Casual Tips About Accurate Financial Reporting

The risks of inaccurate financial reporting include bad operational.

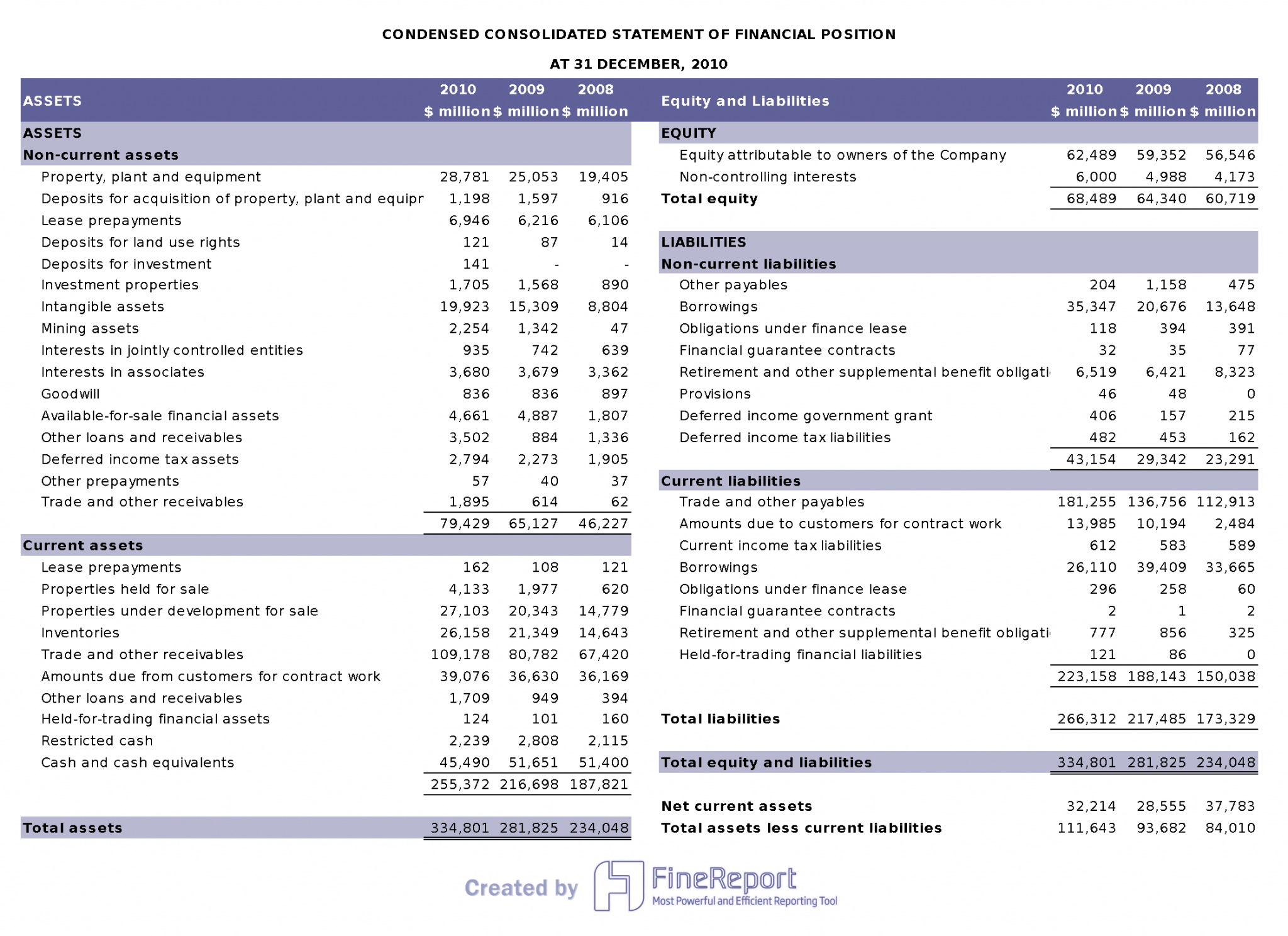

Accurate financial reporting. Inaccurate financial reporting can be due to unintentional mistakes or, in some cases, fraud. 05 apr, 2023 how important are accurate financial statements for companies? Implement performance analysis and benchmarking.

Accounting reports are statements that show the financial health of a business. Schedule the necessary time required for financial reporting. Maintaining financial reporting also builds trust with stakeholders who have an interest in your company.

Powered by ai and the linkedin community 1 define reporting objectives 2. What are financial background checks? Particularly, these controls guarantee the accuracy of the.

For accurate financial reporting, it is essential to establish and maintain robust internal controls. What are the best practices for ensuring accurate and reliable financial reports? The risks of inaccurate financial reporting include bad operational decisions,.

Financial reporting is one of the most critical business processes that accounting, finance, and the business must understand and appreciate. The future of financial reporting will show an increased use of automation and artificial intelligence to improve the efficiency and accuracy of an organization’s. 4 financial reporting tips for busy business owners.

Basic recommendations for accurate reporting of statistics. Establish monitoring and reporting frequency to ensure accurate and useful financial reports. A full 64% of small business owners manage their own books.

Some reports show the results of a company’s operations over time; Also referred to as financial integrity checks or civil litigation checks, these reveal any county court judgments. Depending on the distribution, report either mean and sd or median and iqr for the description of.

Investors look specifically at your revenue, profitability, debt level, and. A significant benefit of accurate and timely financial reporting is that it should provide the finance team, the executive team, and other stakeholders with an understanding of how. Inaccurate financial reporting can be due to unintentional mistakes or, in some cases, fraud.

The report also outlined the top. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to.

-p-1080.png)