Fantastic Info About Cash Flow Statement South Africa

These are also known as “inflow” and “outflow”.

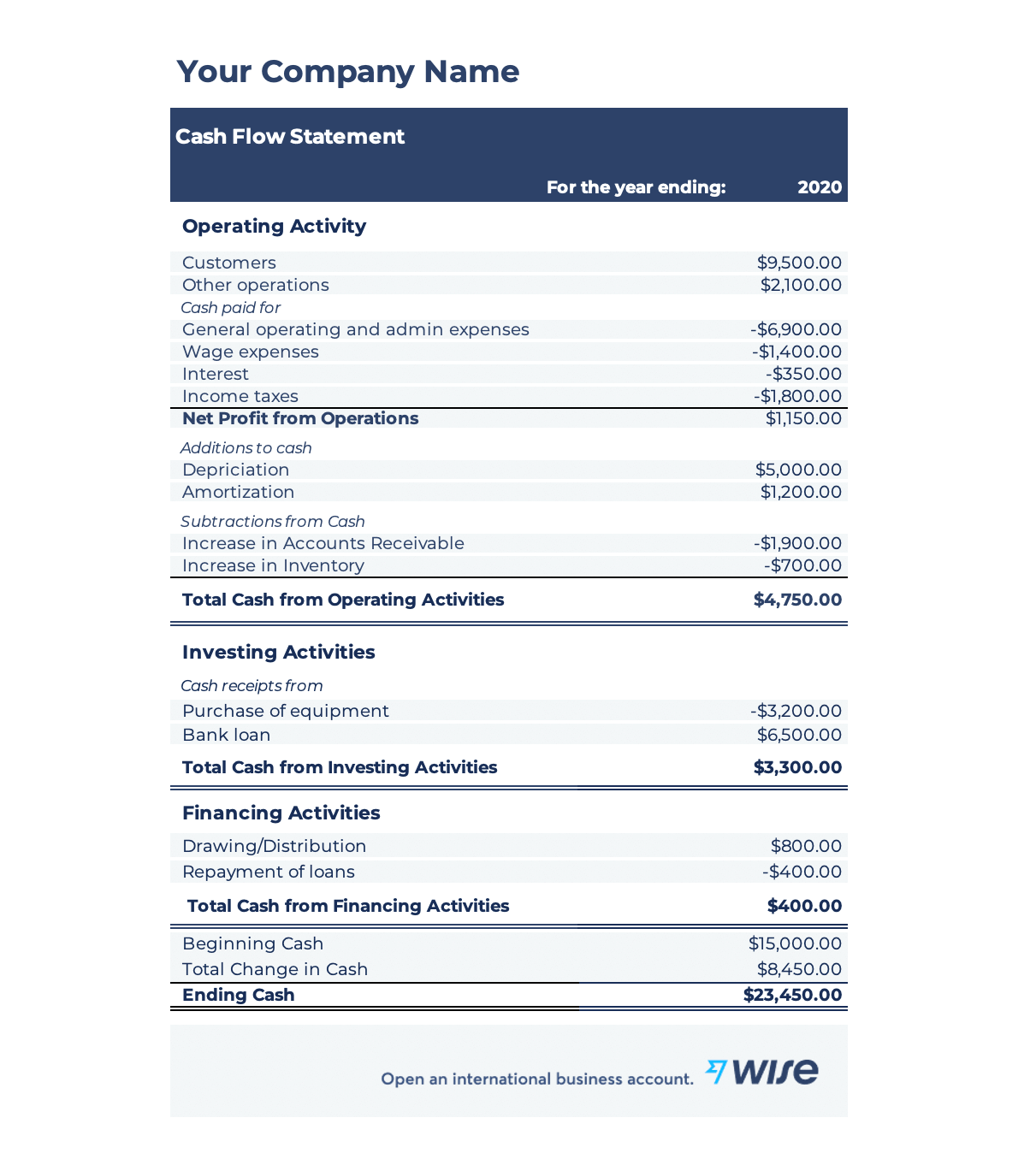

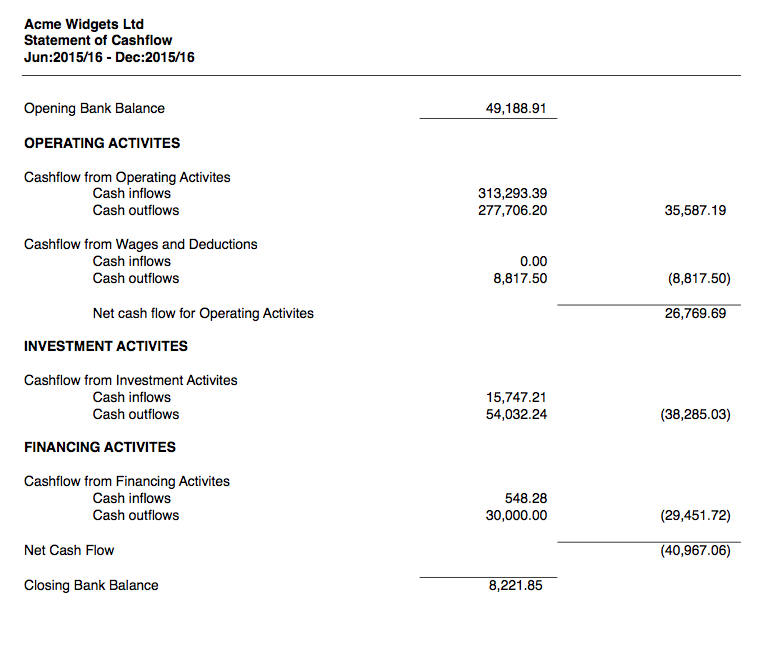

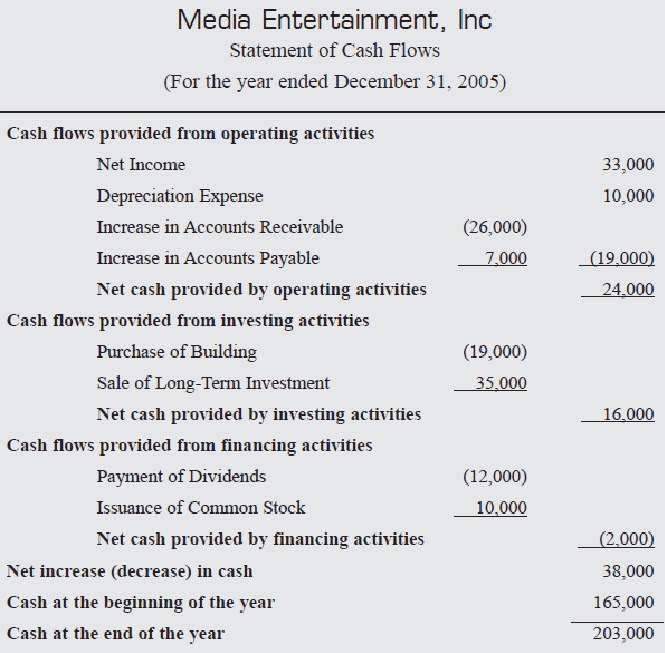

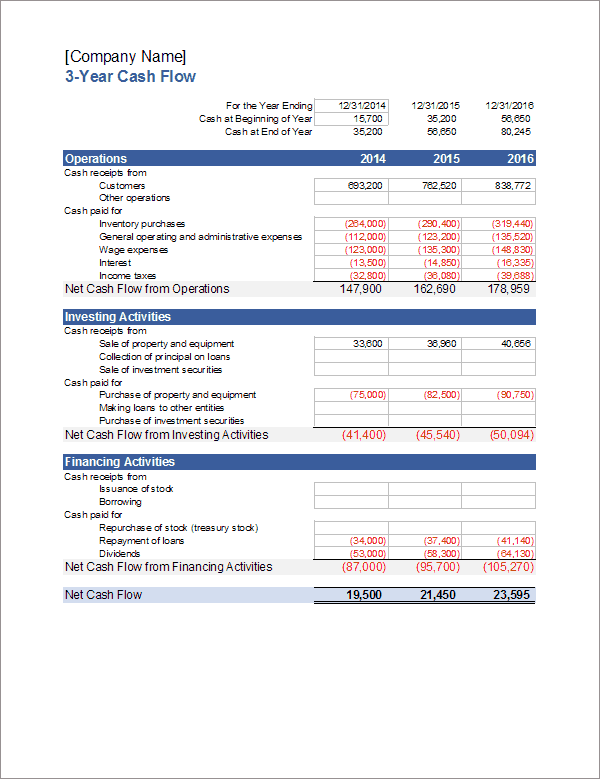

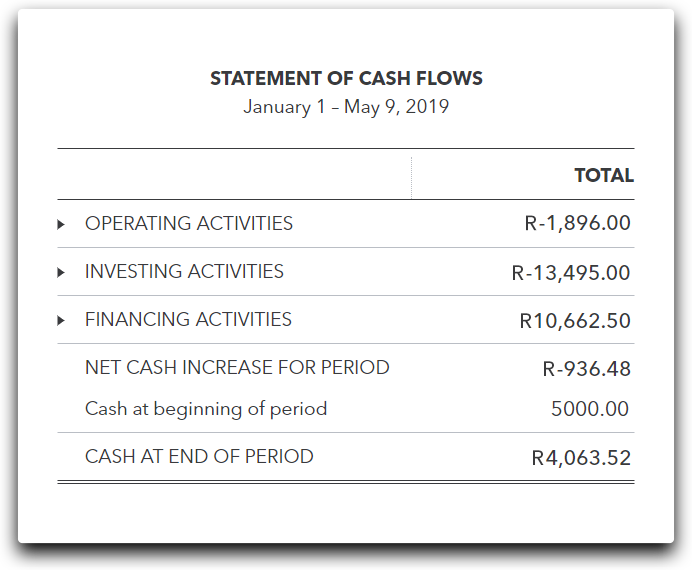

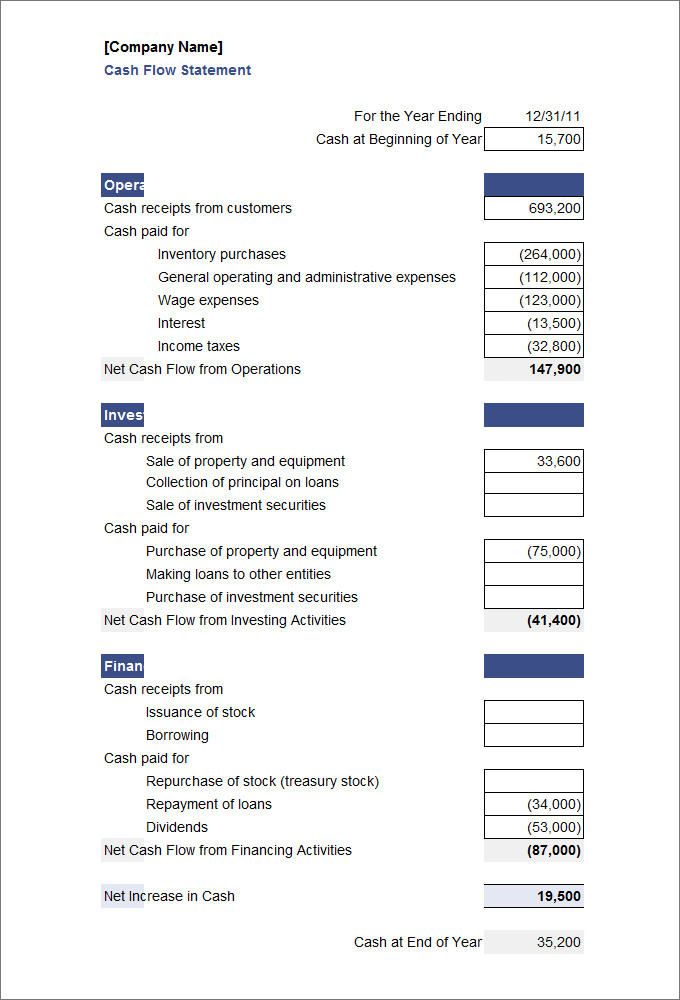

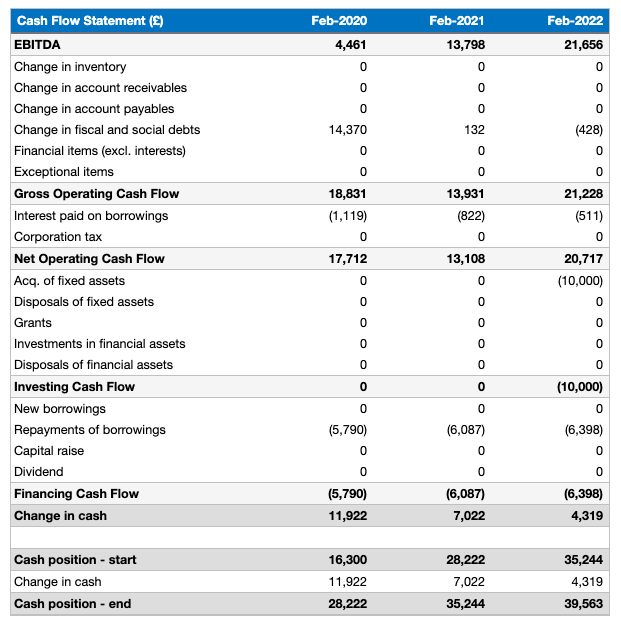

Cash flow statement south africa. The cash flow statement shows the activity of money coming in and going out of the business during a specific time frame and helps with determining details on the. The cash flow statement has three sections: A cash flow statement summarises the amount of cash into, and cash paid out by your company over a specific time period.

The annual financial statements for the year ended 3 july 2022 have been audited by pricewaterhousecoopers incorporated, in compliance with the applicable requirements. It is relevant to f3 financial accounting and to f7 financial reporting. The gfecra captures valuation gains on south africa’s foreign exchange reserves as the rand has moved from r10/us$1 in 2014 to r19/us$1 currently.

A cash flow statement, also known as a statement of cash flow, is one of the main financial statements, along with the income statement and the balance sheet,. Sars national treasury south africa enoch godongwana cyril ramaphosa free market economy national government business finance gdp money matters. Access all xero features for 30 days, then decide which plan best suits your business.

It shows details across a period of time specified by the company; Start using xero for free. Cash flow statement (definition) a.

Consolidated cash flow statement 21 notes to annual financial statements 1.1 basis of preparation 22 1.2 significant accounting estimates and judgements 22 2. The cash flow statement definition does not include net income. A cash flow statement is a financial statement that summarizes the inflows and outflows of cash transactions during a given period of business operations.

The statement of cash flows also referred to as the cash flow statement (cfs), reports the movement in cash of a company during a given financial period. Download a free cash flow statement template (instructions. Cash flow statements provide visibility of upcoming costs and regular outgoings so you can understand the financial health of your business.

These are questions many south african small. Cash flow statements generally cover the ebb and flow of money across. Example of a cashflow.

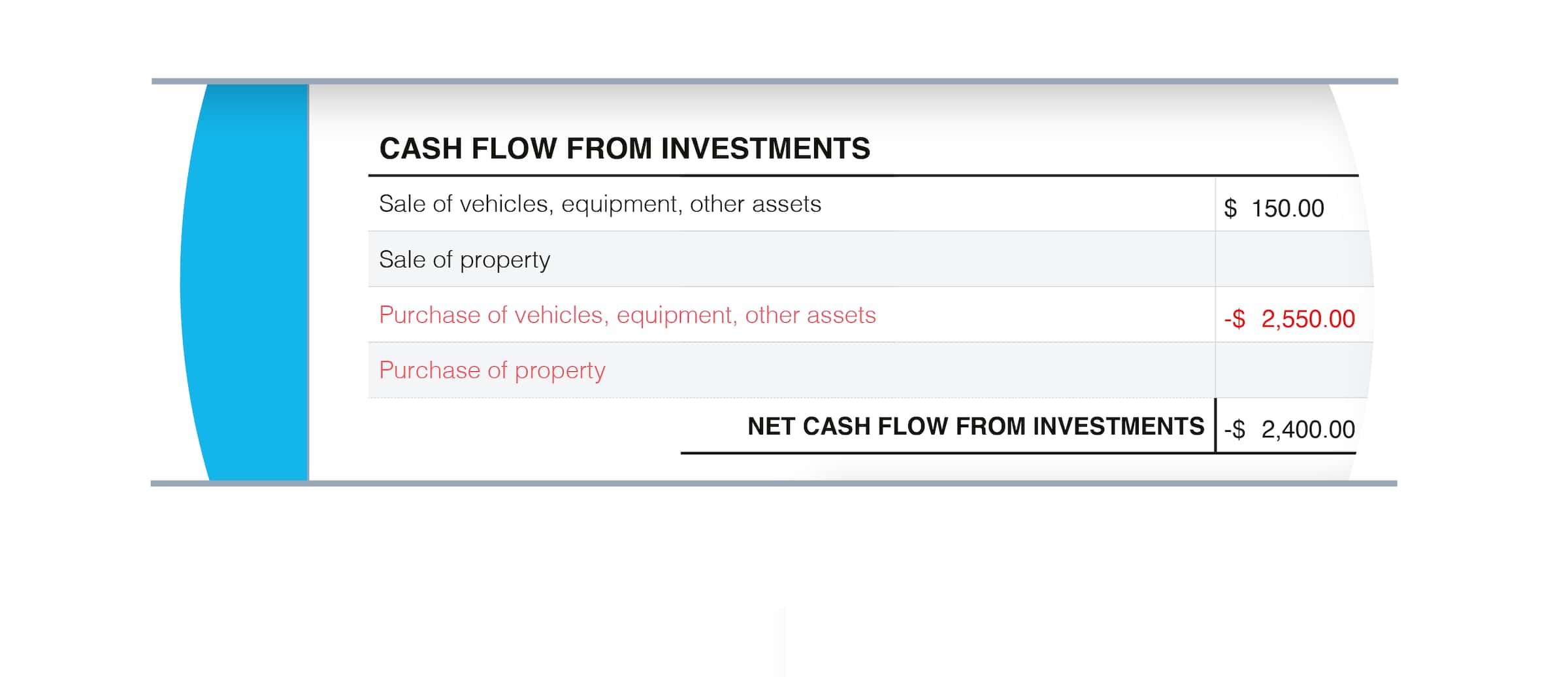

Financing activities are those that the size and composition of the entity's equity capital or borrowings, such as bonds and dividends. Cash flow statement the purpose of this chapter is to provide guidance on the identification and disclosure of information about the historical changes in cash and. As well as your business plan, a set of financial statements detailing you cashflow is essential.

This paper is organized as follows: It indicates the amount of cash or cash equivalents entering and leaving the business over a specified period. Your cash flow statement is an important tool to review the performance of a business as well as in forecast and strategic planning.

This section enables the users of the financial statements to evaluate the cash component of the normal operating activities for the period, and in doing so, to assess the quality of. This will provide details of actual cash required by. And what are the characteristics of a strong statement of cash flows?

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)