Divine Tips About Loan Repayment Income Statement

The biden administration announced that the education department has approved $1.2 billion in student loan forgiveness for more than 150,000 borrowers.

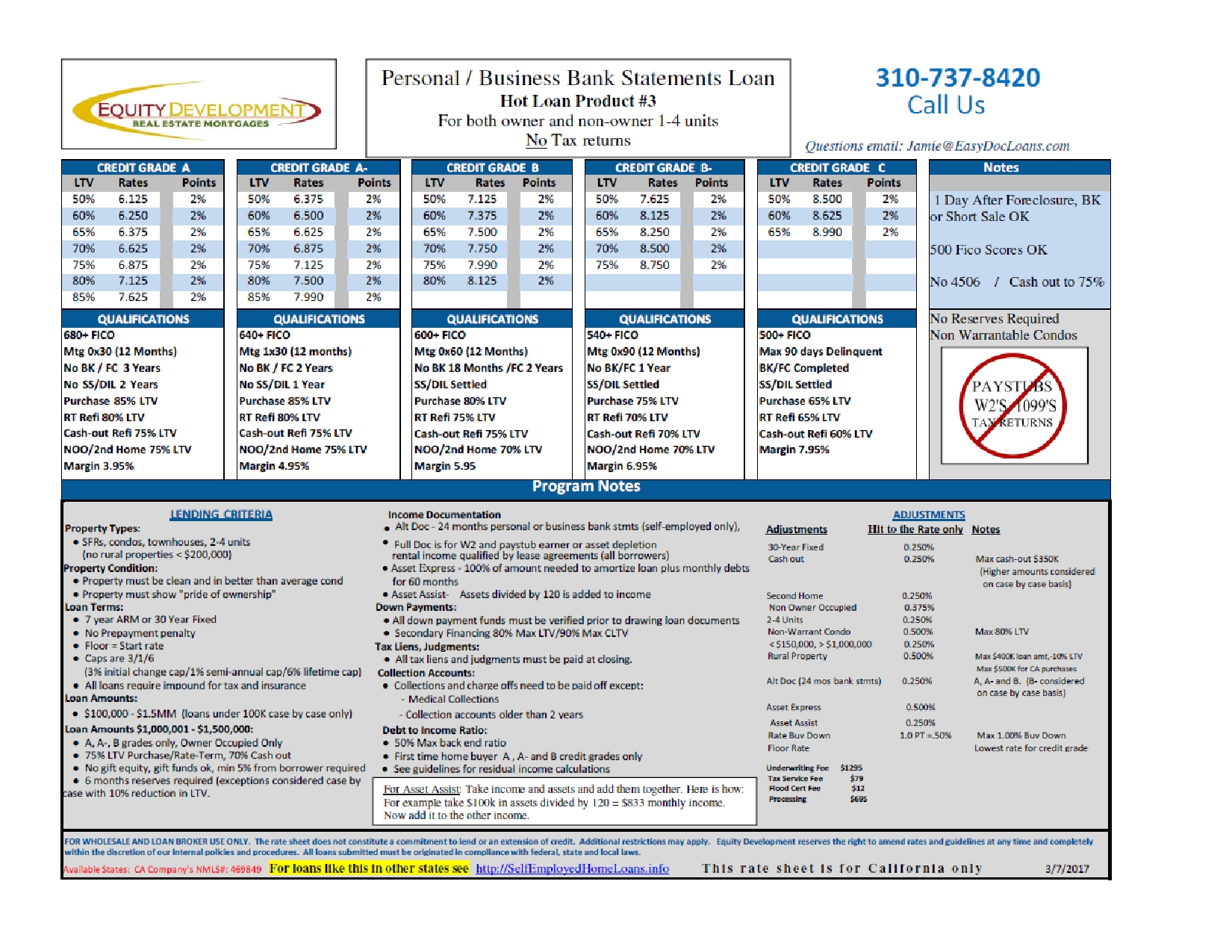

Loan repayment income statement. Should a lender cancel part of a. And they will start repaying when their. Personal loans typically won't be considered income and, as such, cannot be taxed, with one main exception:

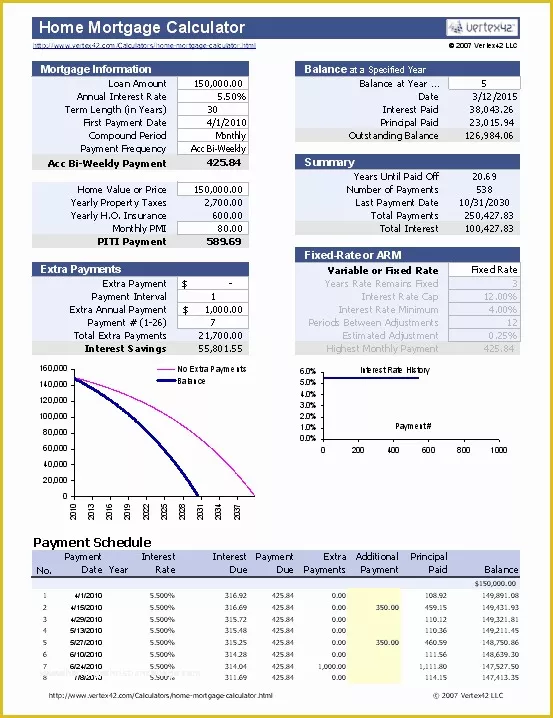

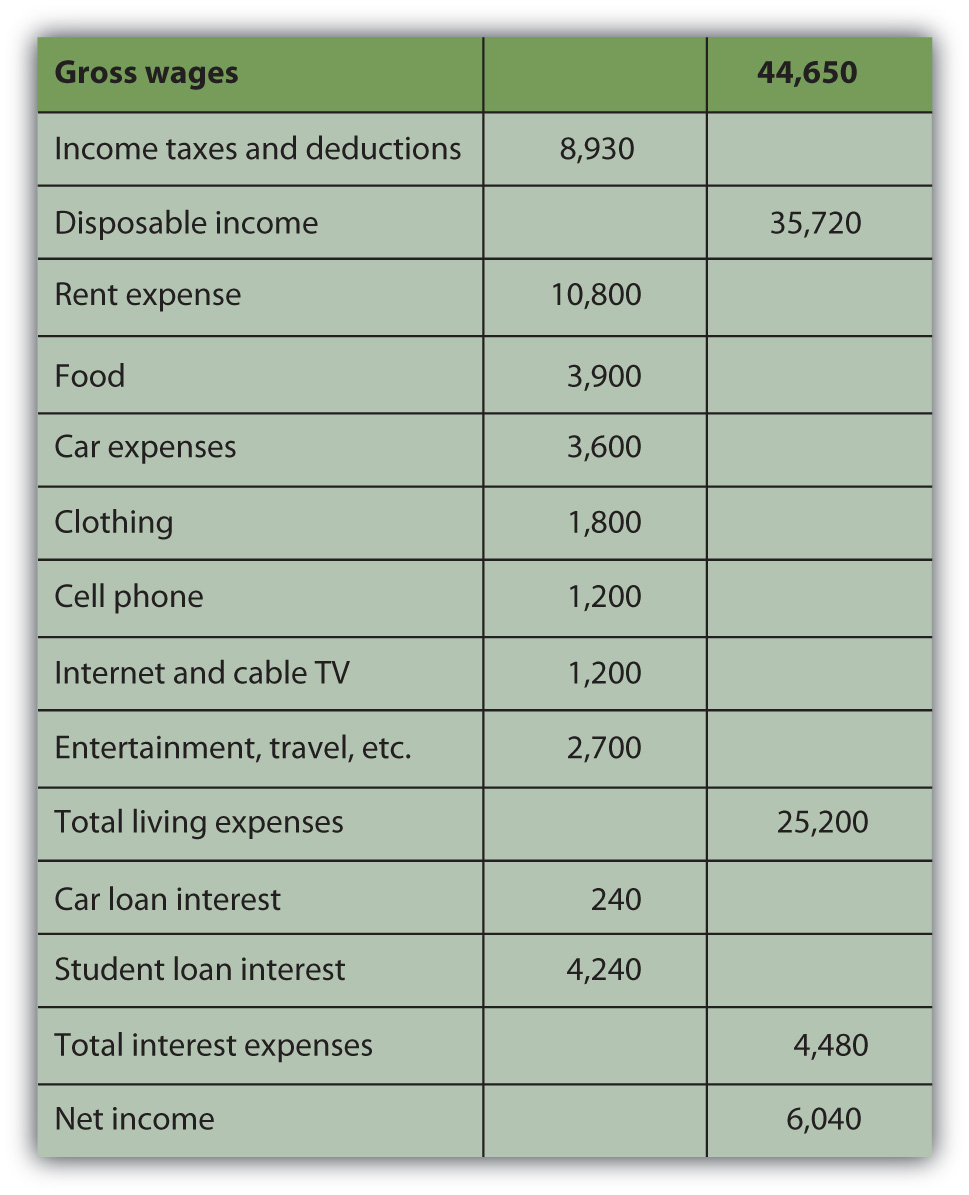

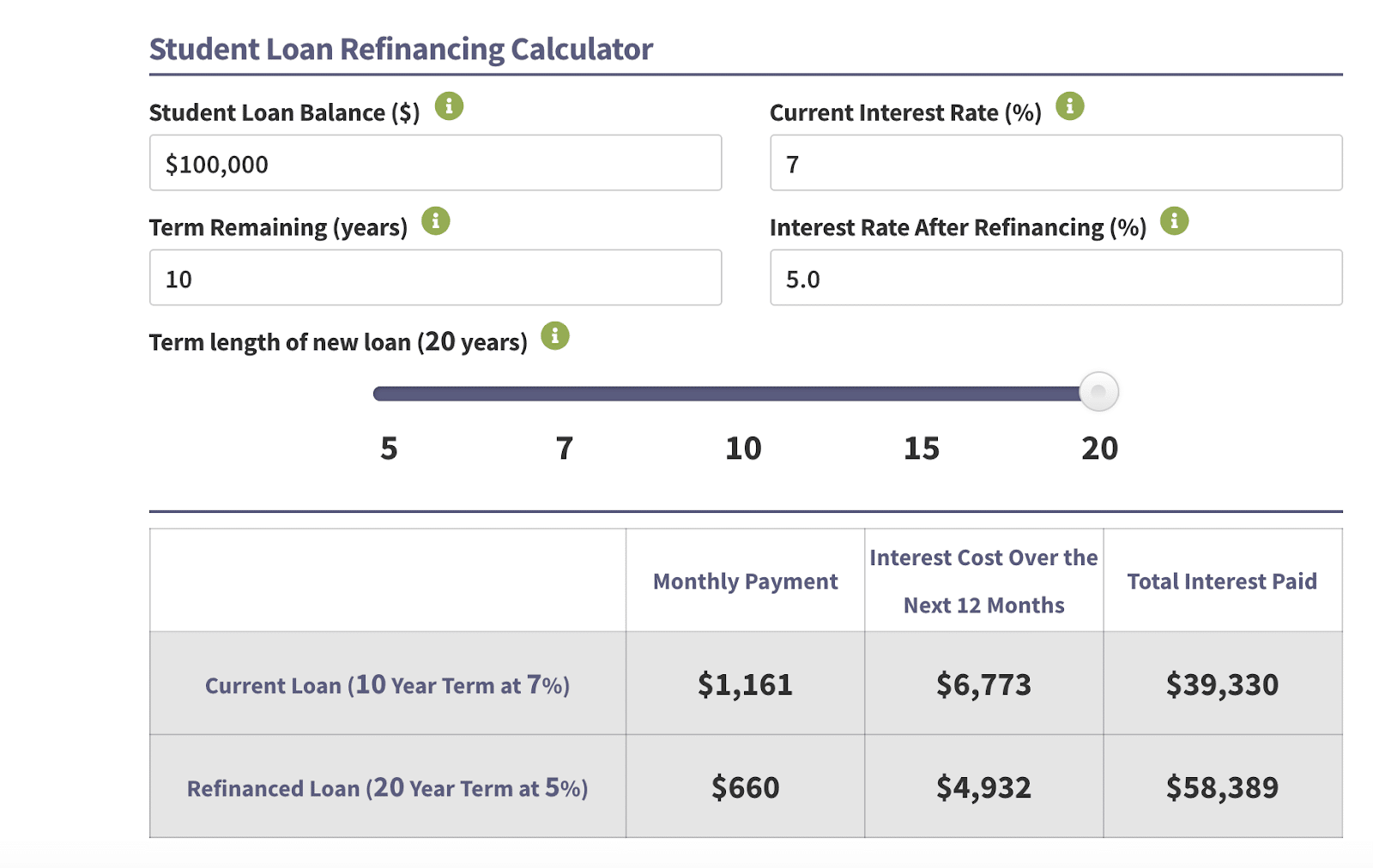

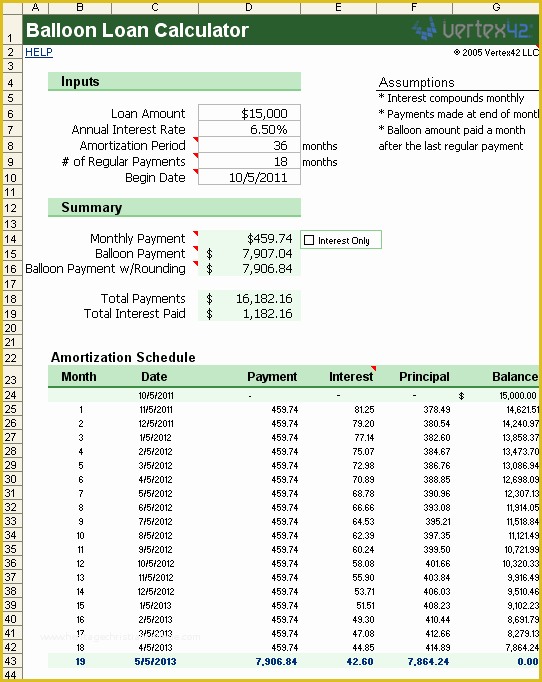

Interest charged is 10% per annum. Ignore rent, but show the entirety of the monthly loan repayment. If you’re considering taking out a loan and want to find out what payments will look like each month, as well as how.

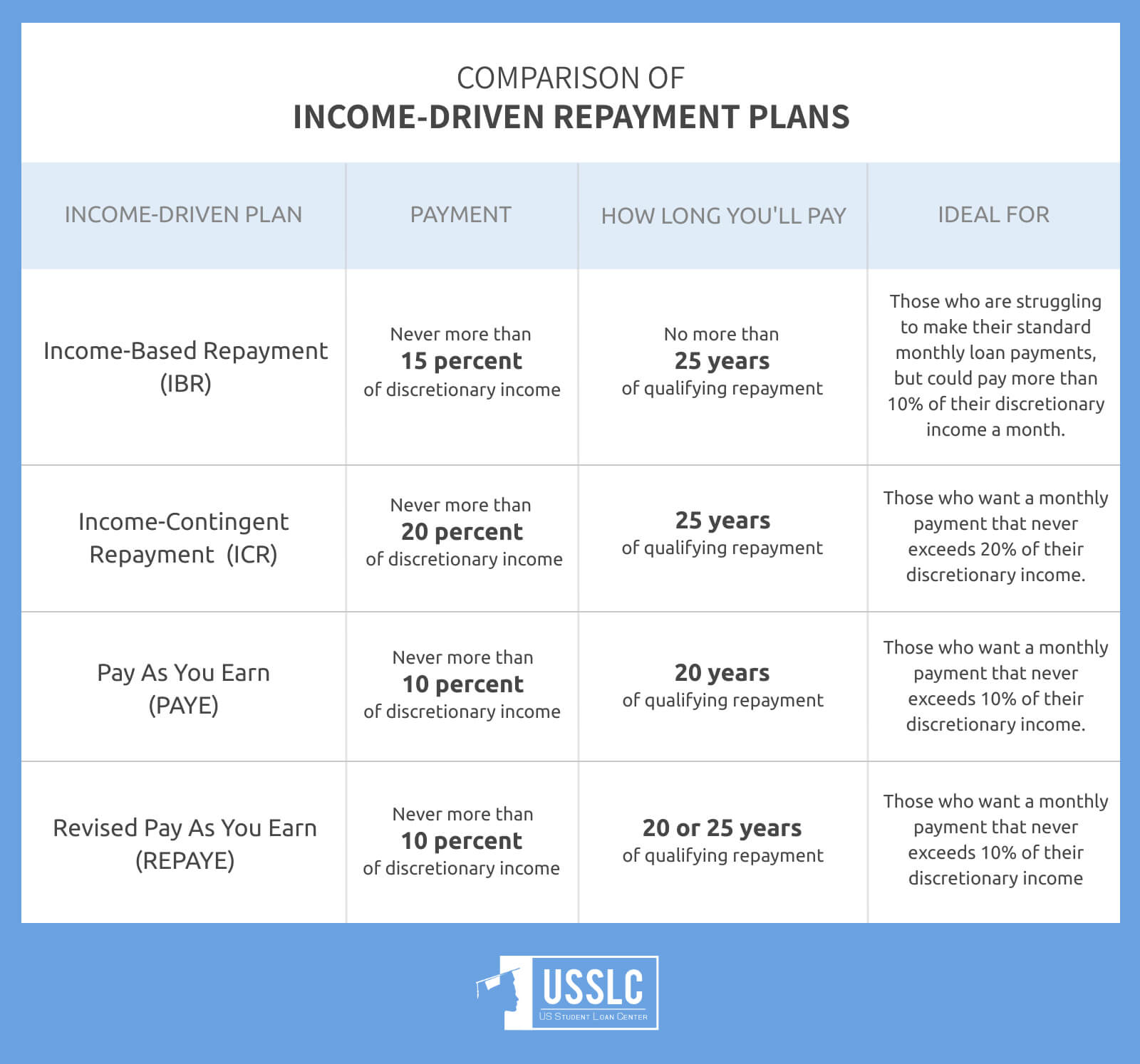

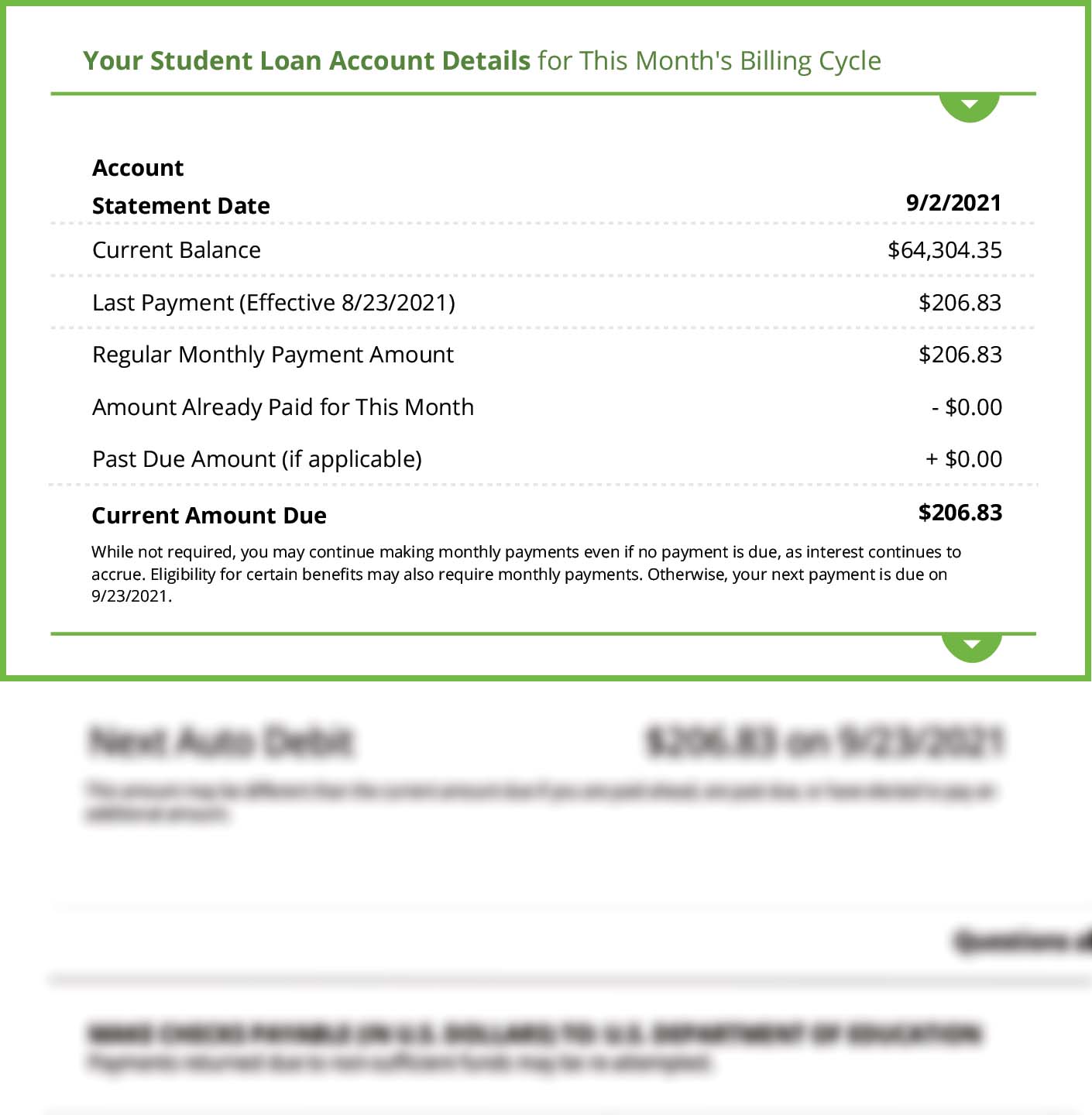

This is not very standard, but the benefit is that it clearly lays out the actual cash cost obligations. Similarly, any repayment of the principal amount will not be an expense and therefore will not be. For those enrolled in the save plan, monthly payments are calculated based on income and family size instead.

In your quickbooks desktop, go to the banking menu and select write checks. The bottom line. No, only the interest portion of a debt payment impacts the income statement.

Biden's latest proposal to expand student loan forgiveness 02:52. The second is used in the context of. An idr plan calculates your payment based on how much money you make and your family.

Your reporting period is the specific timeframe the income statement covers. Abc ltd has taken a loan of 30,000 at the start of current year which is payable by the end of the year. Loan details the statement will provide details about the loan, such as the loan amount, the interest.

There are two general definitions of amortization. The principal amount received from the bank is not part of a company's revenues and therefore will not be reported on the company's income statement. What is the save plan?

Select the bank account where you want to pay the loan. April 21, 2022 02:42 pm last updated april 21, 2022 2:42 pm loan repayment transactions hello, we recently took out a loan and the first payment was just. Company is preparing its financial.

Interpretive response company d is released from the obligation to make. The income statement impact of any loan forgiveness under ias 20 may either be presented separately or be offset against the related expenses. The principal portion of a debt payment only impacts the balance sheet.

As shown in the graphic below, interest expense in the debt schedule flows into the income statement, the closing debt balance flows onto the balance sheet, and principal. Question 1 how would company d account for the loan repayment waiver? Loan repayment calculator.