Supreme Tips About Cash And Equivalents Balance Sheet

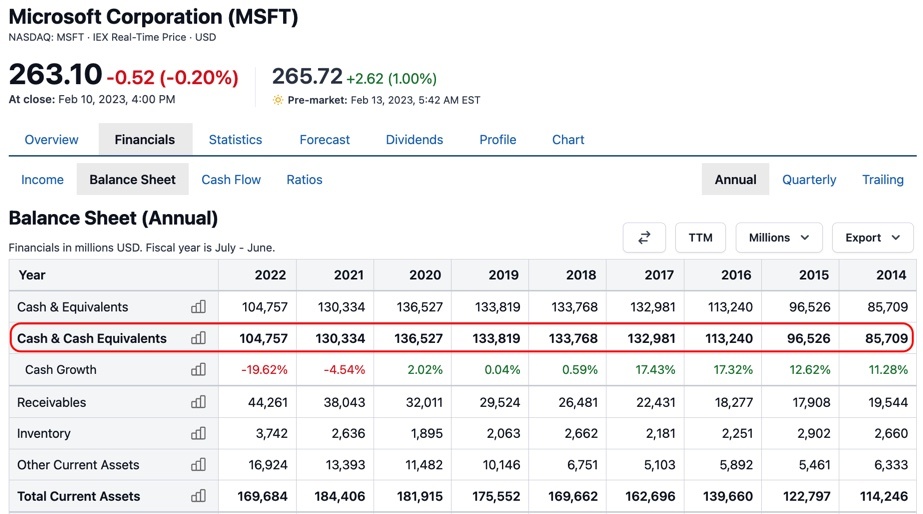

It is an increase from 2020’s report of $7,854.

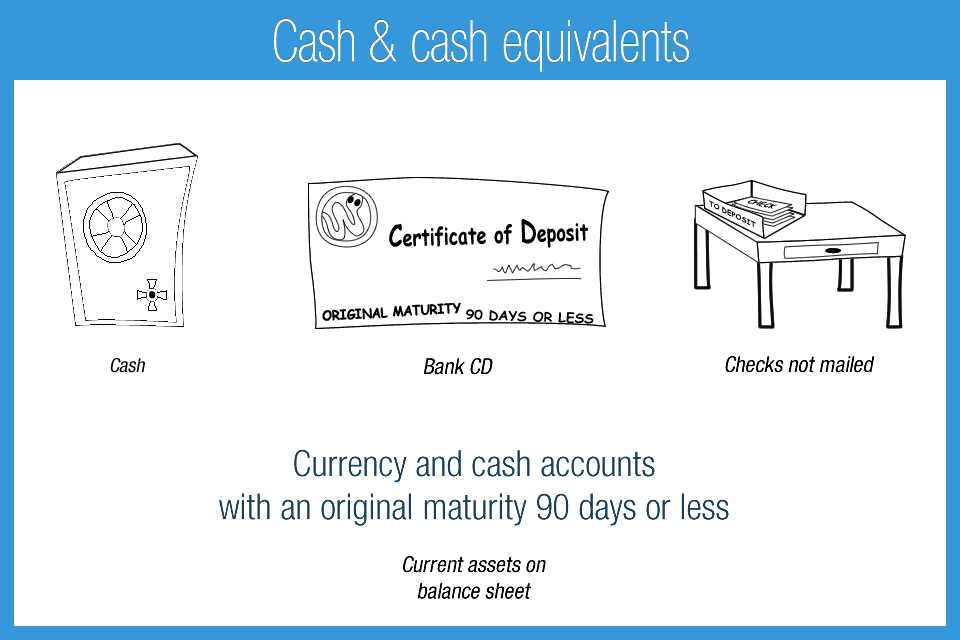

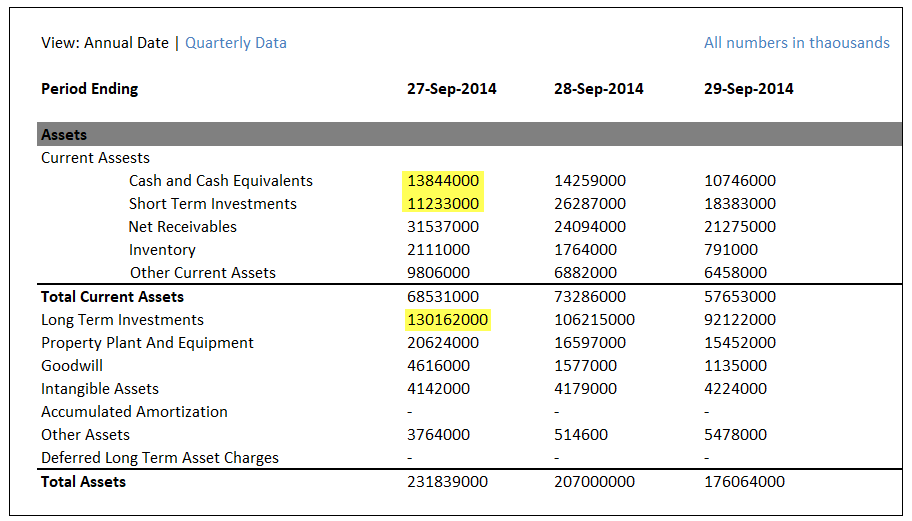

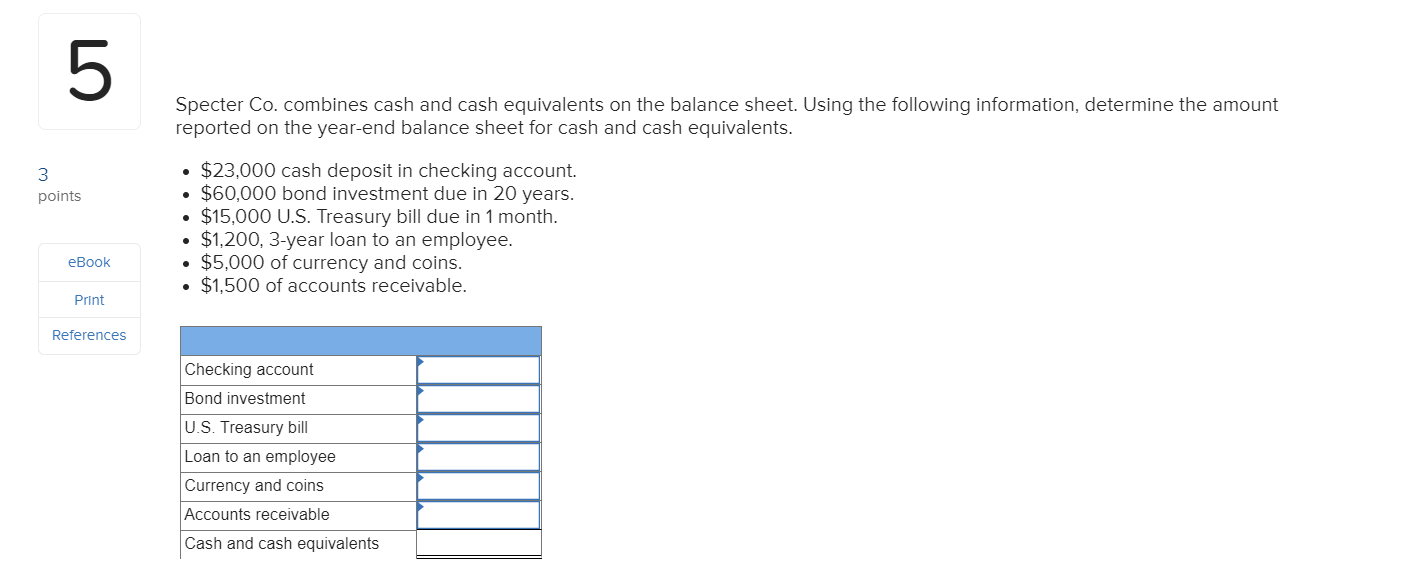

Cash and equivalents balance sheet. Fair value will be their cost at acquisition plus accrued interest to the date of the balance sheet. On the one hand, it must be easily convertible into a certain amount of cash. Cash and cash equivalents are balance sheet details that summarize the worth of a company's assets that are cash or may be converted into cash instantly.

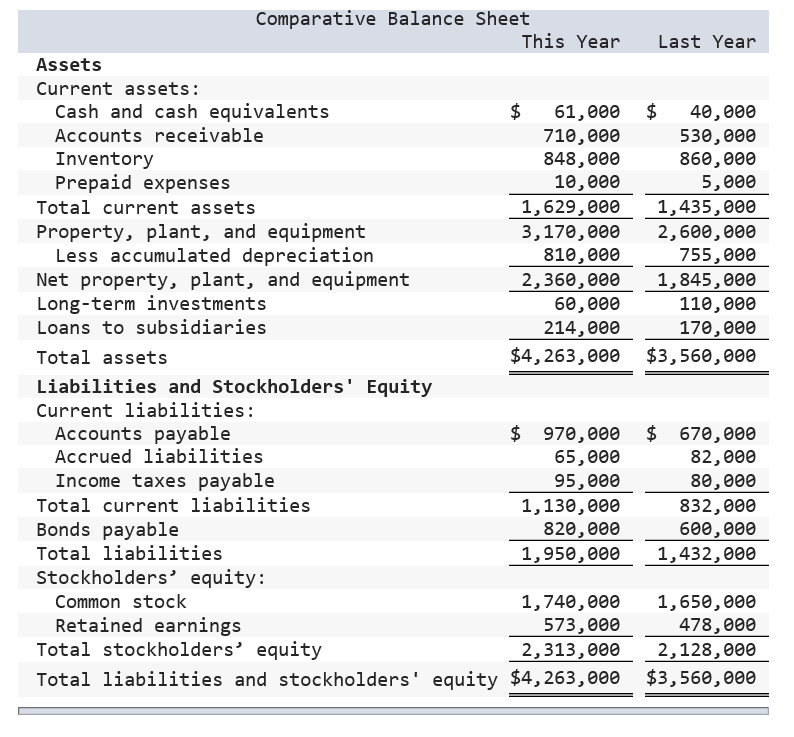

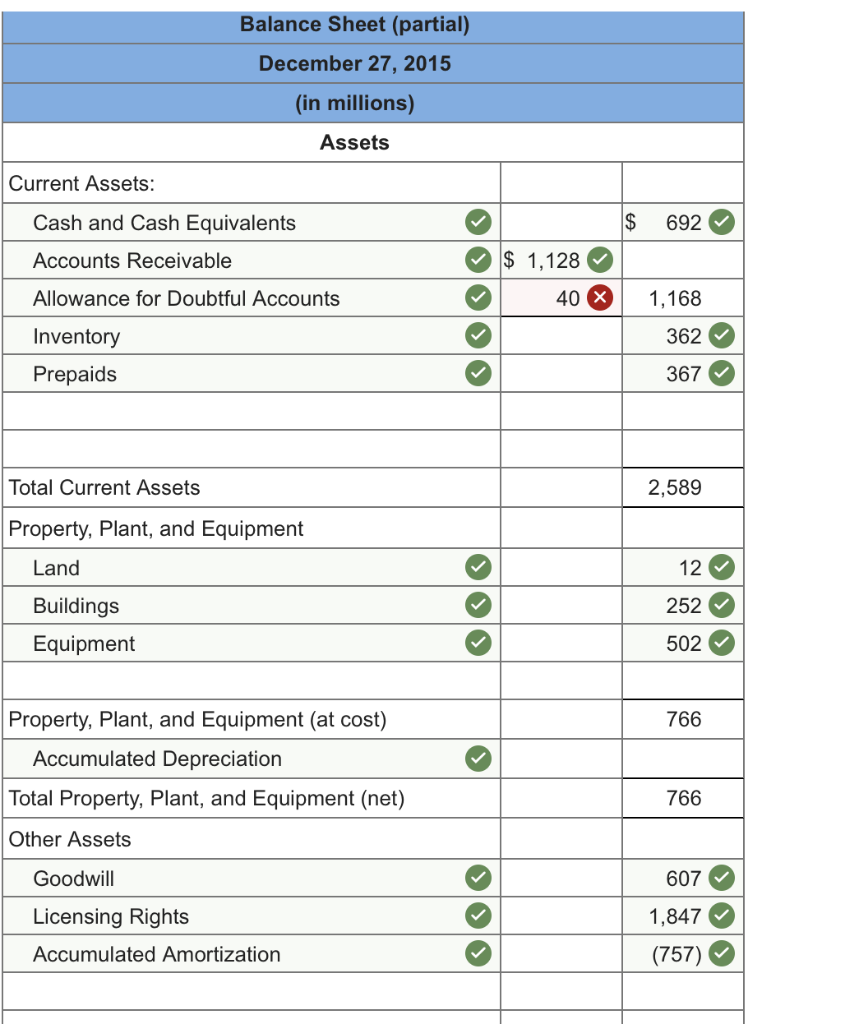

The balance sheet categorizes any possessions that meet this description as current assets. The assets considered as cash equivalents are those that can generally be liquidated in less than 90 days, or 3 months, under u.s. Cash and cash equivalents is a line item on the balance sheet, stating the amount of all cash or other assets that are readily convertible into cash.

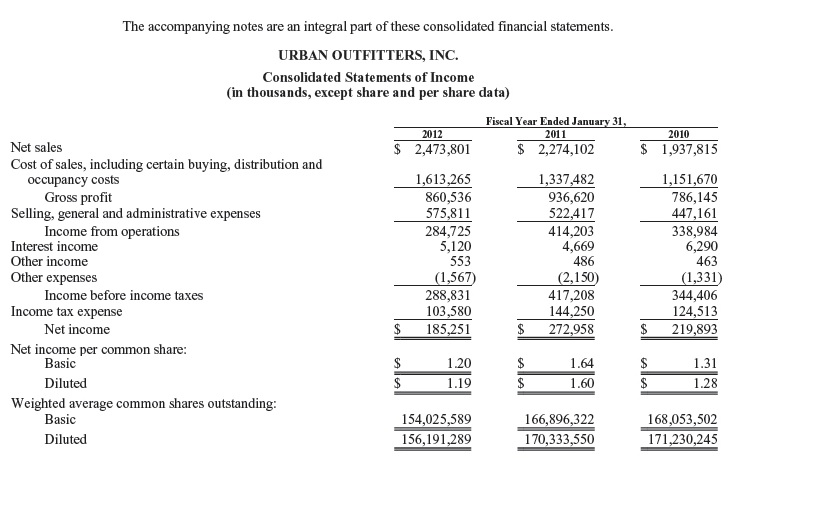

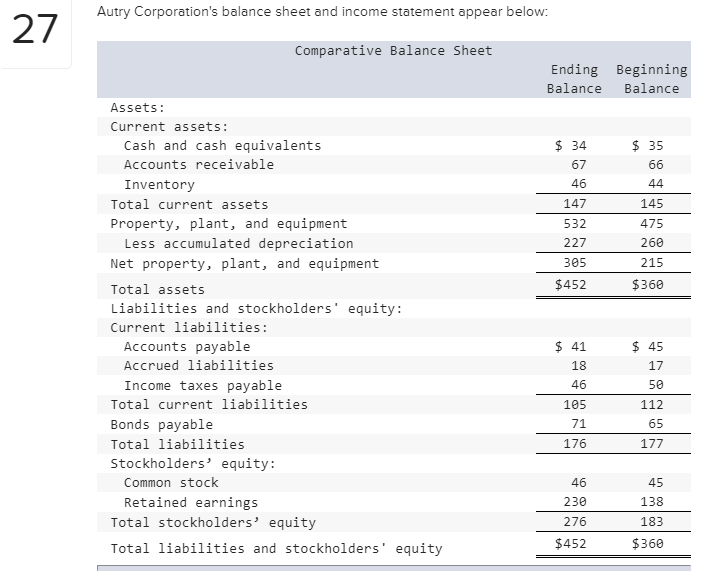

Cash and cash equivalents ( cce) are the most liquid current assets found on a business's balance sheet. These three balance sheet segments. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time.

Businesses can report these two categories of assets on the balance sheet separately or together, but most companies choose to report them together. Cash equivalents can be reported at their fair value, together with cash on the balance sheet. A compensating balance is a minimum cash balance in a company’s chequing or savings account as support for a loan borrowed from a bank (or other lending institution).

Cash and cash equivalents are items on a company’s balance sheet that refer to the value of assets held in cash or easily converted to cash. Asset categories include:. That shows cash and cash equivalents as at december 31, 2020 along with the corresponding notes:

Because cash and cash equivalents are the most liquid assets, they are always listed on the top line of a company's balance sheet. Currency and coins checks received from customers but not yet deposited checking accounts petty cash definition of cash equivalents Below is an overview of cce, including examples, uses, and limitations.

The cash flow statement explains the change in cash over time. The balance sheet shows the amount of cash and cash equivalents at a given time. For example, cvs health, an american healthcare company, shows $9,408 million as cash and cash equivalents in its balance sheet as of 31st december 2021.

How to calculate cash and cash equivalents in balance sheet. Definition of cash and cash equivalents. They mainly include a couple of support, which have relative ease with converting them into cash.

Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. Cash equivalents are the total worth of cash on hand that includes similar goods to cash; What are cash and cash.

The financial statements are used by investors,. Gaap allows this financial statement presentation because some investments are so liquid and risk adverse that they are. Any items falling within this definition are classified within the current assets category in the balance sheet.

:max_bytes(150000):strip_icc()/CCE-009ecb73dfd94702821efed1264573af.jpg)