Simple Tips About The Purpose Of Preparing A Trial Balance

A trial balance is so called because it provides a.

The purpose of preparing a trial balance. Therefore, if the debit and the credit sides of the trial balance are the same, it is assumed that. Importantly, the trial balance is not an account. The main purpose of the trial balance is the ensure that the financial statements are correctly prepared by ensuring that all of the accounting entries that are recorded during the period are correctly recorded in accordance with the rule of debit and credit.

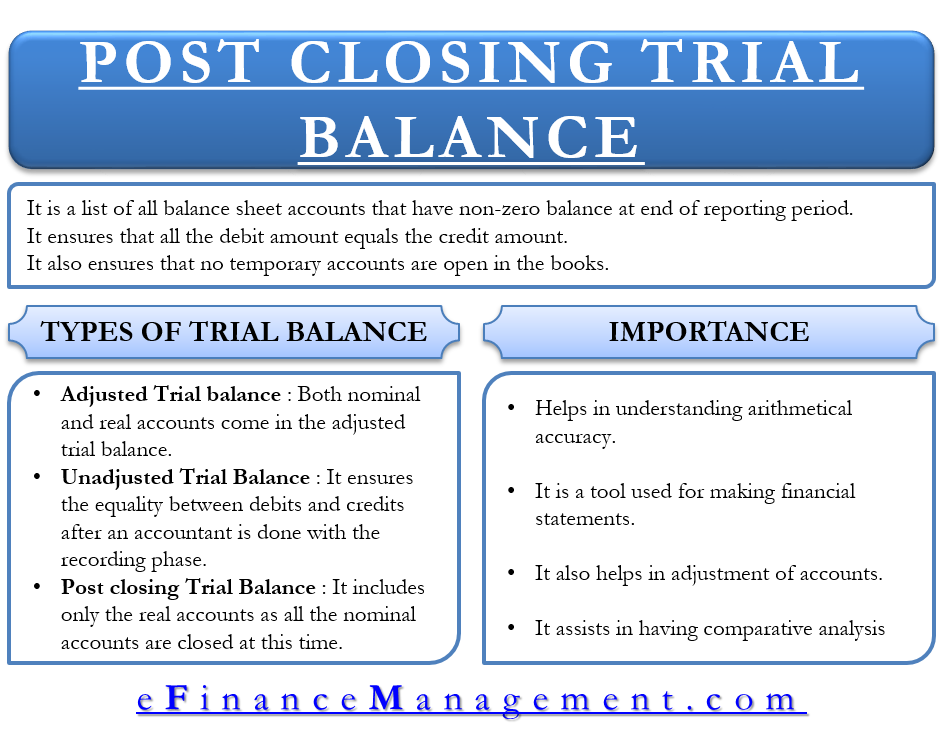

While it is not a financial statement, a trial balance acts as the first step in preparing one. The trial balance is made to ensure that the debits equal the credits in the chart of accounts. The purpose of a trial balance sheet is to detect errors so that they can be addressed before the formal balance sheet is presented to shareholders.

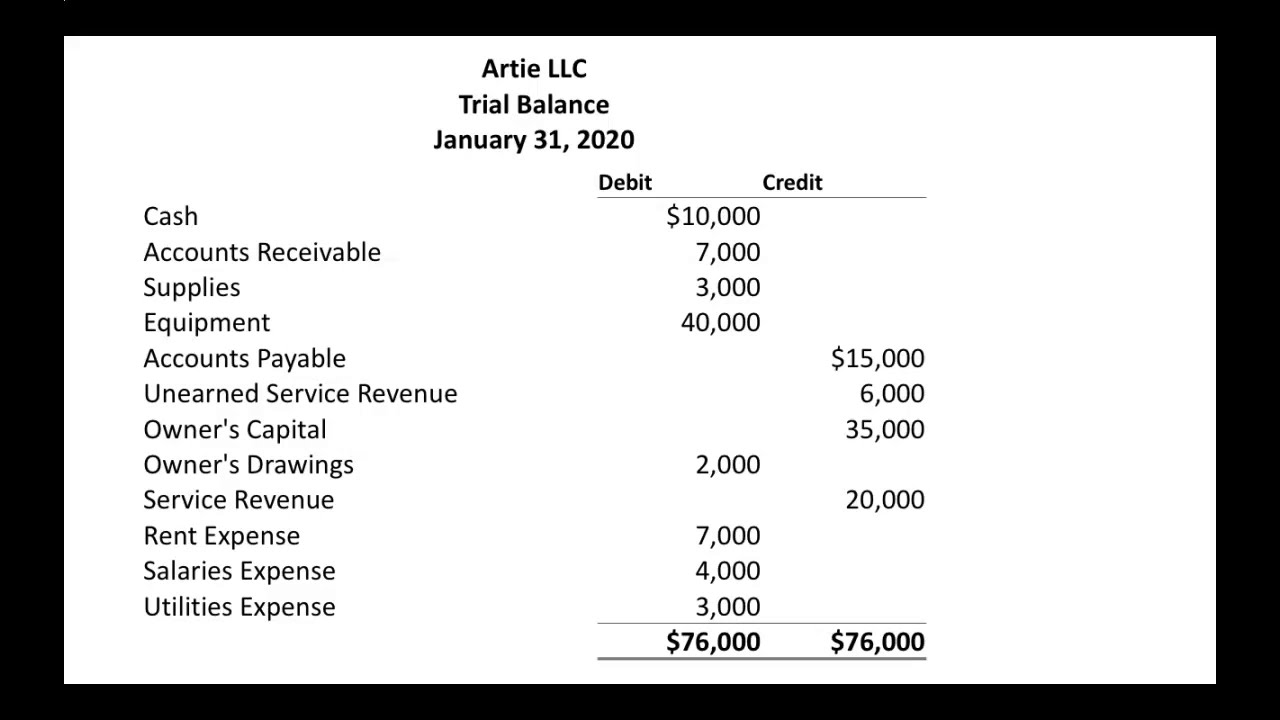

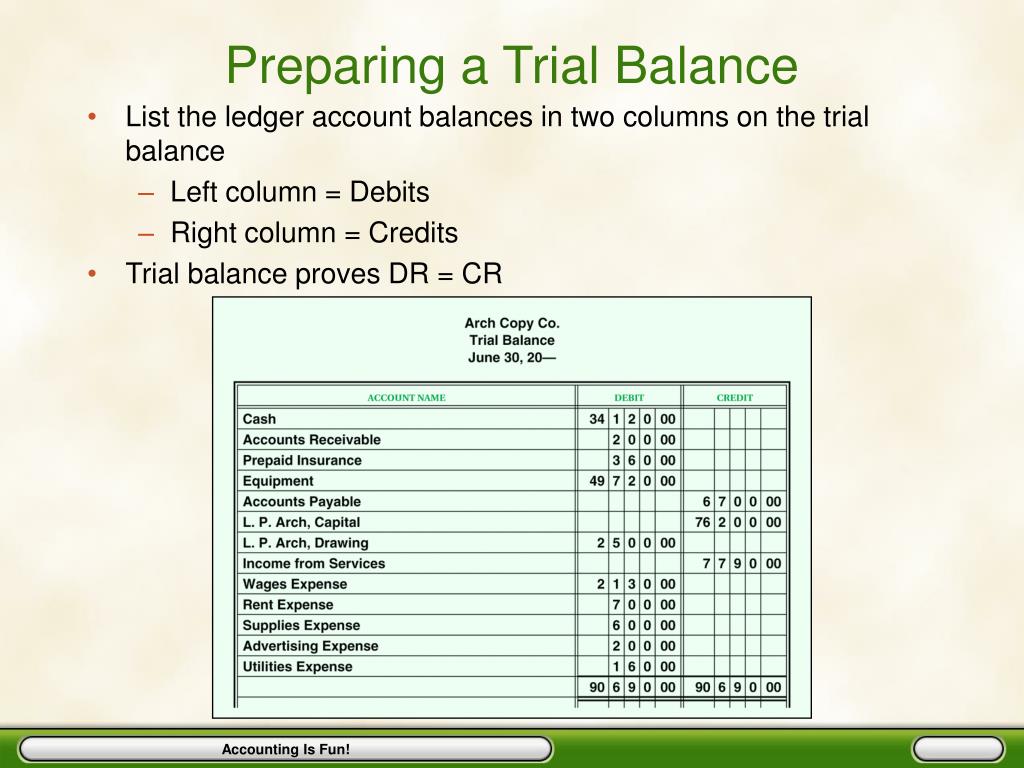

Preparing a trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Ledger balances are segregated into debit balances and credit balances.

Purpose of preparing a trial balance. Aggregate the amounts of the remaining account in two separate headings that is,. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

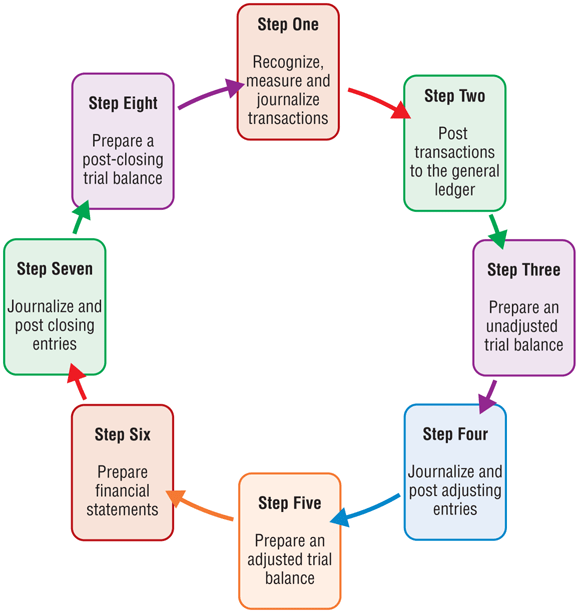

What are the uses of a trial balance? The main objective of a trial balance is to ensure the mathematical accuracy of the business transactions recorded in a company’s ledgers. Steps for preparing the trial balance are:

Purpose of preparing a trial balance; If all debit balances listed in the trial balance equal the total of all credit balances, this shows the ledger's arithmetical accuracy. These additional details in a general ledger reveal account activity during a certain accounting period, which makes it easier to conduct research and recognize possible.

The first step is to make sure that all the ledger accounts are balanced. It is also use as the working papers for accountant and auditors in drafting financial statements. The following are the three simple steps that you can use to prepare bt at the end of your organization.

It is also an indicator of the financial health of the business. Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. This report plays a vital role in consolidating, checking.

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. An adjusted trial balance represents a listing of all the account balances after posting of all the necessary adjusting entries in ledger accounts.¹ the purpose of preparing an adjusted trial balance is to correct any errors and to make the entity’s financial statements compatible with the requirements of an applicable accounting. The primary purpose of a trial balance is to detect potential errors in the general ledger and lay the groundwork for preparing accurate financial statements.

For preparing the trial balance, the closing balances of the general ledger accounts are important. Preparing a trial balance involves listing the ending balances of each account in the chart of accounts in balance sheet order. Asset and expense accounts appear on the debit side of the trial balance whereas liabilities, capital and income accounts appear on the credit side.

![Procedure for Preparing a Trial Balance [Notes with PDF] Trial Balance](https://everythingaboutaccounting.info/wp-content/uploads/2020/01/Procedure-for-Preparing-a-Trial-Balance-1-1024x536.png)