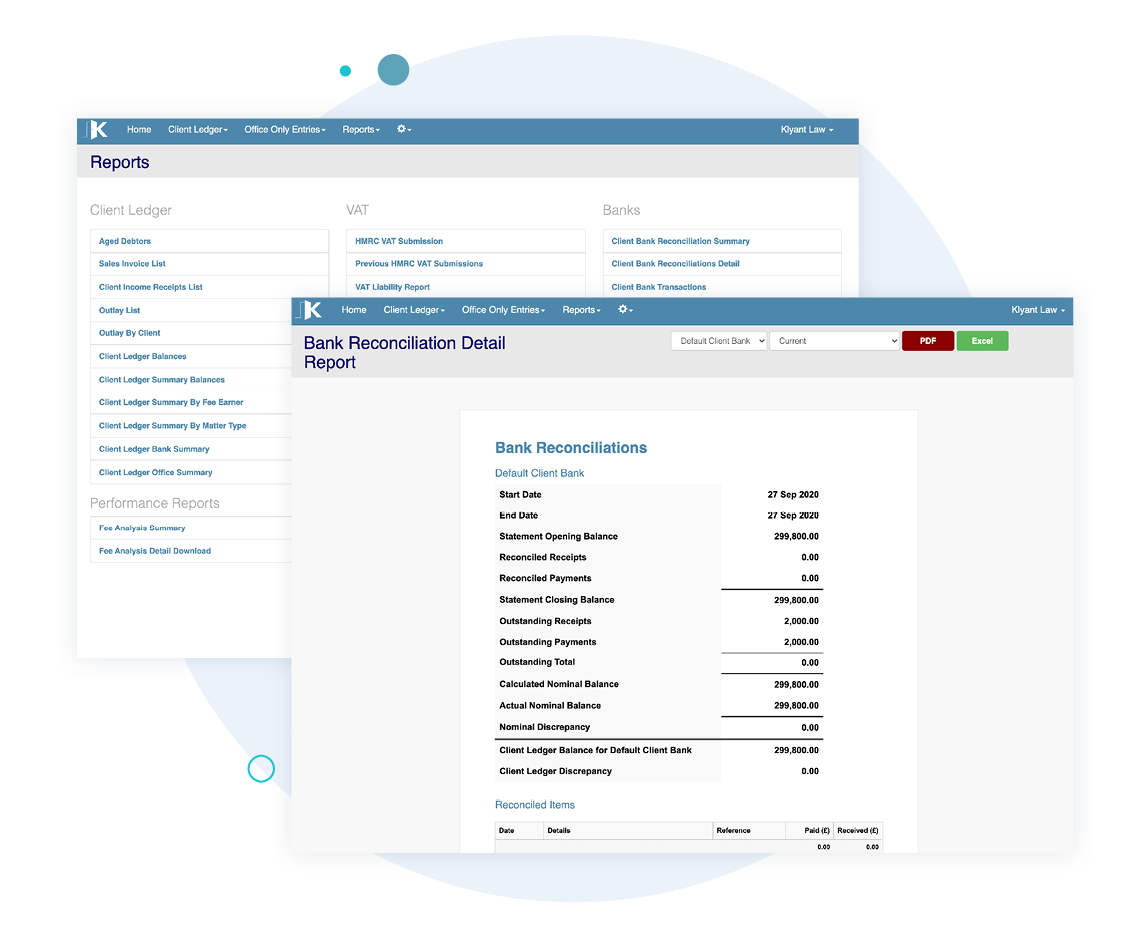

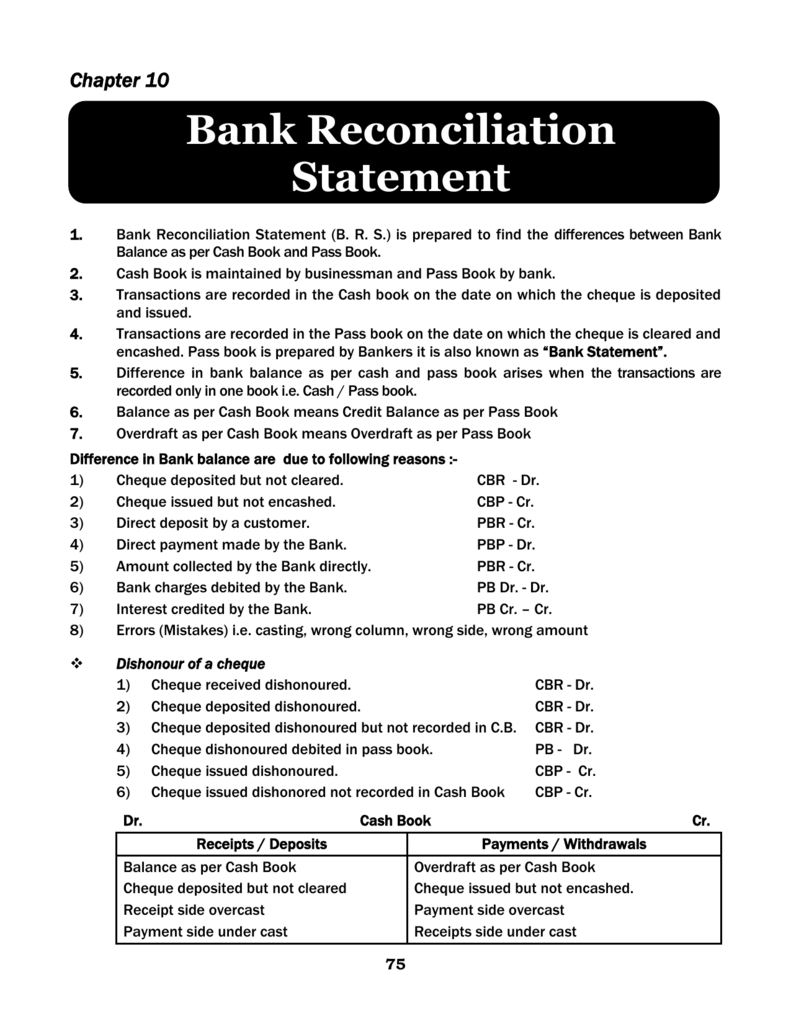

Bank reconciliation proforma. Fatah, which has long been in power in the west bank; The cash book is the. Bank reconciliation is the process of matching the bank balances reflected in the cash book of a business with the balances reflected in the bank statement of the.

Determine the adjusted and unadjusted balance as per the cash book this can be done by comparing the credits and deposits on the company’s passbook against the. Are stepping up their contacts with a view to. A bank reconciliation statement can help you identify differences between your company’s.

Choose your method for reconciliation. Compare the amount of each deposit recorded in the debit side of the bank column of the cashbook with credit side of the bank statement and credit side of the bank column with. If you have online access to your account, your bank statement should.

When banks send companies a bank statement that contains the company’s beginning cash balance, transactions during the period,. How you choose to perform a bank. 1 examine the bank statement balance.

Balance as per the passbook xxxx fig. A bank reconciliation is a process where individuals or organizations make sure that the financial statements’ figures perfectly accord with their respective bank account’s. Bank charges not recorded in the cash book.

This statement helps the account holders to check and keep track of their funds and. Bank reconciliation statement is a record book of the transactions of a bank account. Bank reconciliation statement (brs) involves the process of identifying the transactions individually and match it with the bank statement such that the closing.

A bank reconciliation statement is a financial statement that compares a company’s bank account balance with its own accounting records. Proforma of bank reconciliation statement it can also be prepared with two amount. Gather financial data from the account section for the.

And hamas, which has bent, but not broken in gaza; The objective of a bank reconciliation is to reconcile the difference between: Bank reconciliation is the process of comparing your company’s bank statements to your own records, ensuring all transactions are accounted for.

The bank statement balance, i.e. Access your bank statement as soon as possible. Bank reconciliation statement is prepared to compare the balances of the cash book and passbook and correct the mistakes recorded in them.

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-25-790x1117.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-02.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-36-790x1022.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-40-790x1022.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-28-790x1119.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-27-790x1022.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-15-790x1231.jpg)