Formidable Info About Noncash Investing And Financing Activities

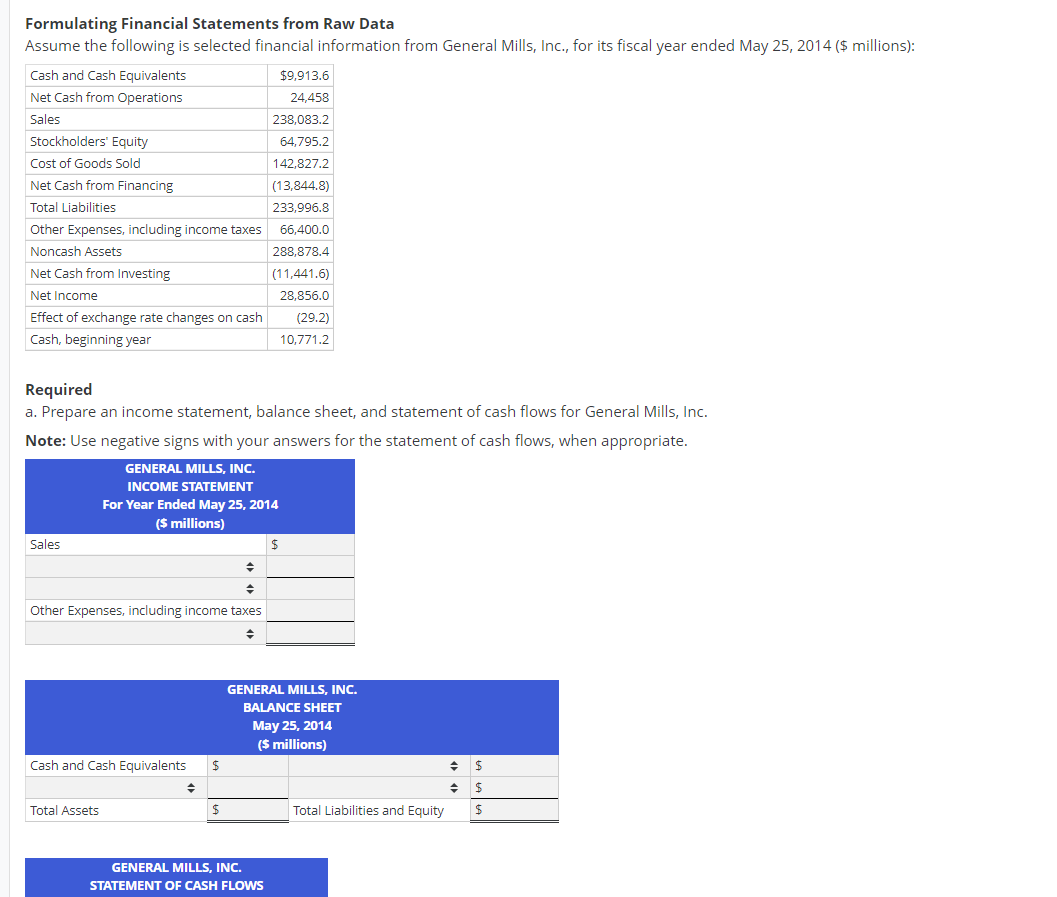

First half 2024 financial results.

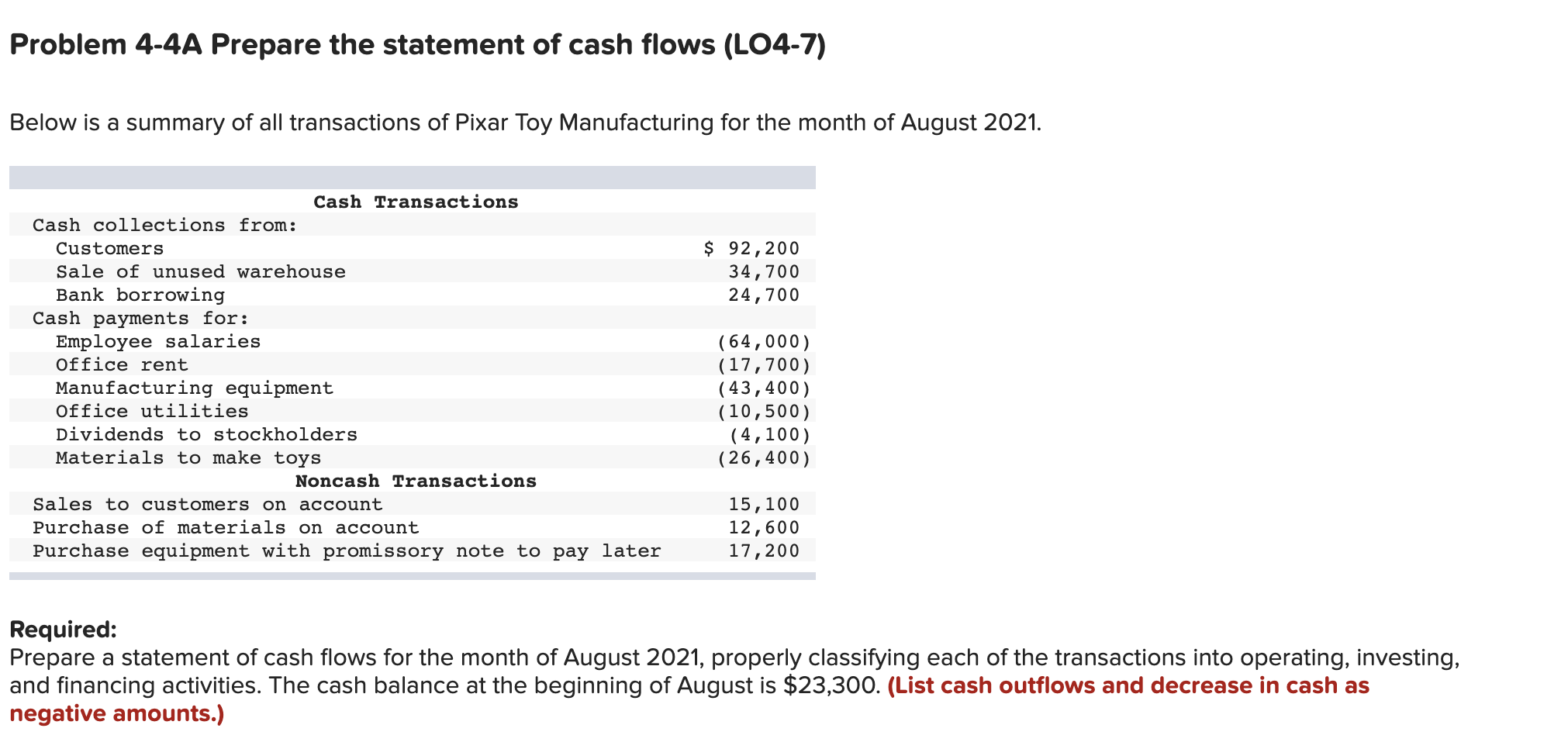

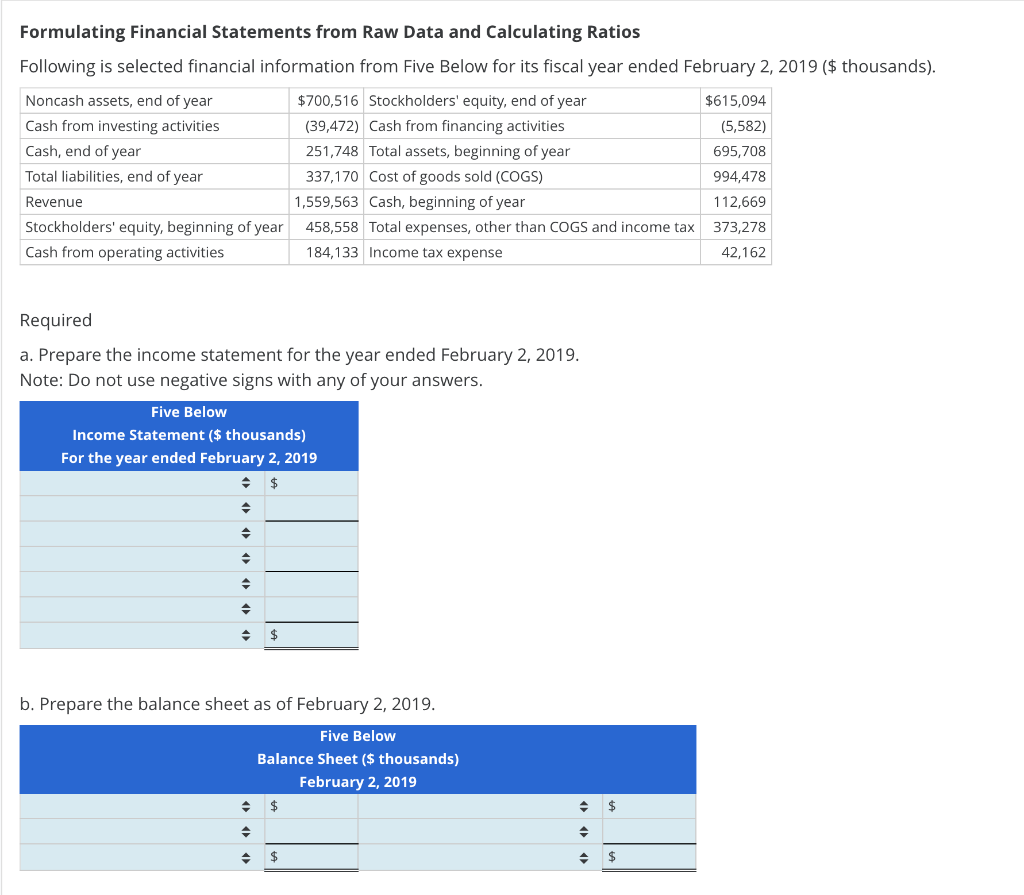

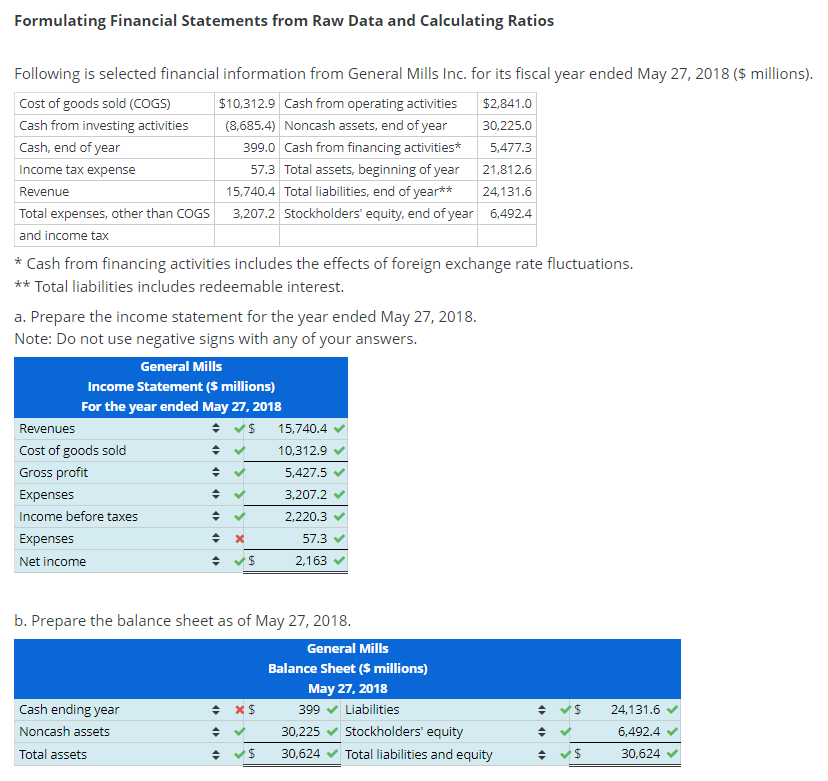

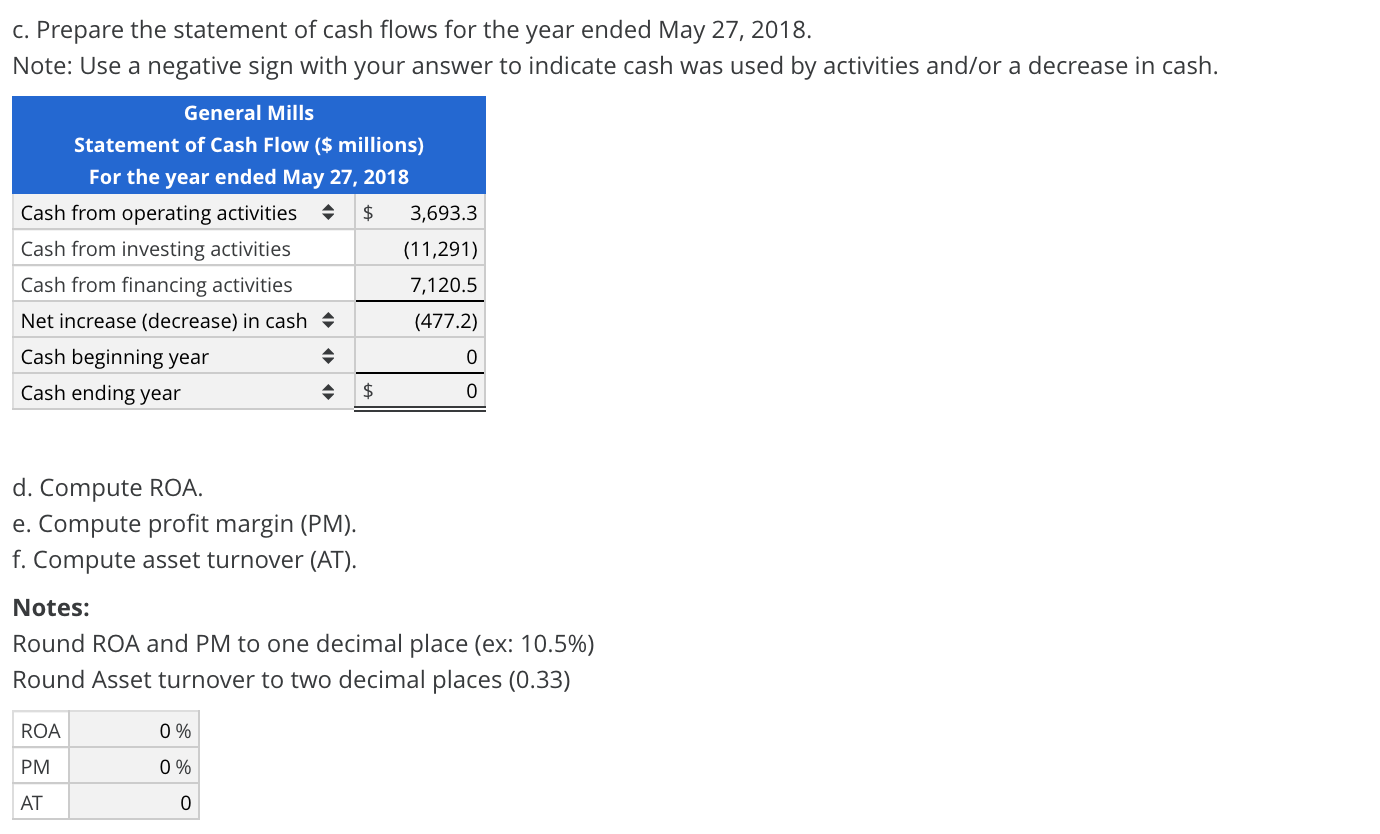

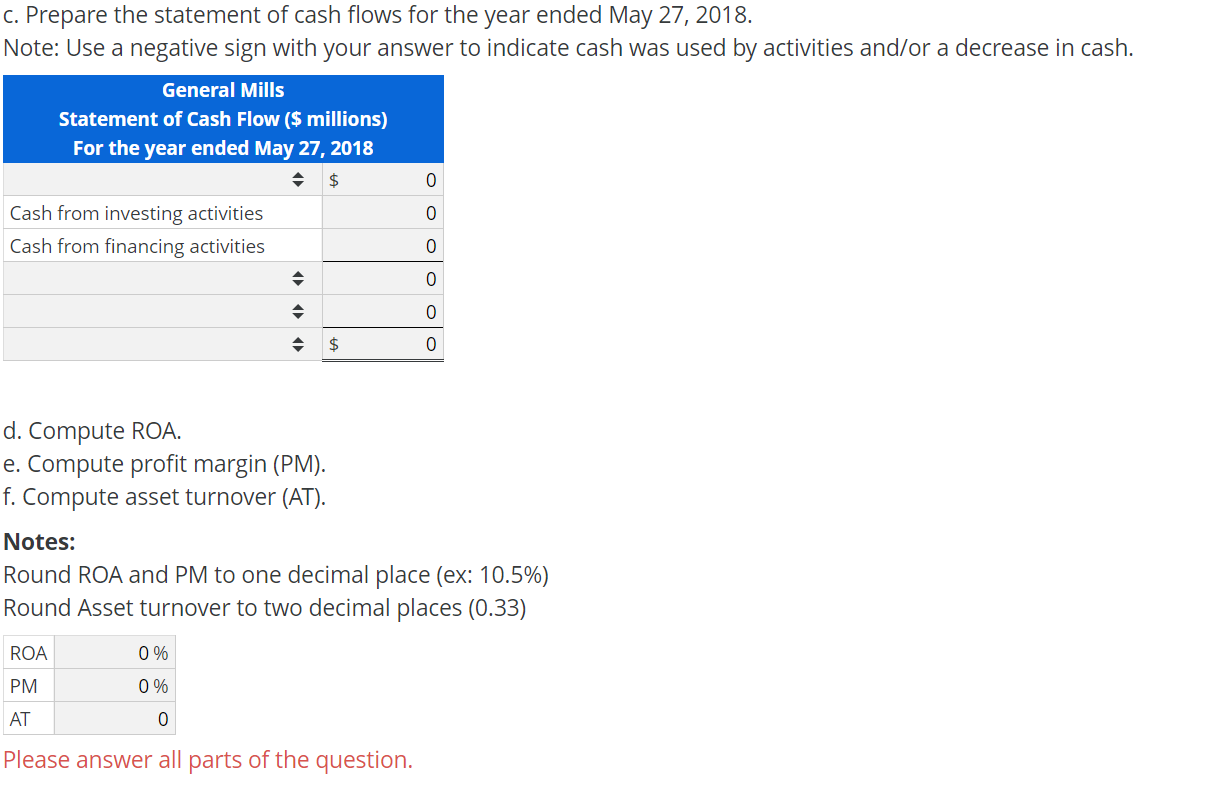

Noncash investing and financing activities. Plant assets were purchased, for $60,000 cash. When reviewing your financing statements, you’ll find either a. Noncash investing and financing activities.

For example, a company may exchange. A tract of land that had an original cost of $10,000 was sold for $14,800. Acquiring assets by assuming directly related liabilities,.

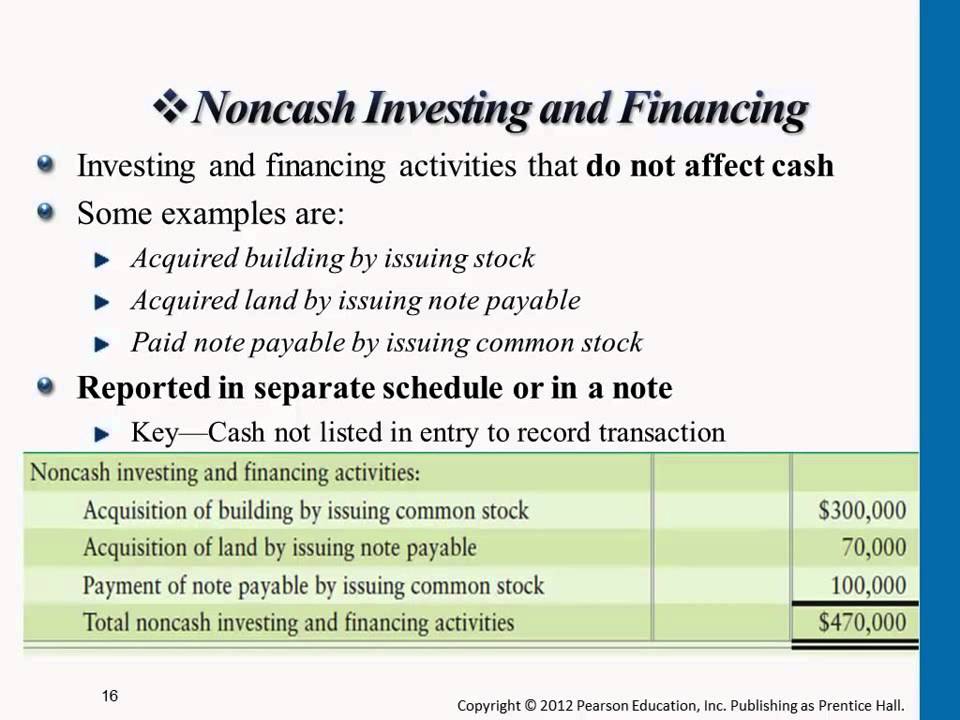

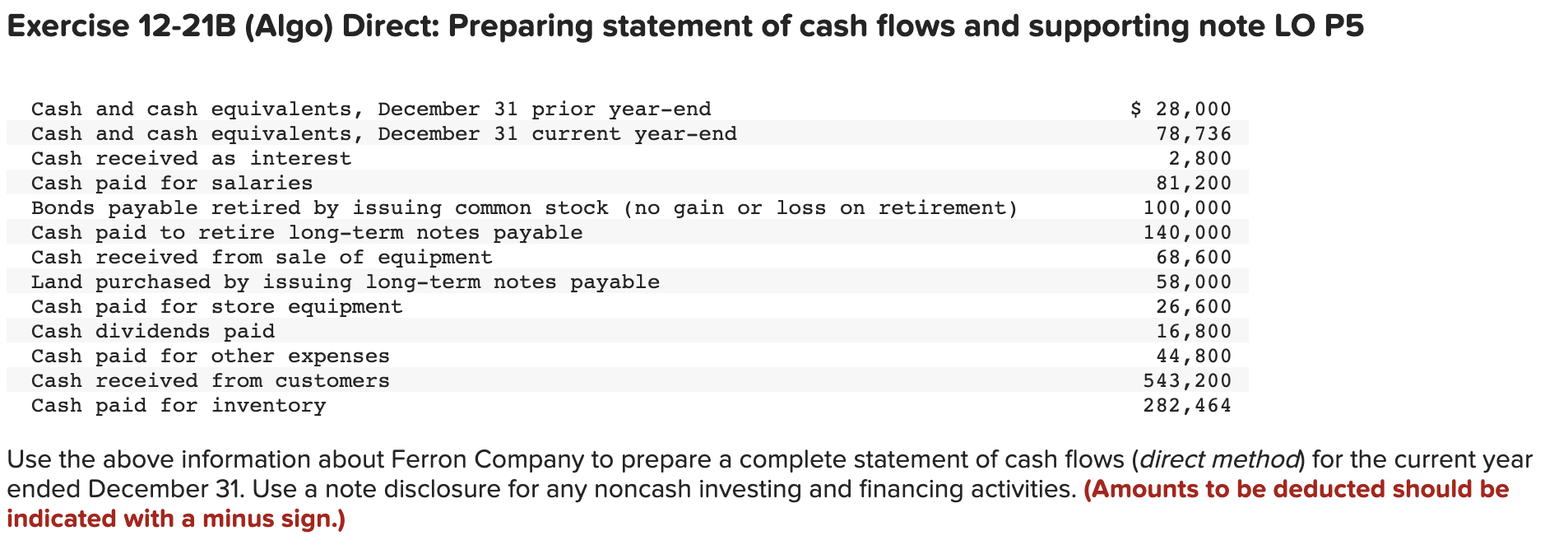

Additionally, issuers must supplement the statement of cash flows with disclosure of noncash investing and financing activities to facilitate an investor’s. Some examples of noncash investing and financing activities include: For example, a company may exchange common stock for land, or.

In this study, for a sample of 120 companies, we identify and recast the statement of cash flows for the implied cash effects of six general categories of non. Reported in the statement of. Supplemental disclosures of noncash investing and financing information:

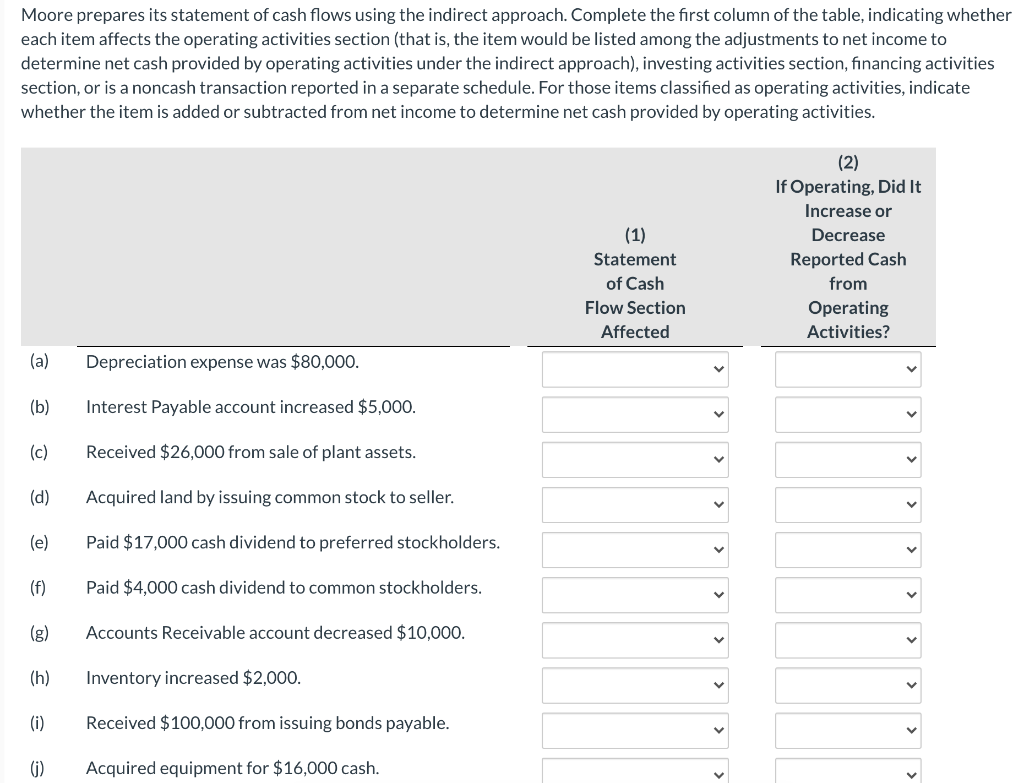

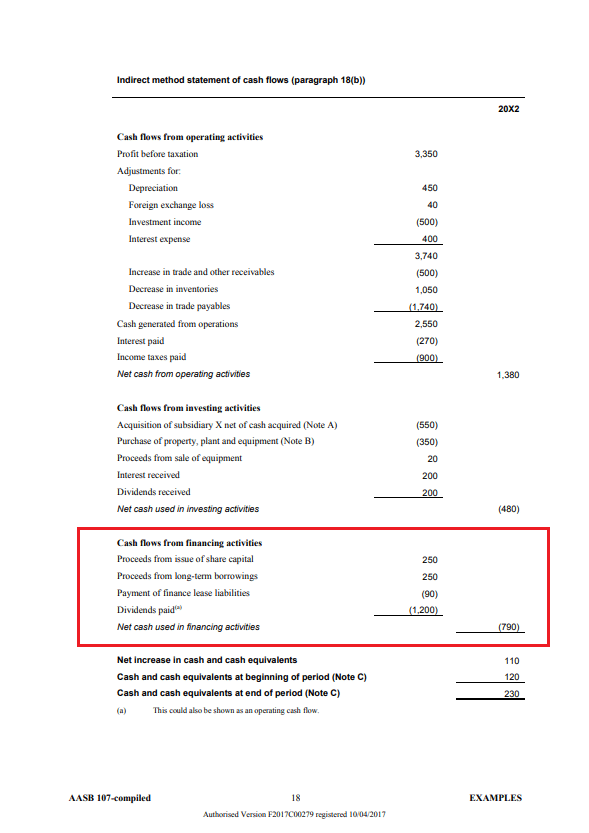

The subsequent principal payments on the debt should be classified as financing cash outflows, whereas the payments of interest on the debt should be classified as operating cash flows. Purchased building for $100,000 by signing a note and a downpayment of. Reasons & methods of disclosure.

Noncash investing and financing activities, if material, are: Revenue for the six months ended september 30, 2023 increased by $10.0 million, or 57.7%, to $27.3 million from $17.3. Reported in the statement of cash flows are the “all financial resources concept” b.

A select set of important investing and financing activities occur without generating or consuming any cash. Asc 230 identifies three classes of cash flows—investing, financing, and operating—and requires a reporting entity to classify each discrete cash receipt and cash payment (or. The noncash investing and financing transaction of $400 should be disclosed.

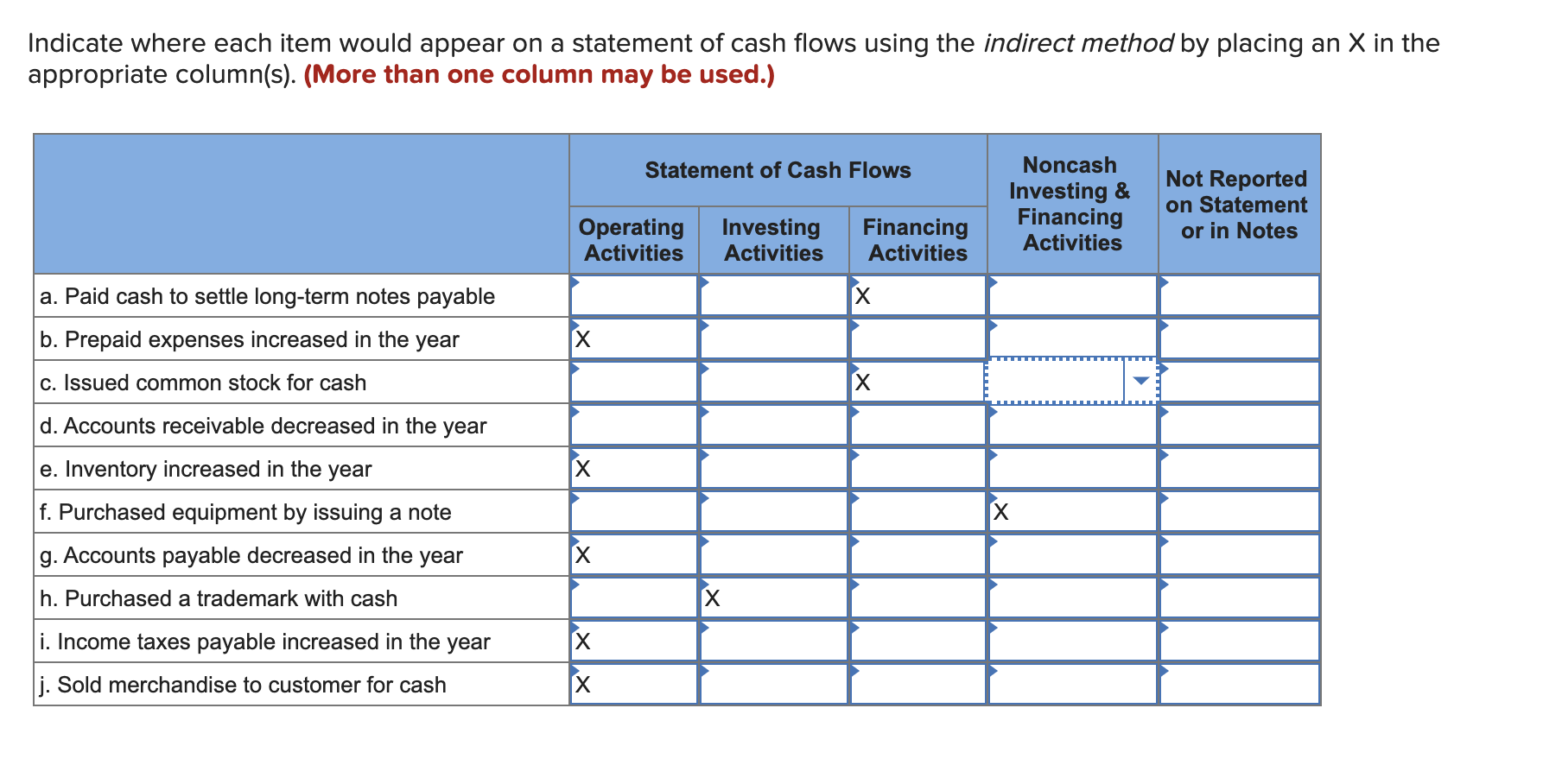

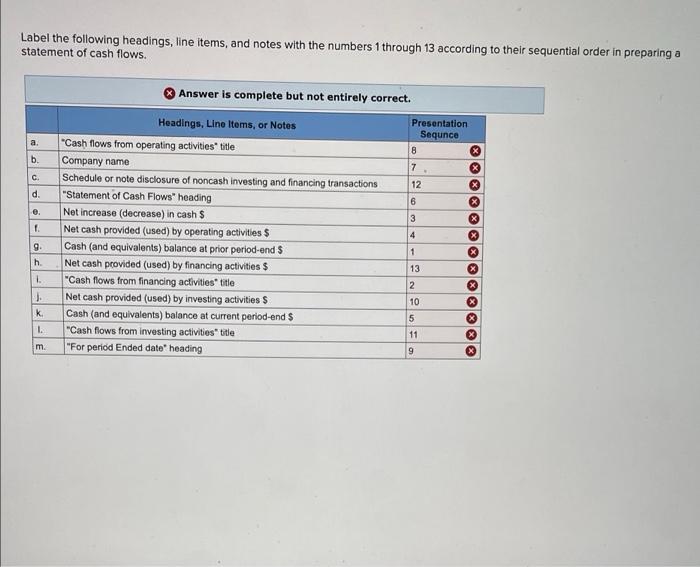

Investing and financing activities that do not involve cash are not reported in the cash flow statement since there is no cash flow. Noncash investing and financing activities: This chapter focuses on two troublesome preparation and presentation issues, including statement classification and noncash activities.

Purchases of marketable securities (29,726) (137,493. Net cash used in financing activities (1,026) (2,213) (4,527). Noncash investing and financing activities.

The company’s policy is to report noncash investing and financing activities in a separate statement, after the presentation of the statement of cash flows.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)