Glory Tips About Sources Of Fund Flow Statement

Source of fund # 1.

Sources of fund flow statement. Difference between fund flow statement and balance sheet. Then, analyze where the company has earned and spent money. Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less than 10 months, according to.

Concept of funds flow statement: Fund flow statement a company's balance sheet and income statement measures one aspect of performance of the business over a period of time. Cash flows from operating activities:

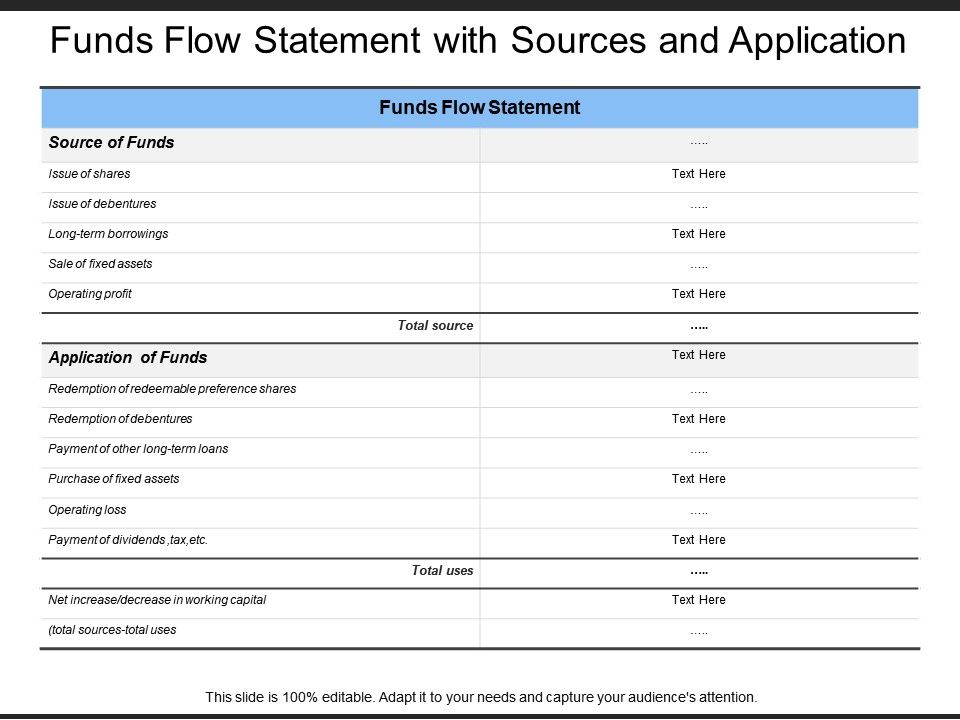

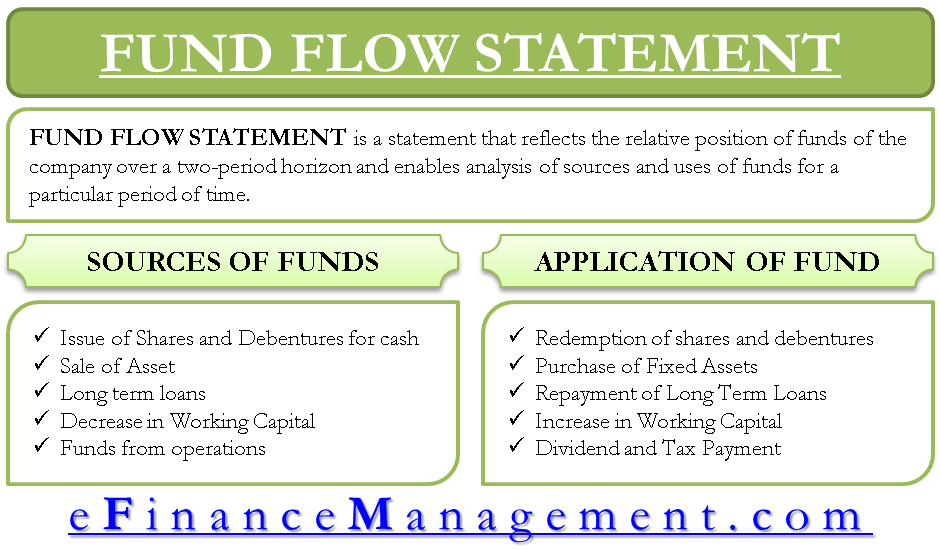

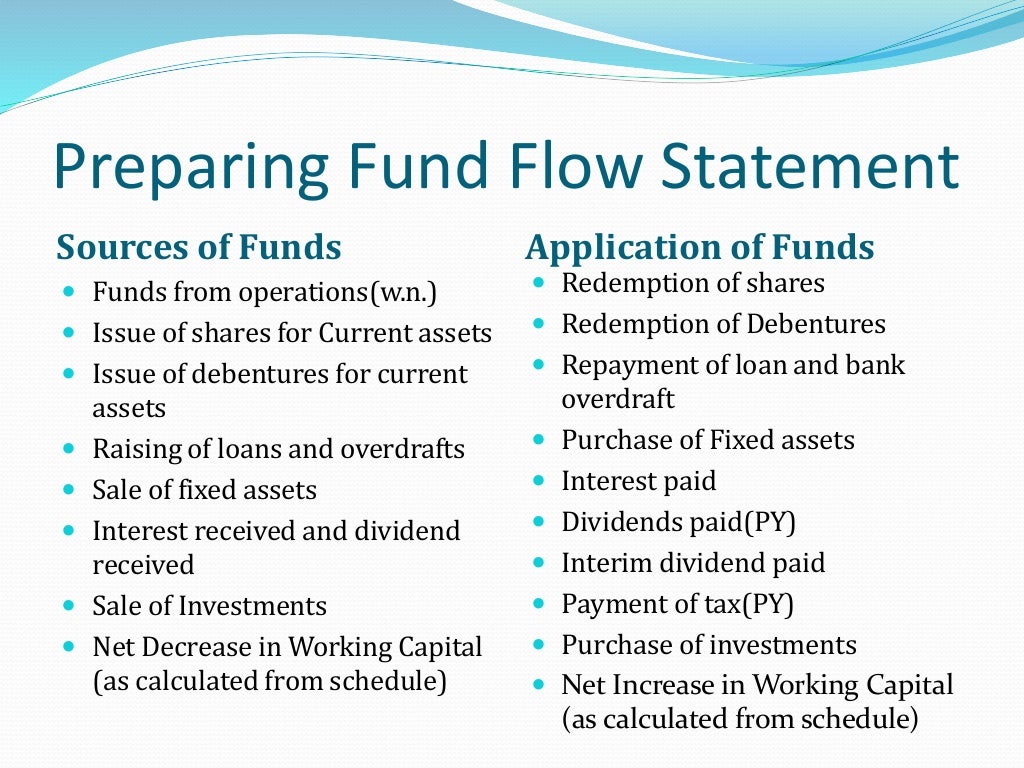

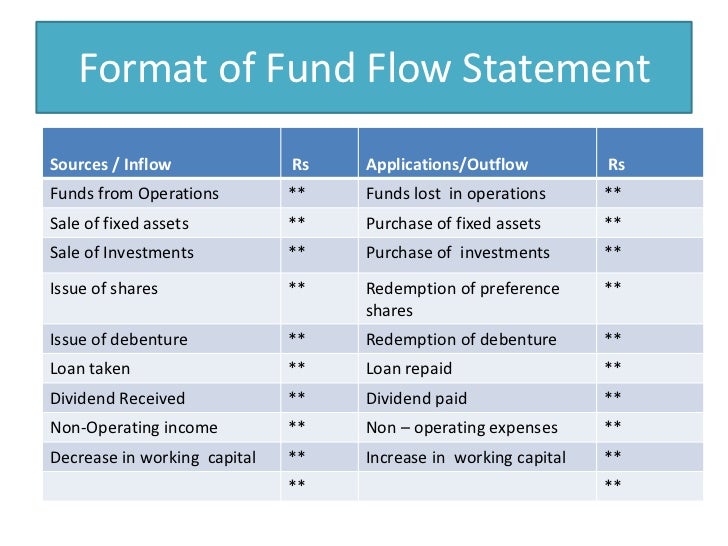

The primary components of fund flow are the sources and uses of funds, which include avenues like loans or asset sales and expenditures like machinery purchase or debt repayment. In a nutshell, transactions that increase working capital are sources of funds, whereas transactions that decrease working capital are applications of funds. A fund flow statement examines the sources and uses of funds of a firm between two points of time.

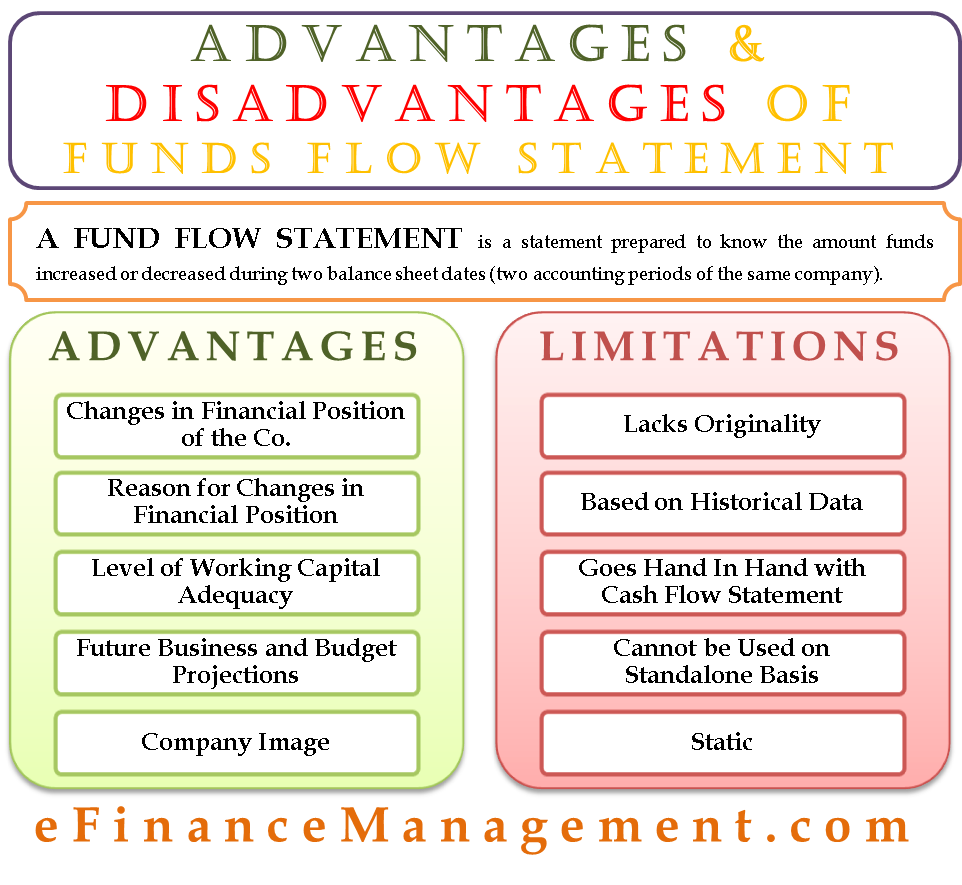

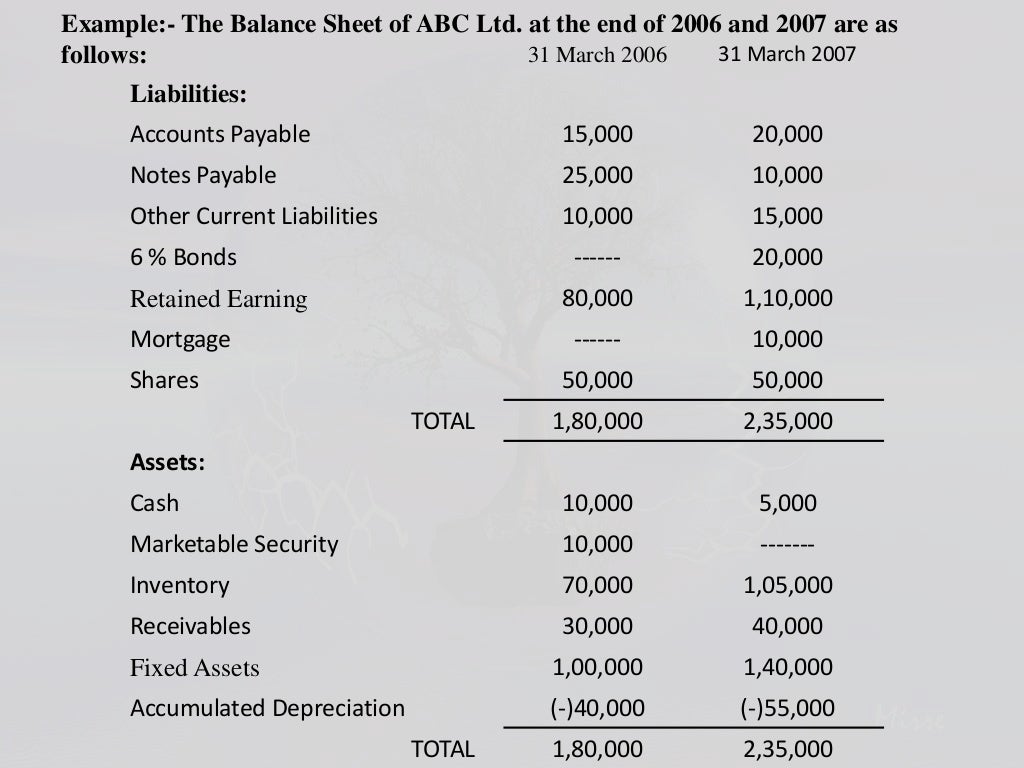

Other startup costs $ 13,000: A fund flow statement is a statement prepared to analyse the reasons for changes in the financial position of a company between two balance sheets. It provides a comprehensive view of sources and uses of funds, highlighting the movement of cash or cash equivalents within an organisation.

Foulke defines the funds flow statement as “a statement of sources and application of funds is a technical device designed to analyze the changes in the financial condition of a business enterprise between two dates.” Cash flow sources can be divided into three different categories on a cash flow statement: Difference between fund flow statement and profit and loss account.

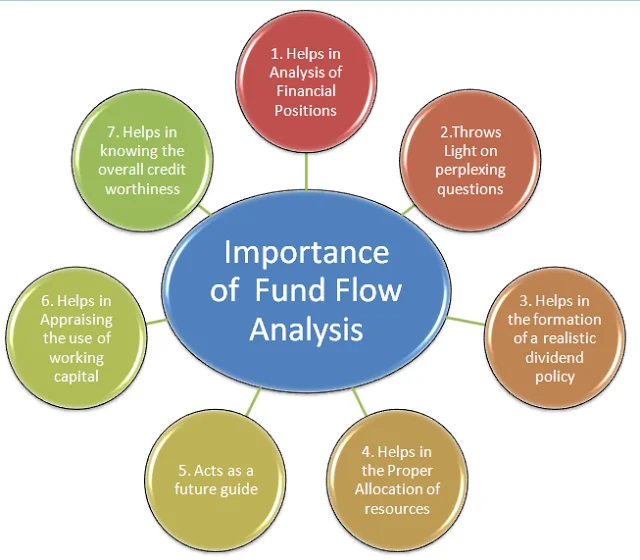

Many interpret funds as cash only and fund flow statement prepared of this ratio is called a cash flow statement. Cash fund, capital fund, working capital fund etc. A fund flow statement allows stakeholders to track the ups and downs of a company’s finances over a specific period.

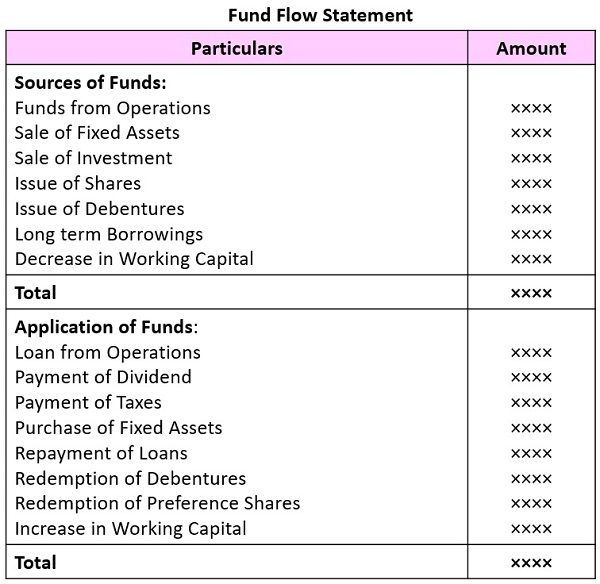

Trading profits or the profits from operations of the business are the most important and major source of funds. Finally, create a fund flow. The components of a fund flow statement are its sources of funds which may be from the outside, and capital brought in by the owners, and details on how the funds are utilised namely whether they’ve been used on fixed assets or on current assets.

To generate a fund flow statement, you must first identify the sources of funds (inflows) and the uses of funds (outflows). Supplies and advertising $ 49,500 home equity $ 30,000: It portrays the inflow and outflow of funds i.e.

Importance of fund flow statement. It is an important part of the financial statements of every organisation even though they prepare a thorough balance sheet. Cash generated from the general or core operation of the.

A funds flow statement is a financial document that analyses a company’s balance sheet of two years to validate the movement of funds from the previous financial year to the current year. It's crucial for business strategy and loan credibility. Total application of funds :