Who Else Wants Tips About Preliminary Trial Balance

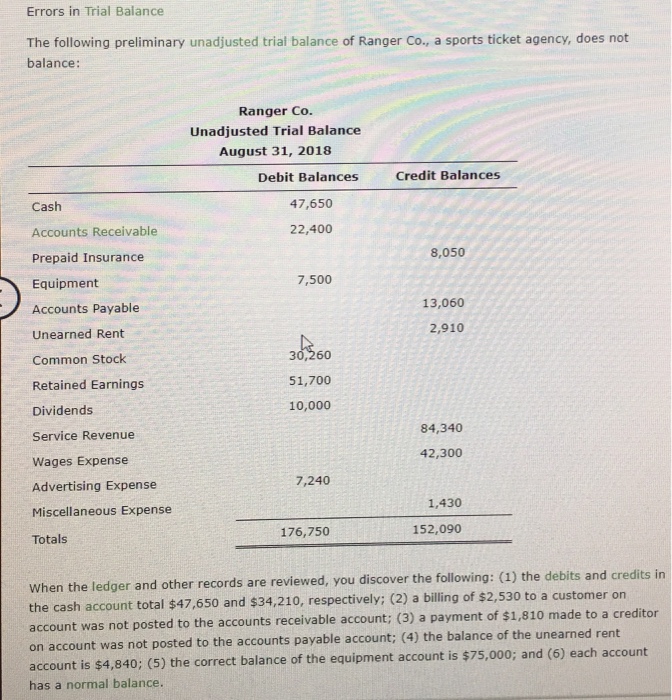

For the trial balance to be correct, debit and credits must be equal.

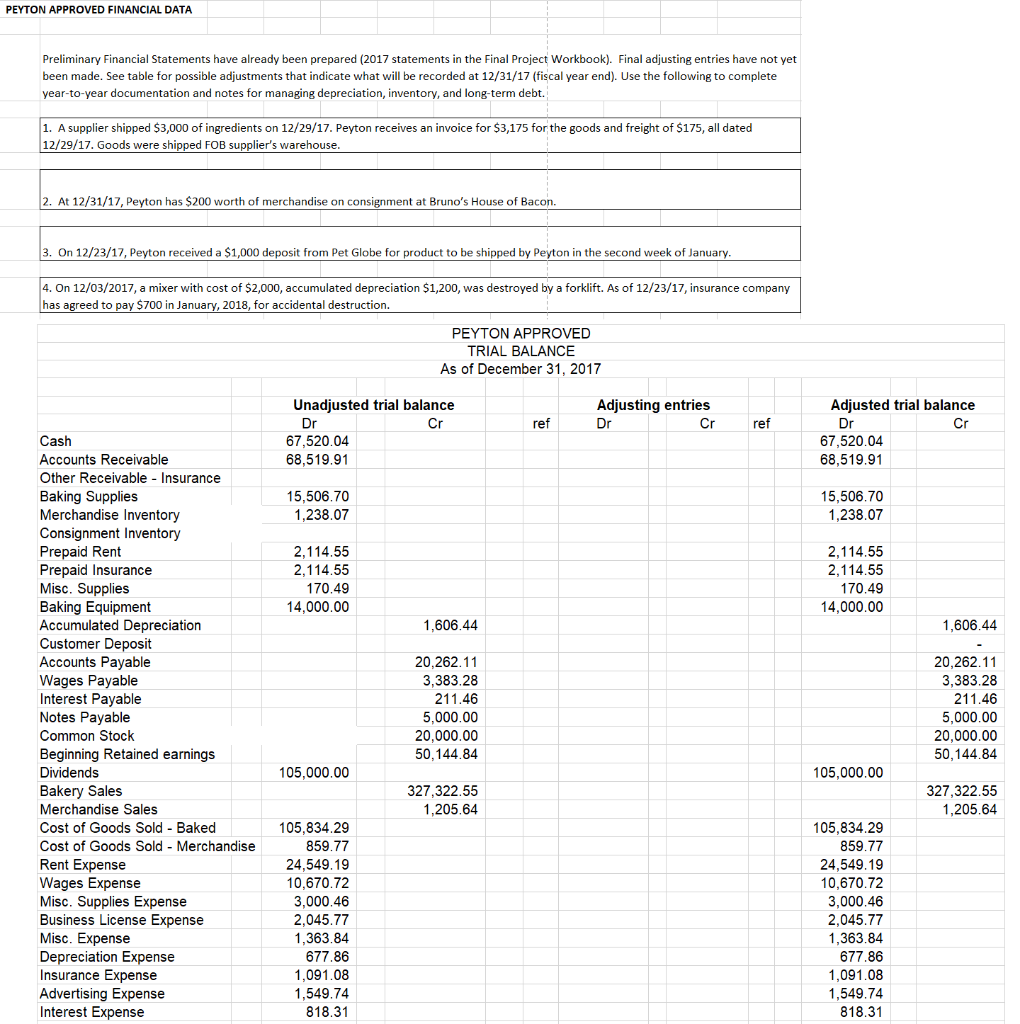

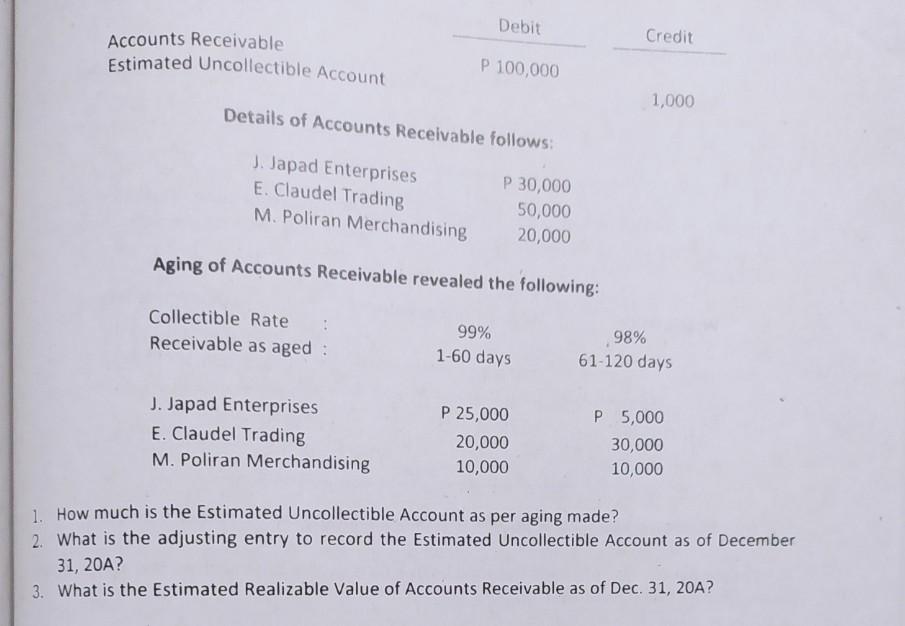

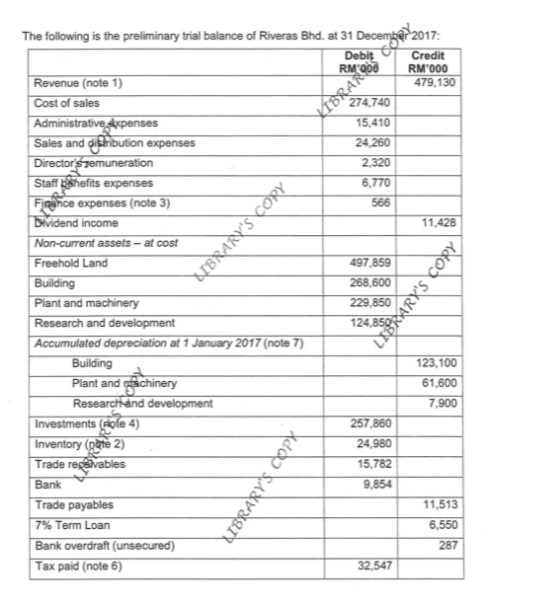

Preliminary trial balance. Debit credit accounts receivable p 300,000 estimated uncollectible account 4,000 1. In this article, i explain how to create planning analytics and how to use them to identify potential misstatements. If there is any discrepancy, it means that either you may not have picked up correct balances from ledger or there is any mistake in recording the transaction in journal.

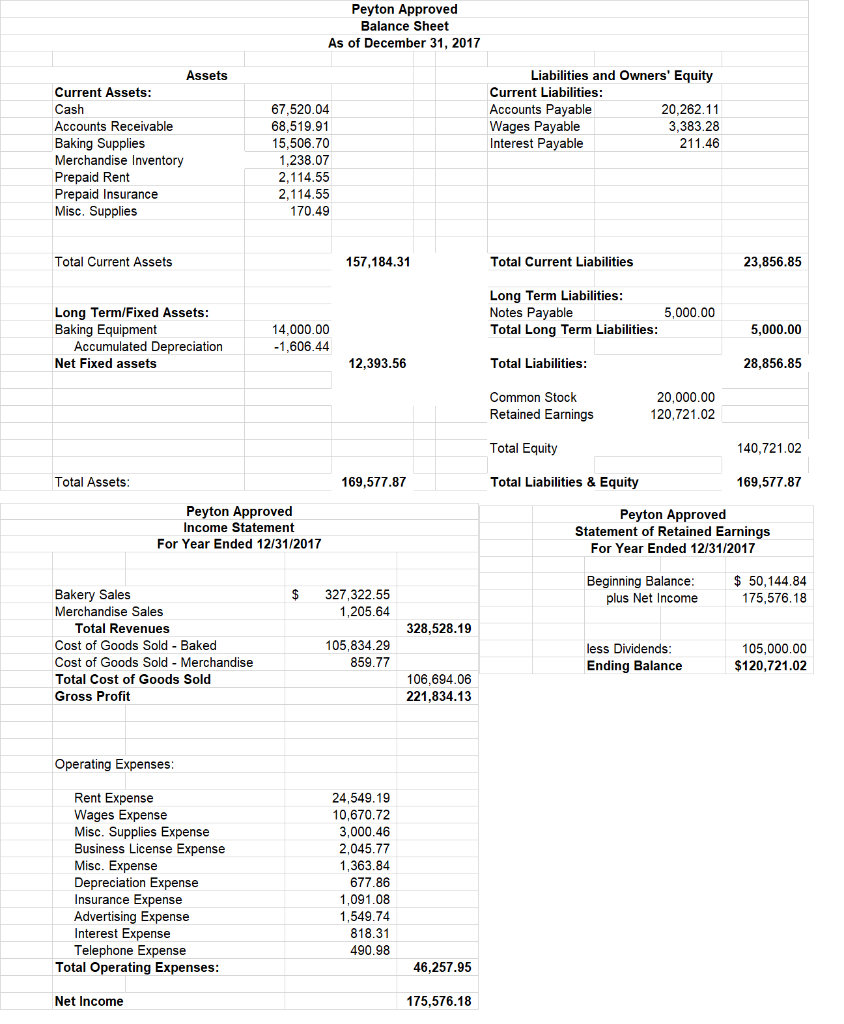

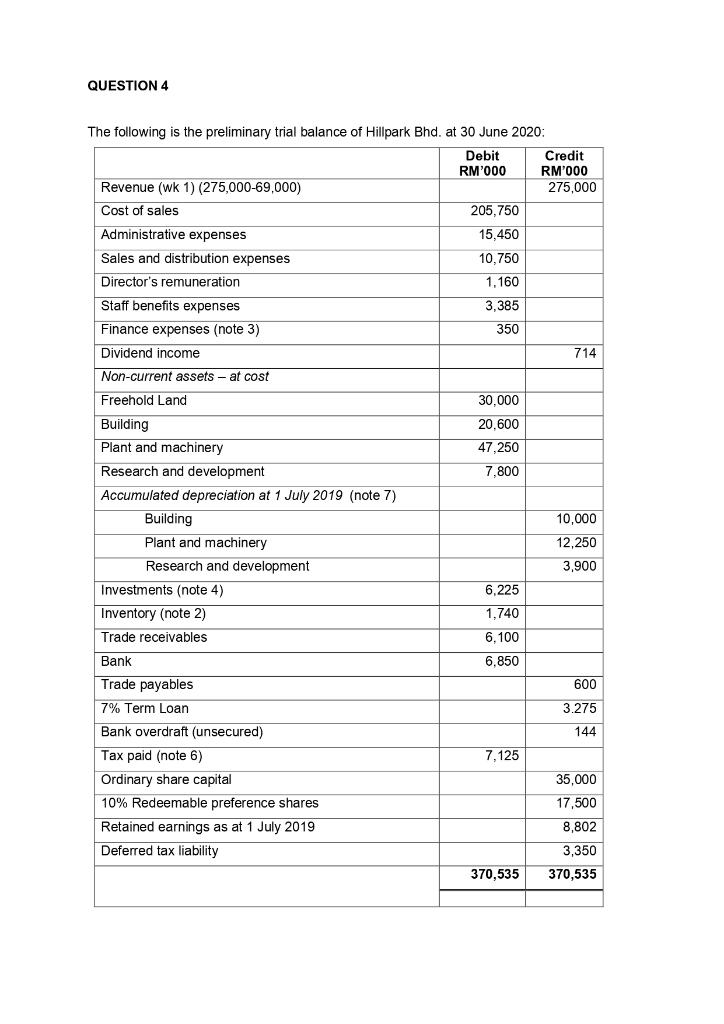

I also provide documentation tips. This will help ensure that the books used to prepare your financial statements are in balance. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

It serves to find and correct errors before they bring discrepancies in the financial statements, as well as bring out a clear picture of a company’s financial health. The trial balance is a handy accounting tool. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

Auditors use tb as a preliminary inspection to find missing general ledger entries or transfer mistakes that call attention to the. This will help ensure that the books used to prepare your financial statements are in balance. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

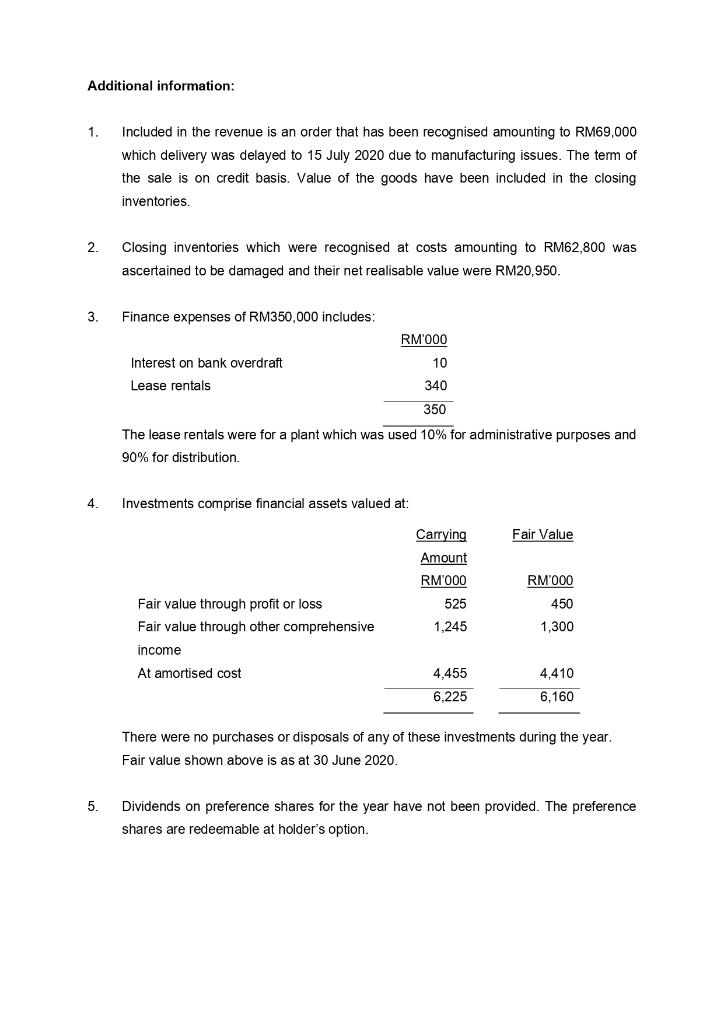

Second:33.extracts from the preliminary trial balance of jessie and co as at 30 september 20x2 are included in the table. Management is contemplating paying some of its accounts payable balance before the end of the fiscal year. The title of each general ledger account that has a balance to the right of the account titles are two columns for entering each account's balance.

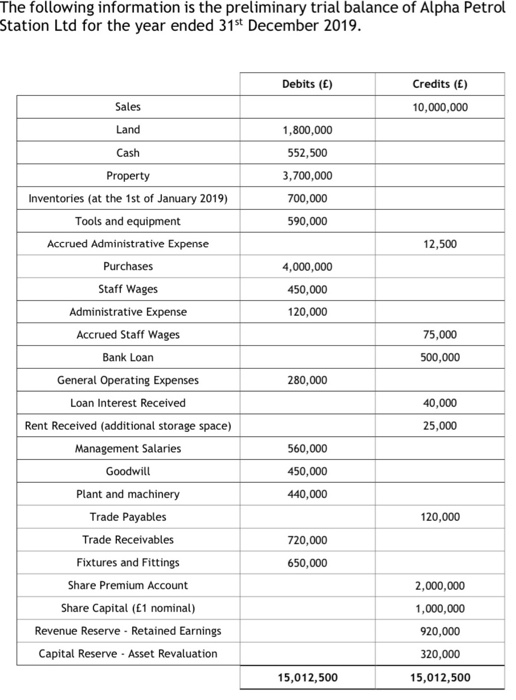

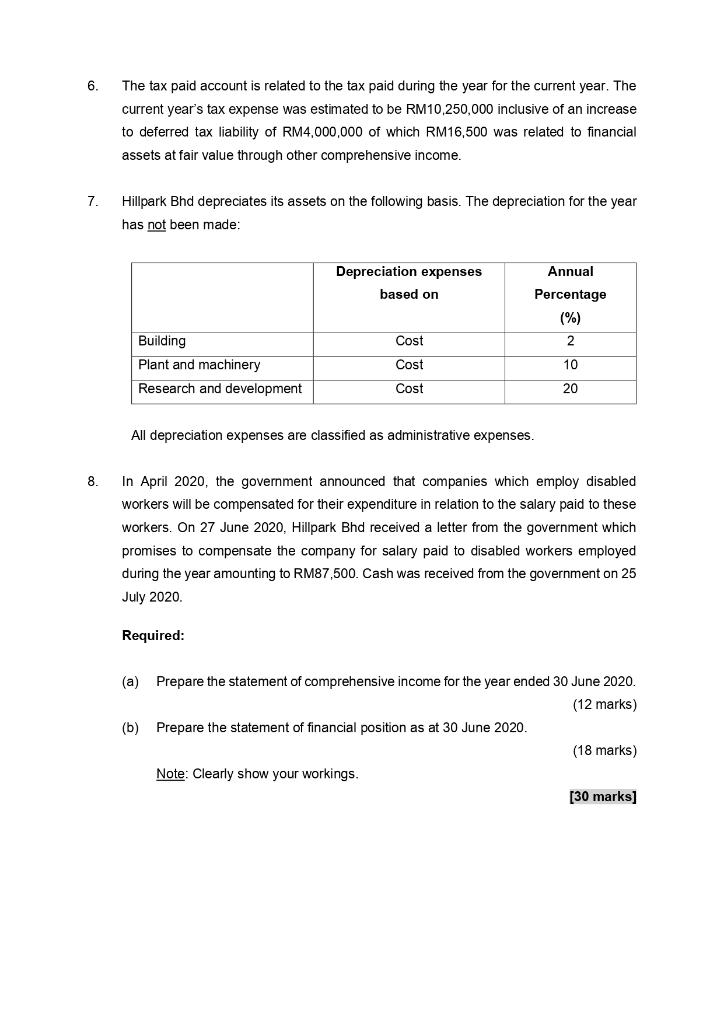

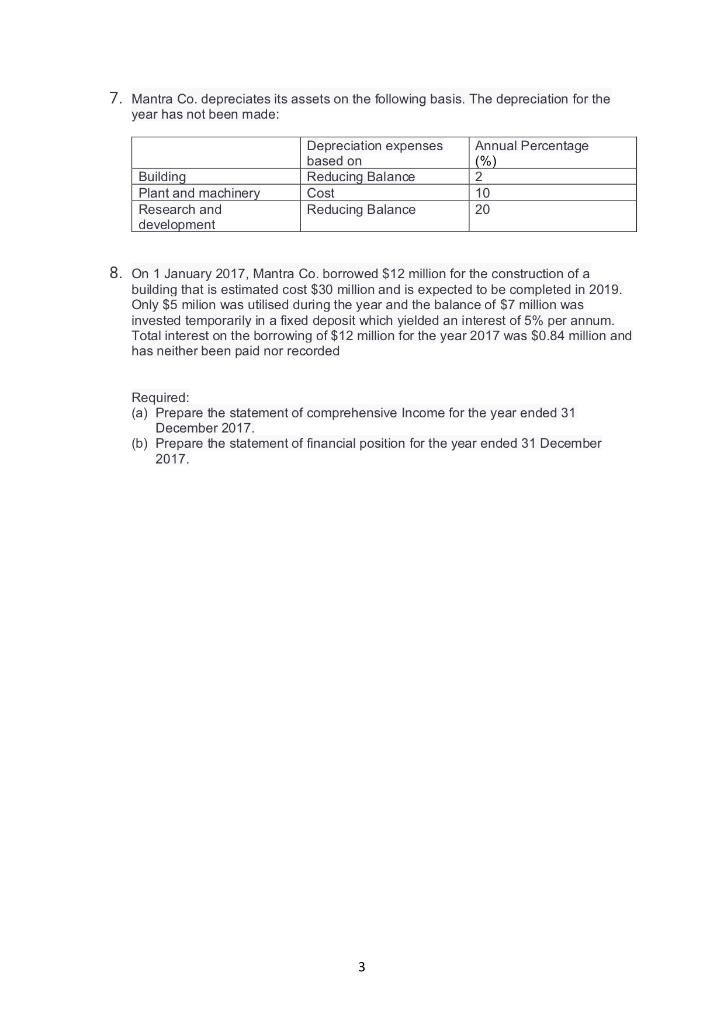

Guide to trial balance examples. Problem on the provision for uncollectible accounts the preliminary trial balance of tagum traders, owned by merry chris ceniza as of december 31, 20a showed in part the accounts receivable and its related estimated uncollectible accounts: Further adjustments are to be made as follows:

A company prepares a trial balance. Trial balance errors refer to those mistakes hidden in the accounting process that the trial balance sheet cannot identify. Determine whether the effect this transaction would increase or decrease the current ratio.

A preliminary trial balance is prepared using your general ledger account balances before you make adjusting entries. Then you prepare the following preliminary trial balance, using the balances from your general ledger accounts. The trial balance is prepared after the.

Example of a trial balance document At the end of 2021, barker corporation's preliminary trial balance indicated a current ratio of 1.2. One column is headed debit and the other column is headed credit.

It typically has four columns with the following descriptions: Account number, name, debit balance, and credit balance. The unadjusted trial balance serves as a preliminary check, leading to adjustments, which in turn form the adjusted trial balance.