Best Of The Best Tips About Provision For Warranty Expense

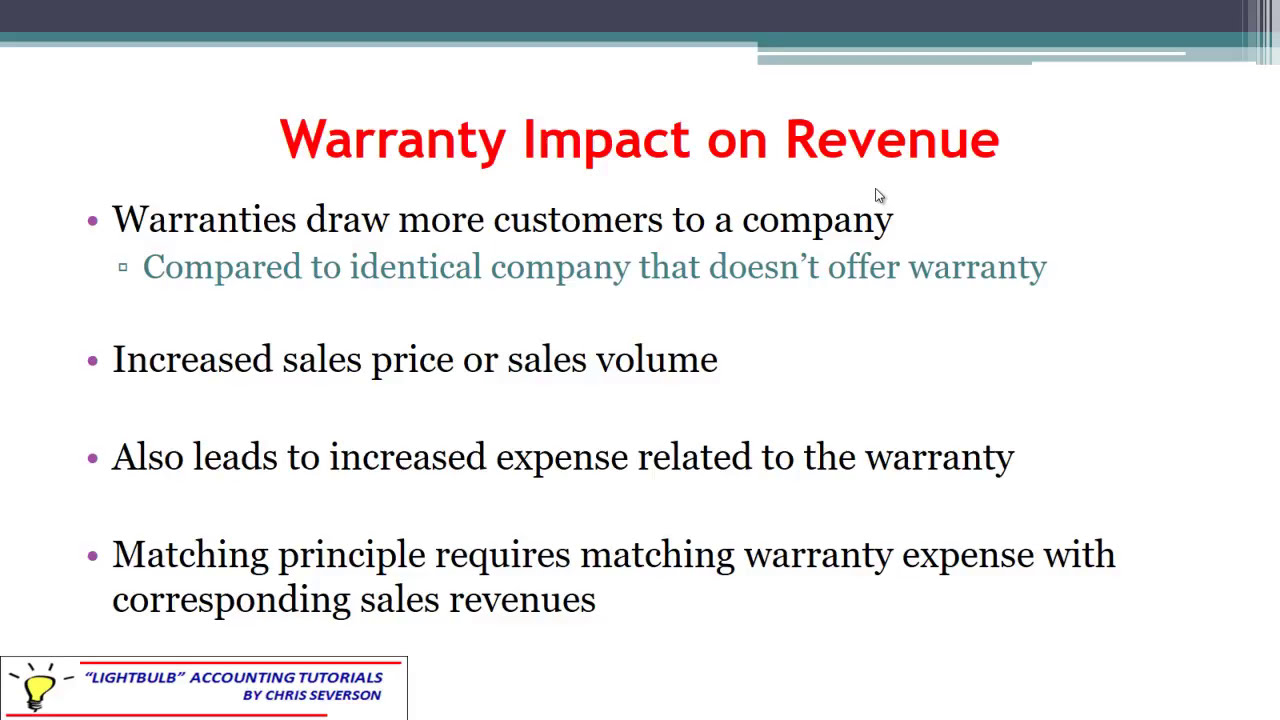

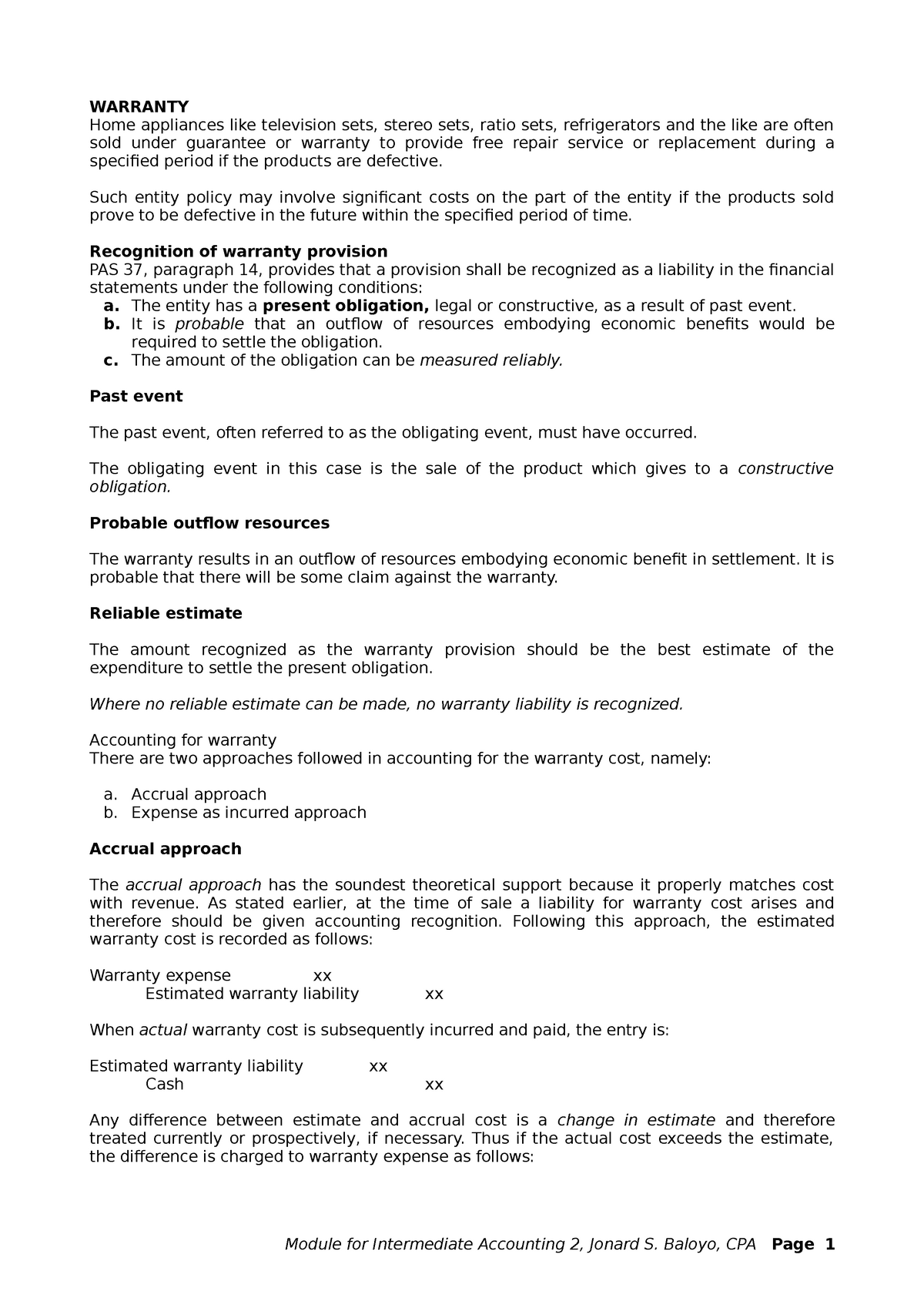

The total amount of warranty expense is limited by the warranty period that a business typically allows.

Provision for warranty expense. The total amount associated is limited to the warranty period permitted by the business. What warranty do you have? The following decision tree could be used to determine whether a warranty is an ‘assurance warranty’ or a ‘service warranty’, as well as the appropriate accounting treatment:

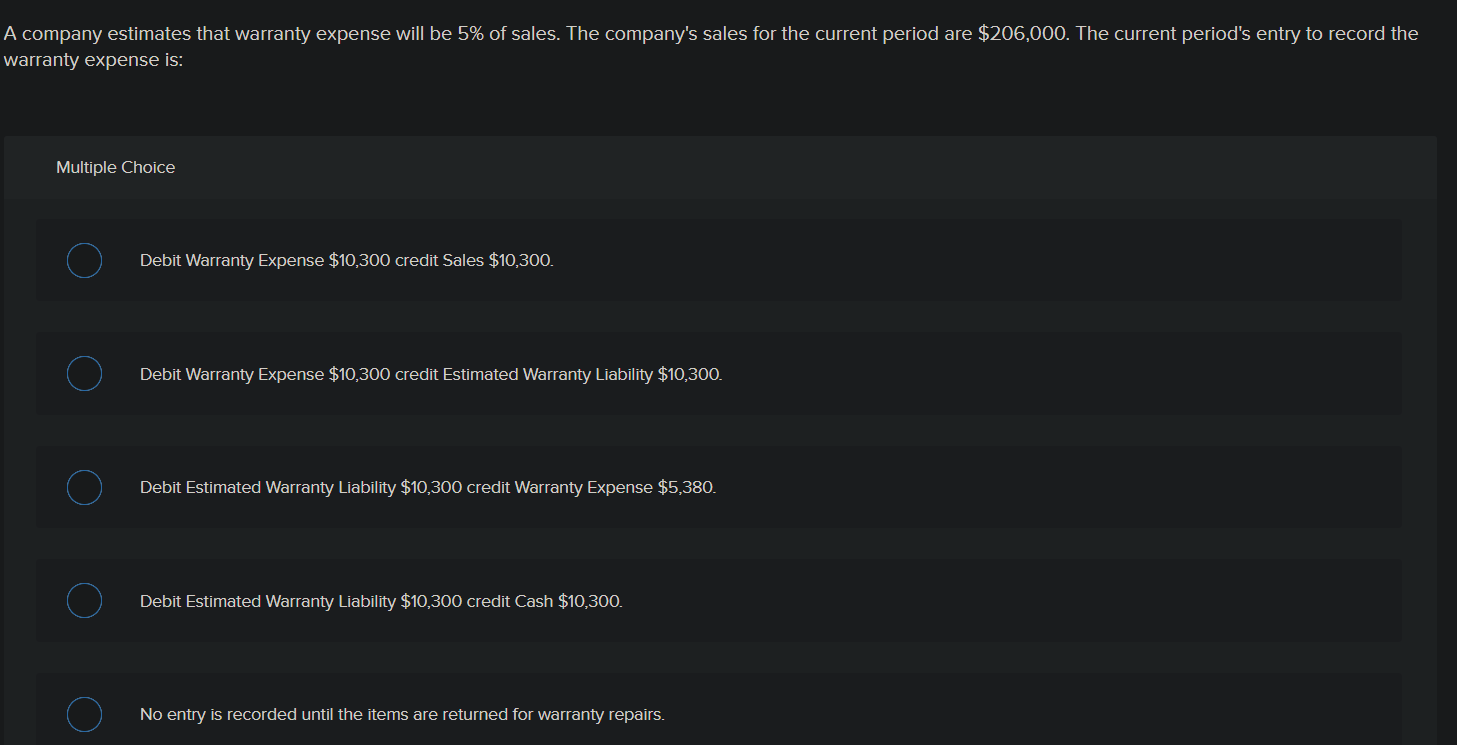

If so, develop a history of the actual cost of warranty claims, and calculate the relationship between costs incurred and the related amount of revenue or units sold. Warranties that provide a service journal entry Warranty expenses provisioning is based on a management viewpoint, their outlook about the default rate, and likely claims during the warranty period.

This balance would be carried forward to the next quarter. How many units of the product were sold during the period of time we need to record? Businesses must account for these expenses accurately.

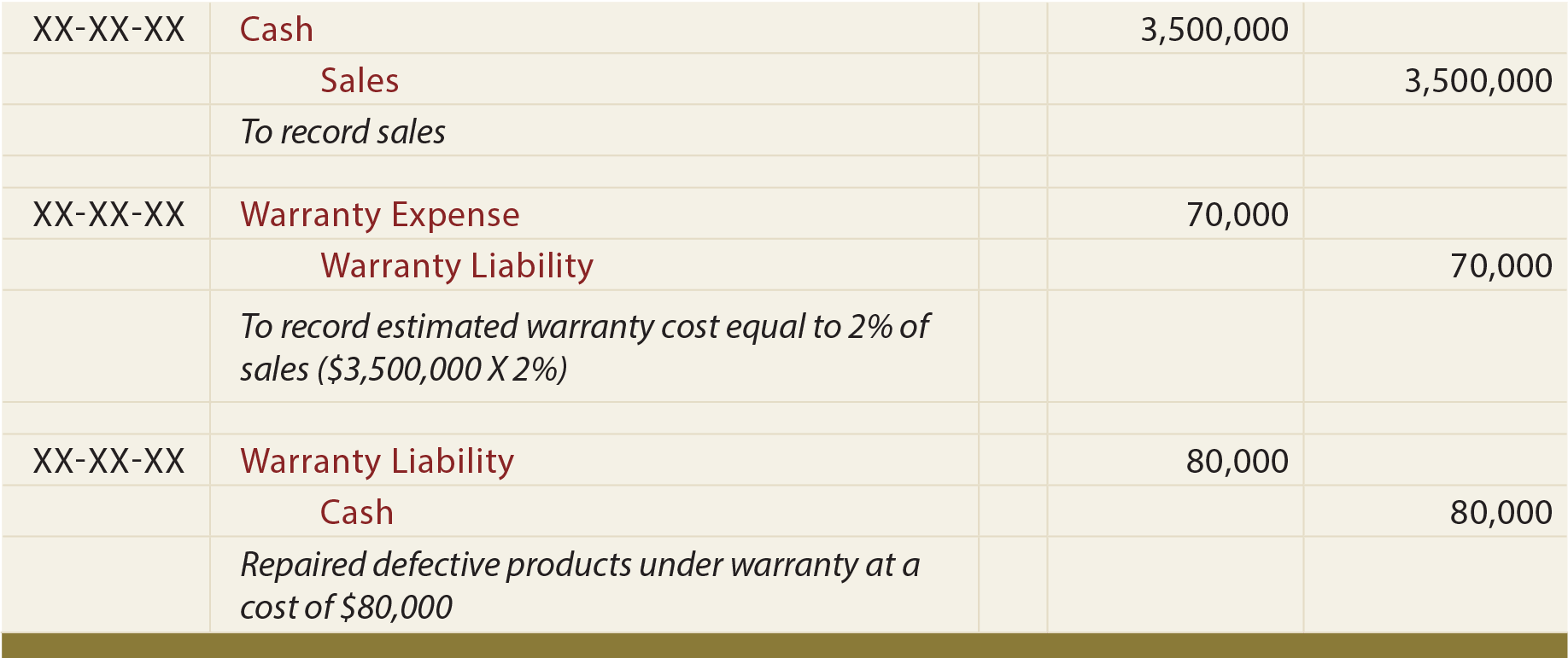

In this case, the company abc can make the journal entry for warrant provision in 2022 by debiting. What is a warranty expense? At the same time, the credit creates the provision (liability) for disclosure in the balance.

If the amount of warranty expense recorded is significant, expect the company's auditors to investigate it. For more details, please read on. Warranty expense is an expense related to the repair, replacement, or compensation to a user for any product defects.

The provision account will be debited against the repairs and replacement inventory account if the warranty is claimed. In order for a company to estimate the warranty expense and liability, we need to know three things: The closing balance of the warranty payable as at 31 march 2013 i.e.

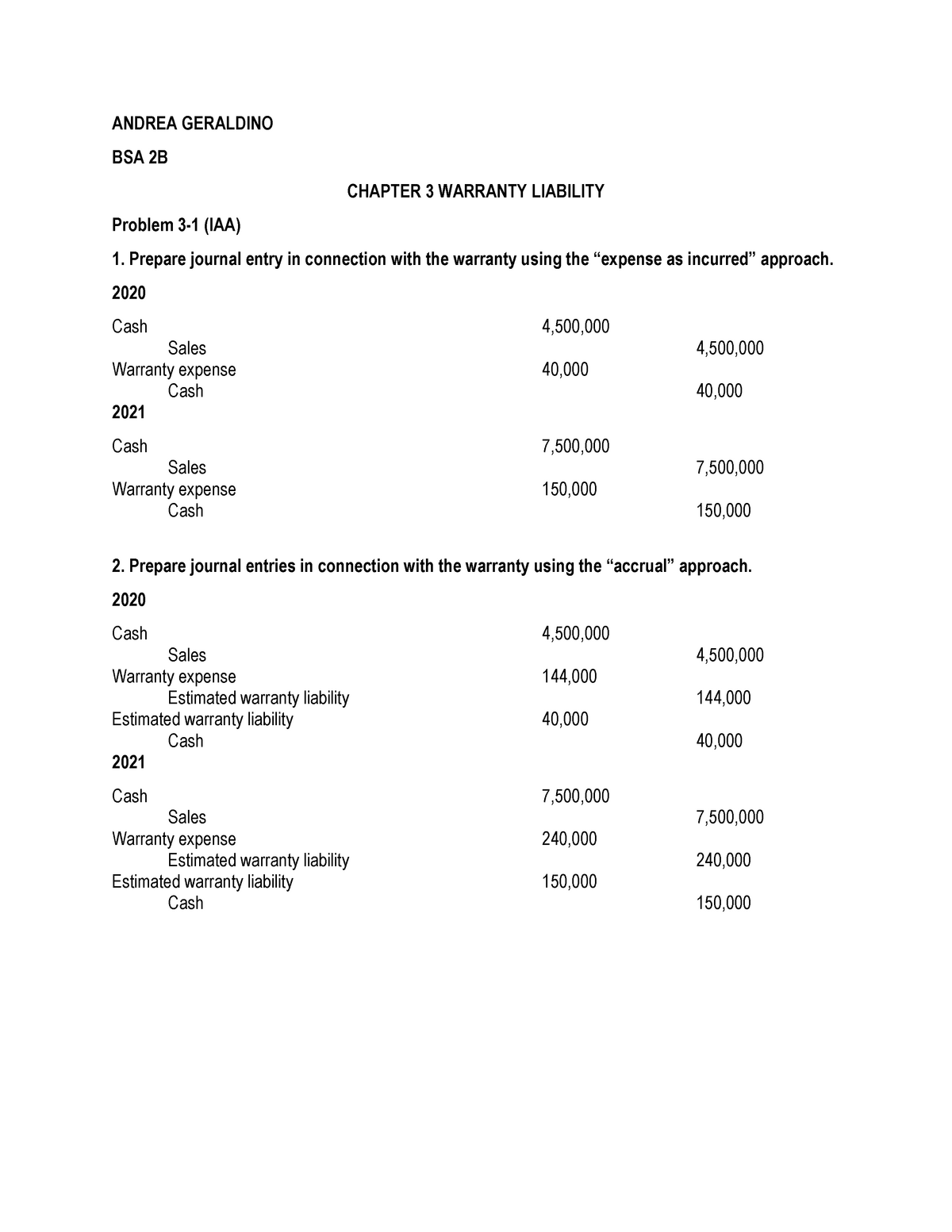

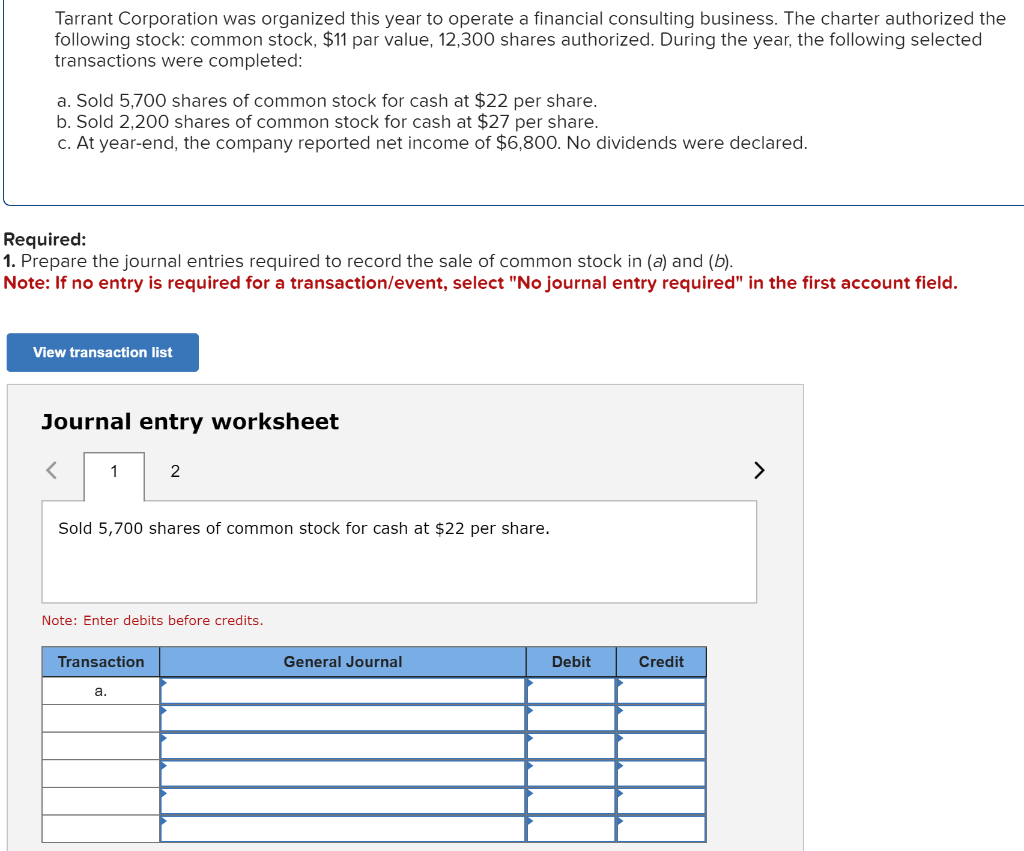

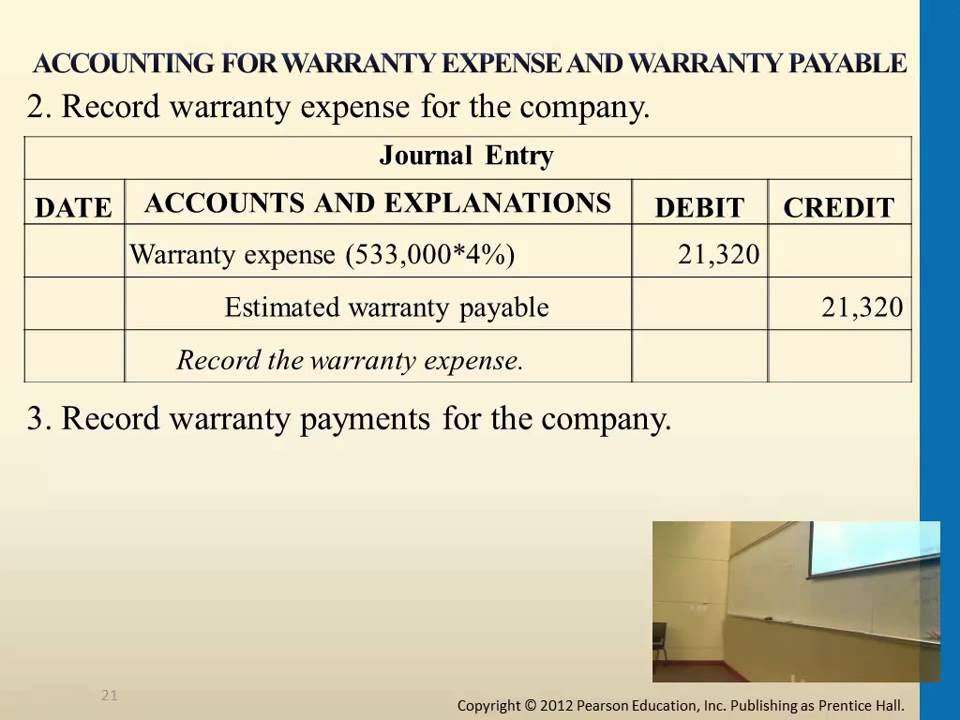

Companies account for warranty expenses only during the established warranty period. The journal entry is debiting warranty expense and credit provision for warranty expense. Actual payments reduce warranty payable:

This part of entry shows up in the profit and loss statement. If the provision being measured involves a large number of items, such as a warranty provision for repairing goods, the expected value should be calculated using the probability of all possible outcomes. This is based on a subjective viewpoint and is usually impacted by management discretion to.

According to the us gaap, since a warranty is an assurance or promise of the seller to his buyer, it will be the expense of the seller if claimed by the buyer, which will be debited to the seller’s accounts at the time of sale in the warranty provision account. So, the warranty’s accounting nature is an expense for the entity that will be debited to the company’s accounts at the time of sale against the warranty provision account. The end of first quarter would be $30,000 ($40,000 minus $10,000).

Warranties, dating as far back as the 1300s, have formed a standard part of trade. Warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of goods that it has sold. The warranty provision includes any replacement, repair, or amendment that which a customer is entitled to under a certain product warranty.