Have A Info About Variable Costing Method Income Statement

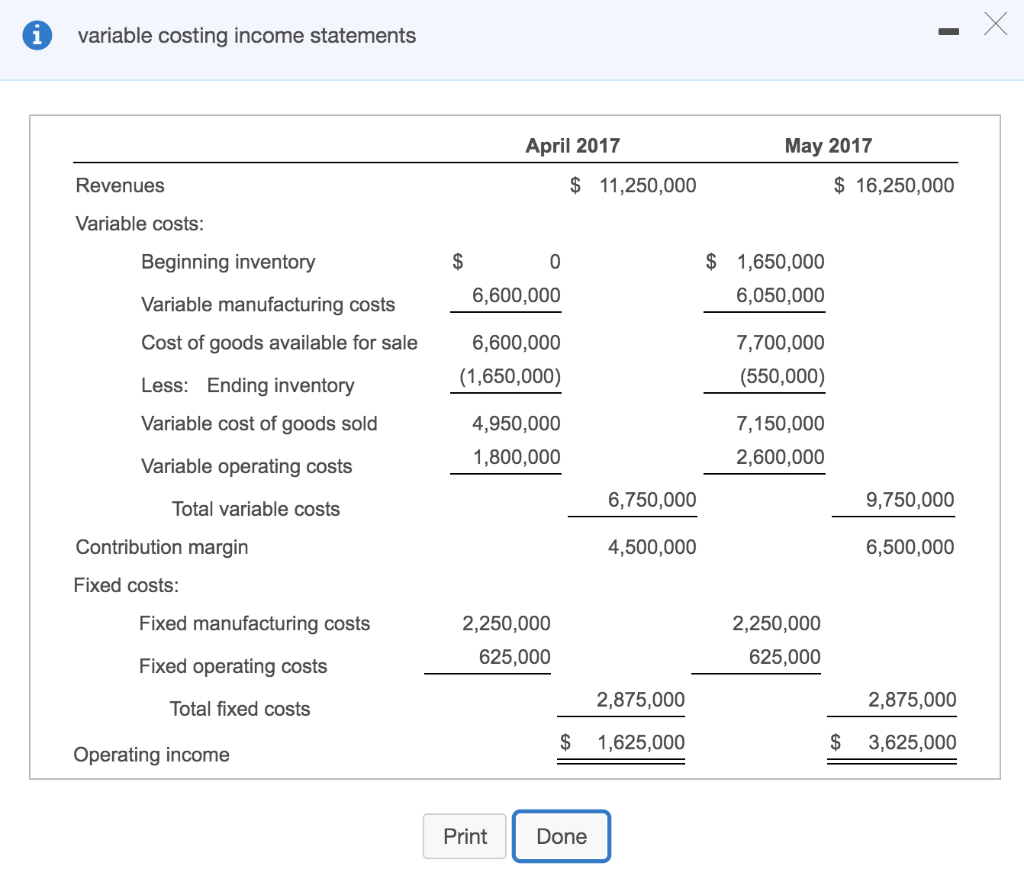

(redirected from variable costing) an example of an income statement using variable and absorption costing.

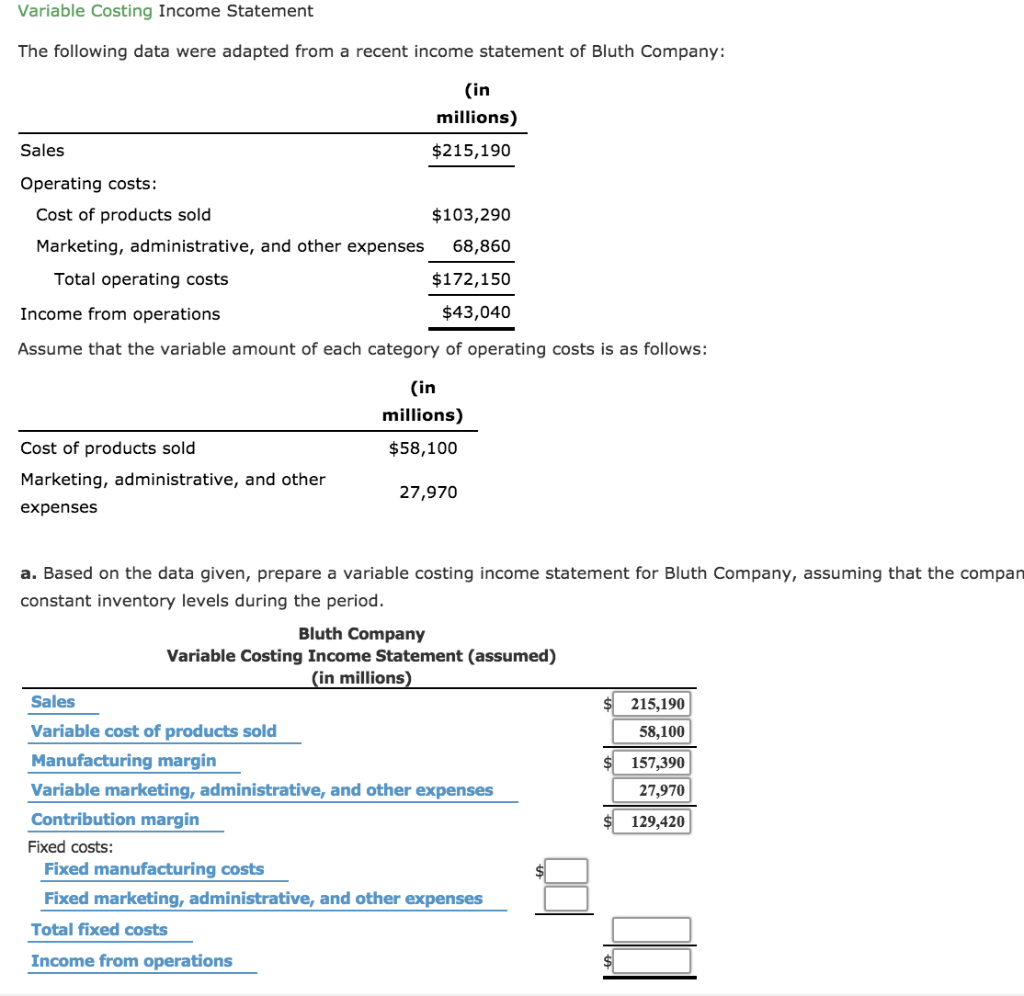

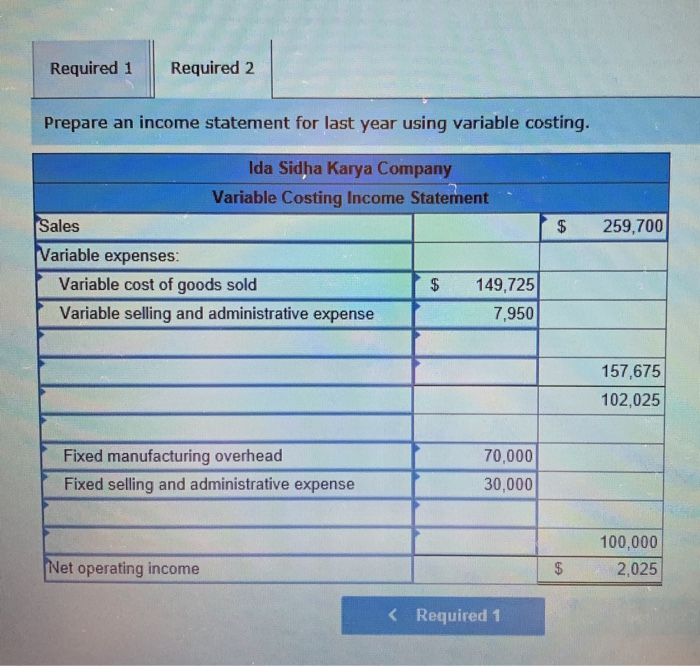

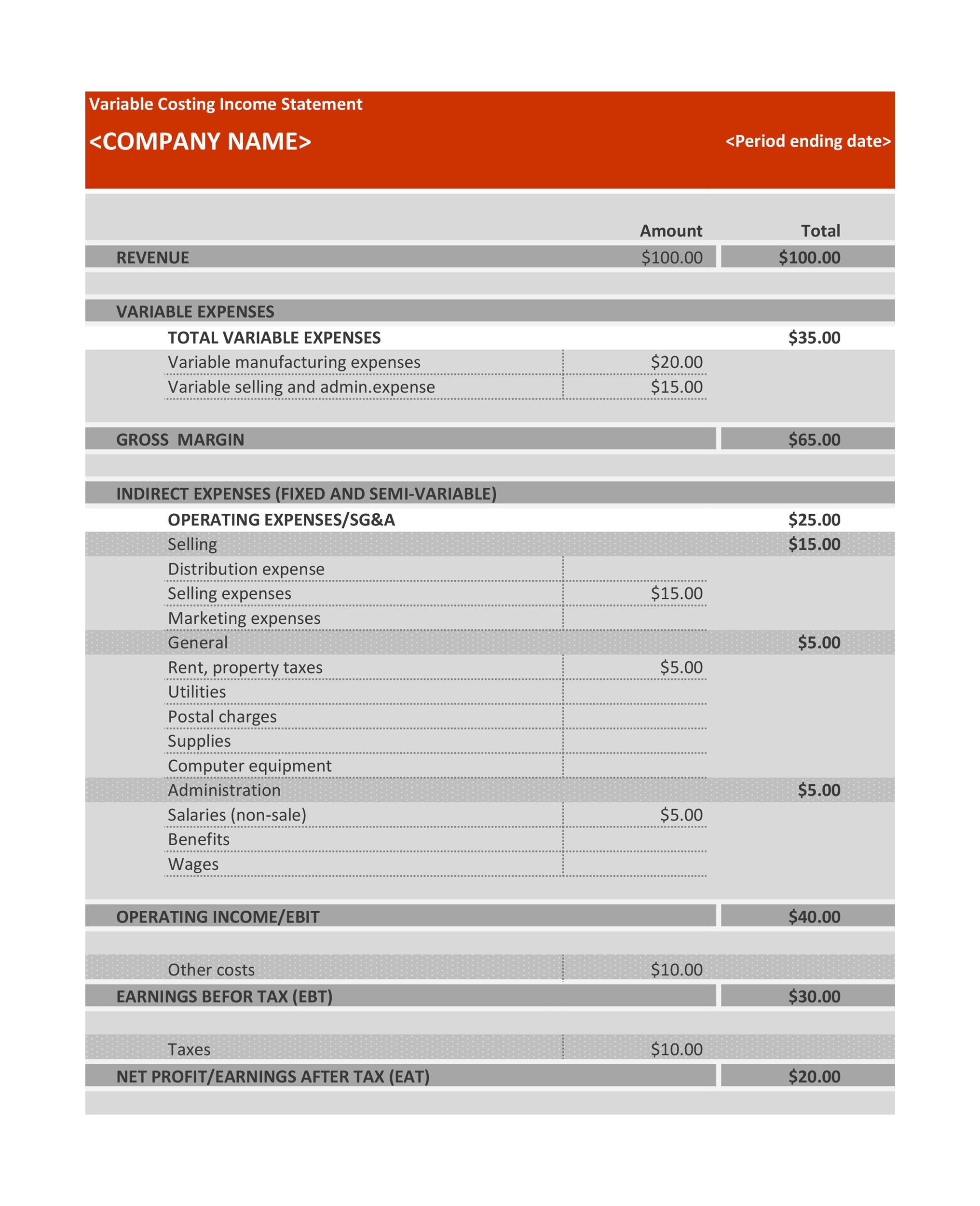

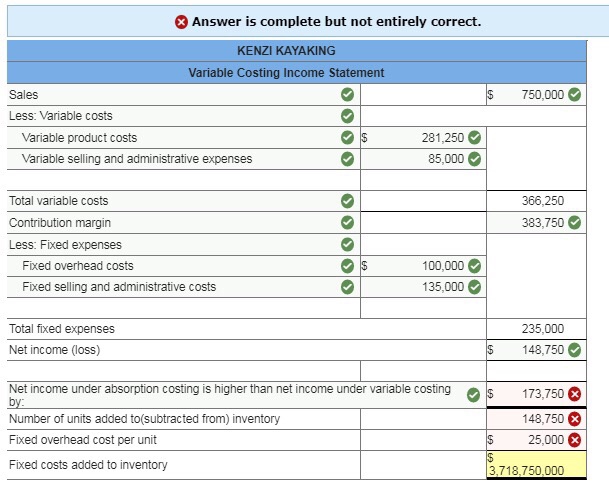

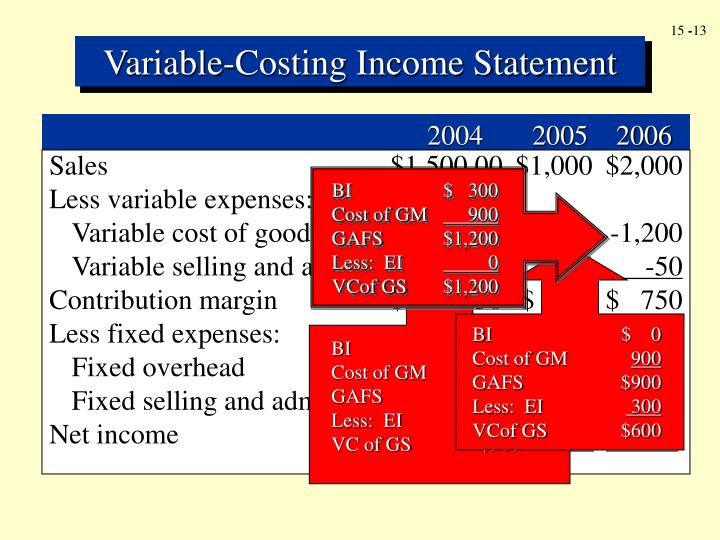

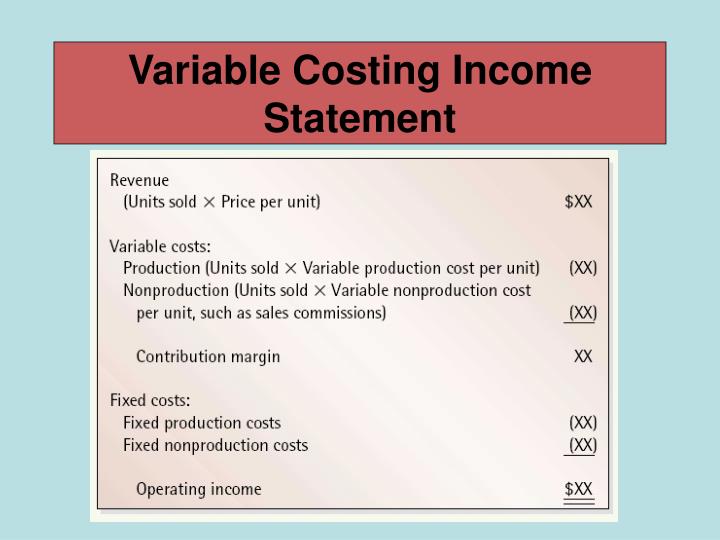

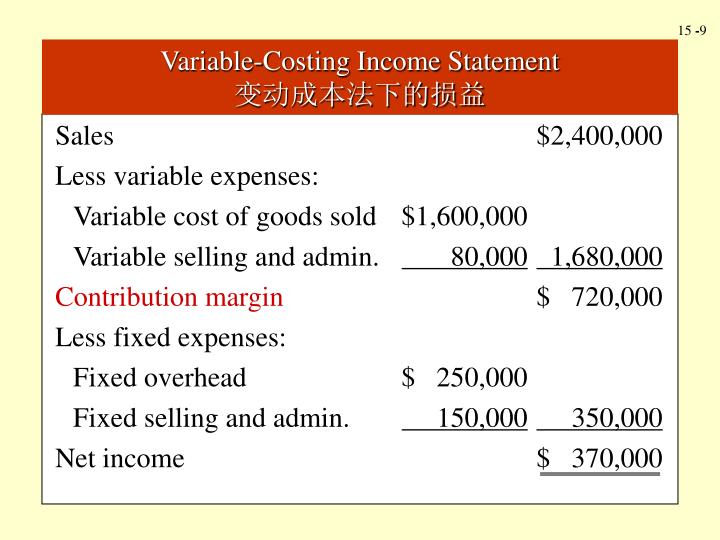

Variable costing method income statement. A variable costing income statement is a report prepared under the variable costing method. The variable cost per unit is $22 $ 22 (the total of direct material, direct labor, and variable overhead). In the variable cost income statement, variable cost is to be reduced from the amount of revenue to arrive at the contribution and contribution per unit.

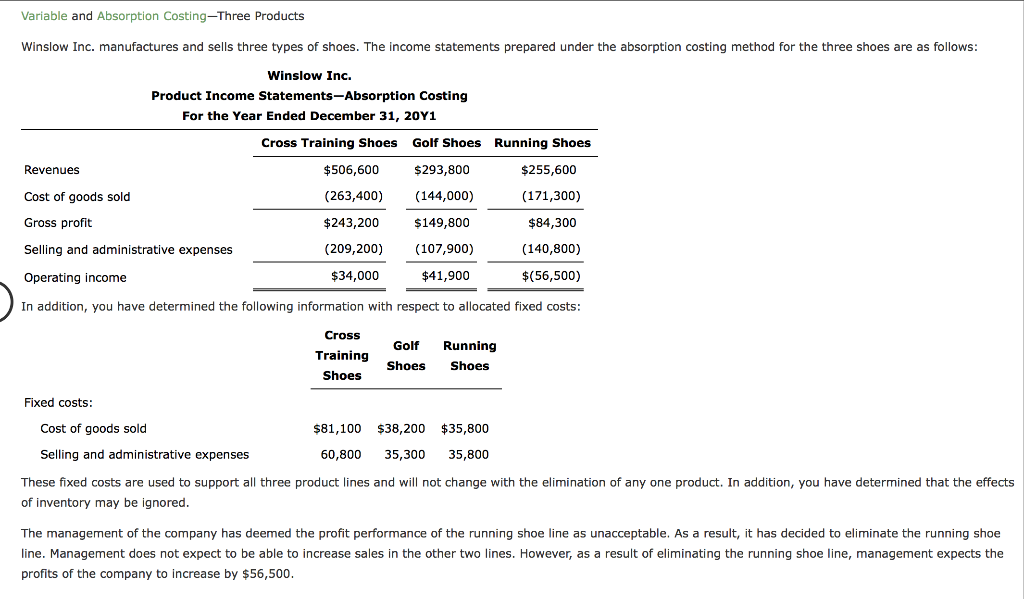

It is useful to determine the proportion of expenses that varies directly with revenues. However, they can perform the variable cost method internally for management accounting. Variable costing can exclude some direct fixed costs.

Variable costing income statement has the following line items: In this statement, companies only deduct variable expenses for a specific period. On a variable costing income statement, changes in inventory have no effect on operating income, making this method more.

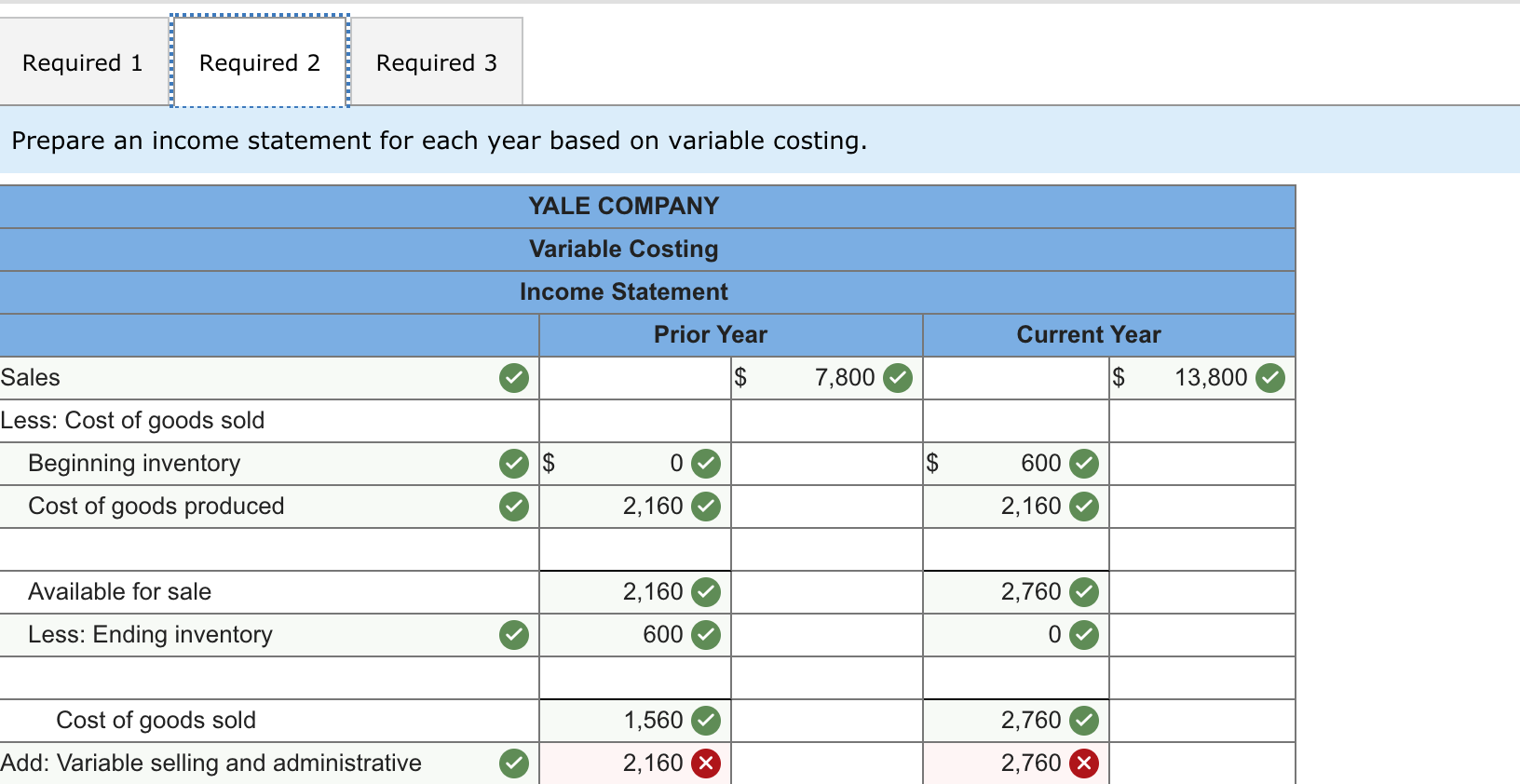

The variable costing income statement is one where all variable expenses are subtracted from revenue, which results in contribution margin. From there, you subtract all fixed expenses to arrive at the net profit (or loss) for the accounting period. Similarly, those profits are known as the contribution to a particular product.

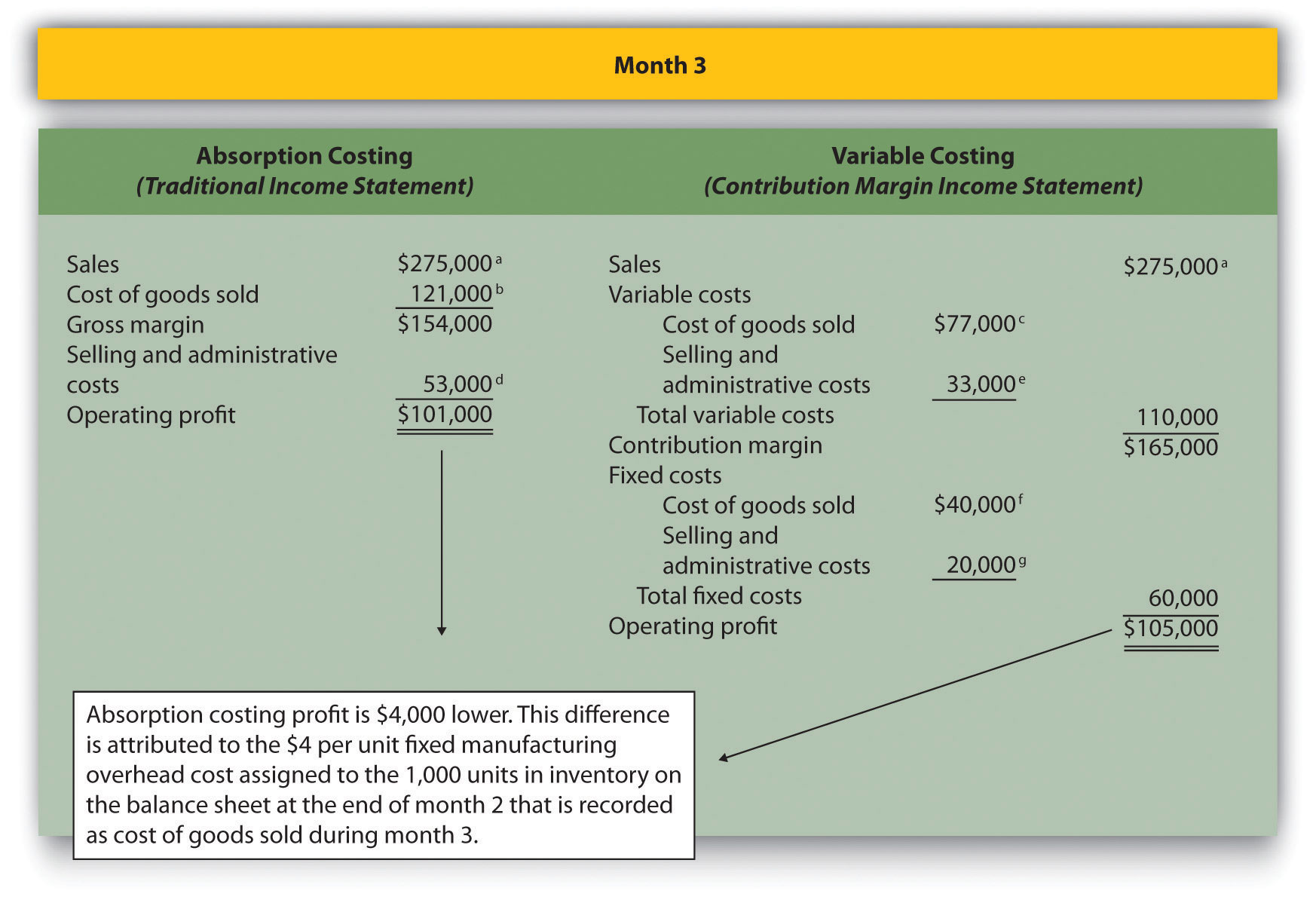

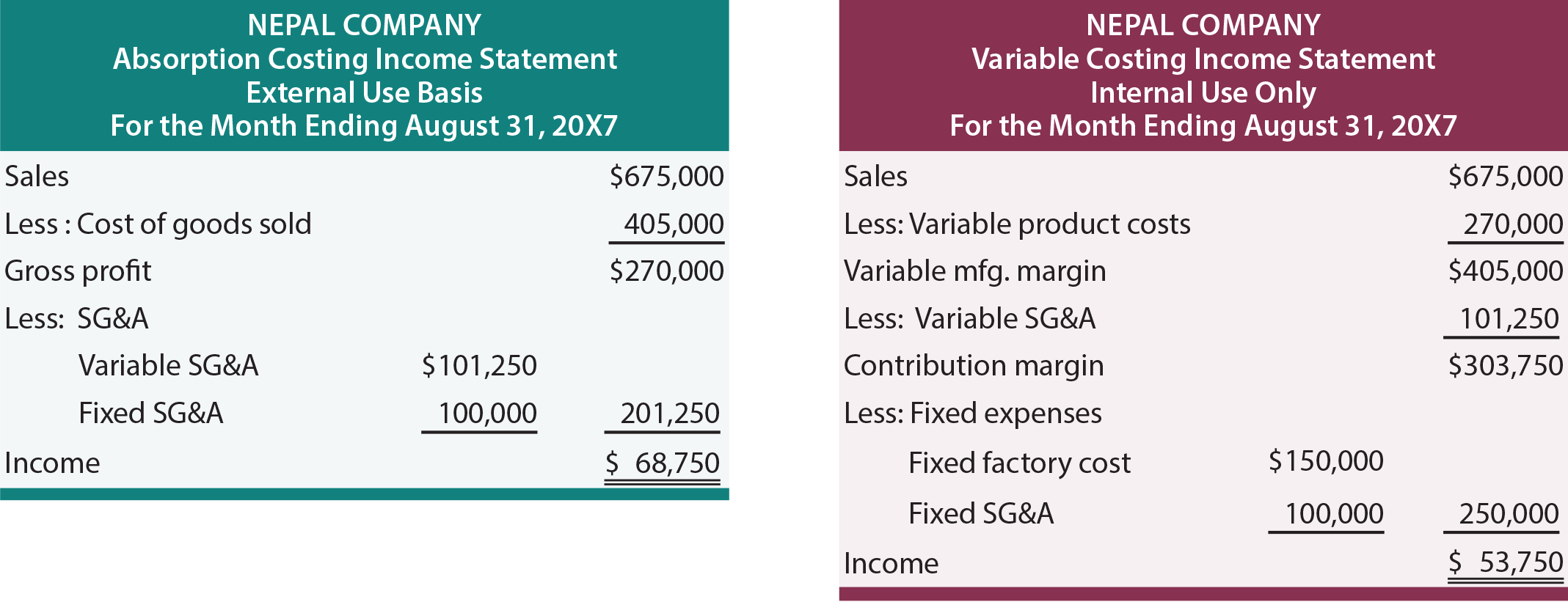

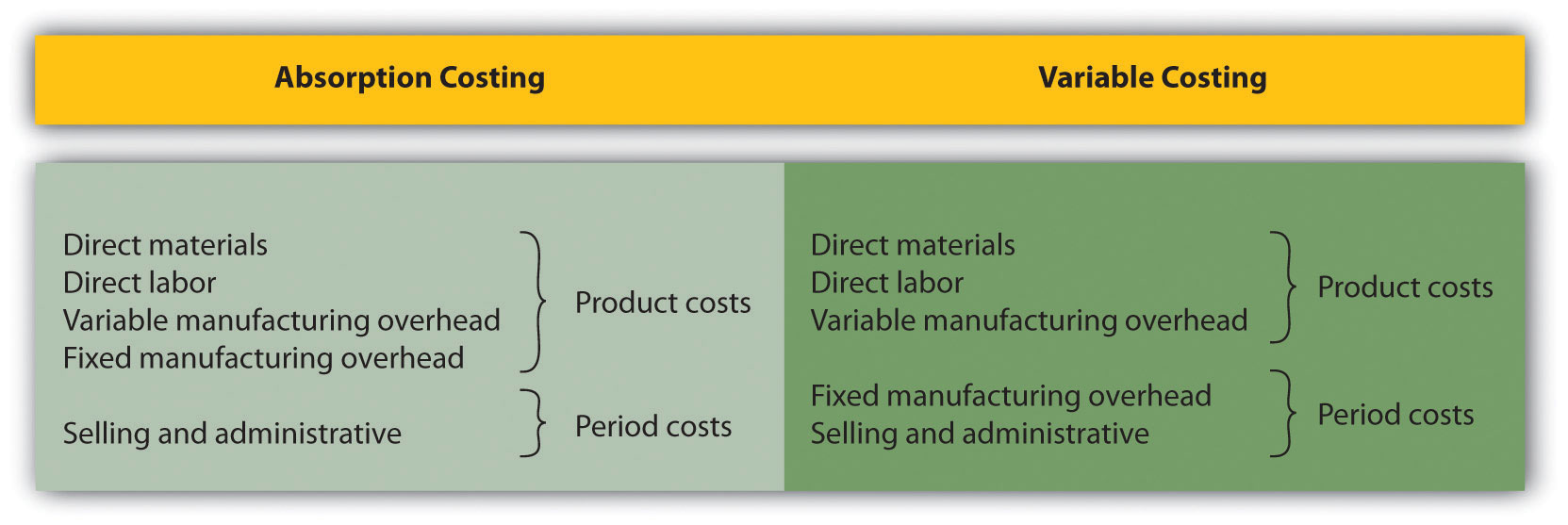

They must stick to absorption costing techniques to comply with the laws. Absorption costing generally accepted accounting principles require use of absorption costing (also known as “full costing”) for external reporting. Absorption costing vs variable costing

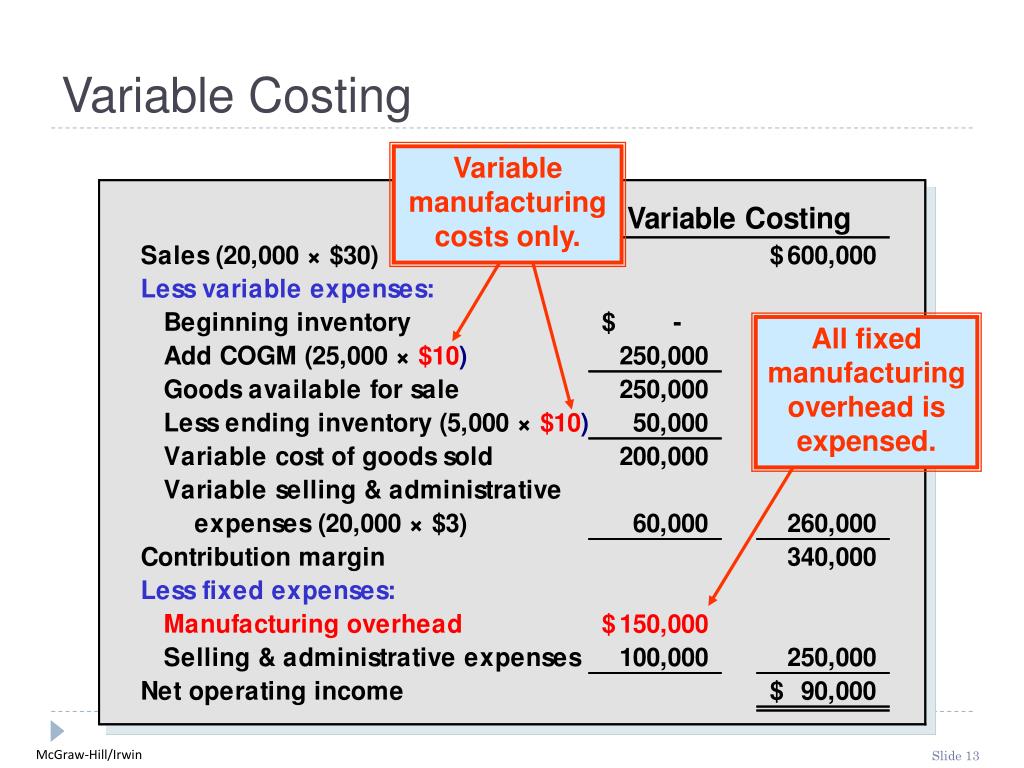

Variable costing, also known as marginal costing, is mainly used for internal reporting. Fixed manufacturing overhead costs are expensed in the period in which they are incurred under direct costing. Key takeaways absorption costing includes all of the direct costs associated with manufacturing a product.

Variable costing, also called direct costing or marginal costing, is a method in which all variable costs (direct material, direct labor, and variable overhead) are assigned to a product and fixed overhead costs are expensed in the period incurred. Under variable costing, fixed overhead is not included in the value of inventory. These costs are attached to inventory as an asset on the balance sheet until the goods are sold, at which point the costs are transferred to cost of goods sold on the income statement as an expense.

Contribution margin is the amount contributed by sales towards fixed costs and profit. When to use a variable costing income. Whereas, full costing, also known as absorption costing, is mainly for external reports.

A variable costing income statement is a financial report in which you subtract variable expenses from revenue, resulting in a contribution margin. Variable production costs include direct materials, direct labor and variable manufacturing overheads. This chapter’s initial topic pertains to an internal reporting method for measuring and presenting inventory and income, known as variable costing.

This results in fewer expenses and therefore greater income with the variable cost method. Key takeaways variable costing is a financial metric used to understand production costs using only variable costs. The three variable costing income statements at the different levels of production were exactly the same, each yielding operating income of $100,000, as shown in the following comparative statements.