Favorite Tips About Cash Inflows From Investing Activities Include

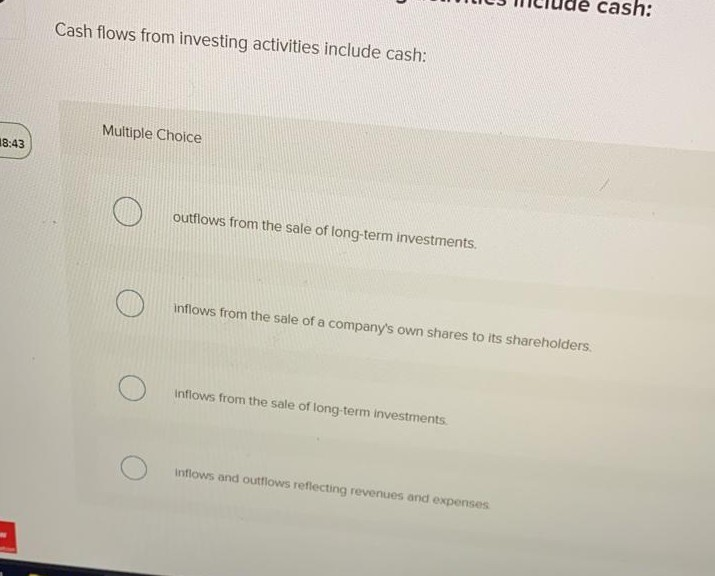

Multiple choice ο sale of land ο changes in accounts receivable.

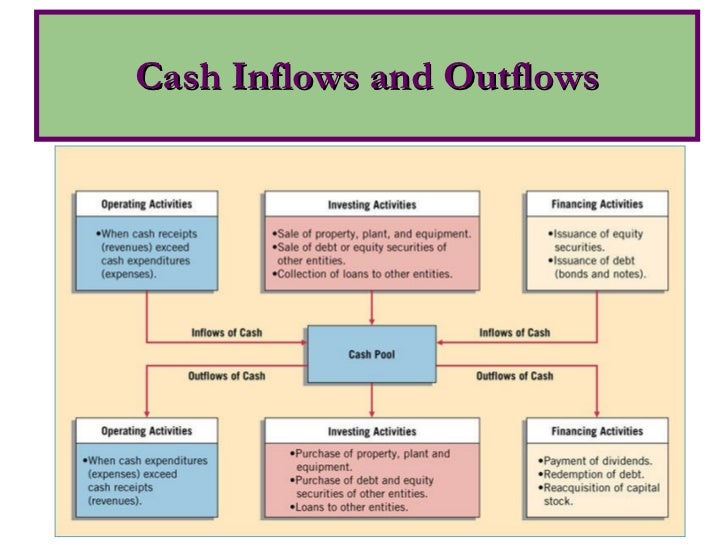

Cash inflows from investing activities include. Learn online now what is cash flow from investing activities? Investing cash flow relates to all the money generated or spent through. Investing activities include the following items:

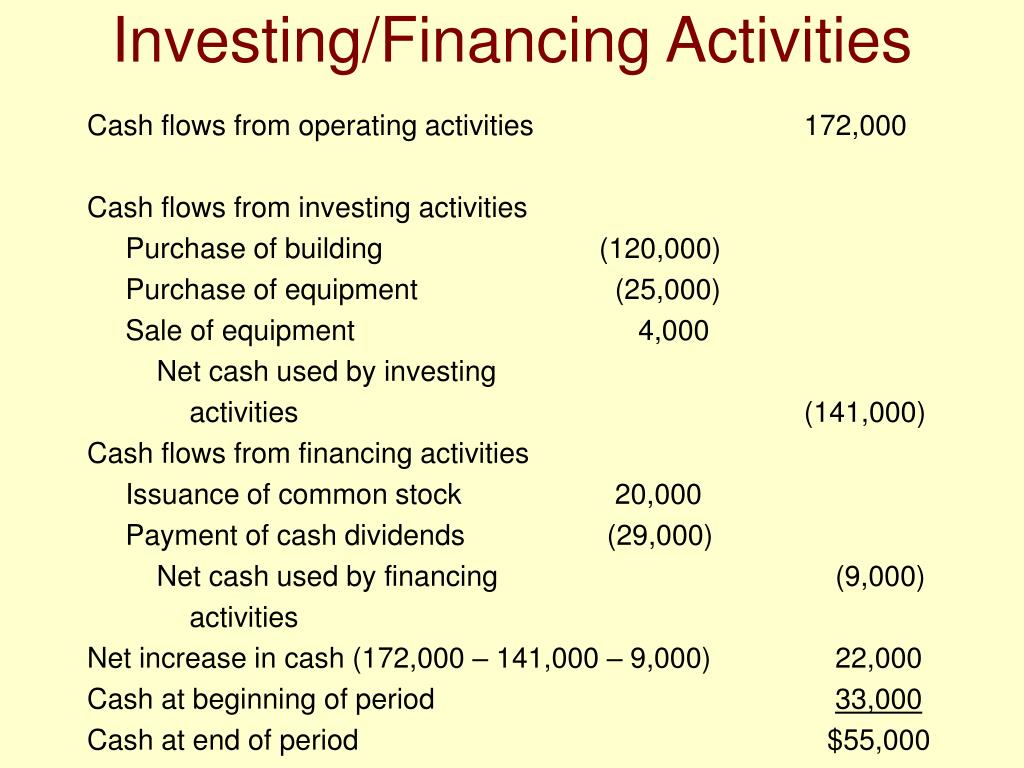

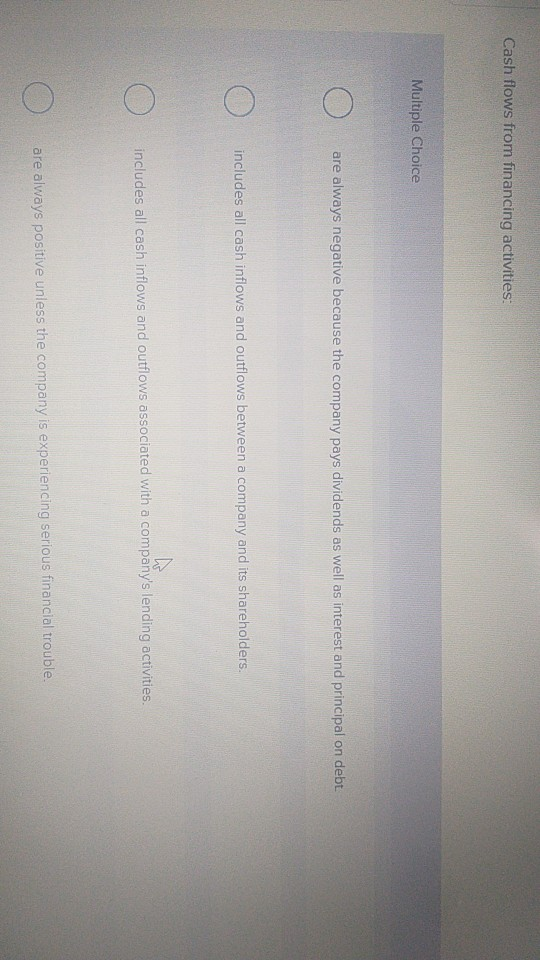

Cash flow, in general, is the inflow and outflow of cash that a business experiences. Cash flow from financing activities (cff) measures the movement of cash between a firm and its owners, investors, and creditors. Items that may be included in the investing activities line item include the following:

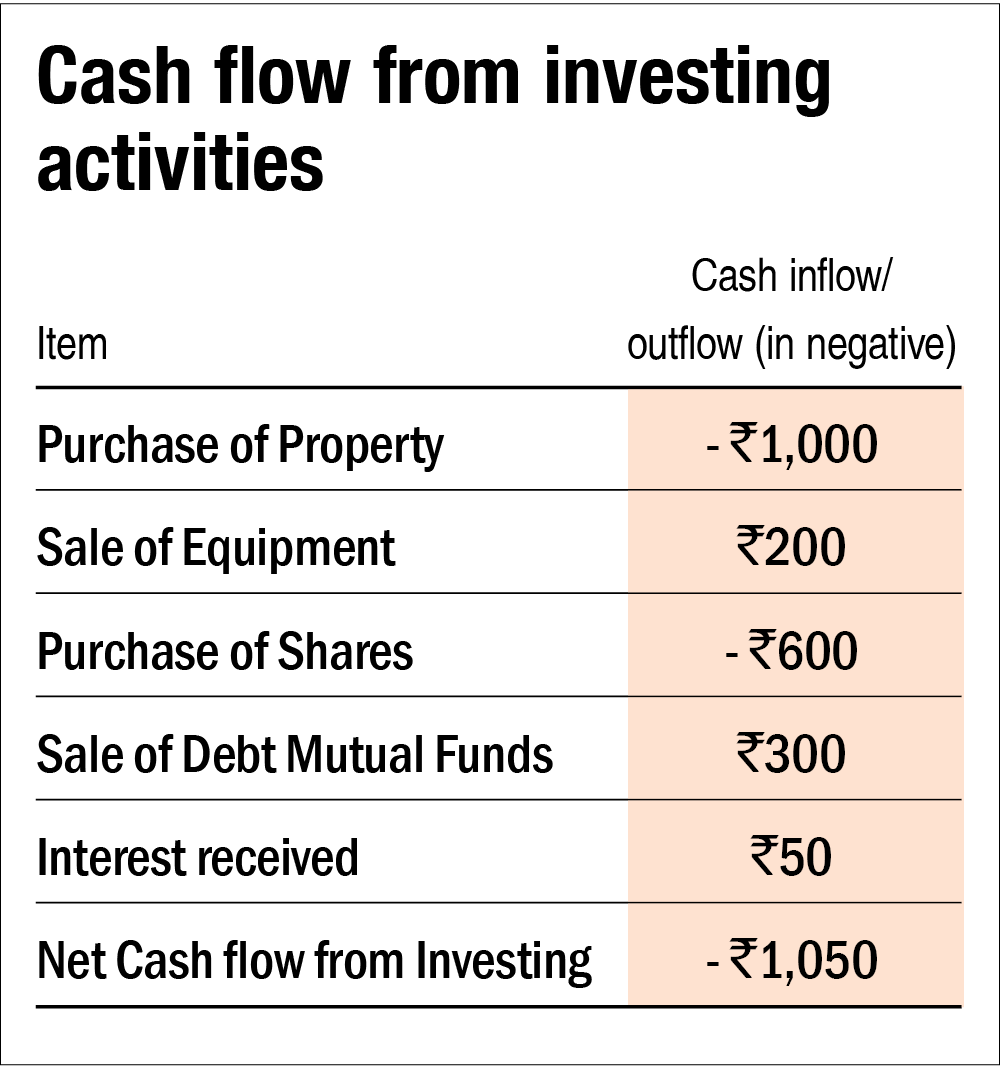

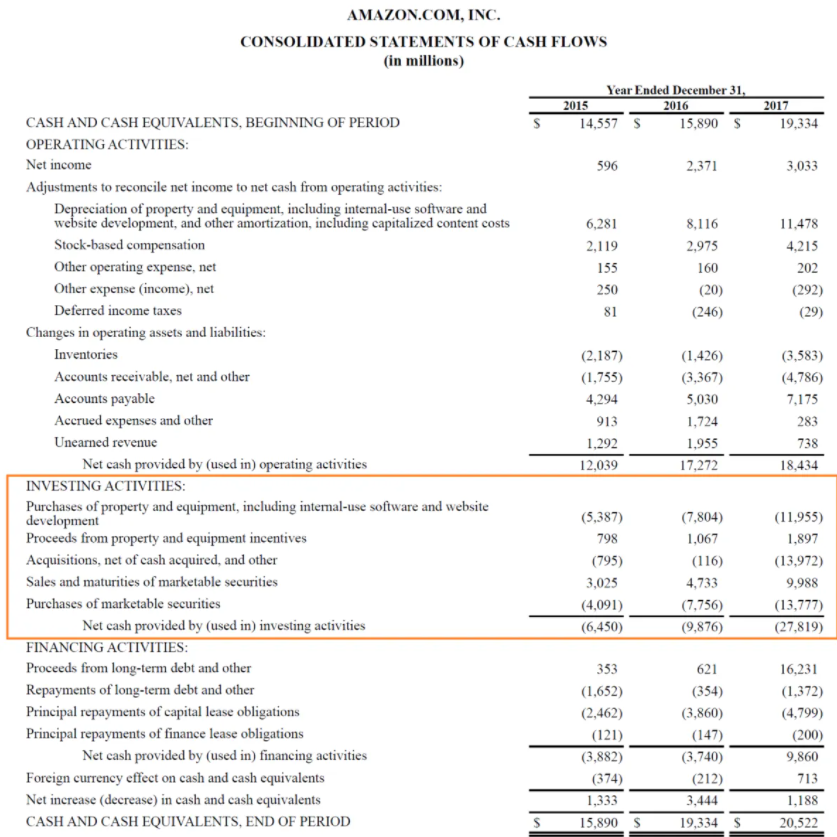

In accounting, costs associated with investing activities are classified by type of expense. Evaluating investment returns: Investments in property, plant, and equipment (pp&e) and acquisitions of other businesses are accounted for in the cash flow from the investing activities.

Financial analysis cont… today’s session is emphasizing on ‘statement of change in equity &. Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments. This report shows the net flow.

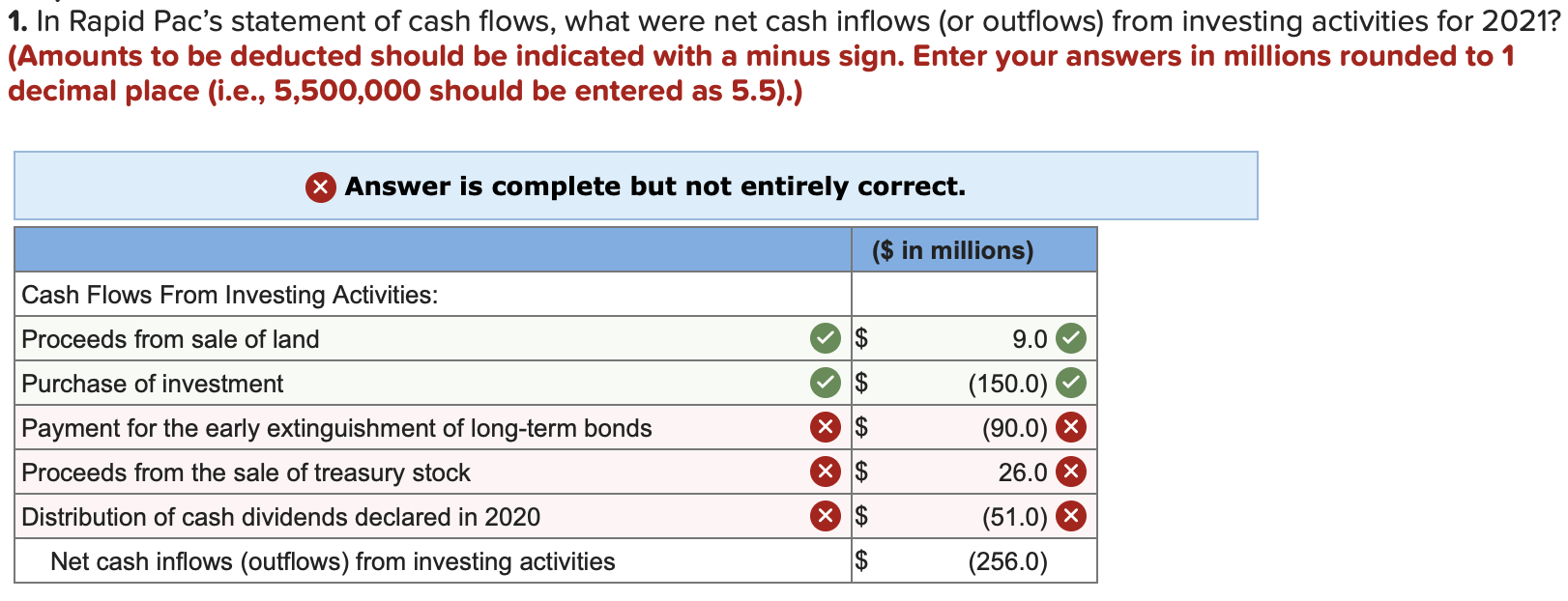

Here are the steps to calculate cash flow for investing activities: Ο paying principal to lenders. (1) the sale of property, plant, and equipment;

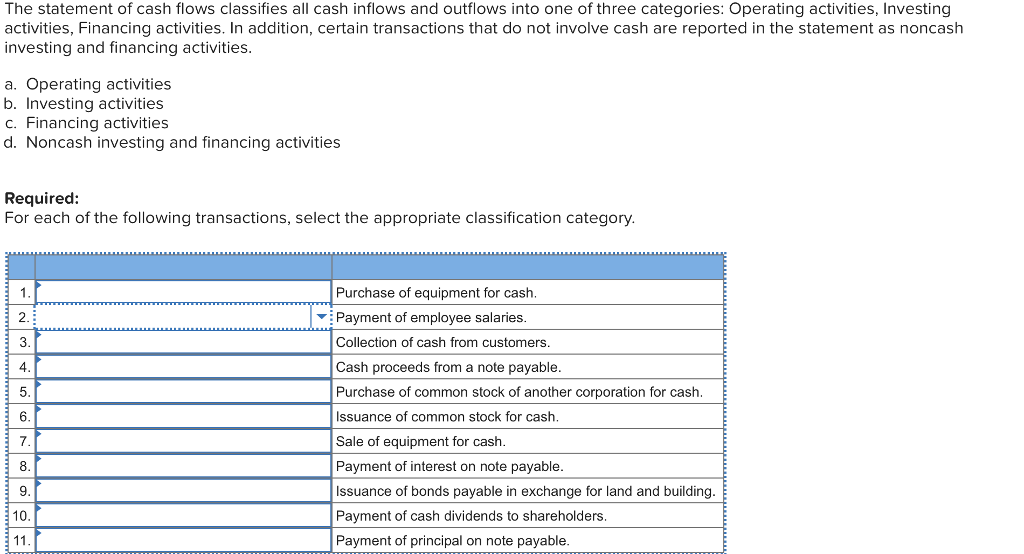

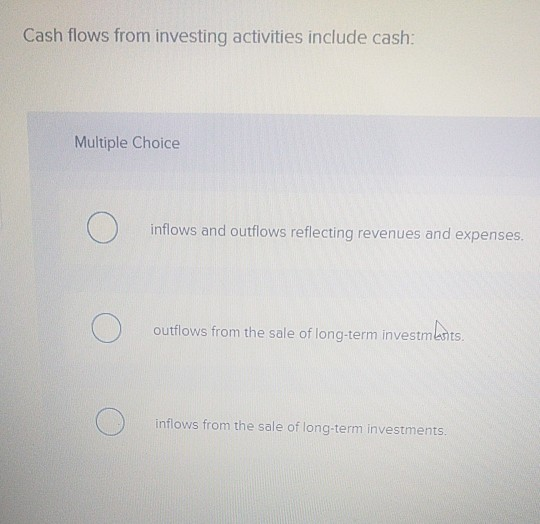

Multiple choice inflows and outflows reflecting revenues and expenses. What does it include and doesn’t include? The cash flow statement reports the.

Buying property, plant, and equipment (cash outflow). Cash flows from investing activities include cash: Examples of cash inflows typical for investing activities include:.

Thus, cash inflows from investing activities include cash received from: Cash flows from investing activities include: Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)