Fun Tips About Net Cashflow From Operating Activities

Stable or increasing net cash flow from operating activities often indicates.

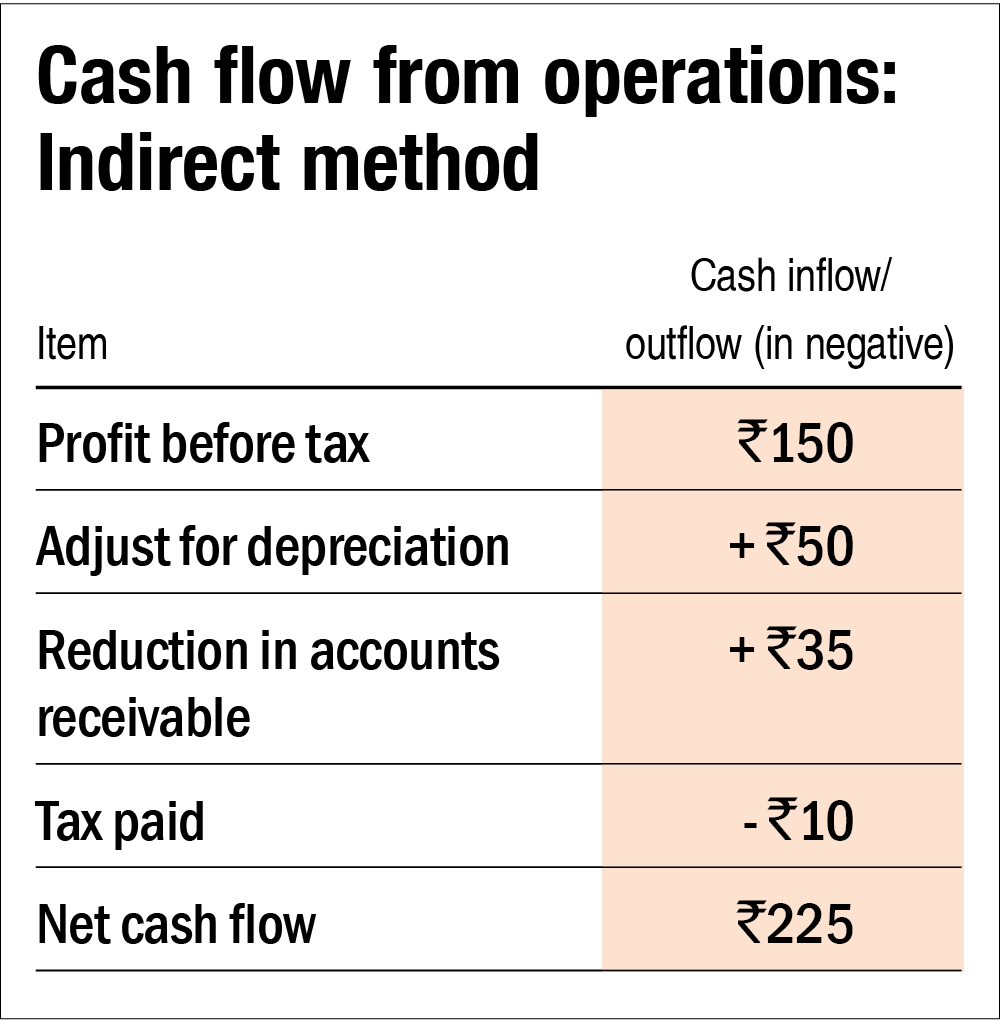

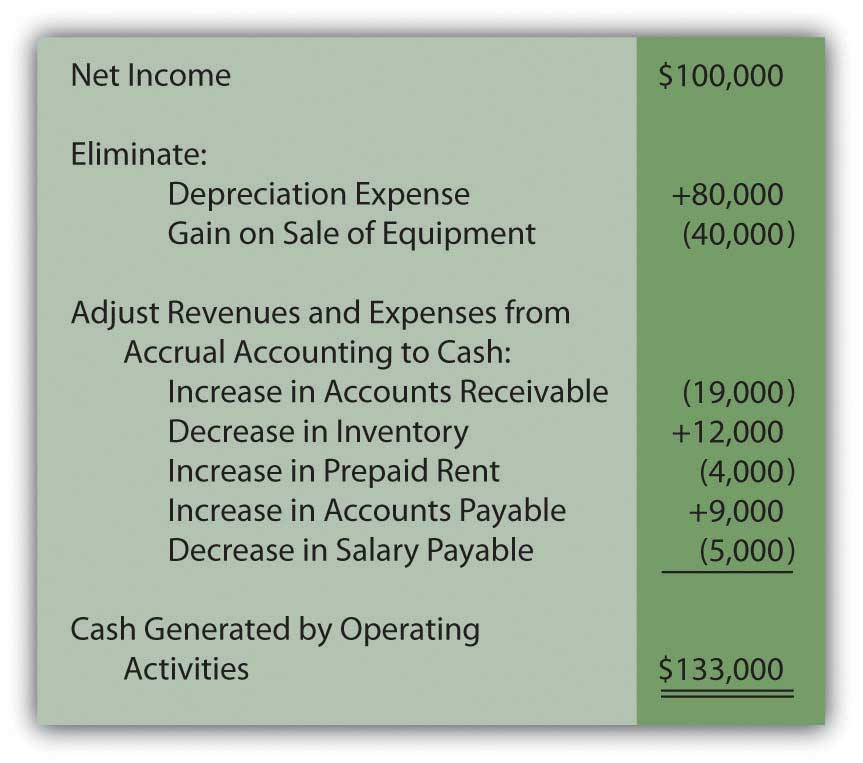

Net cashflow from operating activities. Add back noncash expenses, such as depreciation, amortization, and depletion. Net cash from operating activities, after we’ve made all the changes above, comes out to $40,000. The cash flow from operating activities section of the cash flow statement is generally pretty straightforward.

Cash flow from financial activities. Cash flow from operating activities is one of the categories of cash flow. It’s the first part of the cash flow statement and begins with your net income for the period.

Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. The cash flow statement is typically broken into three sections: Adjust for changes in working capital.

Begin with net income from the income statement. Operating cash flow—also referred to as cash flow from operating. The statement of cash flows is prepared by following these steps:

Learn more about cash flow from financial activities in this article: Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. Begin with net income from the income statement.

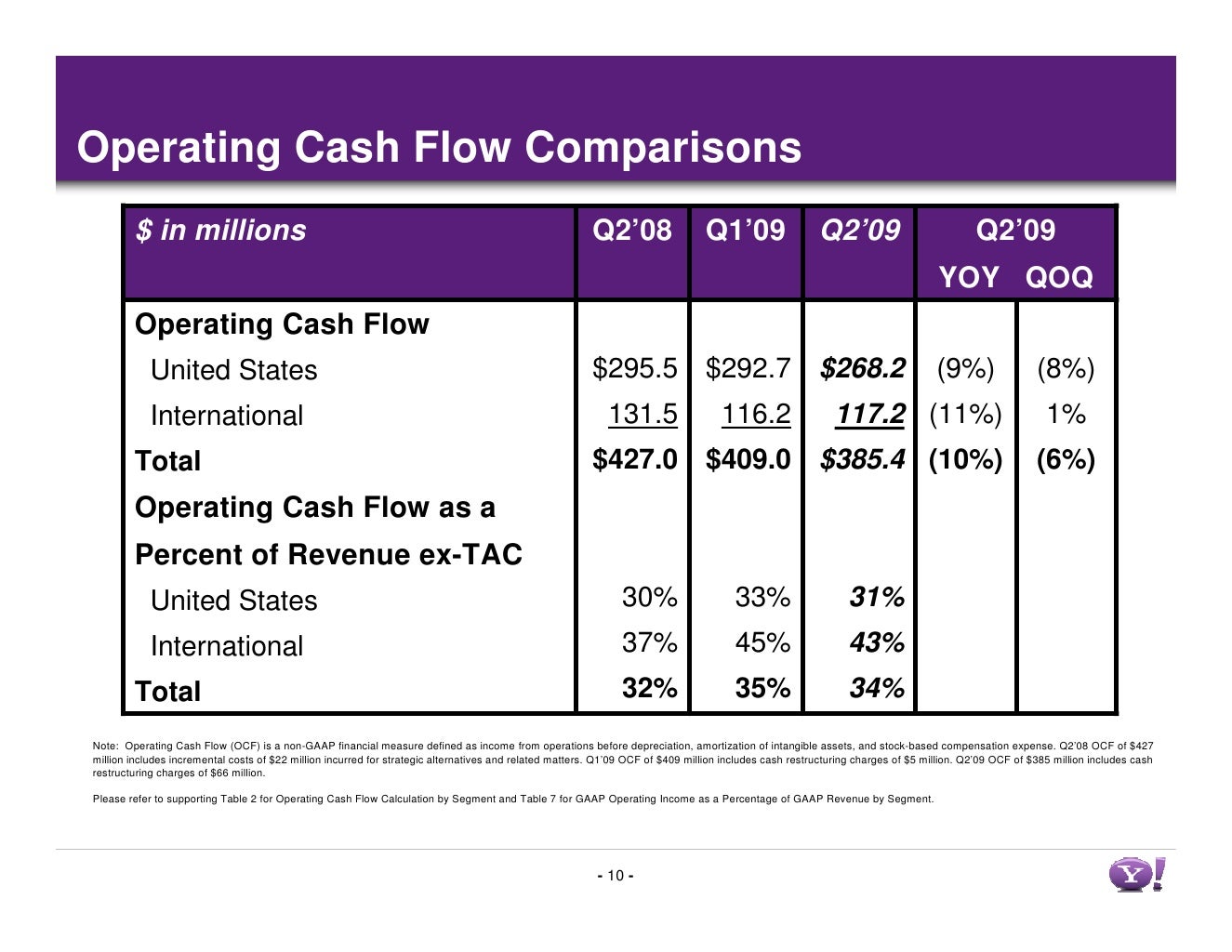

Net cash provided by operating activities of $470 million net income totaled $569. Using the indirect method, operating net cash flow is calculated as follows: Calculation of net cfo:

Meaning, even though our business earned $60,000 in october (as reported on our income statement), we only actually received $40,000 in cash from operating activities. Start calculating operating cash flow by taking net income from the income statement. + net cash flows from investing activities + net cash flows from financial activities.

Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a. The negative balance of $21,000 should be added to find the net cash flow. Cash flow from operating activities formula the “cash flow from operations” is the first section of the cash flow statement, with net income from the income statement flowing in as the first.

The ocf calculation will always include the following three components: Operating cash flow represents the cash impact of a company's net income (ni) from its primary business activities. Put simply, ncf is a business’s total cash inflow minus the total cash outflow over a particular period.

Then, you’ll break down any adjustments you’ve made to reconcile net income to net cash from operating activities. Net cash flow is the difference between a company’s cash inflows and outflows within a given time period. A company has a positive cash flow when it has excess cash after paying for all operating costs and debt payments.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)